General And Administrative Expenses

General and administrative expenses (G&A expenses) are exactly what they sound like: expenses incurred that aren’t directly tied to producing or selling a product or service (like R&D expenses and sales & marketing expenses are) but necessary to maintain business operations overall.

But you can’t just dump any erroneous dollar into G&A. Let’s explain further.

What Are General and Administrative Expenses?

G&A expenses are a large portion of the total operating expenses for a company, impacting your bottom line without being associated with a specific department or function within your business.

For the most part, G&A expenses are fixed costs, and many businesses try to reduce these costs as much as possible since they don’t directly impact revenue or profits (like sales, product development, etc.).

However, as your business grows, you will likely see these expenses increase (more office space, equipment and supplies needed, administrative salaries, and more).

When reviewing income statements, G&A expenses can be typically found below the Cost of Goods Sold (COGS), either grouped together as one line item or broken down further by fees, interest and deducting expenses.

Since G&A expenses are not lumped in with other expenses that are directly allocated to researching, producing, and selling a product or service (which would fall within COGS), they are delegated to their own line item.

Note: some organizations, including manufacturers, do group selling expenses with G&A (SG&A expenses).

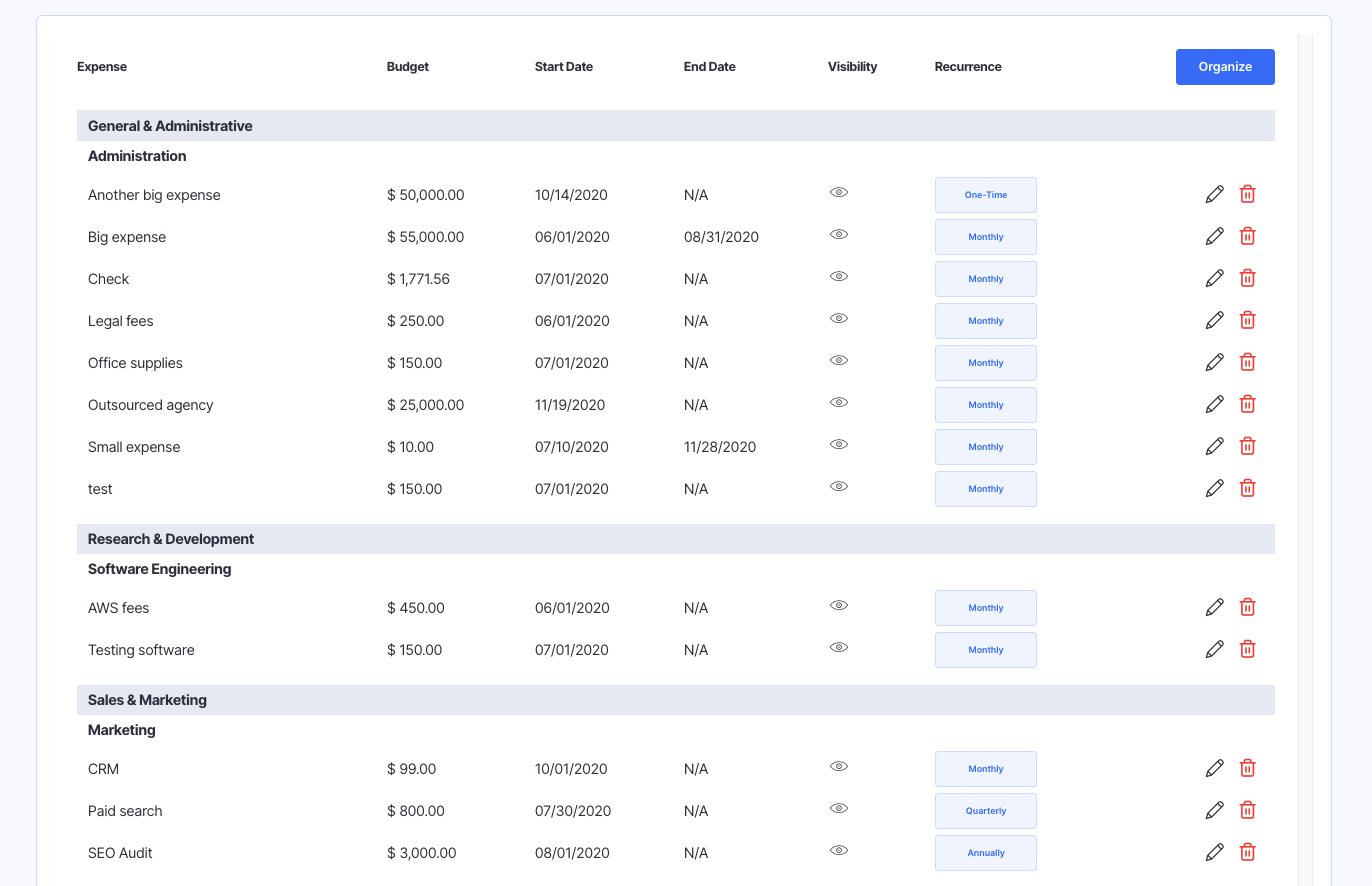

General And Administrative Expenses List

Wondering what should be included in general and administrative expenses? Here’s a quick list of some of the most common expenses you’ll want to record:

- Rent for office space

- Insurance

- Utilities related to the office space (internet, electricity, etc.)

- Employee electronics (laptop, etc.)

- General office supplies, including employee perks, snacks, and swag

- Office equipment and furniture (accounting for the depreciation of these items if previously purchased)

- Management and administrative salaries (titles that are not directly related to a production or sales function, including executives, internal/external legal counsel, finance/accounting, and IT support/administrative staff)

- Consulting expenses

- Subscriptions to services and tools

Why General And Administrative Expenses Are Important

As part of overall operating expenses, G&A expenses are necessary for your business to operate, allowing your startup to run as smoothly and efficiently as possible.

These expenses can also be tax deductible as long as they are necessary expenses that were both utilized and deducted in the year they were incurred, potentially saving your business money down the line. Consult with a tax advisor to get clarity on what can and cannot be deducted.

How to Reduce General And Administrative Expenses

Reducing G&A expenses ultimately comes down to how you want to operate your business.

For instance, during the COVID-19 pandemic, many businesses opted to transition their employee base to 100% remote work, significantly affecting G&A expenses by either reducing or eliminating rent and associated costs altogether.

However, many contracts for larger office spaces may not allow this immediate flexibility but may provide options to downsize the space over time.

Understanding the most significant costs for office supplies can be another helpful way to reduce G&A expenses.

For example, if paper and ink are becoming incredibly expensive for your business, then you may want to consider going paperless.

This may be a no-brainer, but some G&A expenses, like employee perks and swag, do affect employee morale. While these may seem like easy eliminations at first, you should consider the potential implications before striking these from the expense list.

General & Administrative Expenses Keep Your Business Operating Smoothly

While G&A expenses might not contribute directly to your revenue, they play a huge role in how effectively you grow your business. And if you don’t keep an eye on them, they can eat away at your bottom line.

If you want to see the financial impact G&A expenses have on your startup’s forecast, click here to give Finmark a try.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.