Customer Acquisition Cost (CAC)

Unless you have an unlimited budget and resources, customer acquisition costs (CAC) can be the difference between efficient growth and startup doom.

Your CAC is an indicator of how effective your sales and marketing efforts are, how efficiently you’re acquiring new customers, and even whether or not you have product/market fit.

Needless to say, you need to understand how to track, analyze and improve your CAC if you want your startup to succeed long term.

In this guide, we’re going to go over everything you need to know about customer acquisition costs so your business not only grows but thrives.

What is Customer Acquisition Cost?

Customer Acquisition Cost (CAC) is how much money you spend in sales and marketing to acquire one new customer.

Trying to find the “sweet spot” is something a lot of startups struggle with.

Spend too much to acquire customers and you won’t be able to recoup the money, let alone make a profit. Spend too little, and you might not be maximizing your company’s growth potential.

Generally speaking, your goal is to keep your CAC within budget, while achieving your customer growth targets!

CAC & Customer Lifetime Value

CAC by itself is a helpful metric. But in order to add more context, you need to measure it up against your customer lifetime value (LTV).

LTV is the average amount of money a customer pays you before they stop being a customer. For instance, if you’re a SaaS company and your average customer pays you $1,000 over the course of their subscription before they cancel, you’d have an LTV of $1,000.

If your average cost to acquire those customers is less than $1,000 then you’re in a good position. But if it costs you $1,500 to acquire customers, then you have a big problem.

That relationship between your LTV and CAC is called your LTV:CAC ratio.

Most experts like Profitwell and Chargify agree that the optimal LTV:CAC ratio is 3:1. For example, if your LTV is $1,000, you want to keep your CAC to around $333 or less.

How to Calculate Customer Acquisition Cost

In order to calculate your customer acquisition cost, take your sales and marketing expenses over a set period of time and divide it by the number of customers you acquired over that time period.

CAC Formula

Sum of Sales and Marketing Expenses / # of new customers acquired

Here’s an example.

If you’ve spent $5,000 on sales and marketing efforts in the last three months and acquired two new customers, then your CAC is $2,500.

A common question founders have is which sales and marketing expenses should be included in customer acquisition cost?

Essentially, any costs involved with getting new customers over your specified time period should be included.

Here’s a list of some of the most common marketing and sales expenses that you would include in CAC:

- Design for marketing materials (ad designs, landing pages, etc.)

- Sales and marketing employee salaries

- Advertising spend

- Sales and marketing tools (CRM system, reporting tools, etc.)

- Anything else incurred as it relates to sales and marketing

If you’re tracking your expenses with a tool like Quickbooks or Xero, calculating CAC is much easier.

