Customer Churn

Customer churn is one of the few metrics that startups are excited to see go down instead of up.

After all, nobody likes losing customers, but it’s unavoidable. Everyone from small startups to your favorite Silicon Valley unicorn has had to deal with churn at some point. The way you handle it will determine how deeply it’ll impact your company.

Luckily, there’s plenty you can do to keep customer churn at a manageable level so that it doesn’t eat away at your MRR too much.

Let’s take a look at what customer churn is, why you need to track it, how to reduce it, and more.

What is Customer Churn?

Customer churn is the percentage of customers your business lost in a set period of time.

For instance, if you had 100 customers at the beginning of the month, and lost 10 of them throughout the month, you had a 10% churn rate for the month.

Churn is typically measured by SaaS and subscription-based companies that have recurring revenue. Once a customer cancels their account or stops paying for their subscription, they’ve “churned”.

The more customers you retain, the lower your churn rate.

The higher your churn rate, the more difficult it is to grow because you’ll constantly be chasing new customers to replace the ones that are churning. To build sustainable growth, you need to keep your churn rate as low as possible while you acquire new customers.

One thing to keep in mind though, is that every business has some customer churn. Your product won’t be the right fit for everyone, and that’s ok. Your job is to do everything you can to keep your churn as low as possible.

Alternate names for churn: logo churn, customer attrition, customer turnover, customer defection, client churn

Types of Churn

Contrary to popular belief, all churn isn’t the same. Churned customers fall into one of two buckets:

- Voluntary churn happens when a customer wants to stop using your product and cancels their account.

- Involuntary churn happens when a customer’s payment fails and they never update their billing information.

As the name suggests, involuntary churn can happen by accident. Your customer’s credit card expired, they got a new card and forgot to update their billing information, or any other billing-related issue.

It’s called “involuntary” because the customer isn’t actively canceling their subscription. But after a certain period goes by without them making a payment, they’re considered a churned customer.

A lot of startups have a plan in place to reduce voluntary churn, but not as many take action against involuntary churn. We’ll dive into some tips on how to reduce both types of churn a little later.

How to Calculate Customer Churn

To calculate your customer churn rate, choose a time period (usually monthly). Then divide the number of churned customers by the total number of customers you had at the beginning of the period.

Churn Rate Formula

(# of churned customers / total # of customers at the beginning of the time period) *100

For example, let’s say you had 2,500 customers at the beginning of the month, and 50 people canceled during that month. Your customer churn rate would be 2% [(50/2500)*100].

Why Customer Churn is Important

Customer churn is arguably one of the most important metrics for the health of your business. To put it simply, if you can’t retain customers then it’s nearly impossible to grow a sustainable business.

Here’s why.

Churn = Lost Revenue

By definition, churned customers aren’t paying you money. Here’s an example to illustrate just how much impact churned customers have on your MRR.

