CAC Payback

No matter the stage of your business, the sheer joy of a new customer win doesn’t ever fade. You should always celebrate your wins, especially in the early stages of your business.

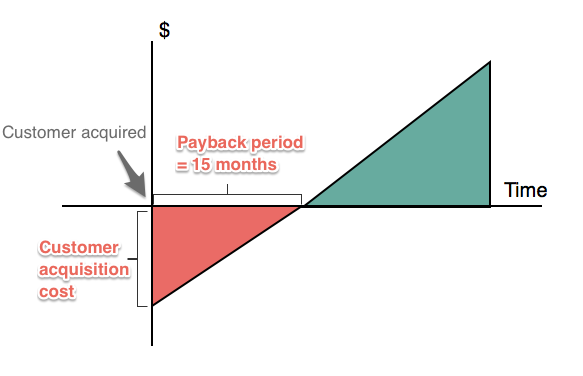

But just as equally important is understanding both the customer acquisition cost (CAC) and the CAC payback period. This is the length of time it takes a new customer to “pay back” the CAC in the form of the gross profit you receive from them. Once you hit that date — that’s when the real celebration begins.

But how do you calculate CAC payback? What’s considered the right amount of time? Why is CAC payback important? All questions we can answer for you here.

What is CAC Payback?

Customer Acquisition Cost (CAC) payback is the number of months it will take to recover the cost of acquiring a customer (your break-even point). It won’t come as any surprise to know that you want to keep this period of time as short as possible to help your company grow. Shorter CAC payback = faster growth!

Once you exceed the CAC payback period, future customer payments will be attributed to your growth.

CAC Payback can also be known as Time to Recover CAC or Months to Recover CAC.

How to Calculate CAC Payback Period

CAC payback is an essential metric for any SaaS business. It helps to determine the period of time it will take for your business to regain the expenses incurred by customer acquisition.

To calculate this metric you need to understand your CAC, net new MRR, and gross margin percentage.

CAC Payback Formula

(CAC / Avg MRR * Gross Margin%)

* Use 3 month averages for CAC, MRR and Gross Margin

Let’s take a look at an example we’ve shared in our guide to CAC.

Let’s say it cost you $250 to acquire a customer, and they’re paying you $25/month. You need that customer to stay with you for at least 10 months in order for them to pay back the amount you spent to acquire them.

If that customer churns within those 10 months, you’ve essentially lost money.

Now, imagine if instead, it only took you $100 to acquire that same customer. You’d get the money back in four months.

It’s also important to note that while you can simplify this metric at the start of your business, you may want to consider having different CAC payback periods for different types of customers, depending on the differences in acquisition costs per customer.

For example, a customer acquired through a tradeshow may have a much higher cost than a customer acquired via a cold call or email newsletter.

Why CAC Payback is Important

Understanding acquisition efficiency via CAC payback is crucial to ultimately understanding the cash flow coming into your business.

If you don’t have a firm grasp on both CAC and CAC payback, you may be wasting hundreds, or thousands, of dollars on ineffective methods to acquire new customers.

Further, CAC payback can help to both understand how much you can (or should) spend per customer and how to project future company growth.

A long payback period may be the first indicator that the current acquisition model is inefficient and changes must be made before you start to lose revenue.

However, you can’t view CAC payback in a vacuum — it must be viewed in context with other relevant metrics, including the lifetime value of your customers (LTV) and the LTV:CAC ratio.

CAC Payback Benchmarks

Generally, a good CAC payback marker is low. According to ProfitWell, SaaS startups average about a 5-12 month CAC payback period.

Early-stage companies may have a higher CAC payback period that can fluctuate as they grow and adapt, but the general rule of thumb is to aim to have no more than a 12-month payback period.

Note that larger enterprises may have longer CAC payback periods as they have more access to capital and resources, but a growing business shouldn’t consider a long payback period as a sign of success.

How to Reduce CAC Payback

Every dollar counts. Keeping this in mind as you grow your business will only help you successfully reduce CAC payback.

Since your payback period is directly associated with your CAC, first up to help reduce the payback period will be to reduce CAC.

But this can’t exist in a vacuum — slashing marketing and/or sales budgets without any consideration for ROI can do more harm than good. If you aren’t putting any dollars towards customer acquistion, then there won’t be any customers to measure against!

With this in mind, the goal would be to minimize CAC while continuing to meet your growth targets. Effectively reducing the cost of acquisition per customer will ultimately help to reduce how long it takes for that customer to “pay back” the cost.

Consider the following:

Double-down on your least expensive acquisition channels

Are you spending money on Google Ads when the majority of your quality leads come from LinkedIn Sponsored Posts? Understand where the least expensive, quality leads are coming from and double-down on those to reduce both CAC and CAC payback.

Don’t forget about your current customers

Focus on customer retention to make sure customers are staying long enough to recover your CAC. Keeping your current customers happy is just as important as selling to new customers. This can include monthly check-ins to see how the product is performing and open lines of communication when something does go wrong.

Encourage annual subscriptions or plans

Your CAC payback period can also depend on your pricing model and how your customers pay you (annual subscription, scaled pricing, monthly fee, etc.). A larger upfront cost from customers will help CAC costs to be recovered more quickly. Any adjustments to your pricing model can and will directly affect your customer acquisition costs and payback period.

Check out more on how to reduce CAC here.

Reduce your CAC payback period and start celebrating those customer wins!

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.