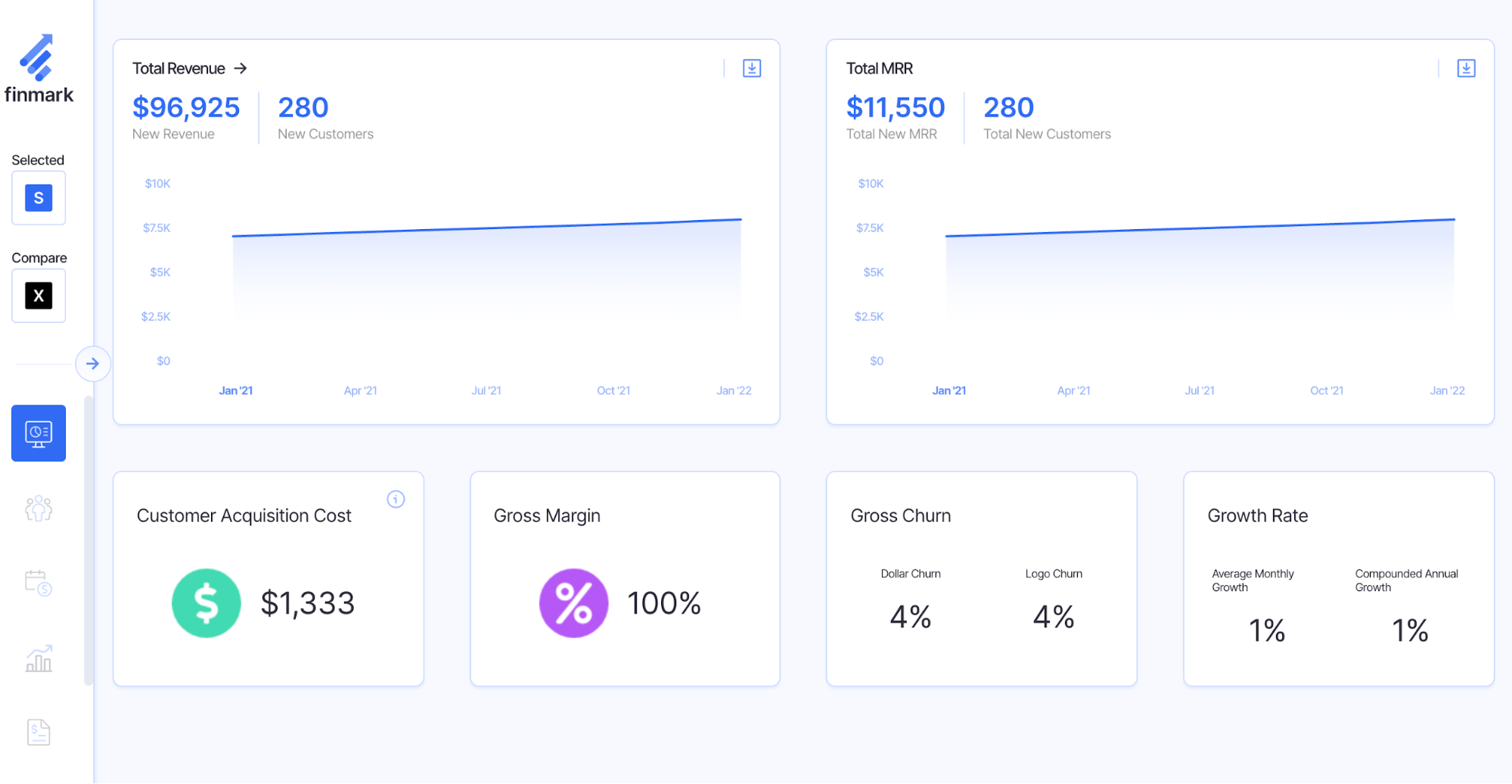

To take things a step further, you can add that data into Finmark to see how your CAC fits into your overall financial forecast (Xero integration coming soon).

We suggest tracking your CAC as early on in your startup as possible. As you start to test new marketing strategies, grow your team, and make other changes, you can see whether they make a positive or negative impact.

Why is CAC Important?

You’re probably already starting to get an idea of why CAC is such an important metric. But here are some reasons why you need to track your customer acquisition costs closely.

Find The Most Efficient Marketing Channels

If you’re spending money on marketing, particularly through paid channels like social media ads, Google Ads, and media buying, you need to keep a close eye on CAC.

Instead of just measuring your CAC as a whole, you should track your acquisition costs per marketing channel as well.

For instance, let’s say you’re running ad campaigns on multiple channels like this:

| Channel | Ad Spend | # of Customers | CAC |

| Facebook Ads | $1000 | 5 | $200 |

| Google Ads | $1000 | 10 | $100 |

| Newsletter Ad | $2000 | 15 | $133 |

The newsletter ad got you the most customers overall, but you had to spend twice as much as your other two channels to get them.

Looking at the numbers, Google Ads seems to be the most efficient use of your marketing dollars, so now you know where to put more resources.

If you’re trying to decide where to put your marketing dollars, CAC is a great indicator of which marketing channels yield the best results.

Optimize Your Sales And Marketing

On a similar note, your CAC can also improve your sales and marketing efforts.

Remember, the CAC formula takes into account all of your marketing and sales expenses. So if your LTV:CAC ratio starts to look more like 1:3 instead of 3:1, you know there’s an issue somewhere.

The problem could be that a specific marketing channel isn’t working well, your sales team is underperforming, or any number of other reasons. Use CAC as an indicator of how efficiently you’re spending your sales and marketing dollars to help identify problems or opportunities for optimization.