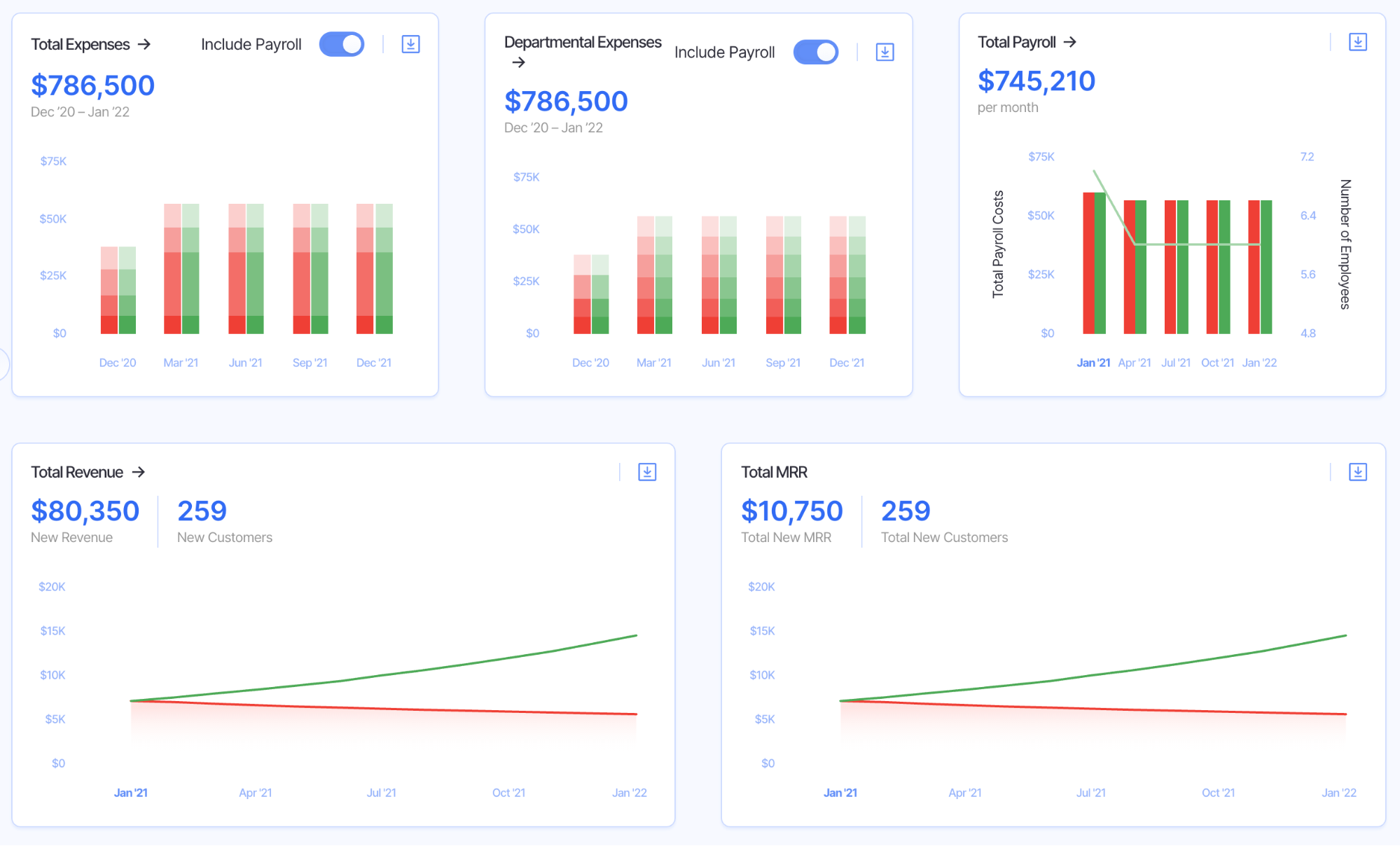

These are two financial scenarios of the same company. In scenario #1 (the green) they have a 4% churn rate. In scenario #2 (the red) they have a 7% churn rate.

Which scenario looks better to you?

As you can see from that example, customer churn will put you out of business if you’re not careful.

