Should You Raise Money in the Next 12 Months? A Bull/Bear Valuation Calculator

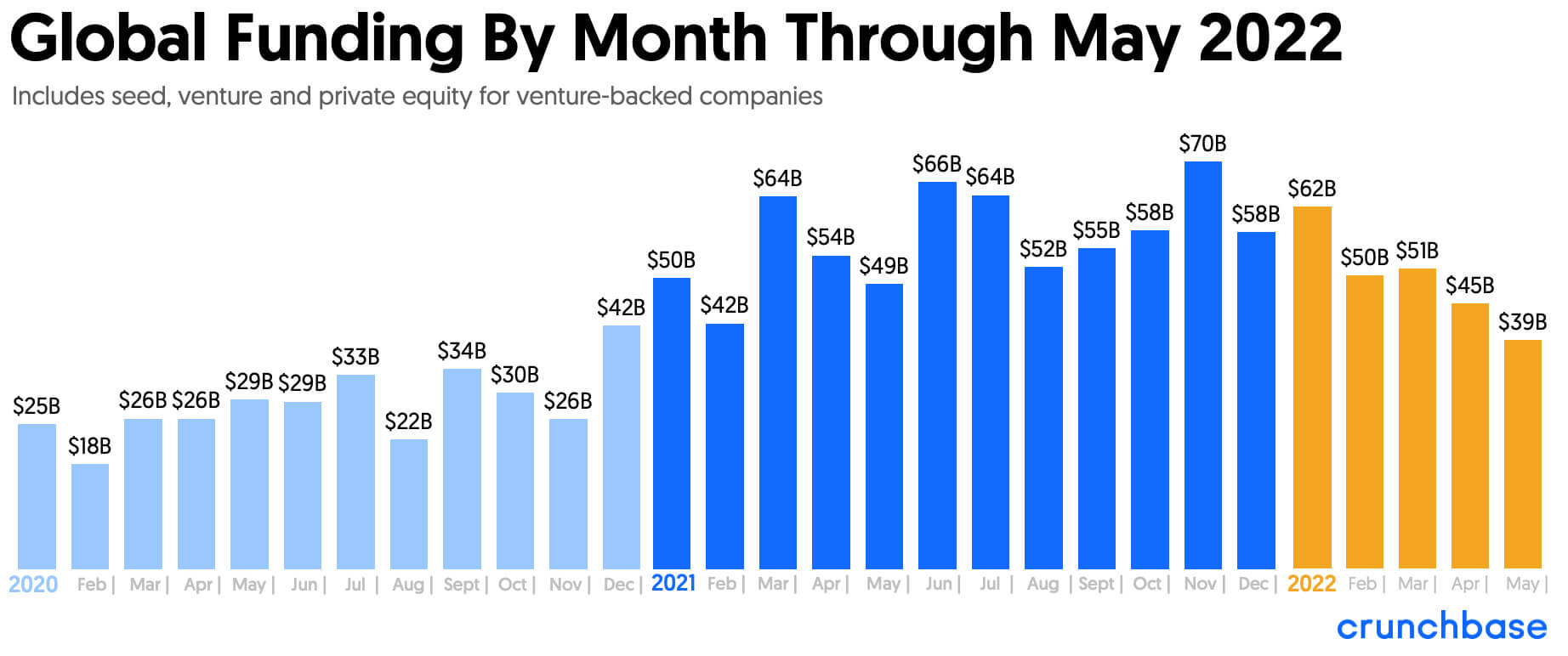

During the Covid-19 pandemic—particularly in 2021—SaaS companies saw historical valuations and unprecedented levels of VC funding.

To give you an idea of how wild things got, consider this. There are currently 1,300+ unicorns, according to data from Crunchbase—600 of which were minted in 2021.

Fast forward a year later, and today’s valuations don’t seem to be keeping pace. Not only that, but VC funding has slowed down considerably.

As you’ve likely seen in headlines, economic uncertainty, fear of a recession, inflation, and other factors have led some of the top tech companies to see plummeting valuations.

This is understandably concerning if you’re a tech company with plans to raise money within the next 6-12 months.

So, where does that leave your company?

What type of valuation can you expect when you raise your next round?

Will you potentially have to raise a down round?

What considerations should you make before you raise?

