What’s The Purpose of a Cash Flow Statement?

Financial reporting is a powerful thing. It’s packed full of information that helps you understand your profitability, growth potential, and much more.

A key part of your financial reporting is the cash flow statement. It’s a document used by business owners, investors, and lenders to learn about how the business handles cash and gives insights into what its potential future looks like.

How do you get this kind of value from a cash flow statement? Don’t worry, we’ve got the information you need to read, analyze, and learn from this highly valuable document.

What Is A Cash Flow Statement

A cash flow statement shows how cash moves in and out of the business over a period of time.

Combined with information from two other essential financial reports—the income statement and balance sheet—it provides a full picture of how money flows through the business.

Cash flow statements break down cash flow into three types of activity:

- Operating activity is money earned and spent through day-to-day operations. This includes sales revenue and operating expenses like paying salaries or rent.

- Investing activity is money earned and spent on long-term assets. Long-term assets have a lifespan or convert to cash in more than a year’s time like a new delivery vehicle or computer equipment.

- Financing activity is anything related to borrowing, repaying, or earning money from debt or stocks. Examples include taking out a new loan or issuing stock.

Typically, you’d need to check an income statement for operating activity and balance sheet for investing and financing activity.

But with a cash flow statement, you can understand all of this activity at a glance. This means less time reading reports and more time learning from them.

How Cash Flow Is Calculated

Over a period of time, your cash levels either increase or decrease by some amount.

There are two methods for calculating the cash flow behind this change. Both will leave you with the same result, but the method of getting there is different.

Direct Method

The direct method can be thought of as the simplest method of calculating cash flow.

To calculate your cash flow using the direct method, simply add up all cash transactions in the period of time you’re looking at. This is especially easy for businesses using the cash basis method of accounting as their books only include activity when cash changes hands.

Examples of cash transactions to include are sales where payment has been collected, expenses that have been paid, and interest earned or accrued.

Indirect Method

The indirect method of calculating cash flow starts with your net income and treating it as a cash inflow. Then you complete multiple steps of adjustments so that only cash activity is included.

For businesses using the accrual method of accounting, there’s likely revenue and expenses included on the income statement that haven’t actually been collected or paid yet. This means adjustments must be made so they aren’t included.

Other examples of non-cash activity that need to be adjusted for are depreciation, changes in inventory, and gains or losses on investments.

Which Method Should You Choose?

The method of cash flow calculation you use should reflect what you’re trying to accomplish and the complexity of the business.

A basic understanding of cash flow is easily achieved by using the direct method. But if you want a fuller, complete picture of all your activity, the indirect method provides more context.

It’s worth noting though, that most companies use the indirect method because it’s preferred by the International Financial Reporting Standards (IFRS), and publicly traded companies use it because it’s required under Generally Accepted Accounting Principles (GAAP).

How To Read A Cash Flow Statement

Cash flow statements are designed to be read from top to bottom. Look at each section and its breakdown separately to understand the cash activity of each in a silo before connecting it to the bigger picture.

Operating Activity

Positive cash flow in operating activity means day-to-day operations are bringing in more cash than what’s going out. This is a good sign that the business is scalable even if it’s experiencing negative cash flow from all other activities in the immediate future.

Negative cash flow from operations isn’t necessarily a bad thing. Even the biggest businesses go through some seasonal slow down where they might have negative cash flow. What’s important is understanding when and why cash flow was negative so you can plan ahead.

Investing Activity

Generally speaking, a negative cash flow in investing activity is indicative of growth. It shows the company is spending money on assets that will help them achieve their future goals.

A positive cash flow does not mean a business is struggling, it means they’re selling off assets. They could potentially be selling underused assets to run more efficiently.

Financing Activity

This section breaks down how a company is tending to its debt or issuing of equity. Positive cash flow means the company is taking on more debt or investment while negative cash flow indicates paying dividends or making payments to the principal.

Early stage businesses are likely to have positive cash flow from financing activity due to start up loans or investment. It would then be negative as they tend to the debt or pay out dividends.

