MRR Churn

Monthly Recurring Revenue (MRR) is one of the most important SaaS metrics you need to track in your startup. If you understand MRR, then you are one step closer to understanding and tracking MRR Churn.

Keep reading to learn the definition of MRR Churn, how to calculate it, why it’s important, and the steps you can take to reduce it.

What is MRR Churn?

MRR Churn, also known as Churn MRR or Revenue Churn, is the amount of MRR lost due to downgrades or cancellations from your customers in a given period of time. As MRR is calculated monthly, MRR churn is also calculated monthly, and it’s typically shown as a percentage (MRR churn rate). You can also track the amount of lost revenue, like we do in Finmark.

While some may use MRR churn and customer churn interchangeably, (or better yet, only measure customer churn), it’s important to note that these are separate metrics.

Yes, each focuses on losing customers and revenue. However, customer churn is the percentage of customers you lost in a given period of time, while MRR churn is the percentage of monthly revenue you lost due to churn or downgrades.

Make sure you are tracking both customer churn and MRR churn to be able to talk about and report on your churn metrics accurately.

How to Calculate MRR Churn

To calculate MRR churn, you’ll need your churn rate percentage and the number of customers you had at the beginning of the month.

MRR Churn Formula

Customers at the beginning of the month x Churn Rate x ARPU

Why MRR Churn is Important

MRR churn has a major effect on your financial planning and performance.

Here’s why it’s crucial to track your MRR churn.

MRR Churn Provides Insights Into Product Performance & Value

We mentioned earlier that MRR churn helps to show inefficiencies in your product or service, especially if you have a tiered pricing plan.

If you are losing a significant amount of customers on your mid-level plan, but aren’t seeing major changes in your entry-level or enterprise plan, this can be an indicator that the mid-level isn’t meeting customer needs or expectations.

You should work closely with your product team to determine if there are additional features or benefits that need to be included in the mid-level plan to reduce MRR churn.

MRR Churn Helps to Predict Company Growth

MRR churn can impact other financial metrics. Understanding MRR churn over time can help when building your financial models to accurately predict future company growth.

If you know how much revenue you may lose over the next six to twelve months, you can more accurately forecast your startup’s runway.

Having a financial model is incredibly helpful to measure MRR churn. Finmark’s financial modeling software provides real-time visibility into metrics that matter most to you, like MRR churn.

What is a Good MRR Churn Rate?

So what’s the ideal MRR churn benchmark?

Unfortunately, there’s no right answer. It depends on your industry, the age of your company, how many customers you currently have, your MRR, and more. There are too many variables to be able to say that all startups should be marching towards XYZ MRR churn.

There may not be a silver bullet to the best MRR churn rate, but there are several industry benchmarks that can help to determine an MRR churn rate that won’t put you out of business.

In his blog, Tomasz Tunguz, Managing Director at Redpoint Ventures, says startups tend to operate with higher monthly churn rates, somewhere between two to five percent, while mid-market and enterprise companies see lower churn rates.

