Annual Recurring Revenue (ARR)

Recurring revenue is a cornerstone of any good subscription business.

Without recurring revenue, your company may be left dying on the vine.

Just as monthly recurring revenue (MRR) is the amount of predictable revenue your business earns each month from customers, annual recurring revenue (ARR) is the annualized amount of predictable revenue your company will generate.

In this guide, we’ll explain how to calculate ARR, the difference between ARR and total revenue, some key ARR benchmarks and how to increase ARR.

Let’s dive in.

What is Annual Recurring Revenue (ARR)?

Annual recurring revenue (ARR) is the amount of predictable revenue your business earns in a year from customers.

Another way to think of ARR is an annualized version of your MRR.

Note: depending on contract terms for your business, ARR may be different than the subscription agreement amount, especially if it is longer than one year. For multi-year subscriptions, ARR is normalized to a one-year period.

What’s the Difference Between ARR and MRR?

MRR is the more commonly used recurring revenue metric for early-stage businesses, especially if contract terms are less than a year.

However, the one difference between the two is time. If you multiply MRR by 12, then you’ll have your ARR.

Another distinction between MRR and ARR is that MRR is typically an operating metric while ARR is more of a valuation metric.

Investors like to see ARR to understand overall business performance, and many founders will present ARR when fundraising or in board meetings, while MRR shows the more day-to-day operations of a business.

To learn more about Monthly Recurring Revenue (MRR), read our guide here.

ARR vs. Revenue

While ARR is the annualized version of MRR, ARR and total revenue are quite different.

The total revenue for your business considers all of your cash coming into the business, while ARR measures solely your subscription-based revenue.

For example, if you provide one-time implementation fees or have an offering outside of your subscription business, then that revenue would not be part of your ARR.

Say you’re a SaaS startup that offers monthly packages plus ad-hoc services like consulting. Your total revenue would be the sum of the money you earned from the monthly subscriptions plus the consulting services. However, your ARR would be the monthly subscription you receive from your SaaS product.

How to Calculate Annual Recurring Revenue

As mentioned above, the simplest way to calculate ARR is to multiply your MRR by 12.

And the simplest way to calculate MRR is to multiply your average billed amount (or average revenue per customer) by your total number of active subscription customers for that month.

Annual Recurring Revenue Formula

MRR [Average revenue per customer (monthly) * total number of customers] * 12

For example, if you have 20 customers currently and 10 are paying for your basic subscription ($50 per month) while the other 10 are paying for your premium subscription ($100), then the calculation would look like this.

- Average revenue per customer: $75

- Total customers: 20

- ($75 * 20) * 12 = $18,000

By using the above calculation, then your MRR would be $1,500 and your ARR would be $18,000.

Note: any upgrades or downgrades happening within a month would be accounted for within the average revenue per customer.

Why is ARR Important?

As mentioned, early-stage businesses typically think in terms of MRR vs. ARR. That being said, you shouldn’t lose sight of measuring ARR.

MRR may provide a quick snapshot of short-term growth, but ARR can paint a bigger picture. With ARR, you can use these metrics for long-term planning, company road mapping, and financial modeling.

As you grow, ARR will be a great benchmark for you to show investors and other stakeholders the impact you have made in the market and how your growth has compounded over time. Some larger businesses also use ARR as a measure of overall business health and performance.

ARR Benchmarks

Growth metrics are the most important metrics for an early-stage company. However, on the flip side, growth can be volatile in the early days of your business.

How can you know if you are measuring up to others that are in your shoes? Luckily we have a few benchmarks for you to compare your ARR growth against.

According to Bessemer Venture, growing ARR should be your North Star. For them, the average growth rate for companies between $1-10MM of ARR was nearly 200%, decreasing to 60% for companies over $100MM+.

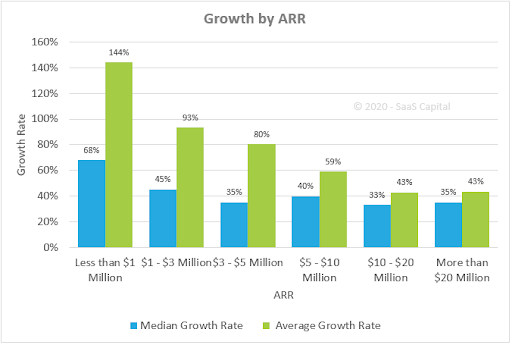

They’re not the only ones who see growth rates skyrocket in the early stages of a business. SaaS Capital also sees the average growth rate for companies with less than one million of ARR is 144%.

Needless to say, you want to grow as fast as possible when you’re starting out. Once you achieve that coveted product-market fit, growth should come easily for you.

How to Increase ARR

We get it. Thinking long-term may be tough when you’re constantly putting out fires as an early-stage startup founder. But any good founder will tell you that thinking strategically can position you for long-term success.

With ARR, you need to be thinking about the long-term growth of your business. Continuous growth will allow you to achieve those 100%+ growth metrics you saw above. But how can you increase ARR?

The short answer lies in customer acquisition (you should be getting as many customers in the door as possible), but the long answer is a bit more nuanced.

Another thing to keep in mind is keeping those customers happy. Your ARR can dip tremendously if you have a revolving door, where customers are churning faster than you can keep up. Let’s dig into a few strategies to help minimize churn and maximize ARR.

1. Find Your Ideal Customers

Every startup should have an ICP (ideal customer profile). This should be the measuring stick you use when creating strategies to sell to prospective customers.

Understanding your customers’ pain points and ensuring your product offering can solve that pain point will mean more long-term growth for your business.

2. Invest in Customer Success

As the saying goes, you have to spend money to make money.

If a new customer is left stranded once they sign on the dotted line, you better believe they‘ll start looking for greener pastures before you know it. Having a customer success team is another safeguard to ensuring your customers (and ARR) are in good hands.

3. Play the Long Game

Short-term wins like incentives may be great wins early on, but you should be playing the long game.

Add-ons and upsells translate to larger MRR, which means ARR grows as a byproduct of that.

Other long-term options are subscription increases after a standard period of time (your YoY ARR can grow tremendously if you bake a 5-10% annual increase into your subscription agreement) or an overall price increase for your services (especially if you feel like you are underpricing your product or service).

Start Measuring ARR with Finmark

If you’re a first-time founder looking to start measuring MRR, ARR, and more, you likely started building your financial model in a templated Google sheet. But you quickly found out that spreadsheet models are error-prone and often inaccurate.

The good news? You can build an accurate financial model faster with Finmark.

Finmark is financial modeling made easy. Create and share financial plans, manage burn rate, and forecast revenue and expenses—without spreadsheets.

Get started with your 30-day free trial today!

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.