Forecasting Risk: How to Forecast Financial Unknowns

No business operates in a vacuum, absent of potential risks to profitability, efficiency, and operational viability.

For some organizations, the risks are greater than others—emerging tech sectors like cryptocurrency, for example, are risky fields.

But even well-established verticals are not protected from risk. Consider, for example, the current shortage of new vehicles many countries are facing as a downstream consequence of supply chain shortages.

While not every risk can be accounted for, forward-thinking financial leaders can help protect their businesses against potential issues by building risk analysis into their financial forecasts.

In this article, you’re going to learn how to forecast risk.

We’ll discuss why forecasting risk should be a key component in your financial planning process and which types of risks to consider, as well as a play-by-play blueprint to account for risk in your own financial plans.

Why Risk Should Be Considered As Part Of The Forecasting Process

Assessing risk is not a new endeavor.

Companies have been hiring dedicated risk managers for years, and spending tens of thousands of dollars to have external firms analyze risk and present potential solutions.

However, this all too often occurs as a separate and distinct process from financial planning, resulting in some pretty distinct finance and risk department siloes.

As a result, financial plans fail to account for risk or to include strategies and action plans should a particular risk become a reality.

That’s the primary reason for including risk analysis in your forecasting process: improving the validity, accuracy, and effectiveness of your financial forecasts.

But there’s a secondary benefit here as well.

One of the biggest challenges that finance teams face is being seen as a cost center. In many organizations, senior leadership struggles to understand the tangible benefit that finance can have on the bottom line.

They understand that the finance function is necessary, but they would just as soon as do away with the need for actual employees if the forecasting and planning work that finance does could be automated with software.

Activities like risk analysis and mitigation plans help finance teams deliver tangible benefits to the business.

If you’re able to identify a risk and build a plan to avoid or react to it, you’re no longer seen as a cost center. You’re a core business function that can actually save money and prevent catastrophes from occurring in the first place.

Types of Risk To Consider

It’s important to bear in mind that you’re not going to be able to account for every kind of risk your business might face.

This is especially true for large-scale macro-events like economic recessions.

Attempting to plan for every single scenario that could ever happen is futile, and you’re going to spend more time trying to dream up the types of risks you might be facing than creating viable financial plans.

Instead, focus more on the kinds of risks that are closer to your actual operations (e.g. market changes and production costs).

These five risk categories should cover most of what you’re likely to face. Use them as a little checklist when assessing risk as part of the financial planning process.

1. Market Risk

Even if you’re working in a new or emerging market, you’re going to have at least a couple of competitors, all of whom are vying for the same total addressable market.

That means there’s always a possibility of a competitor (whether it’s one that exists now or a market newcomer) outperforming your efforts and poaching some of your customers.

Keep an eye on competitor product developments and marketing efforts. Consider how these new developments might impact your ability to retain customers, or to capture available market potential.

2. Cost of Production Risk

This is a very real and common risk for businesses that are engaged in creating physical goods.

Let’s say, for instance, that your company manufactures computers.

If the price of a critical component suddenly rises (CPU chips, say), then your cost of production is going to increase.

It’s unlikely that you’ll be able to quickly increase the prices of your products to counter this rising cost, meaning the result will be lower profit margins.

Consider how your current reliance on component suppliers, as well as wider market and economic developments, might pose a threat to production costs.

