Net Income

At the end of the day, after your revenues are tallied and your expenses added up, how is your business performing? If you can’t answer that question, you need to start tracking your net income.

While there are many metrics business owners use to measure performance, net income is one of the most common and easiest to understand.

Whether it’s trying to bring on investors, looking for a loan, or presenting information to shareholders, you’ll likely be asked about net income. We’ve got everything you need to know about what it is, how to calculate it, and how you can use it to make effective business decisions.

What Is Net Income?

Net income is the profit or loss your business incurred after deducting all expenses from your revenue.

In other words, it’s the difference between the total revenue you bring in and the total expenses that are going out.

By tracking net income, you understand whether your business is profitable or operating at a loss. If your net income is high, it’s an opportunity to save or reinvest in the business. But if it’s negative, you might need to think about ways to inject more revenue or cut down on costs.

Net income is frequently used by investors and lenders to evaluate business performance. For business owners, it’s extremely helpful for financial planning, budgeting, forecasting, and setting goals for the future.

How To Calculate Net Income

The net income equation is simple:

Net Income Formula

Net Income = Total Revenue – Total Expenses

Where you get this information can get a bit tricky. If you have up-to-date accounting, the easiest way to get this information is from your financial reports. They’ll provide the clearest breakdown of revenue and expenses.

If you don’t have up-to-date accounting, you need to tally up your total revenue and total expenses.

Start by looking at a payment processor report or invoicing summary to find your total revenues. Then you’ll need to review any accounts payable invoices you’ve received, expense reports, or bank and credit card statements to start tallying up expenses.

Net income includes non-cash expenses. Don’t forget to include expenses like amortization and depreciation which are the “expenses” of how an asset decreases in value over time.

Cash Basis vs. Accrual Basis

An important differentiator in how you calculate net income is whether you use the cash or accrual accounting method.

Cash basis records revenue and expenses only when money changes hands while accrual is when the transaction is incurred.

For example, accrual would record the transaction when you receive the invoice, and cash would record the transaction when it’s paid.

If you use the cash basis, you can pretty easily calculate your net income from your bank and credit card activity. Accrual requires a little more work.