Find Your CAC Payback Period

When you spend money to acquire new customers, the plan is to make that money back and then some. Your CAC payback period tells you how many months it’s going to take to recoup the money you spent.

The higher your CAC payback period, the harder it is to grow your startup.

Let’s look at a quick example of how it works with a single customer.

Let’s say it cost you $250 to acquire a customer, and they’re paying you $25/month. You need that customer to stay with you for at least 10 months in order for them to pay back the amount you spent to acquire them.

If that customer churns within those 10 months, you’ve essentially lost money.

Now, imagine if instead, it only took you $100 to acquire that same customer. You’d get the money back in four months.

It’s a much quicker path to profitability and sustainable growth.

But it all starts with knowing your CAC.

What’s a Good CAC Benchmark?

There are a few CAC benchmark reports floating around online. But the numbers vary so much that it’s hard to compare your own business to the data.

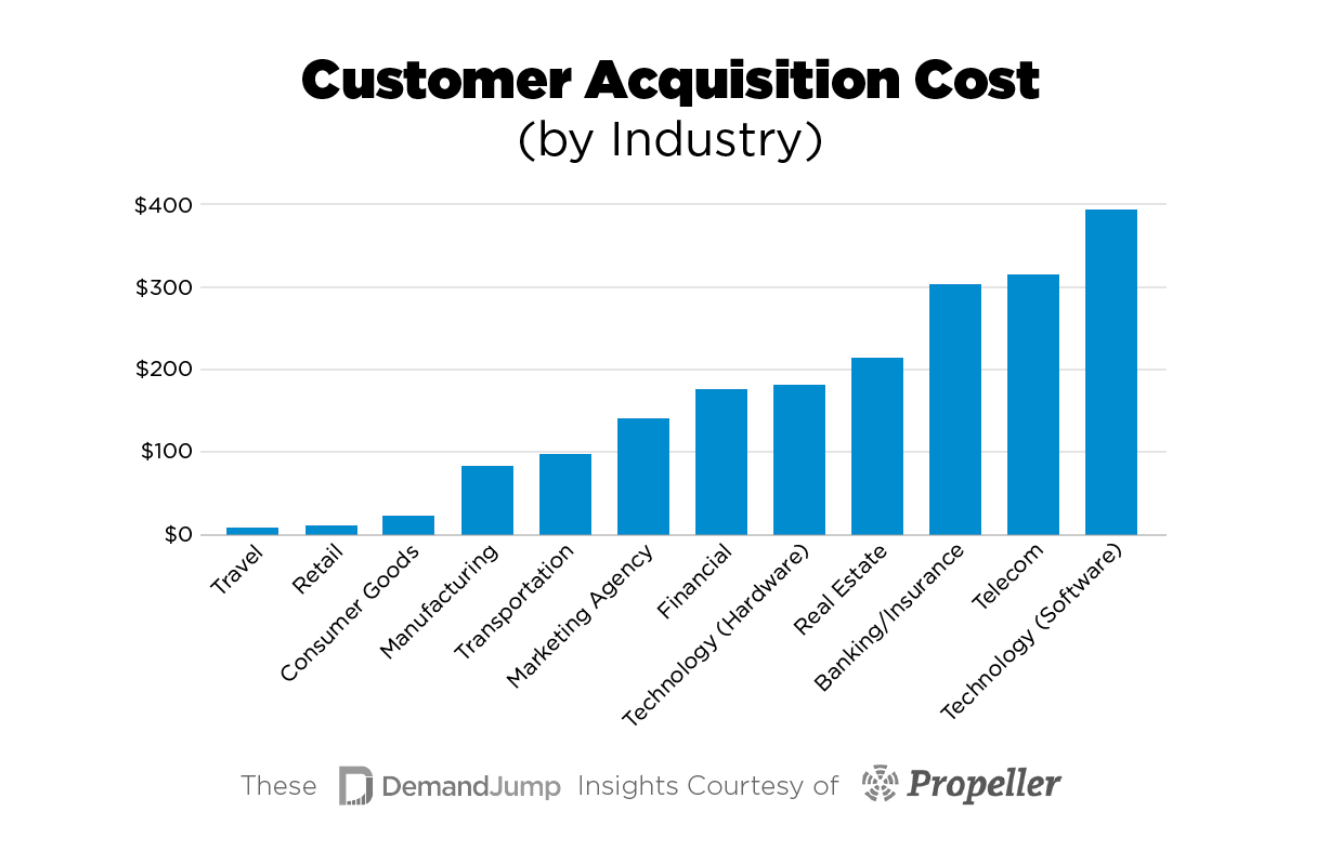

For instance this study shows most industries have an average CAC of over $100, but it doesn’t account for company size, product price, and other factors.

Your industry, target audience, pricing, and more, all have an impact on customer acquisition cost. That makes it really difficult to benchmark against other companies.

Instead, you can use yourself as a benchmark. As long as your LTV:CAC ratio is positive, you’re likely in a good position for your startup.

How to Reduce Customer Acquisition Cost

Like we mentioned earlier, the goal is to minimize your CAC while meeting your growth targets. But how exactly do you do that?

Here are a few ideas.

1. Constantly Test New Marketing Channels

When you need a contractor to work on your house, do you just go with the first quote? Or do you shop around to get the best price?

Hopefully, it’s the latter. Otherwise, you might be overpaying.

Marketing is similar. If you commit yourself to just one or two marketing channels, you won’t know if there are more efficient places to get customers.

It’s always good to test the waters a bit and experiment with different channels to see which gives you the most bang for your buck. Just remember to measure your CAC for each channel.

Resources:

- 22 Overlooked Digital Advertising Channels That Can Drive Acquisition

- 99 Powerful Marketing Channels That Drive Sales

2. Improve Your Funnel

A bad funnel can kill your customer acquisition cost. Two startups can sell very similar products, but if one has a better marketing and sales funnel than the other, they’re going to acquire customers for less money.

