Cash Runway

For a pilot, runway is critical in both takeoff and landing. Unsurprisingly, runway is also incredibly important for startups, as the amount of runway you have can make or break your startup taking off.

Continue reading to learn more about cash runway.

What is Cash Runway?

Cash runway is the number of months until cash runs out. You can either estimate your cash runway using forecasts, or you can calculate it based on your burn rate.

If your business is spending more than it takes in, it is burning cash. Your burn rate is your cash expenses minus cash revenues.

If your company has a burn rate of $10,000 then that means you are spending approximately $10,000 per month in excess of your revenues.

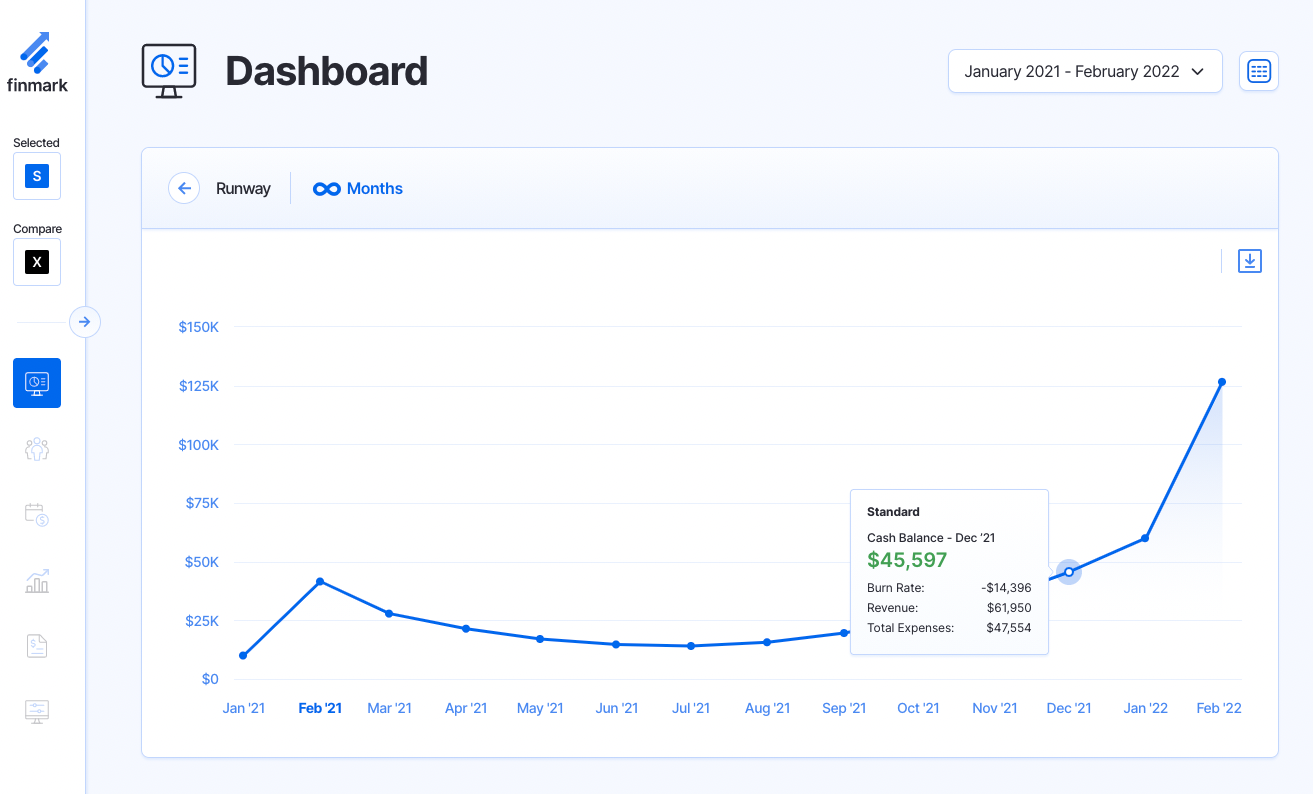

Forecast Your Runway With Finmark!

Early-stage startup founders typically track cash runway far more often than more mature businesses, as revenue and profits are not immediately forthcoming as they build the product and company.

This is important to keep in mind — if you are wildly spending money to create a never-before-seen product without your cash runway in mind, your business may fail before you can even make your first sale.

How to Calculate Cash Runway

There are a few different ways to calculate cash runway, however the most accurate will be using burn rate. Finmark takes your projected burn rate to calculate cash runway.

Cash Runway Formula

Cash in Hand / Projected Burn Rate

Revisiting the example above, a company that is spending, on average, $10,000 a month (burn rate) and has $100,000 available to spend (cash in hand) has a 10-month cash runway.

Why Cash Runway is Important

Your cash runway can be a clear indicator of whether or not your business is overspending.

A short runway, without any near-term profit, means you should consider seeking additional funding options to keep your business afloat, or cutting costs to reduce the amount of cash you are spending per month.

Even worse, if you’re not tracking runway, then there will come a day when you no longer have enough money to support the business — an unexpected blow if you’re just getting started.

This could also mean you need to tap into team cash or your own cash reserves to keep the company going, which will only make it more difficult to be successful (or convince investors to give you additional funds).

If you’ve already received funding, then cash runway will likely be a metric your investors want to know about to track your growth and profitability.