Tying It All Together

Having a positive or negative cash flow for certain activities isn’t an inherently good or bad thing. What’s important is how it’s all connected.

For example, an early stage business might have negative cash flow from operating activities and investing activity, but positive cash flow from financing. This could mean they needed external capital to start and scale their operations.

By taking time to read and analyze a cash flow statement, you start to piece together how different parts of your business contribute to your current cash situation.

Don’t forget to also do some cash flow forecasting or compare with prior time periods to understand how your activity changes over time.

Why Cash Flow Statements Are Important

Let’s get into the real world value you get from using cash flow statements. On top of basic cash flow analysis, these are important aspects of your business that cash flow statements help you understand.

Cash Is More Than Sales And Expenses

An income statement shows profitability, not cash activity. A business can be profitable in a month but have less money in the bank than they started with.

Taking the extra time to look at a cash flow statement helps you understand why that’s the case. Most importantly, this understanding helps you plan for the future.

If your operations aren’t generating enough cash inflow to cover cash outflow in other activities, you need to make moves to cut down costs or find alternative ways to tend to financing and investment activity.

Liquidity Matters

Not all debt is equal. There are businesses with a large amount of debt that are sustainable because of how effectively they turn that debt into cash flow. Cash flow statements show how well a business does just that.

Let’s say you take out a $10,000 loan in February and looking at the cash flow statement in March, cash from operations increases to keep your net cash flow positive. This shows the business is successfully generating more cash flow after taking on debt.

For businesses that have recently taken on debt or investment, looking at the cash flow statement in the following months can show whether it was a net positive for the business.

Planning For The Future

A great way to think of cash flow statements is like going to a doctor for a check up. You might visit your doctor and learn everything is fine. But if something seems off, there’s further investigation and suggested changes to your day-to-day.

Checking in on your cash flow statement regularly flags when there might be cash shortages in the future or if something is trending in the wrong direction. This is the jumping off point for looking into why and adapting your strategy.

An example of this is looking at a month-over-month cash flow statement for the prior year. If you see that due to seasonality you had negative cash flow in certain months, you’ll know how much to save ahead of time to cover that down period.

Take your future cash flow analysis up a notch with a cash flow projection.

Investors And Lenders Care About It

While cash flow statements have many uses internally, it’s also a common request when applying for a business loan or being vetted for investment.

Both financial institutions and banks use cash flow statements to get a clear picture of how the business operates. They want to see the history of prior debt, how operations have trended, how funding from investors has been used, and how much has been invested into assets.

Together, the information on a cash flow statement uncovers how financially viable a business potentially is.

