Trailing Twelve Months Revenue (TTM)

If you’ve read any of our glossary terms, you’ll know that acronyms are abundant in the SaaS space (see what we did there?).

And TTM is no different. TTM stands for trailing twelve months.

Most companies look at TTM as it relates to financial performance. In the case of this article, we’ll be looking at TTM revenue.

But how do you measure TTM revenue? We’ll review what TTM revenue is, where to report TTM financials, and why TTM is important to financial reporting.

Let’s dive in.

What Does TTM Mean?

TTM stands for trailing twelve months. But what does that actually mean?

Trailing twelve months – in general – means that you are looking at data (typically financial performance) from the past twelve months.

It doesn’t necessarily mean you are looking from January to December or the end of a fiscal year, but the previous twelve months of a set time period (month, quarter, etc.).

If you are square in the middle of March and want to understand the last twelve months of performance, then you’ll look from March 15th of this year to March 15th of last year. It is as simple as that!

While this article takes a deep dive into TTM revenue, finance teams may look to use TTM to review all sorts of financial data within profit and loss statements (P&Ls), cash flow statements, and other financial documents.

What is TTM Revenue?

TTM revenue is the amount of revenue a company generates within the last twelve months.

In other words, it is yet another way to measure revenue (along with MRR, ARR, total revenue, the list goes on).

Check out our full list of revenue terms in our Startup Glossary.

TTM revenue is important for a few reasons.

First, it is an easy way to determine if your company has experienced growth. And second, it is a surefire way to see exactly where that growth is coming from.

Third, given that it includes real-time data, it provides a more accurate picture of revenue performance, rather than relying on old data or annualized figures (that don’t account for fluctuations, market changes, etc.).

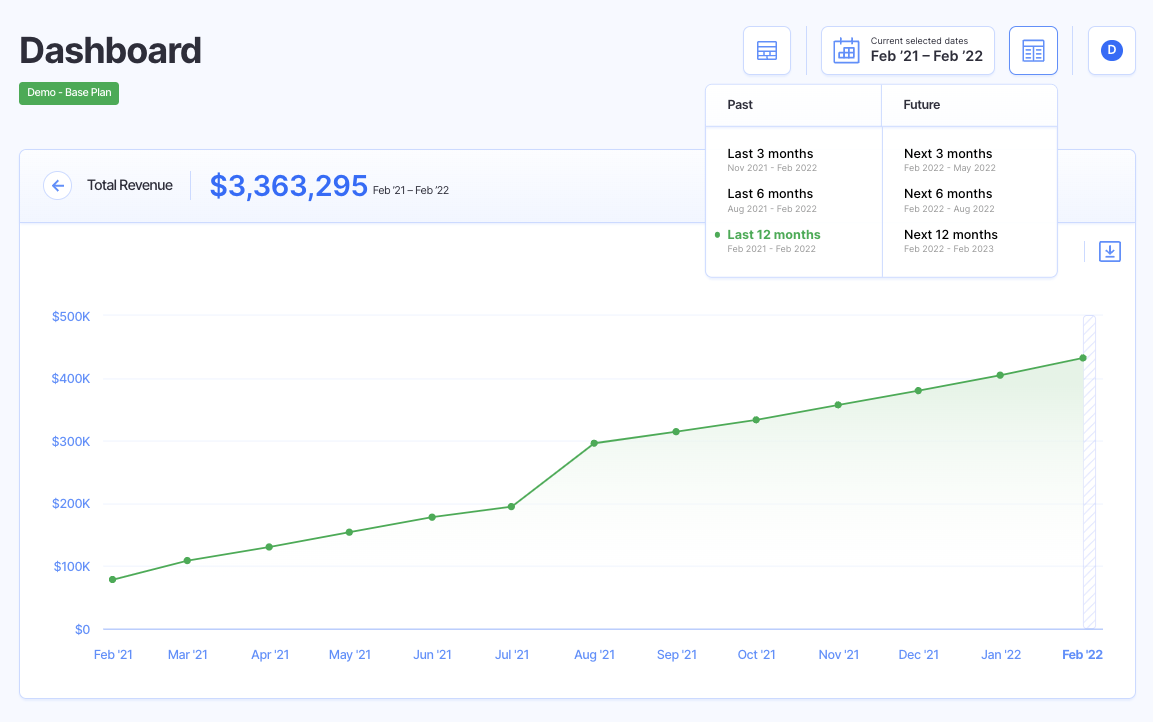

Calculate your TTM revenue with Finmark!

Where to Report TTM Financials

TTM financials, including TTM revenue, are a hot ticket and should be highlighted within the majority of your financial reports.

This includes:

- Your profit and loss statement (P&L)

- Your cash flow statement

- Your balance sheet (note: some say TTM financials are irrelevant to balance sheets as they already represent a specific point in time)

Most software tools allow you to run TTM calculations for these financial reports too, and easily allow you to compare actuals to the previous period so you are up-to-date on performance and growth.

Why TTM is Important For Financial Reporting

You may be thinking, but Finmark I already track revenue!

We alluded to the importance of TTM earlier in this article as it relates to growth tracking and performance, but TTM is also important when you are on the hunt for new investors.

For investors, TTM revenue is a good indicator of how your business is trending. If your revenue has been on an incline over the past 12 months, it’s a sign of growth. On the other hand, if your revenue is up and down or declining, it can signal a red flag for investors.

That’s why TTM revenue is a financial figure you should include in your investor deck.

Check out How to Create a Pitch Deck Investors Want to See for more on what to include in an investor pitch.

Not to mention, TTM is also a metric you’ll be interested in if you’re planning to acquire another company.

In general, TTM is important due to the fact that it is always real-time data. You don’t need to rely on outdated data from the last fiscal year, nor do you have to annualize figures that may not provide you with the outcomes and data you’re looking for.

TTM financials are a great way to measure performance while also thinking about future growth.

For example, if you are a sales software startup and you saw spikes in revenue at the tail end of each quarter in the last twelve months, then you may be right in making an assumption that many people purchase your software right before the quarter ends.

Or it may allow you to better understand which of your product lines are outperforming the others, and if you need to sunset an underperforming product due to the lack of interest and sales.

These insights may help you to plan out marketing campaigns, nurture current prospects, and predict future demand for your software. Having this data can also help you to build a realistic budget so you’re not spending too much or too little cash as you grow.

Revenue forecasting is never easy, but having accurate data from the past twelve months is a great jumping-off point to use in financial modeling, planning and investor discussions.

Start Measuring TTM Revenue with Finmark

If you’re a first-time founder looking to start measuring TTM, you likely started building your financials in a templated Google sheet. But you may have quickly found out that spreadsheet models are error-prone and often inaccurate.

The good news? You can build an accurate financial model faster with Finmark.

Finmark is financial modeling made easy. Create and share financial plans, manage burn rate, and forecast revenue and expenses—without spreadsheets.

Get started with your 30-day free trial today!

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.