How to Build Your Investor Pipeline (+ Free Template)

Partnering with your cofounder, landing your first customer, officially going to market; There are many milestones in a founder’s journey.

Perhaps one of the more daunting milestones is seeking your first round of funding.

There are so many questions to answer:

- What’s up with all the different funding stages?

- How much funding do I need?

- How do I pitch investors?

- How do I even get in front of investors?

For most, tackling that last question involves building an investor pipeline, and managing your communication with them.

This means that rather than calling or emailing a few investors and leaving it at that, you’re acting as a salesperson would when chasing down new customers.

You put together a list of possible investors, start the communication process, and keep track of all interactions in your pipeline as you move through the various stages.

In this article, we’re going to discuss how to build an investor pipeline, both in terms of identifying potential investors and creating a system to keep track of communication.

Resource: Grab our free investor pipeline template

1. Determine Which Kind of Investors to Include

As a starting point, before you even go building a system or spreadsheet, you need to have a strong understanding of the kinds of investors you’d like to reach out to.

Are you going to target angel investors only? Perhaps venture capitalist firms or micro-VCs? Perhaps crowdfunding is a better fit for you?

Let’s briefly look at what these different investor types offer (if you want to dive into more detail, click here to read our in-depth guide).

Venture Capitalists

VCs are companies designed specifically to invest in startups.

The VC works on behalf of their own investors (i.e. they aren’t lending their own money), and will have a thorough process for making funding decisions.

Venture capitalists are known for being very diligent, which can mean the process takes a little longer. However, some VCs may also be able to provide advice and guidance through your startup journey.

Learn more about venture capitalist firms here: Angel Investors vs. Venture Capital vs. Micro VCs: What’s The Difference?

Angel Investors

Angel investors on the other hand are wealthy individuals, many of whom have experience growing (and selling) a startup, though this isn’t always the case.

By and large, angels are willing to lend less, though they have a faster process for decision-making (since they are only one person).

Some angels are willing to get involved earlier and make riskier funding decisions than most VCs.

Learn more about angel investors here: 8 Ways to Find The Perfect Angel Investor For Your Startup.

Other Investor Types

Angels and VCs are definitely the two most common sources of funding, however, some companies access funding via:

- Friends and family

- Crowdfunding

- Accelerators and Incubators

Learn more about the various types of investors and their suitability in our guide to raising seed funding.

2. Create Your Investor Pipeline Spreadsheet

Before we start researching potential investors, let’s prepare our pipeline.

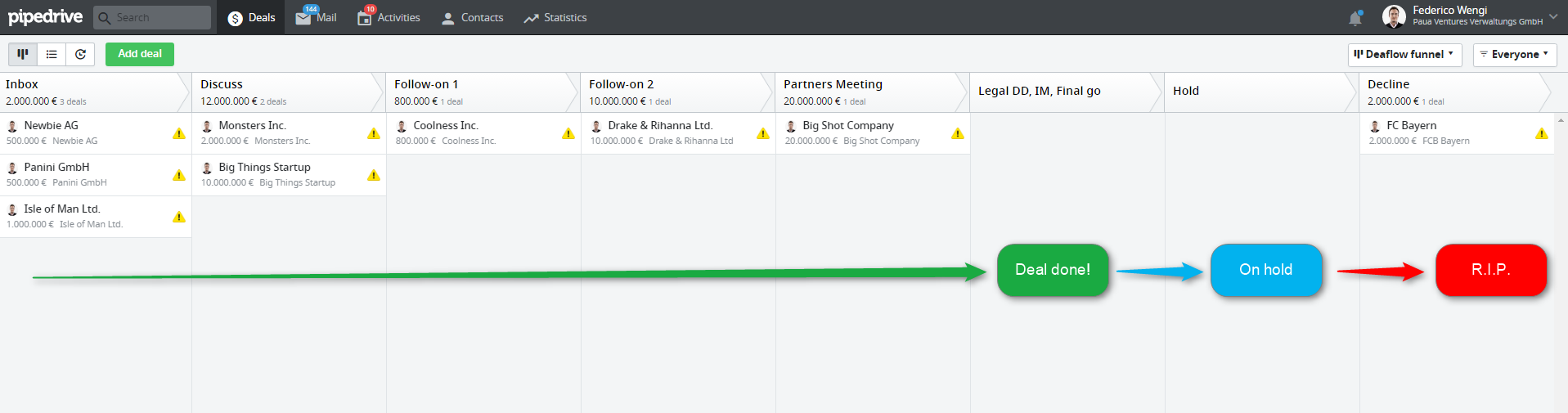

There are a couple of ways you can do this. If you like, you can sign up for a CRM platform like Pipedrive, Hubspot, or Copper.

