Fundraising is Like Cruis’n USA: Top 5 Takeaways From Our Founder Institute Webinar

According to Finmark CEO Rami Essaid, raising your first round of funding is like plowing the road with your face.

While that sounds daunting, alas is a necessary evil in the startup world.

When launching a new venture, securing seed funding ensures that you have enough runway to keep the lights on while you perfect product-market fit and lay the foundation to grow your business.

Don’t know where to start? Check out our step-by-step guide for seed funding.

Never fear, dear founders – we are here to support you in your journey to securing that illustrious first round of capital.

In fact, Rami has shared some of his top tips in the Founder Institute webinar, Seed Funding & Financial Planning: A Guide to Raising Your First Funding. As a three-time entrepreneur and venture partner who has raised more than $80M throughout his career, he’s seen it all.

In this session, he takes a deep dive into the venture capital ecosystem, including how to effectively pitch your startup, the key metrics investors care about, and more.

If you’d like to watch the full video, click here, otherwise keep reading to see the top takeaways from the session.

1. While it’s never easy, it does get easier

The first “no” from an investor may be a major blow to your ego, but the 15th or 20th no is a far easier pill to swallow.

Raising funds is never easy, but as you gain experience, it becomes easier, says Rami.

You start to understand what works and what doesn’t work, especially as you start to gain experience and narrow in on your ideal investor profile.

2. Understand who you are pitching

You may already know some of the top VC firms – from Andreessen Horowitz to Bessemer Ventures to Tiger Global.

While these may seem like the gold standard, you need to first consider the thesis of the VC firm. Some specialize in the stage of a company, while others focus more on geography (state, country, etc.) or industry.

It’s important to find VC firms that make sense for your company. Not to mention, you should also identify the partner within the firm that specializes in your industry. Don’t just assume that every partner has a vested interest in the same industries.

If you do your homework, you’ll start to hear more yeses than no’s over time.

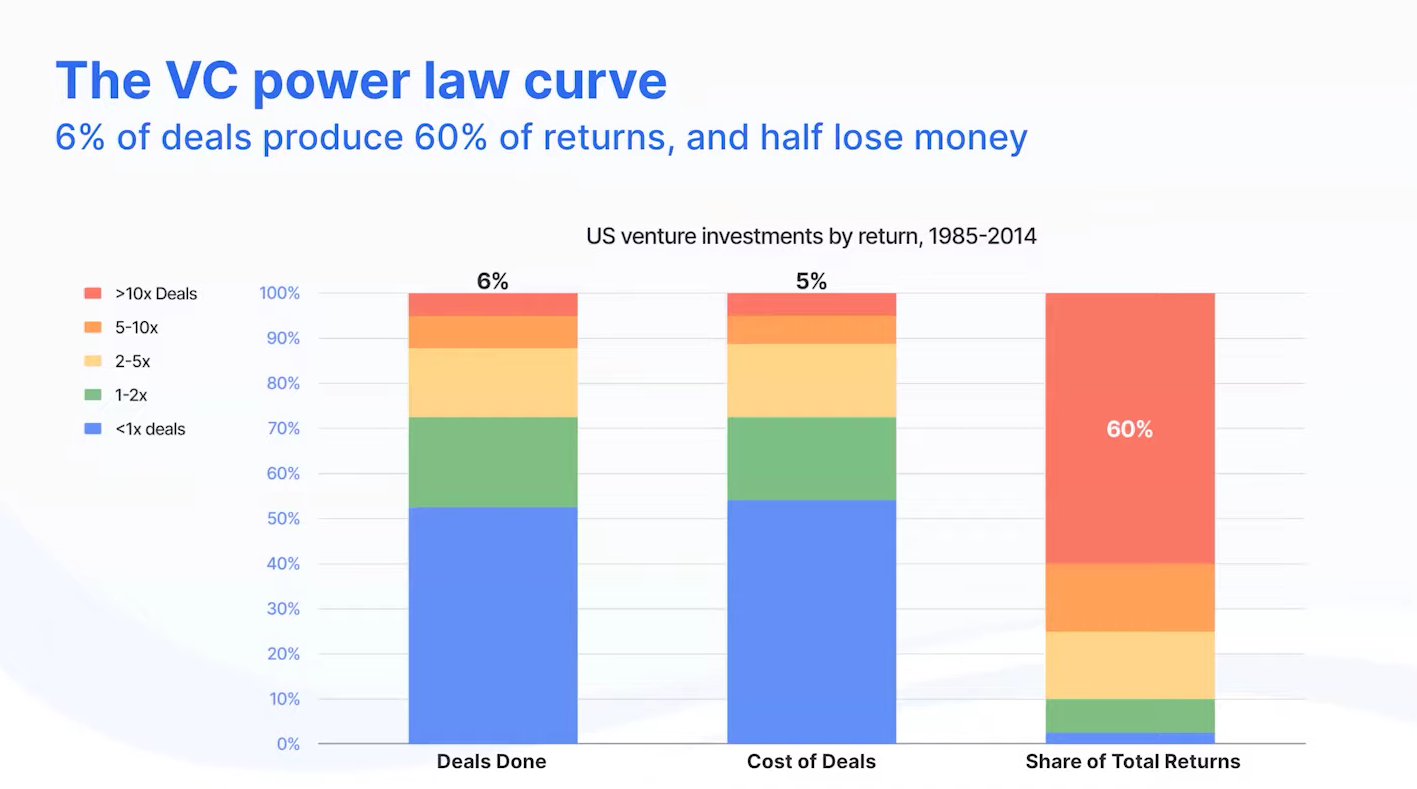

3. Every VC is only looking to invest in billion-dollar unicorns

Not every startup will become a unicorn, but most investors are on the hunt for the next great unicorn.