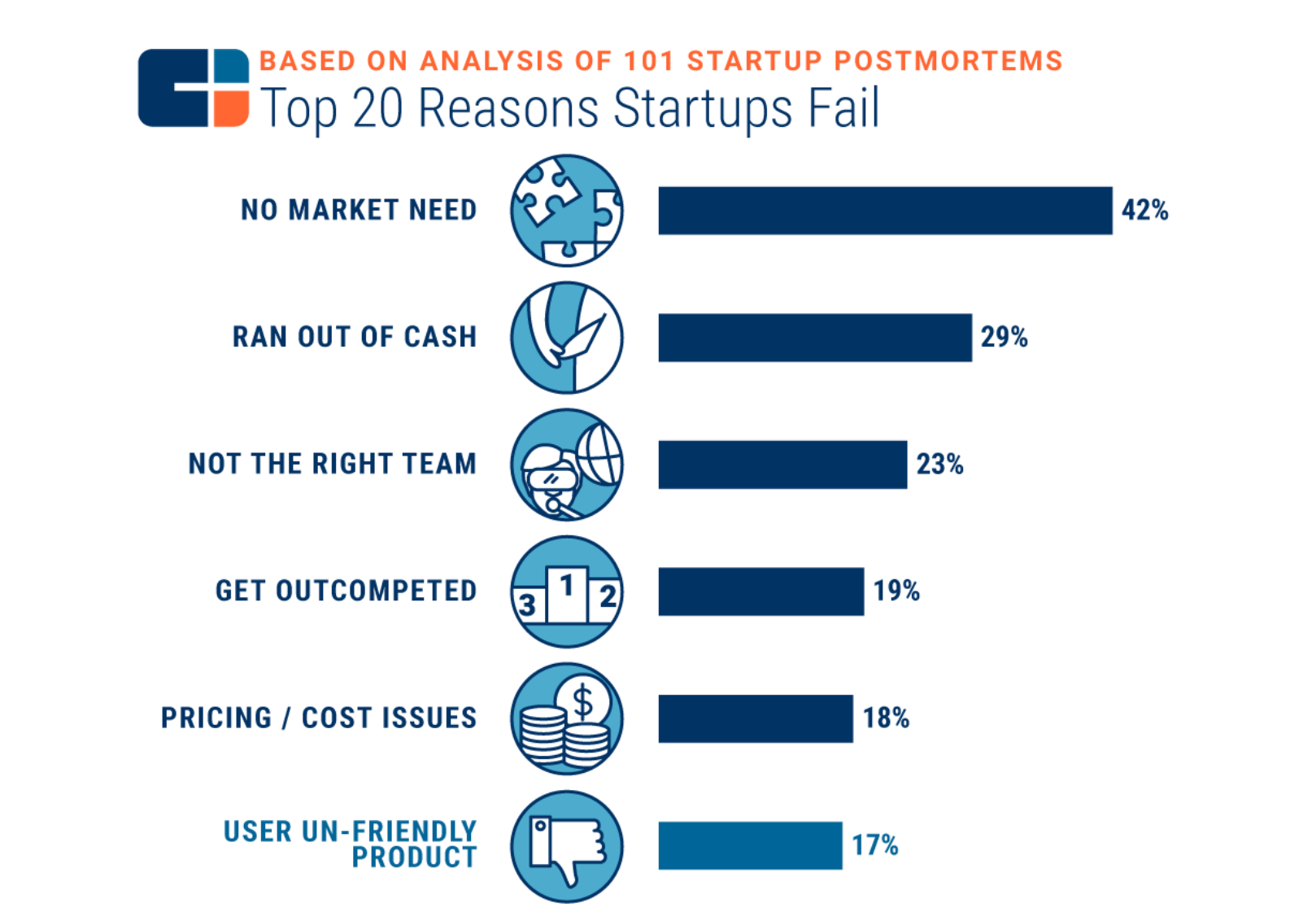

According to one study, running out of cash is the second most common reason startups fail. Many of the other reasons are also closely related to churn (no market need, getting outcompeted, pricing).

To keep a healthy runway, you need to retain customers. And at the very least, you need to prevent customers from churning within your CAC payback period.

High Churn Can Scare Away Investors

High customer churn is a red flag to investors when you’re trying to fundraise after you’ve been around a while.

Churn isn’t so scary when you’re doing a Series A round and trying to find product/market fit.

But when your company has been around for two years and you’re still struggling to reduce churn, it’s a sign of a bigger problem and can make fundraising more challenging.

Churn Exposes Your Shortcomings

Customers churn for a variety of reasons, including:

- They don’t understand how to use your product

- They found a better alternative

- Your product doesn’t solve their problem

- They don’t feel like they’re getting enough value to justify the price

All of these reasons are vulnerabilities you need to work to fix. And oftentimes, you might not know just how much of an issue something is until customers start canceling because of it.

Customer Churn Benchmarks

What’s a good customer churn rate?