How much runway is enough? That depends on your business and how effectively you are managing cash.

The ultimate goal is to be Default Alive — on track to be profitable with your current resources.

Being Default Dead—or not having enough cash or revenue to cover expenses—can be the kiss of death for your business. A general rule of thumb for many startups is less than two months of cash runway is the point of no return.

While many startups should be keeping near real-time measurements of cash runway, any company can benefit from understanding its runway — especially when times are tough.

How to Extend Your Cash Runway

By now, you understand why cash runway is critical information when you’re tracking finances and evaluating overall projections and progress.

But how to extend it when you are already working hard to spend as little cash as possible as an early-stage company?

Having an up-to-date, accurate financial model can tell you exactly how many months you’ve got left, allowing you to make real-time decisions to reach out to investors or cut corners to decrease burn rate and increase runway.

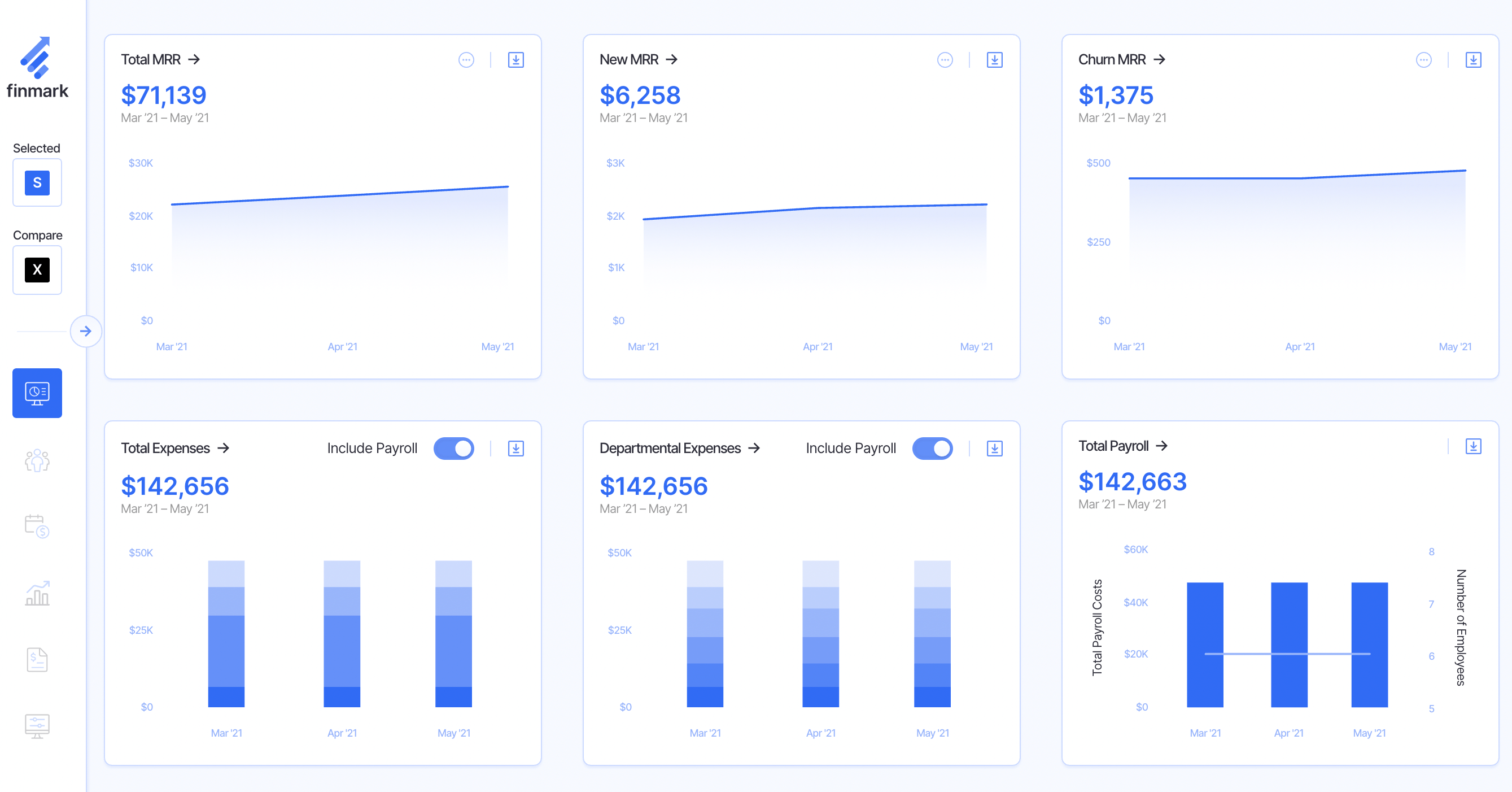

You should be keeping track of each dollar going in and out of the business to be truly on top of your financials and financial models. You can use Finmark to help.

You can also consider reducing your expenses where possible to further extend your cash runway. This could include:

- Office Spaces: Do you need the penthouse office space in the big city? Or can you move to a remote-work model to save on rent and associated expenses?

- Contractors: Do you need full-time internal resources or can some work be outsourced?

- Payments: If you are making sales, make it as easy as possible for your customers to pay their invoices and have open lines of communication when they are late on a payment.

The old adage still rings true today — cash, and cash runway, is king. Keep accurate tabs on your cash runway and your business and investors will thank you.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.