Platforms like this will get you started quickly with pipeline templates, but bear in mind that

- They are primarily designed for salespeople, not startup founders

- You’ll need to pay (for most of them)

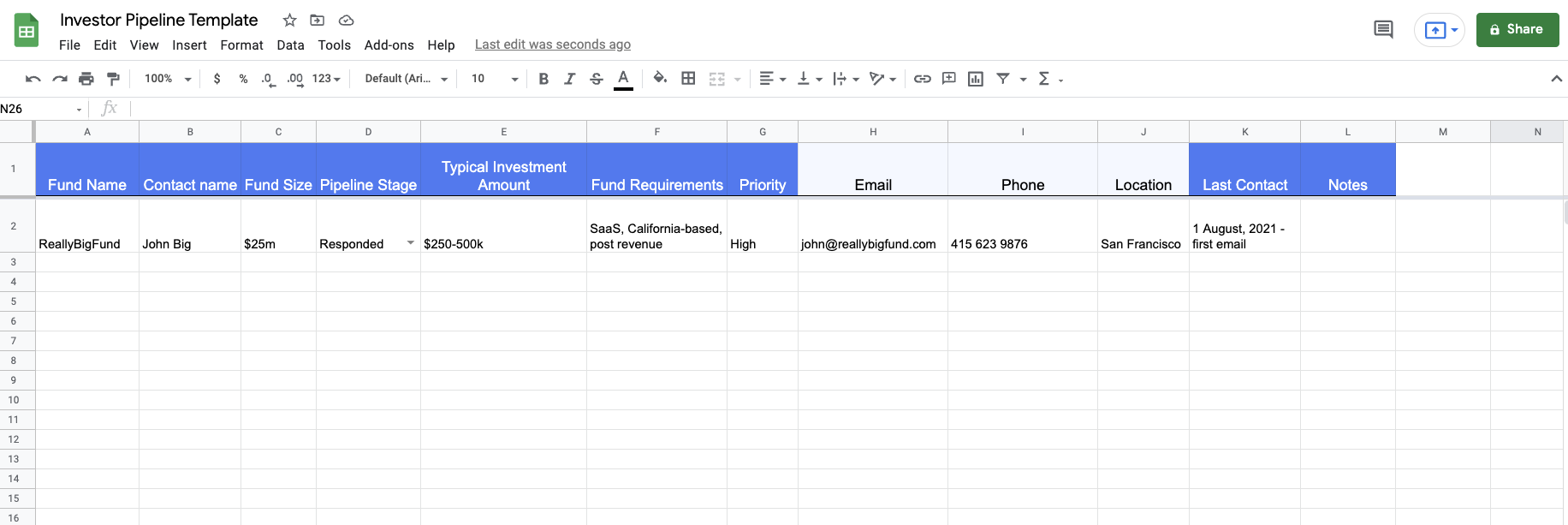

A free and simple alternative would be to build your investor pipeline using Microsoft Excel or Google Sheets, like this:

Sure, it’s not as pretty as Pipedrive, but it’s super customizable and best of all, free! (We’ve all gotta count the pennies when we’re in startup mode).

Get the investor pipeline template here.

The key fields to include in your investor pipeline are:

- Fund name

- Contact name (who at the fund you’re dealing with, or the name of your angel)

- Contact details for the investors (email, phone)

- Their typical investment amount (helps you to gauge what kind of funding you might be able to get)

- Specific requirements the fund has (maybe the only fund companies in a certain industry, for example)

From there, you can customize as you like.

As you can see in the above, we’ve added fields for fund size, investor priority (so we can prioritize initial outreach), our last contact, and general notes.

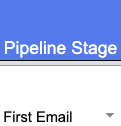

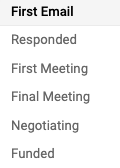

Lastly, you’ll want to have a dropdown field for the stage of the investment deal.

This helps you see at a glance where you stand with each investor, whether you’ve started communication or not, etc.

We’ve set our pipeline up with six stages, but you can adjust these to your liking depending on your specific investor communication process.

3. Research and Identify Potential Investors

Now that we’ve got our pipeline set up, it’s time to start finding potential investors to add to the top of our funnel.