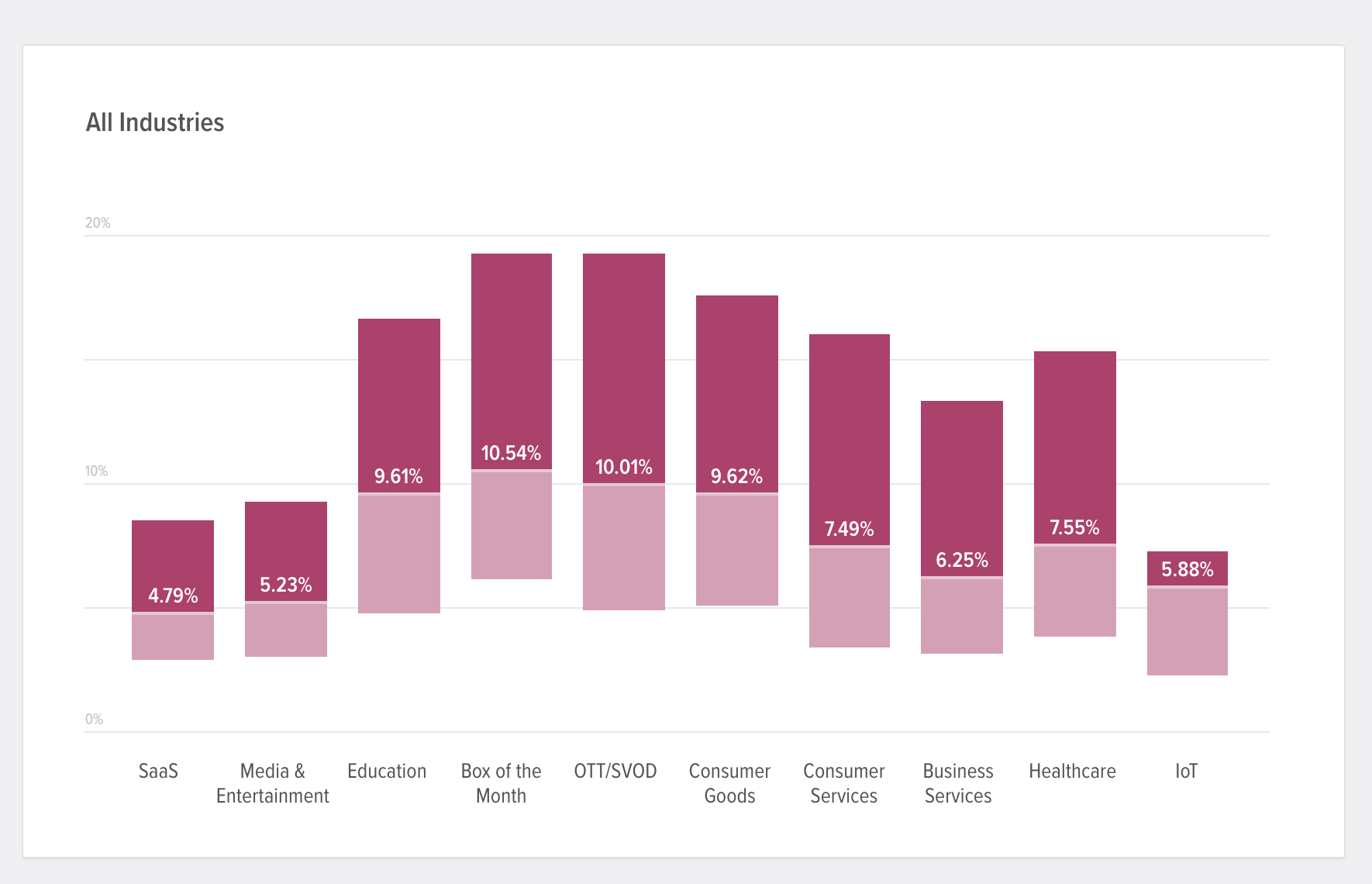

The answer can vary from industry to industry. However, there’s quite a bit of benchmark data from tools that report and analyze churn.

For instance, data from Recurly showed that the average churn rate for SaaS companies is around 4.79%. And for other industries, it teeters around 6-9%.

