Research And Development Expenses

Similar to other operating expenses, Research and Development (R&D) expenses are true to their name, as the costs related to the research and development of your company’s product or service.

R&D costs may be high during the early stages of your business as you work on a prototype or create your minimally viable product (MVP), but as you grow and adapt, you may want to consider continuously reinvesting in R&D to stay on top of trends and exceed customer expectations.

Consider the following as you calculate what you should and shouldn’t include within R&D expenses.

What Are Research And Development Expenses?

Simply put, R&D expenses are all costs associated with the research and development of your product or service, along with any intellectual property (IP) generated during the R&D phase, including patents and copyrights.

R&D expenses include the original development and design of the product, as well as any enhancements you and your team choose to make over time. R&D expenses are included within the overall operating expenses and typically reflected as an individual line item on an income statement.

The benefits of R&D aren’t always immediately felt. For example, it may take several iterations of a product before it is ready for a beta test.

Given these uncertainties, GAAP mandates that all R&D costs are expensed in the same year they are spent, even if you are months or years away from your product launch.

Research And Development Expenses List

So you understand R&D expenses, but what should you account for when calculating R&D as part of your operating costs?

While an idea or innovation may be difficult to define, the salary of all executives and employees who contributed to R&D is a good place to start, including:

- Chief Technology Officer (or any other technology or product-specific executives that were a part of the process)

- Engineers

- Designers

- External contractors or consultants

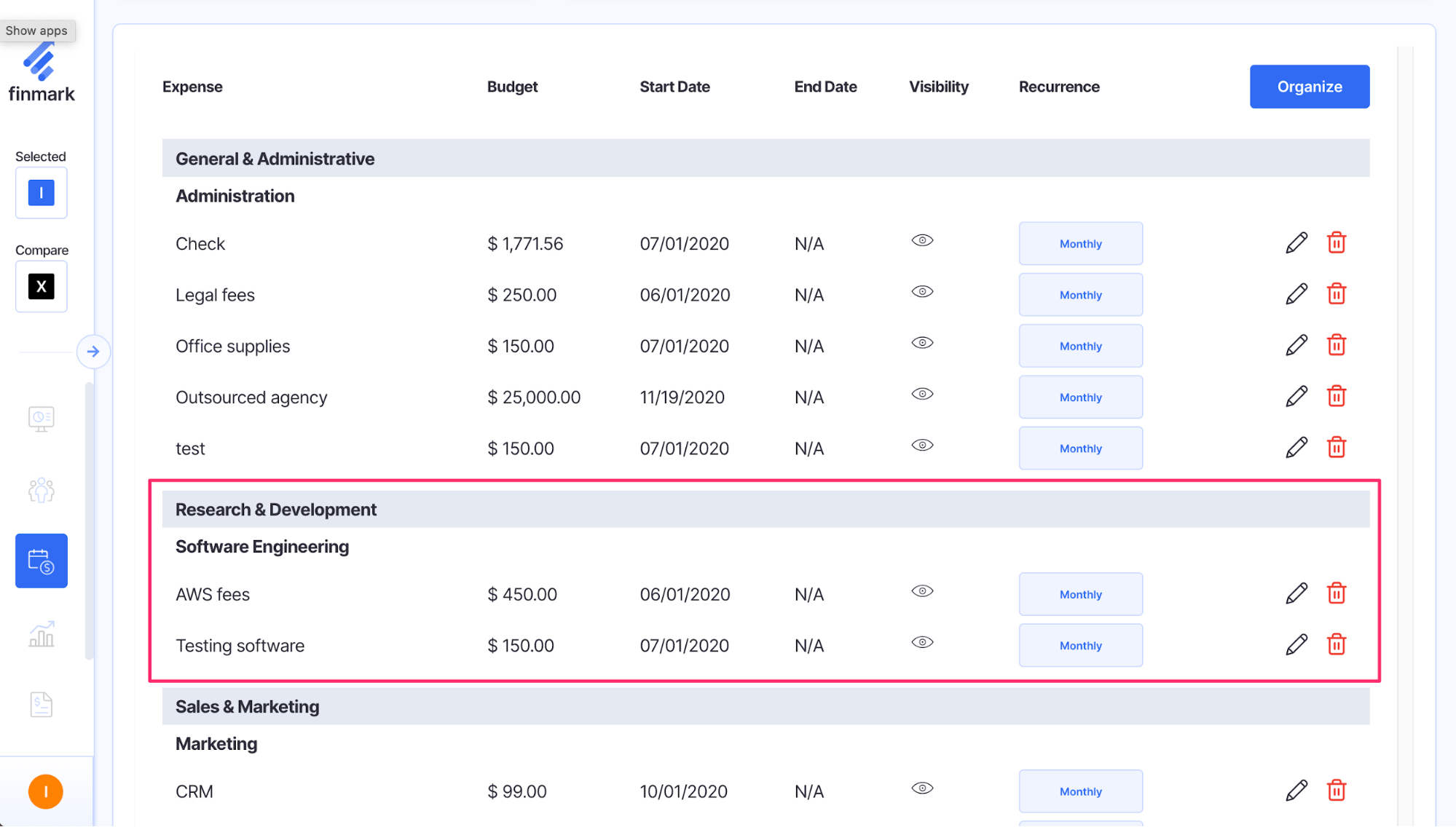

Other costs to consider include the cloud infrastructure, version control services and any other software or tools used to create the design or development of your product, along with the costs incurred if you file for a patent on your design or innovation.

Why Research And Development is Important

For many startups, R&D is a major investment and is a necessary element to getting your business up and running.

Without R&D, your idea may still be on the back of that paper napkin. As a startup founder, depending on your background, you may be able to spearhead R&D. However, more often than not, it is necessary to invest in quality talent and resources to create and improve your idea.

As you continue to iterate on your product, R&D also allows you to stay ahead of the competition, ultimately allowing you to sell more products and grow your business.

How to Maximize Your Research And Development Expenses

Good news! You may be eligible to claim R&D expenses as an R&D Tax Credit to offset some of the costs incurred during R&D.

The US Research & Experimentation Tax Credit is a general business tax credit under IRS code section 41 for companies that incur R&D expenses in the United States.

There are several resources and services available to help determine if your expenses qualify for the R&D Tax Credit. A quick Google search can help to determine which resource or company may be right for you.

R&D is a worthwhile investment to create and improve your product offering. Many businesses invest millions of dollars into R&D, and while cost-cutting measures may be helpful in the short-term, your product or service may suffer.

Research And Development is Key to Innovation

The startup world is full of innovation and new ideas. Whether it’s improving on products that already exist, or building something the world has never seen, it all starts with research and development.

But if you aren’t mindful of how much you’re spending, innovation can put you out of business before you even get off the ground. If you want to track the impact your R&D expenses have on your startup’s future, build a financial model in Finmark so you can forecast into the future.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.