At the end of the day, it is all about the benjamins. A VC’s main goal is to find the diamond in the rough – the companies that will provide them with the largest bang for their buck. The startups that can show a clear ROI over time will be the ones who win those coveted VC dollars.

4. Venture capital is like Cruis’n USA

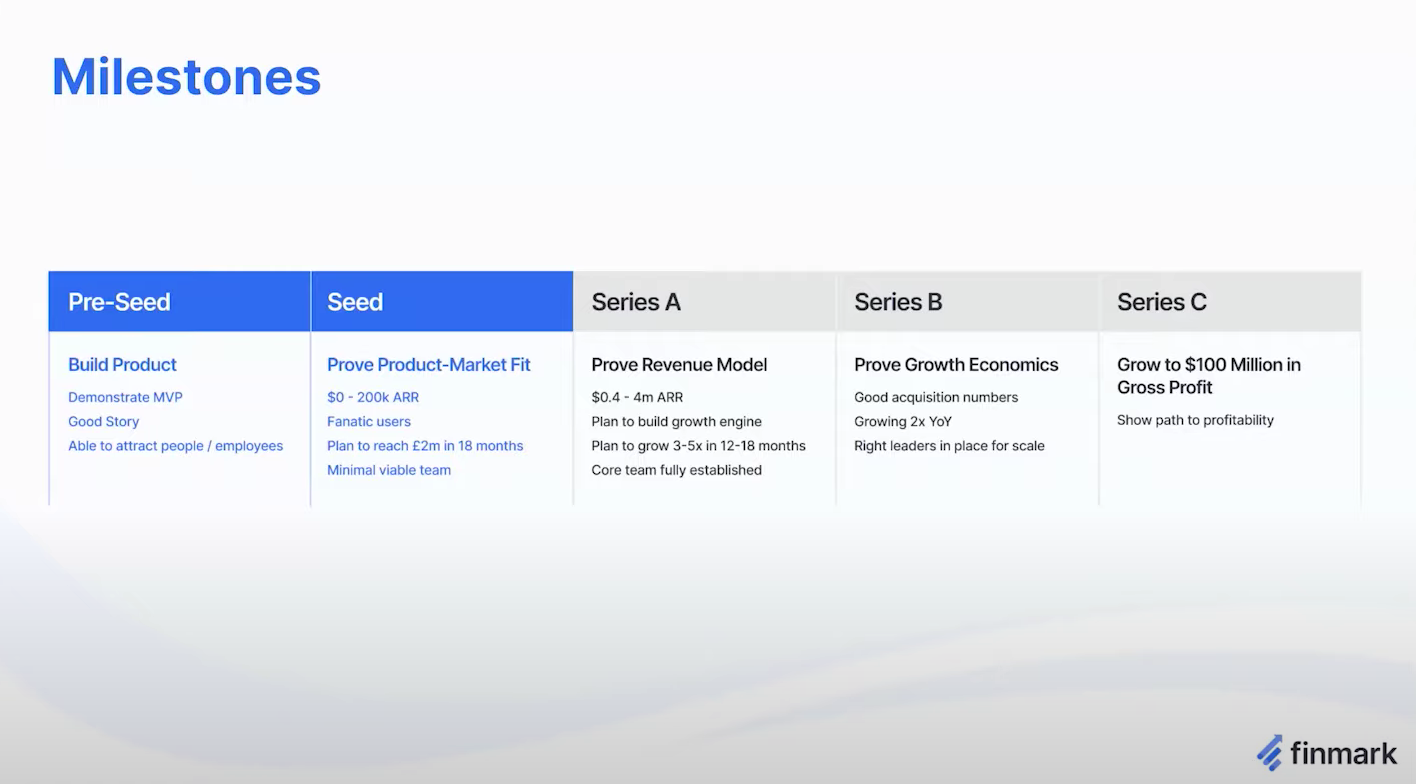

Venture capital works like step functions.

Once you accomplish enough goals or milestones, especially in the early stages, you unlock more money. It’s like the 80s arcade game Cruis’n USA. As soon as you pass a checkpoint, you earn more time on the clock.

Venture capital is the exact same way. You need to make sure you move fast enough to meet the checkpoint, all while ensuring you have enough money to make it there without time running out. Otherwise, your company will die on the vine.

5. Triple, triple, double, double, double

We’re not just talking gibberish here.

A good rule of thumb for growth rates is that you want to triple your first three years of revenue in year four, triple that year four revenue in year five, and continuously double your revenue in the years after.

So in the seed stage of funding, you need to clearly articulate how you will make money for these first few years, so you can triple, triple, double, double, double.

What’s Next?

Need some additional advice on preparing financials for your pitch? Have that seed funding secured and need some guidance on showing progress to your investors? We can help!

Click here to get started.

Or if you’re well on your way to raising that first round, upload your pitch deck into Finmark and get matched with dozens of the best investors like Bessemer, Village Global, Draper & Associates, and more.

Learn more about Get Funded with Finmark.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.