A simple Google search can be a good start (top venture capitalists in San Francisco), but there are a number of sites for founders to connect with founders as well:

- AngelList – Both a job board for startups looking to recruit, and a database for venture capitalists and angel investors.

- FundersClub – A platform that connects investors with founders (previous startups include CoinBase and InstaCart).

- CrunchBase – Software solution and database for finding potential investors.

- Seedrs – Mainly designed for investors, but they help investors find startups so you may be able to find some value here.

- PitchBook – A research platform for identifying and digging up information on investors.

- Signal – A platform for VCs, angels, and startup founders to connect.

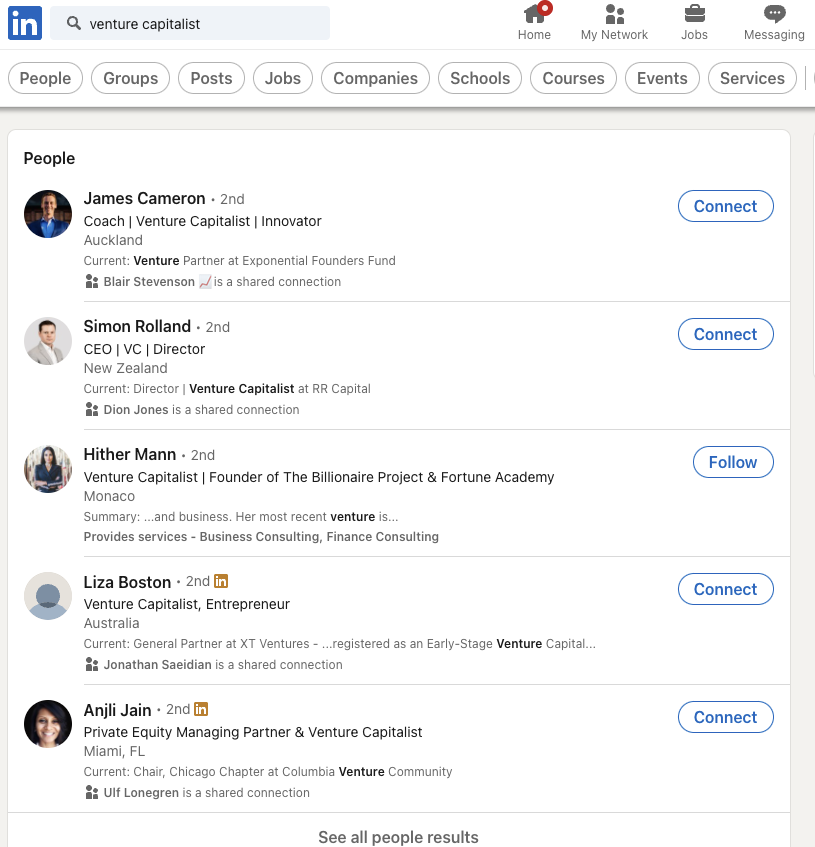

Alternatively, you can go hunting for investors the manual way.

Research companies that have been recently funded, and see where they’ve sought investment from. Attend meetups and conferences. Search for ‘venture capitalist’ on LinkedIn.

A combination of the above methods should give you a fairly substantial list.

Each time you come across a potential investor, make sure to assess them against a variety of important factors.

- Geography – Are they local to you? Does this matter (it might for them)?

- Fund interests – What industries and verticals do they typically fund? Do they only invest in specific business models? Are there specific requirements (green initiatives, for example)?

- Typical investment amount – Does the fund or angel typically write checks in the range you’re looking for?

- Conflict of interest – Is the investor already working with companies that are competitive to your business? You’ll want to avoid this.

Lastly, ask yourself the question: “What makes this investor a good option for me and my startup?”

This can help you determine whether you’re considering partnering with a firm you think can bring value to your company, short of just providing the money you need to get going.

4. Reach out to Your Mentors

Remember: you don’t know who you don’t know!

One way to get in front of new investors is simply to reach out to your network. If you have mentors (formal or informal), get in touch and see if they know any investors.

Better yet, ask if they’d be comfortable introducing you. This is an old sales trick, where 73% of executives are more comfortable working with a salesperson who they’ve been introduced to by someone they know.

The same applies in the investment world, so get as many warm intros as possible!

Aside from mentors, you may have other people in your network who can help put you in touch with new investors.

