Negative Churn

The dreaded negative number.

Seeing that you are “in the red” on your financial model, business docs or income statements may send you into a state of panic. However, for this metric being in the negative is actually a good thing!

Keep reading to learn more about negative churn, how it’s calculated, and why it’s important to have negative churn.

What is Negative Churn?

Negative churn — also known as net negative revenue churn or negative revenue churn — is when new revenue from existing customers (expansion MRR) is greater than the amount of revenue you lost from cancellations and downgrades (churned MRR).

Note, expansion MRR is the monthly recurring revenue gained from existing customers through upgrades, add-ons, or cross-sells, while churned MRR is the monthly recurring revenue lost from customers who cancel a subscription to your product or service or downgrade their plan.

Learn more about monthly recurring revenue (MRR) and MRR churn.

Note: having negative churn is fairly difficult to achieve for most early-stage startups, so don’t worry if you’re not seeing a negative number just yet.

How to Calculate Negative Churn

To calculate negative churn, you’ll need to subtract your expansion MRR from your churned MRR and divide that by your total MRR from the previous month.

Negative Churn Formula

(Churned MRR – Expansion MRR) / MRR at end of last month

For example, if you lost five customers but gained 10 hours of professional services from two customers looking to implement new features, your negative churn formula may look something like this:

Churned MRR: Five customers ($250 monthly subscription) = $1,250

Expansion MRR: 10 professional service hours at $150 per hour = $1,500

MRR: 50 total customers = $12,500

($1,250 – $1,500) / $12,500 = -2% churn

As you can see with this example, having expansion MRR (upselling and cross-selling current customers) offsets the revenue lost from churn.

Why is Negative MRR Churn Good?

Simply put, negative MRR churn is the pinnacle of customer retention.

Negative churn means you’re doing a great job of delivering added value to your existing customer base. This additional value comes in the form of retention — which is incredibly important for subscription-based startups.

Not to mention, having negative churn helps to increase growth, as you are adding new revenue from your existing customers, while also acquiring new customers. Coupled with consistent customer retention, then you’ll be on an upward trajectory fairly quickly.

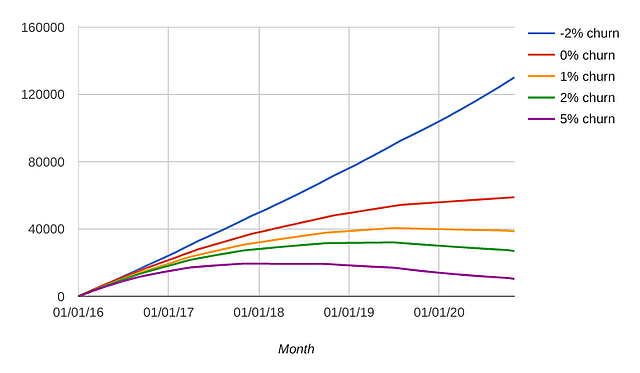

This chart from ProfitWell does an excellent job of showing why negative churn is so important. Hint: the fastest growth is from the -2% churn rate!

Your churn rate can also impact other financial metrics. Understanding churn over time can help when building your financial models to accurately predict future company growth.

For example, if you know how much revenue you may lose over the next six to twelve months, you can more accurately forecast your startup’s runway.

How to Get a Net Negative Churn Rate

Safe to say that the best way to make an impact with your churn rate is to make an impact on your customer base.

Providing compelling options for add-ons, like new features, while reducing the number of customers that walk away or drop your service can help you to improve or optimize your negative churn rate.

Consider the following as you build negative customer churn into your overall business plan:

1. Increase Expansion MRR

Expansion MRR is the key to improving churn metrics. While selling to new customers may be more of a thrill, focusing on improving the service you provide to current customers will pay off in dividends.

In fact, studies show that acquiring a new customer is at least five times more expensive than marketing to your current customers — a major sign to focus on expansion MRR.

Increasing expansion MRR can include customer upgrades, cross-sells and up-sells. For example, you can up-sell a customer on a basic subscription plan to an expanded subscription that will give them access to new features and services.

You can also build subscription increases into your contracts to guarantee new revenue each time a contract is renewed (typically on an annual basis).

2. Reduce Revenue Churn

Before you can start reducing your churn, you should have an understanding of typical churn. For some early-stage startups, this may mean you have to turn to industry benchmarks, as you may not yet have enough data to understand what your churn may be.

In his blog, Tomasz Tunguz, Managing Director at Redpoint Ventures, says startups tend to operate with higher monthly churn rates, somewhere between 2-5%, while mid-market and enterprise companies see lower churn rates.

But how do you bring that churn down? Similar to expansion MRR, it starts with your customers. If you can focus on providing exceptional customer service, then you will naturally see your churn improve over time.

While bringing on a customer success team may be at the bottom of your to-do list when starting a business, it’s more important than you think. The moment your first (or fiftieth) customer signs on the dotted line, you should be ready to provide them with stellar levels of service.

Other opportunities to reduce churn can include preventing involuntary churn — where a customer has a payment failure due to an expired credit card or incorrect billing information. Investing in a dunning management tool can help you to prevent this type of churn.

Start Reducing Churn with Finmark

Ready to start tracking churn metrics but don’t know where to start?

That’s where Finmark comes in. Our financial modeling software puts you in control — where you can create and share financial plans, manage burn rate, and forecast revenue — without complicated and pesky spreadsheets that are difficult to manage.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.