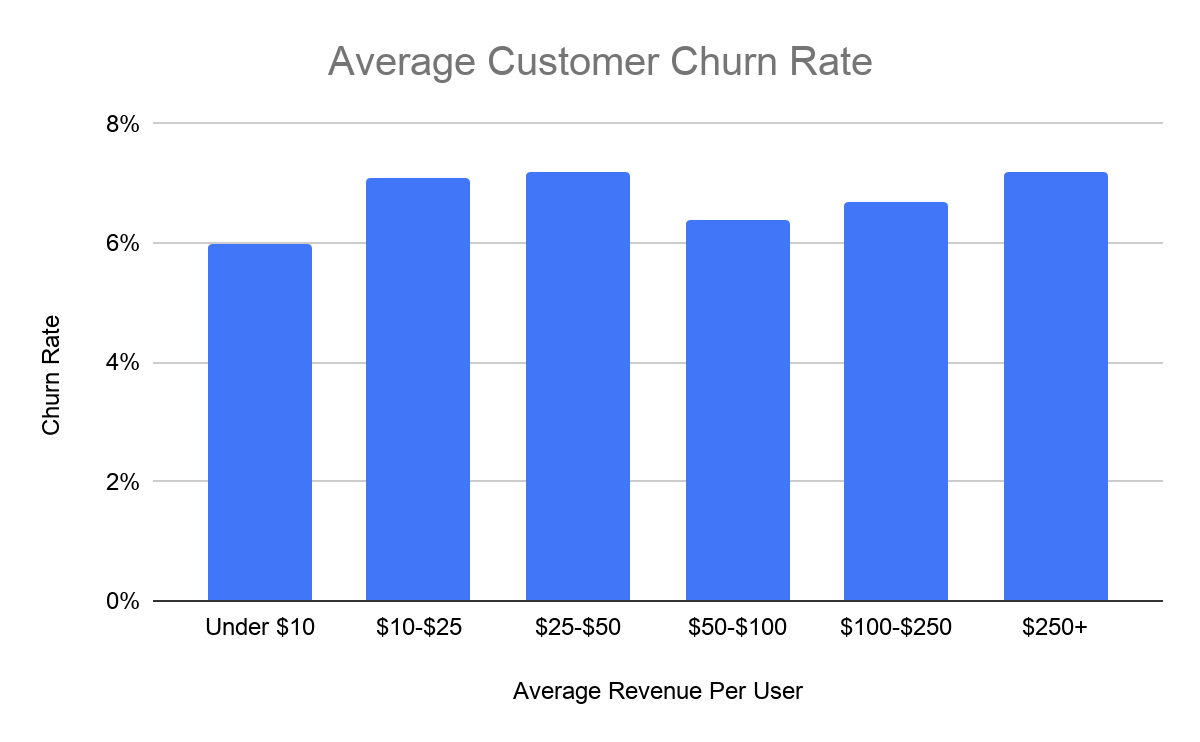

Baremetrics also has some customer churn benchmarks. According to their data, most subscription companies have an average churn rate of 6-7% depending on average revenue per user.

Ultimately, a “good” churn rate depends on your business. Can you sustain a 7% churn rate? What does your 12-month runway look like if you have an average monthly churn rate of 4% churn vs. 6%?

You can build these types of scenarios out in Finmark, and see the impact churn has on your business. You can learn more here.

How to Prevent Customer Churn

You know how to calculate churn and why it’s important. The only thing left is to figure out what you’re going to do about it.

Whether you have a high churn rate and need to reduce it to stay in business, or your churn rate is at a good level and you want to keep it that way, here are some ways you can prevent customers from churning.

1. Learn Why Customers Are Churning

The first step to retaining customers is to understand why they’re leaving. And the easiest way to do that is to just ask!

Part of your cancellation process should include an exit survey or a form to collect cancellation reasons.

You don’t even have to set up expensive tools to get started. Pat Walls, the founder of Pigeon, sends out an email asking for feedback when customers cancel.

You can also use a tool like SurveyMonkey to set up a questionnaire.

As the results start to come in, go through them and look for trends. Then use your findings to build your product roadmap and create a growth strategy.

For instance, if most users are canceling because a specific feature is missing, you know what to build next.

Resources:

- How We Grew Our Customer Exit Survey Responses by 785%

- How to Create Cancellation Surveys That Get a Response

2. Be Proactive

If the first time you interact with a customer is when they’re canceling, there’s a chance you could have prevented them from churning by intervening earlier.

Since minimizing churn is vital to the growth of your startup, try to prevent it before it happens. Here are a few things you can do:

- Reach out to inactive accounts: If you use a product analytics tool like Pendo or Amplitude, you can see when customers have gone a long time without logging in. Reach out to them to see if there’s anything you can help them with.

- Send content after onboarding: A lot of startups know the importance of sending helpful content to trial users and new customers. But after about two months, the emails often slow down or completely stop. If you want to keep people engaged with your product, be consistent with giving them tips and advice to get the most from their subscription.

- Use NPS surveys: NPS surveys can be a good way to see trends in how your customers think about your product overall. Use them to your advantage to get in touch with unhappy customers before they churn.

Those are just a few ideas. The main point is to communicate as much as possible. The last thing you want is for customers to churn over something that could’ve been prevented.

Resources:

- 12 Great NPS Survey Question and Response Templates

- 5 Tactics That Will Help You Re-Engage Inactive Users

3. Provide Amazing Customer Support

Have you ever had a customer support experience that was so terrible it made you stop doing business with the company altogether?

You’re not alone.

