EBITDA

From CFO to GAAP to COGS, there’s no shortage of acronyms in the world of finance.

One that you’ll see regularly discussed in both business finance management and investor circles is EBITDA: Earnings Before Interest, Tax, Depreciation, and Amortization.

Like most metrics, EBITDA is valuable for financial analysis but does have some drawbacks.

It’s regularly used for comparing profitability across businesses with different capital structures. On the other hand, it’s often criticized as a false metric that doesn’t take into account very real costs like taxes.

Let’s take a closer look at EBITDA to understand what it can tell you about your business, and help you determine whether or not it’s a financial metric you should measure.

What Is EBITDA?

EBITDA stands for Earnings Before Interest, Tax, Depreciation, and Amortization. It’s a measure of company profitability and is an alternative to net income (though in practice both should be used).

Let’s break the acronym down:

- Earnings: This is your gross income (total revenue less operating expenses)

- Interest: The cost of servicing debt repayments (can also be interest earned, though that’s less common).

- Tax: You’ve probably got a pretty good idea of what tax is.

- Depreciation: The loss in value of long-term assets like vehicles and machinery.

- Amortization: The loss in value due to the eventual expiration of intangible assets such as patents

EBITDA is essentially net income stripped of non-cash expenses (depreciation and amortization), as well as taxes and debt costs that are dependent on the company’s capital structure.

As such, EBITDA’s goal is to represent cash profit generated by company operations.

While EBITDA is a widely used metric, it is actually not recognized under generally accepted accounting principles (GAAP).

That means that you won’t always find EBITDA in the big three financial statements (income statement, balance sheet, and cash flow statement).

That said, many public companies still report EBITDA as part of their quarterly results (often on the income statement), as they understand that it is a measurement that many investors recognize and use to make investment decisions.

EBITDA Formula: How To Calculate EBITDA

To calculate EBITDA for your business or one you’re considering investing in, you’ll want to first pull together the company’s financial statements.

Here’s where to look:

- Earnings (net income): Income statement

- Interest: Income statement

- Tax: Income statement

- Depreciation: Cash flow statement

- Amortization: Cash flow statement

From there, it’s a pretty straightforward calculation:

EBITDA = Net Income + Taxes + Interest Expense + Depreciation & Amortization

There is a quicker way, though.

Most organizations report operating income, which has another name: EBIT (earnings before interest and taxes).

With EBIT already in hand, all we have to do is add back in depreciation and amortization, making our formula even simpler:

EBITDA = Operating Income + Depreciation & Amortization

So, EBITDA is fairly straightforward to calculate.

But is it worth tracking? Or is it just another number that distracts from the bigger picture?

Why Is EBITDA An Important Metric For Businesses, And How To Use It

EBITDA is useful for tracking the underlying profitability of companies, absent of the impact of depreciation practices and financing choices (and therefore debt repayments).

This makes it an important measure for comparing companies with different debt structures or that are based in different countries (and, therefore, may operate under different accounting principles).

EBITDA is a particularly useful metric in two distinct industries:

- Asset-intensive industrires

- Intellectual property-heavy industries (like software development)

Companies in asset-intensive industries have a high degree of investment in property, plant, and equipment (PPE), and therefore have correspondingly high depreciation costs.

High depreciation can obscure changes in the underlying profitability of the company, and EBITDA helps illuminate that.

For companies with a heavy reliance on intellectual property (like early-stage health tech, software, and research organizations), amortization is regularly used to expense the cost of developing that intellectual property.

This, too, can mask the underlying profitability of the company. Hence EBITDA is often preferred as a metric.

However, EBITDA does have a few potential drawbacks.

Drawbacks Of EBITDA As A Financial Metric

We’ve already mentioned that EBITDA is not a metric that is recognized under GAAP.

While we shouldn’t write it off just because it isn’t sanctioned (where’s your rebel spirit?), we should recognize that EBITDA is kind of a doctored metric.

Ignoring Some Real Costs

The expenses that EBITDA ignores (like tax) are real. The business still has to pay that tax, whether you look at it or not, so EBITDA isn’t exactly a true measurement of profitability.