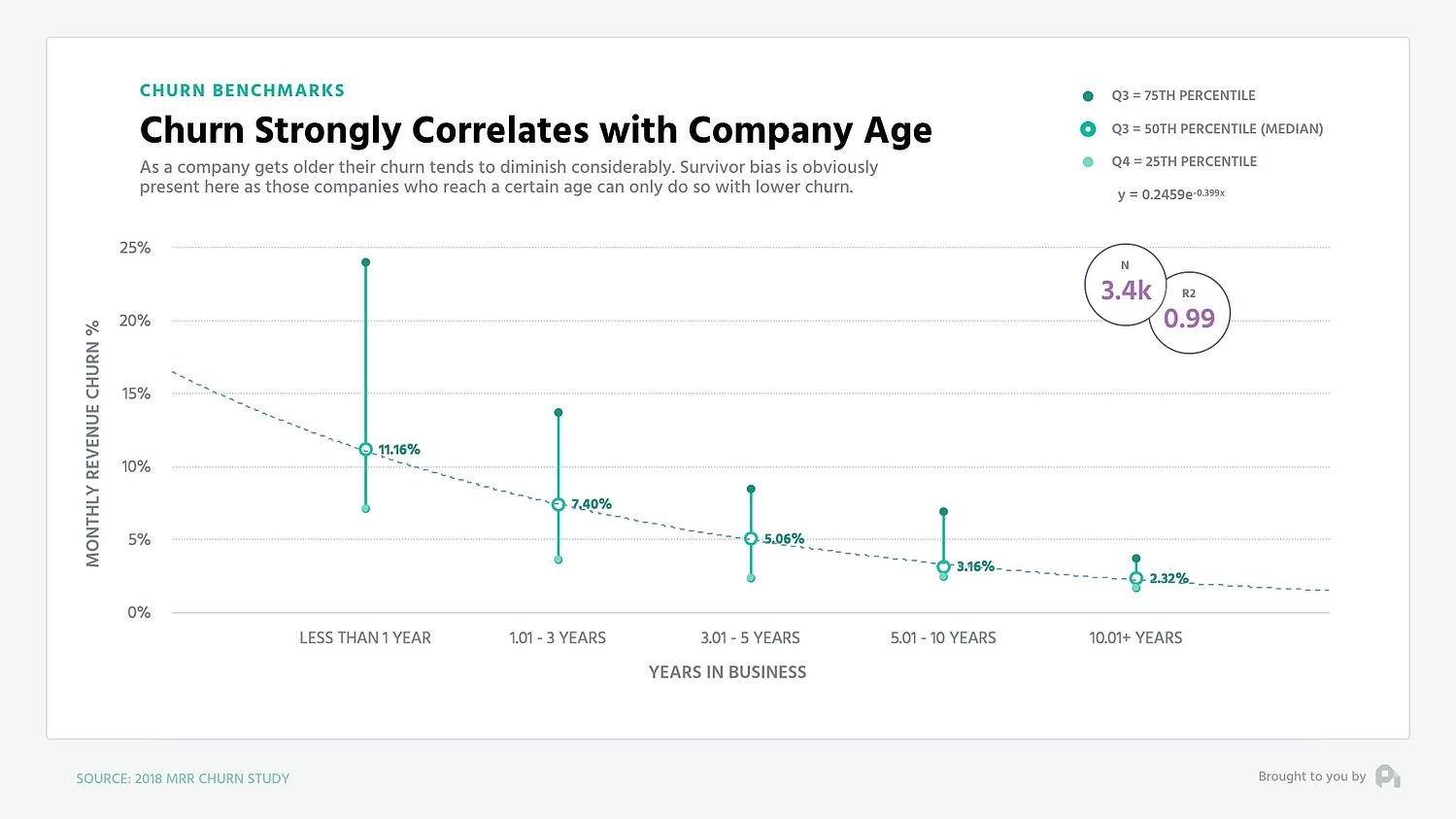

His point regarding the size of companies is similar to what ProfitWell has gathered, where churn correlates to the age of a company. Younger companies have higher churn rates, and as they age are able to get their churn rates under better control.

Baremetrics also has some insights into MRR churn benchmarks depending on the average revenue per customer (ARPU).

For Baremetrics customers, however, an ARPU between $50-250 has the lowest MRR churn rate (7%) while anything below or above that ARPU results in a higher churn rate. The full Baremetrics data can be found below.

| ARPU | Average MRR Churn Rate |

| Under $10 | 8.3% |

| $10-$25 | 8.6% |

| $25-$50 | 8.9% |

| $50-$100 | 6.8% |

| $100-$250 | 7.0% |

| $250 and up | 9.8% |

Take these metrics with a grain of salt. Every startup is different, and you shouldn’t rely solely on industry data when measuring the performance of your business.

How to Reduce MRR Churn

So now that you understand the ins and outs of MRR churn, let’s talk about the steps you can take to reduce it.

1. Focus on Customer Retention

If you provide a stellar customer experience, then you will (hopefully) have reduced levels of MRR churn. It’s as simple as that!

Well, it may not be that simple, but focusing on customer retention and exceeding your customers’ expectations will mean happier customers and fewer customers who churn.

This can mean investing in customer service, providing incentives to marquee customers, or even creating communities or events where customers can interact and learn from each other.

2. Prevent Involuntary Churn

Involuntary churn is when a customer has a payment failure, like an expired credit card or incorrect or out-of-date billing information, and the subscription is canceled due to the lack of payment. (This is different from voluntary churn, where a customer is actively canceling or downgrading their account).

Dunning management can help to reduce the amount of involuntary churn your startup has. This means alerting your customers when the payment fails with a direct link for them to update their billing information.

Send additional follow-up emails to those customers who have yet to take an action to prevent involuntary churn. You can either handle this process manually or invest in a dunning management tool to handle it for you.

3. Offer Deals & Discounts

Yes, your goal may be to increase revenue, so you don’t want to risk offering any discounts that can impact your bottom line.

However, offering a small deal or discount to maintain a customer in the short term can help to reduce your MRR churn over time.

4. Maintain Your Product’s Value

When a customer wants to downgrade or cancel, remind them why they signed up for your product or service in the first place!

Your product is likely solving a problem or filling a necessary gap for them. Have metrics and case studies that showcase your product’s value on-hand to share with customers who may be on the fence to help prevent churn or contraction.

Less MRR Churn, More Happy Customers

MRR churn may only be one piece of the financial puzzle, but understanding MRR churn and taking the steps to reduce it can make a major impact on your bottom line.

Ready to start measuring MRR churn? Sign up for Finmark and take the guesswork out of building a strong financial model.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.