Gross Margin

Understanding and measuring your startup’s gross margin is a key part of business.

In fact, gross margin is typically one of the first metrics investors ask about, so you should have real-time visibility into this metric to be able to share with investors and other stakeholders alike.

What’s gross margin and how do you calculate it? Let’s dive in.

What is Gross Margin?

Gross margin is your company’s net sales revenue minus your Cost of Goods Sold (COGS). In short, it’s the retained revenue after incurring the total cost it takes to produce and sell your product or service.

This is the revenue before other costs, like General & Administrative Expenses or Sales & Marketing Expenses are calculated. Your gross margin is what is left over to cover all operating expenses within your business.

Your gross margin will be a numerical value displayed on your company’s income statement. It can also be displayed as a percentage of your sales.

How to Calculate Gross Margin

As stated above, you subtract your COGS from your net revenue to determine your gross margin.

Gross Margin Formula

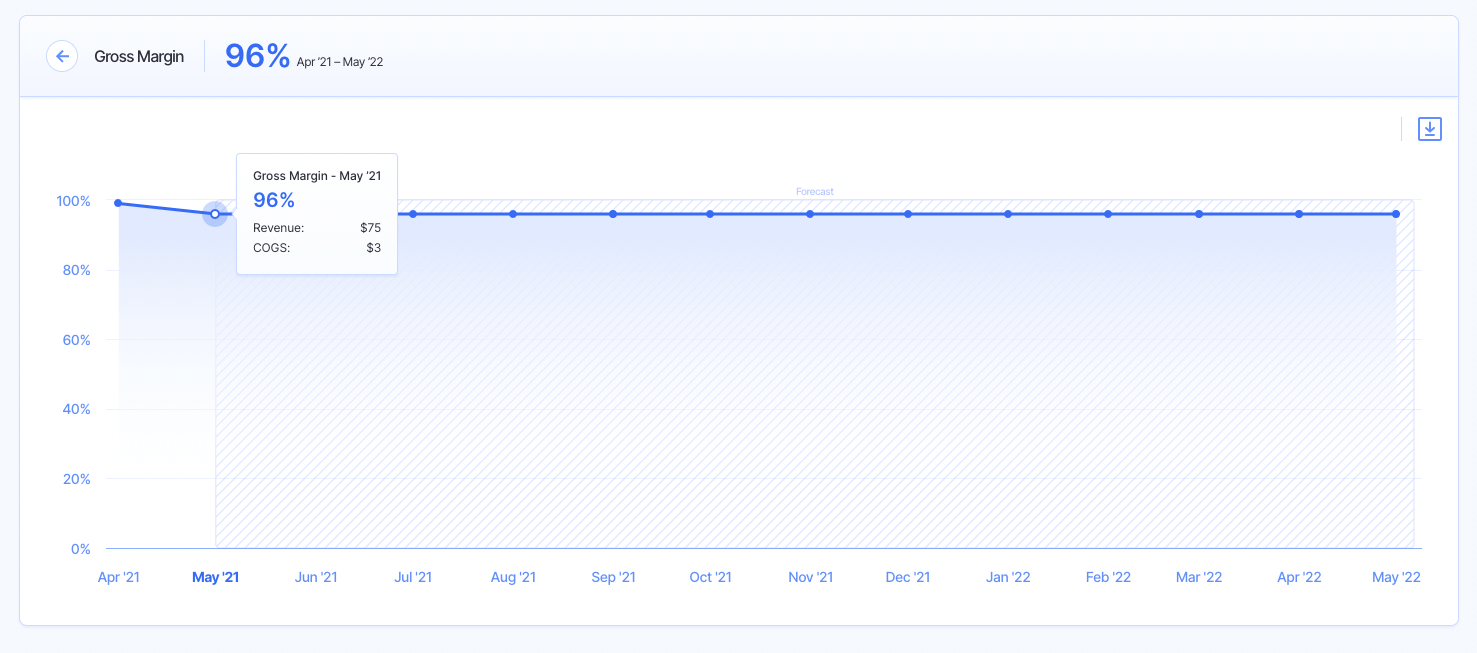

Gross Margin = (Revenue – Cost of Goods Sold)/Revenue

For example, if you bring in $100,000 in revenue and your COGS is $25,000, then your gross margin is $75,000. If you are displaying your gross margin as a percentage, then your gross margin is 75%.

Why Gross Margins Are Important

Gross margins are important as they are a key indicator of how well you are managing your resources. Having a high gross margin means you can grow your business more efficiently as you’ll have more funds dedicated to growth.

A lower margin may mean you need to adjust the cost of your product or service in comparison to the cost it takes to create or provide the service. You need to sell your product for more than it costs to produce in order to generate revenue and grow your business. Over time as you grow, ideally, your gross margin will grow with your successes.

Measuring your gross margin will help you in budgeting and planning for future growth. Having an up-to-date financial model can help with planning and understanding how forecasted margins may affect overall company growth and future revenue.

How to Increase Your Gross Margin

Since you calculate gross margin using revenue and COGS, you need to focus on adjusting either (or both!) of these metrics to improve your gross margin. This means increasing revenue and decreasing your COGS.

This may sound simple on paper, but selling more products or services as you’re starting out may be tougher than you think.

As an early-stage startup, you’re likely still testing out different customer acquisition strategies to determine the lowest Customer Acquisition Cost (CAC) and identify how to best market and sell your product or service.

According to OpenView’s SaaS Benchmarks Report, the average gross margin is between 70-75%. This is aligned with KeyBanc’s SaaS survey, which reports that the average gross margin for SaaS companies is about 78%.

If you find your business outside of this percentage, then it’s likely time to make some adjustments to ensure your company is set up for future success.

1. Increase Your Subscription Prices

Determine if there is an opportunity to increase your subscription price by understanding costs and reviewing your competitions’ prices to see if there is an opportunity to offer better services and increase your price point.

2. Add Professional Services

Are you able to introduce new revenue streams? Adding professional services to implement your product or service can help to increase your gross margin.

3. Refocus Your Current Product Mix

Is there a product that costs more to produce but isn’t performing as well as some of your other services? Perhaps it’s time to phase this out to focus efforts on better-performing revenue streams.

4. Streamline Costs & Reduce Waste

Is there any opportunity to automate processes to reduce overall costs? Conducting an audit of your current processes to see where you can cut costs and reduce waste to increase your gross margin.

Start Increasing Your Gross Margin Today

Understanding gross margin is part of developing a solid foundation for your business. Having a financial model is a great place to start.

Start building your financial model in Finmark today.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.