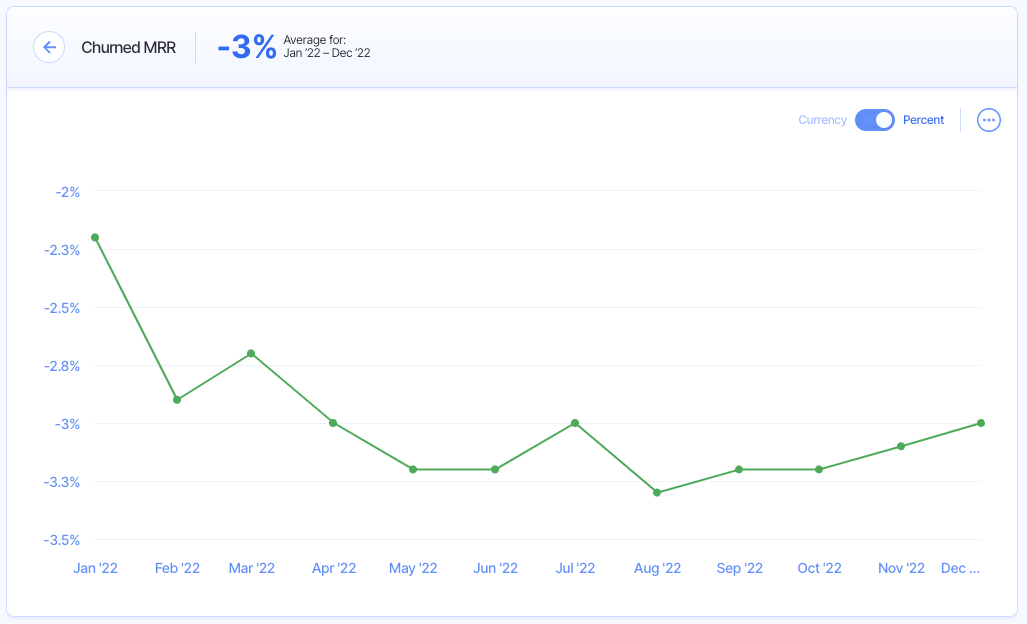

3. Customer Churn Risk

Customer churn is always a concern, especially for software and subscription businesses that rely on ongoing customer relationships to drive revenue.

Analyze the factors that might lead to increased customer churn, for instance:

- Customer support chat logs (if tickets are increasing, this may be a bad signal for churn)

- Upcoming contract renewals

- New market competitors

- An increasing trend in churn rate

4. Cost of Promotion Risk

Not only is there a risk that the cost of goods required to manufacture your product will increase unexpectedly, but that the expenses involved in promoting your brand might as well.

Consider, for instance, the possibility of a sharp increase in ad costs.

If you’re spending $400k a month on advertising right now, a 20% increase could mean close to a million dollars more in advertising fees over the course of a year.

5. Employee Risk

Lastly, consider how the people who work for you currently might pose a risk to the viability of your financial plans.

Monitor employee morale and churn rates here. If people are unhappy, they’re more likely to leave. If key resources leave your company, you’ll be unable to enact the strategies you’ve put in place, meaning you’re likely to drive less revenue than anticipated.

Additionally, you’ll have to front up for the extra hiring costs, so this one can be a double whammy.

How To Account For Risk While Creating Financial Forecasts

1. Determine Which Risks Are Most Applicable To Your Businesses

Step one is to consider which risks you’re most subject to, and that actually apply to your business.

For instance, customer churn might not be a particularly relevant risk for companies that work in a very transactional manner, such as clothing retailers.

Identify which risk categories apply specifically to your organization early, allowing you to narrow your focus on things that matter and reduce the scope of risk analysis.

2. Review Historical Data

Next, comb through your existing historical financial, customer, and employee data to determine if there are any trends you should be concerned about.

Let’s say, for example, you identify a noticeable trend in your churn rate, which has steadily increased by 0.5% each fiscal year for the last three years.

This is notable in and of itself, but it would also be helpful to dig deeper to understand any root causes.

For example, increased churn might be due to:

- A poor level of customer service and ticket resolution from the support team

- Successful poaching efforts on behalf of a competitor

- A misalignment between marketing messages and actual product capabilities

Identifying the root cause will help you to put strategies in place to mitigate it (often by providing recommendations to other department leaders), and to account for this risk in your forecast.

For instance, in this case, you might build the expected customer churn increase into your financial forecasts.

3. Analyze External Factors

Invest some time considering any external factors that might present a risk to your financial plans.

While factors like supply chain delays and employee or customer churn are largely internal, factors such as economic uncertainty or new legislation within your industry could pose a significant risk to the viability of your strategic financial plans.

You won’t be able to predict every external risk, but being prepared at least for the most likely events gives you some level of protection.

4. Create Financial Plans With Multiple Scenarios

Now that you’ve identified the potential risks your business might face, it’s time to dive into financial planning.

Build your forecasts as normal, but then use a financial modeling platform like Finmark from BILL to create several models based on specific scenarios.

You might, for instance, create a baseline forecast, and then two additional forecasts:

- One that forecasts what revenue might look like if customer churn increases at the same rate that it has been

- Another that forecasts what would happen if your churn mitigation strategies were successful

Remember, not all risks can be accounted for. As such, it may also be helpful to create more general upside and downside forecasts. This allows you to create a plan for spending if revenue were, say, 10% lower than expected.

5. Lock In A Process For Reviewing Risk

Forecasting risk should not be a one-and-done affair. That is, considering risk once annually as you create financial plans for the coming year is not sufficient.

Instead, design and implement a process for regularly reviewing risks, and integrating that information into your existing financial plans.

For most organizations, quarterly risk analysis should be sufficient, though you might like to schedule a briefer risk review process on a monthly basis.

Conclusion

Accounting for risk in your forecasts is a practice that not only improves the effectiveness and accuracy of your financial plans, but can improve the internal position of your finance team and prevent the department from being seen as a cost center.

To forecast risk effectively, you’ll need easy and immediate access to accurate financial information.

A collaborative financial analytics platform like Finmark is the CFO’s best friend here, helping strategic finance leaders unlock key insights, build multiple scenario plans, and report accurately on the effectiveness of their risk mitigation strategies.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.