Let’s take a look at an example of two companies selling a similar product. They have the same process for their sales and marketing funnel and they both spent $1,000 to acquire 100 leads.

Notice the drop off rates after each stage.

| Stage | Business A (# of Leads Remaining) | Business B (# of Leads Remaining) |

| Live demo | 100 | 100 |

| Free trial | 60 | 80 |

| Paying customer | 20 | 50 |

You can see Business A loses 40% of their leads after the first stage, and then another 66% after the trial stage. So they end up with 20 paying customers for the $1,000 they spent—a CAC of $50.

On the other hand, Business B retains more customers through each stage and acquired 50 customers with a $20 CAC.

That’s the power of an effective funnel, and how it can drastically improve your CAC.

Resources:

- 18 Proven Ways to Increase Your Conversion Rate Throughout Your Sales Funnel

- 9 Ways to Make Your Sales Funnel Convert Better

3. Use Retargeting

Retargeting is one of the best ways to decrease your CAC because you’re showing ads to people who’ve already been to your website before.

That means they’re already somewhat familiar with your brand, and aren’t as “cold” as someone who’s never heard of you before.

One of the most common examples of this is when someone lands on your website via an article they found on Google. Then, you can retarget them on Facebook, Google, or another ad channel. Studies show retargeted visitors are anywhere from 43–70% more likely to convert than a cold lead.

Resources:

4. Invest in Sales Training

You might be thinking, “won’t spending money on sales training add to my acquisition costs?”

In the short term, yes. But if the training works well and your sales team is able to convert customers more efficiently, it’ll lower your CAC over time.

According to data from Accenture, for every dollar a company invests in sales training, they get about $4.53 in return. Spend the money now and reap the benefits long term.

Resources:

- 12 Sales Training Techniques To Build An Unstoppable Sales Team

- Top 40 Sales Training Programs and Techniques That Will Help You Win

Get a Grip On Your Customer Acquisition Cost

For startups, every dollar counts. Understanding CAC means you can invest the right amount of money into marketing and sales, instead of taking all those hard-earned fundraising dollars and flushing it down the toilet.

The right sales and marketing strategy can make or break your company, and knowing your CAC will set you up for success in the long run.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.