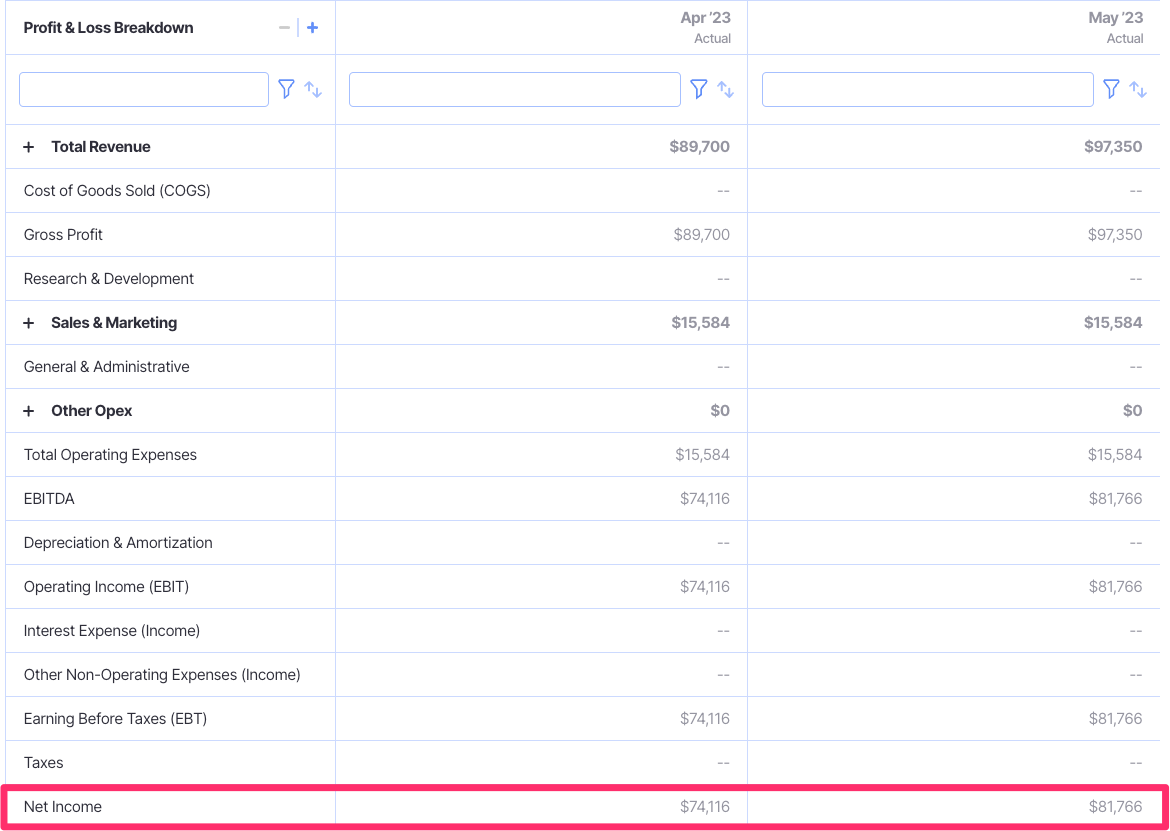

Where To Find Net Income on an Income Statement

It’s easiest to find your net income on your profit and loss statement (or income statement). Net income is often referred to as “the bottom line” because it’s exactly that: the bottom line of a profit and loss statement.

A profit and loss statement provides a clear breakdown of your revenues and expenses. This means when you check your net income, you can review what were the key drivers behind that outcome. Take the extra time to review for expenses that were abnormally higher or lower than expectations.

Why Is Tracking Net Income Important?

Generally speaking, net income is one of the simplest, easiest to use indicators of a business’s financial health. It answers the key question of whether the business is operating at a profit or loss, and to what degree.

Beyond profitability, net income provides even more value when you track how it trends.

For example, say you’re launching a new marketing initiative.

You see that after it launched, sales increased, but you want to know the overall effect on your business.

Not only will your marketing expenses increase, but you spend more on fulfillment and maybe headcount to accommodate the extra activity.

If your net income increased from month to month, you can more conclusively say that the marketing push had a positive effect rather than looking at sales in a vacuum.

You can also base budgeting and planning around a targeted net income. From there, you can start to sketch out what you anticipate revenue and expenses to be and adjust to hit that target.

Since net income is one of the best and easiest measurements of operational efficiency, you can consistently refer back to it for evaluating success, setting targets, and planning for the future.

Net Income vs. Net Cash Flow

Net income and net cash flow sound very similar, but the differences are key.

Net cash flow is how much money has entered or left your business over a period of time. To find this number, you start with your cash inflows and subtract all cash outflows.

So are inflows and outflows fancy ways of saying revenue and expenses? Not exactly.

For starters, cash inflows and outflows contain all cash activity. This means you’re including any cash contributions from owners, money made from selling an asset (like a delivery vehicle), or injection of capital from a loan or line of credit.

To add to that, cash inflows and outflows solely include money changing hands. If you sell $100,000 on the last day of the month but you don’t collect until the next day, it impacts your net income but not your cash flow.

Net income also includes non-cash activity like amortization and depreciation expense. These are tax deductible expenses that lower your net income but don’t actually involve money changing hands.

A business can record a loss in a month and still be cash flow positive, or vice versa.

Net income is better for measuring your business’s operational performance and cash flow helps you understand the real world cash impact of all of your business activity.

How To Increase Net Income

Net income has two parts: total revenue and total expenses.

Simply put, to increase net income, you either need to increase your revenue or reduce your expenses. Here are some tips to get started:

- Create (and stick to) a budget: If you have a specific net income goal, you can create a budget that helps you get there. Start with an anticipated revenue number then review your expenses from past months to set amounts such that you’re hitting or exceeding your net income goal.

- Renegotiate with suppliers: It’s always worth reaching out to suppliers to see what it would take to cut down on the per unit cost. Offer to shorten turnaround time on payments or seeing if they’ll discount higher volume orders.

- Introduce upselling or bundling opportunities: Rather than getting new customers, focus on selling more to the customers you already have. Bundling means providing a small discount when someone buys two or more goods or services together, a great way to get someone to buy more than they initially intended.

- Invest in new efficiencies: Sometimes, a new piece of equipment or technology is the efficiency boost you need to impact your bottom line. Be sure to do some financial planning before making the purchase to understand the long-term effect.

- Efficiently manage inventory: Unsold inventory that’s been sitting around takes up space that could be used for faster moving products. Consider regularly using discounts to turn that idle inventory into revenue more efficiently.

- Make a habit of tracking net income: Checking in on your net income periodically shows you whether you’re trending towards your goal. If you’re off track, this signals you need to make a change that gets you back towards your net income goal.

Tracking Net Income Made Easy

Business owners are always told to “know your numbers.” How well do you know yours?

With Finmark From BILL, you have the ultimate cheat code to knowing your numbers inside and out. From basics like net income to advanced metrics and ratios, all of the key information you need can be tracked and visualized with intuitive dashboards and graphs.

Spend less time finding the numbers and more time understanding them. Get started today with a free 30-day trial.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.