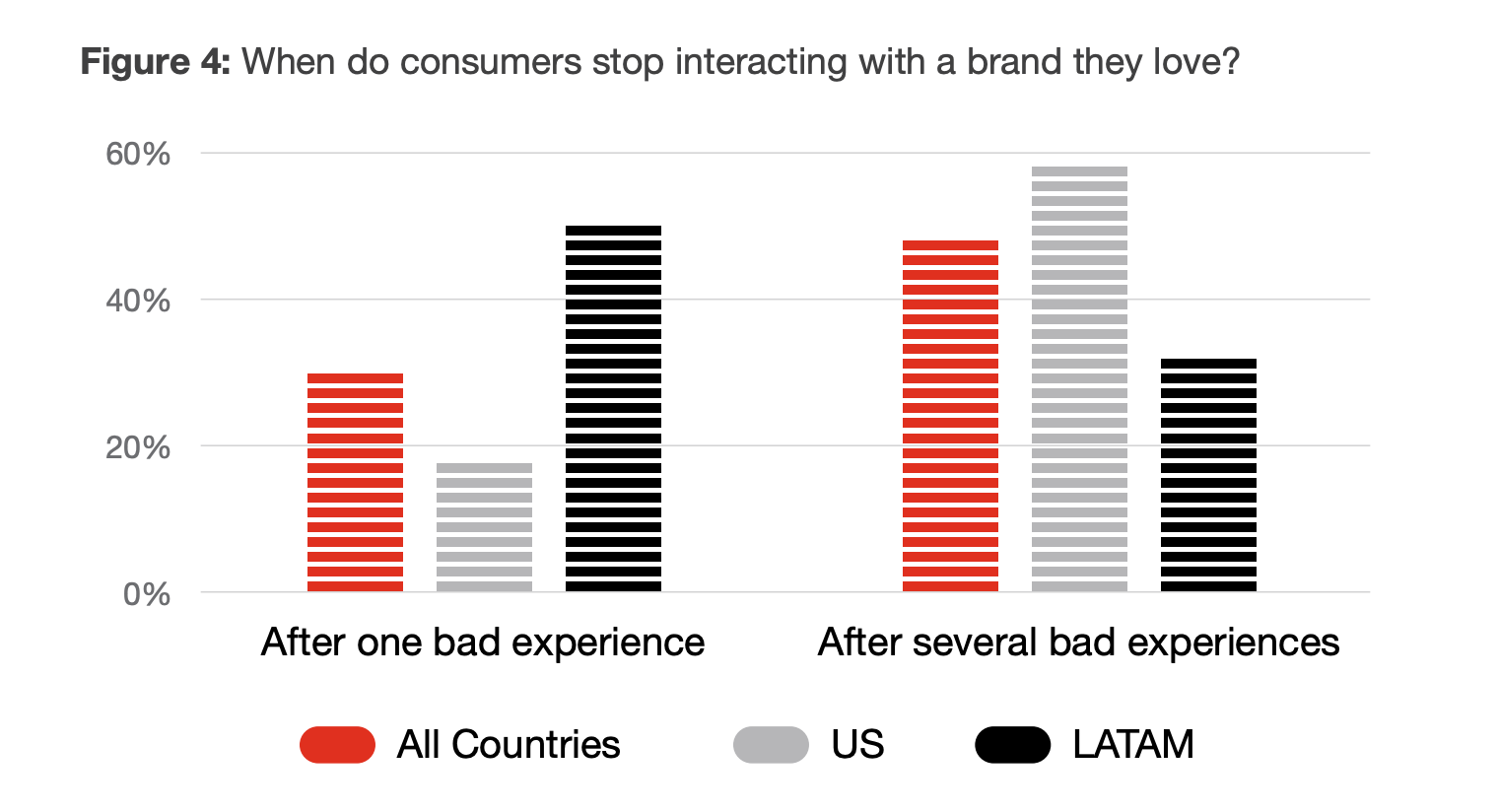

One survey found that almost 20% of Americans would walk away from a brand they love after just one bad experience. That number almost triples to 59% after several bad experiences.

If you want to lower your customer churn, do everything you can to give customers a great experience whenever they interact with your brand. And go the extra mile when possible.

Resources:

- How Startups Can Build a World-Class Customer Support Operation in Seven Days

- 16 Key Customer Service Skills (and How to Develop Them)

4. Prevent Involuntary Churn

According to Recurly, the average monthly involuntary churn rate is 1.39%. For a company doing $100,000 MRR, that’s over $10,000 a year in lost revenue that could have potentially been prevented.

Here’s the process a lot of companies go through when payments fail:

- The payment fails

- The company sends a generic email to let them know

- It’s up to the customer to take action or not

Step #2 is where there’s a big opportunity to improve.

Instead of sending a generic email from your payment processor, create a series of custom emails to remind the customer to update their billing information. That’ll increase your likelihood of recovering the payment and reduce involuntary customer churn.

Resources:

Stop Churning, Start Retaining

Customer churn can easily get out of hand if you’re not careful. Even if it’s only going up 1% or less each month, eventually it’ll eat away at your revenue until you look back wondering where all your customers went.

Get in the habit of monitoring your churn monthly. And to be prepared, use Finmark to create financial models and see what your startup’s growth will look like if your customer churn rate goes up, down, or stays flat.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.