So, too, are capital expenditures. Under GAAP, large capital expenses are expensed using deprecation so that the cost of the purchase can be amortized over the life of the asset.

If we’re cutting that out of the equation, we’re basically pretending that capital investments don’t exist, and those assets came to use at no cost.

Issues With Calculation

Since EBITDA isn’t a GAAP-recognized metric, it’s “no holds barred” when it comes to its calculation.

Well, not exactly, but the way EBITDA is calculated can vary between companies.

Once you add in the fact that different companies use different earning figures as their starting point, it becomes apparent that the value of EBITDA as a comparison tool might be more than a little diminished.

In the United States, the U.S. Securities and Exchange Commission (SEC) requires listed companies that use EBITDA figures to show how they were calculated from net income to provide some transparency here.

Bad Reporting Habits

It has, unfortunately, become common for businesses to emphasize EBITDA over net income, since the number is almost always higher.

This is a red flag for investors, especially if a company hasn’t reported EBITDA previously and has now started featuring this figure prominently.

In this case, it’s possible that the business is servicing high debt or is suffering from rising capital and development expenses, and is thus using EBITDA as a way to distract from these challenges.

For all of these reasons, some investors (like Warren Buffett) reject EBITDA as a valid measurement.

They believe that since tax, interest, depreciation, and amortization are all real costs that shouldn’t be ignored, EBITDA is a false flag.

Track And Analyze EBITDA In Finmark

First, it’s important to recognize that EBITDA isn’t perfect.

If you’re going to use it, whether in the context of investing or in tracking your own company’s progress, make sure to do so alongside other financial metrics like net income.

Then, as with all finance measurements, the critical thing to keep front of mind is that it’s not about the number itself; it’s about how you interpret that figure and use it to improve financial strategy.

For instance, if net income isn’t growing over time, but EBITDA is, this could be because your debt servicing obligations are excessively high. You may make a decision to seek equity funding to help pay down debt, and improve your net earnings figure.

In the pursuit of making analysis your focal point, consider how you can implement modern finance tools to automatically calculate key figures, saving you the need to pull out the old calculator each time you want to review EBITDA.

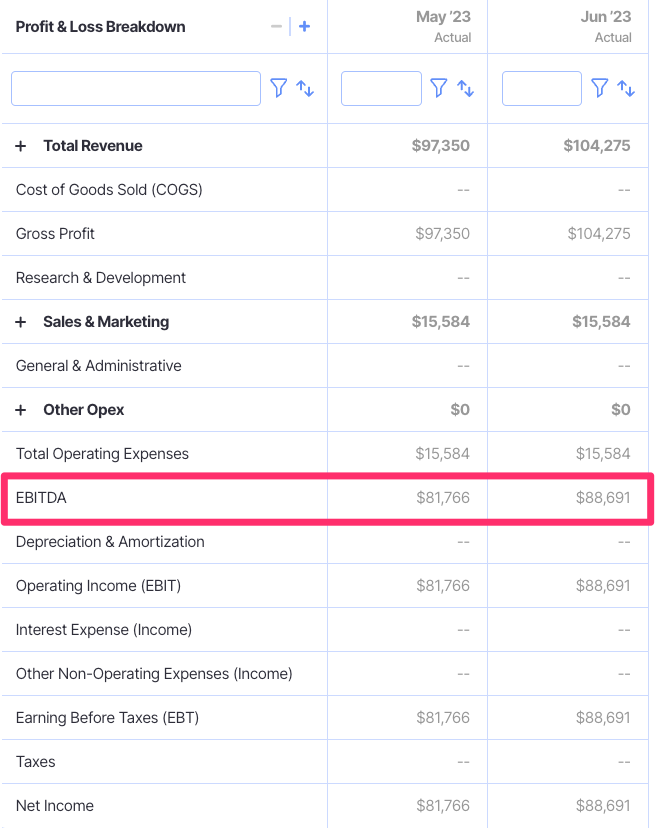

In Finmark from BILL, you can automatically calculate EBITDA and track changes in our profit and loss report.

Learn more about Finmark’s diverse set of features for financial planning and analysis here, or dive in yourself with a 30-day free trial.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.