That guy you met at that party last week who just sold his company? Probably got funded at some point. He might be able to provide some advice, and possibly even a recommendation.

5. Prepare an Intro Email Template

So, you’ve got your pipeline spreadsheet ready and filled with contacts for potential investment deals.

The first step for most is going to be to send an introduction email (unless you’ve been referred by someone in your network, where your first step might be to reply to that intro email or even to go straight in for a meeting).

Like sales outreach, the idea here is to find a balance between personalization and the ability to work at scale. If you’re contacting more than 20 investors, you don’t want to have to start from scratch every time you open up Gmail.

The best method here is to craft a template email, which you can then personalize to the specific investors you’re contacting.

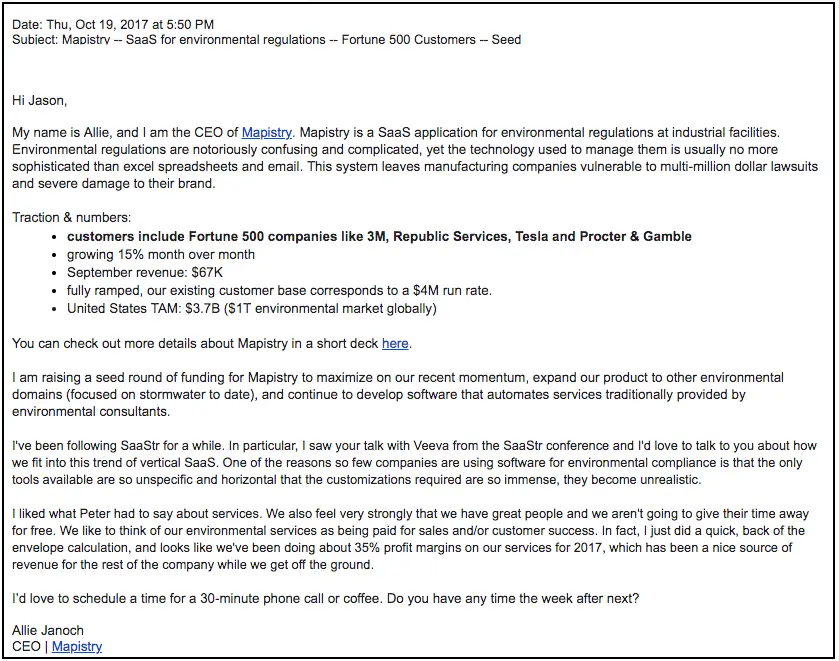

Here’s a great example of what that should look like:

The rough format to follow here is:

- A simple intro, followed by the elevator pitch for your company.

- Straight into the numbers. You’re telling the investor “here’s why you should give me the time of day.”

- Link to a slide deck so they can check out more details, without making the email and essay.

- What kind of funding you’re looking for, and what you’re going to use it for.

- What you know about the VC/angel, and why you feel your company is a good fit.

- Call to action: Let’s schedule some time to discuss.

6. Use Your Pipeline to Track Investor Communication

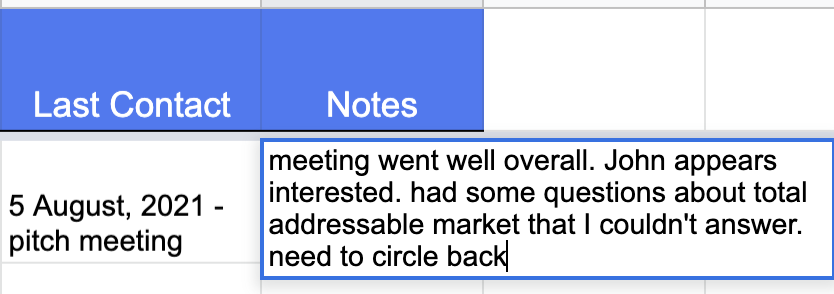

Remember: the intention of building a pipeline of investors is so that you can track the stages of communication, and accurately remember who you spoke to, when, and about what.

Each time you communicate with an investor, remember to jump back into the pipeline document and:

- Change the stage

- Edit the last communication field

- Add any appropriate notes

Next Steps

Building an investor pipeline is a smart tactical move for staying organized, keeping on top of investor communications, and making sure you land the best funding deal possible.

Once you’re in contact with investors, though, your next step is to book a meeting to pitch them your startup, and convince them to fund you.

Check out our guide to get prepped for this step: How to Pitch Investors.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.