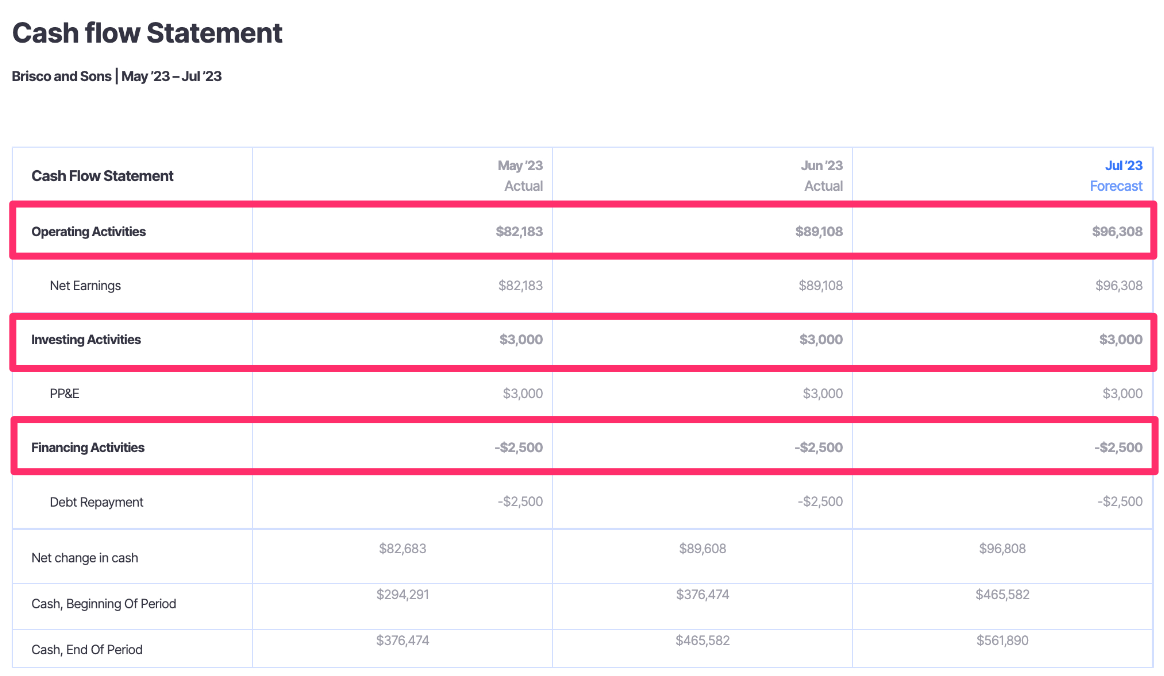

An Example Of Reading A Cash Flow Statement

To illustrate the value of the cash flow statement, let’s look at an example.

Peaked Interest is a made-to-order mountaineering equipment manufacturer. They had their most profitable month in February but ended up with less money in the bank than when the month started.

To understand what’s going on, they check out their cash flow statement.

Peaked Interest

Monthly Cash Flow Statement – February 20XX

Cash Flows From Operating Activities:

Net Income – $25,000

Adjustment for Depreciation – $1,000

Change in Accounts Receivables – ($20,000)

Change in Accounts Payable – ($7,000)

Net Cash From Operating Activities: ($1,000)

Cash Flows From Investing Activities:

Purchase of New Computers – ($10,000)

Net Cash From Investing Activities: ($10,000)

Cash Flows From Financing Activities:

Repayments of Loan Principals – ($2,000)

Investment From Owner – $10,000

Net Cash From Financing Activities: $8,000

Starting Cash Balance: $20,000

Net Cash Flow: ($3,000)

Ending Cash Balance: $17,000

Starting with the operating activities, something immediately jumps out.

Of the sales that were made, there was a net increase of $20,000 in uncollected payments. This is a factor as to why they had less cash hitting their bank account than what their profits indicated. But it’s also a positive indicator for cash inflows in March when the payments should come in.

Peaked Interest also paid down $7,000 of accounts payable after seeing their high performing sales numbers. They could improve cash flow by timing the inflows of their accounts receivable with the outflows of their accounts payable.

Looking at investing activities, we see that the business invested in new computers. But we get the full picture when we look at financing activities and see an investment from the owner for $10,000, presumably to cover these costs. From this, we see how a negative cash flow in one category can be connected to a positive cash flow in another.

Finally, we see the impact of recurring payments on cash flow. Assuming that their loan payments are similar every month, the business knows they need to net a positive cash flow of $2,000 to even things out.

Key takeaways

From looking at the cash flow statement example, we learn:

- Plan accounts payable payments depending on accounts receivable payments to minimize impact to cash flow

- Strategize to net enough cash to cover recurring payments and time them accordingly

- Negative cash flow is okay so long as there is a reasonable context

Monitor Cash Flow With Ease

Spending time analyzing your cash flow statement doesn’t have to mean time generating one.

Using a cash flow report that updates with real-time data means you have the information you need when you need it. That frees up your time to understand how money moves through your business.

With Finmark from BILL, you can customize your cash flow statement to suit your needs. Sub-headings and choices of what to include gives you a tailored experience where the detailed reporting you need is always available. Plus, integrations to QuickBooks, Xero, Wave, and more allows you to automatically import data from your accounting software.

Get started with a free 30-day trial.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.