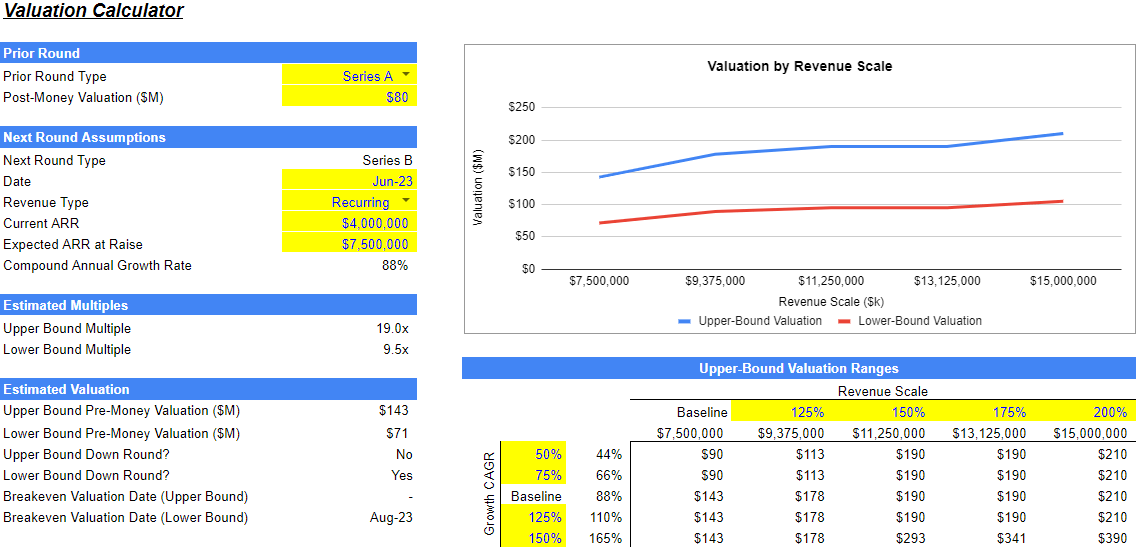

We created a free calculator that will help you answer all these questions and give you a baseline for raising your next round.

With the calculator, you enter some basic information about your company (revenue, the funding round, revenue type, etc.), and you’ll see an estimated valuation, whether or not you’ll need to raise a down round, breakeven valuation date, and other critical data points.

If you want to jump right to the calculator, you can access it here.

However, we’d highly recommend reading the rest of this guide!

We’ll shed light on the current state of SaaS valuations, some considerations you need to account for, and a brief walkthrough of how to get the most value from the calculator.

The Current State of SaaS Valuations

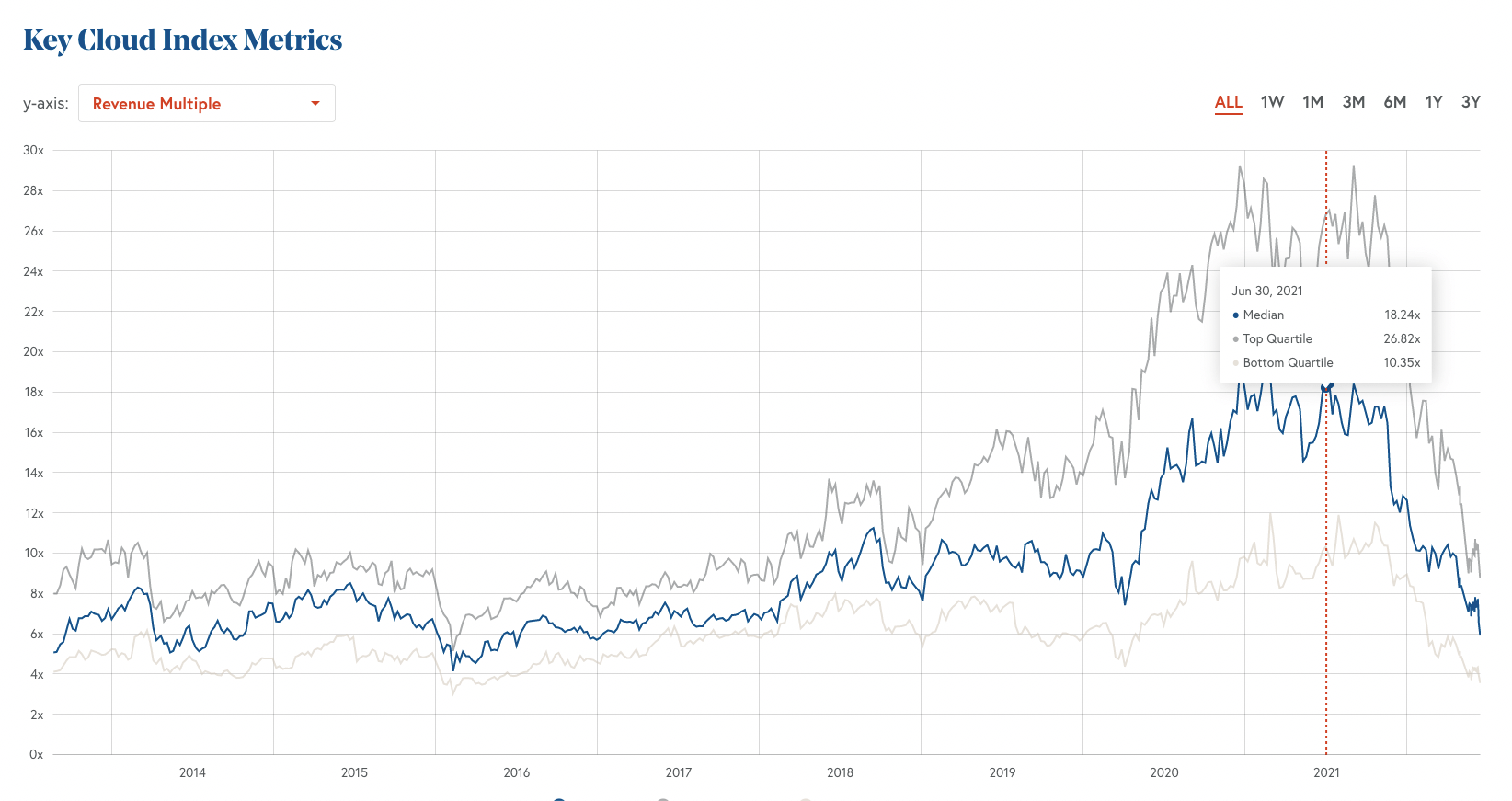

According to data from Bessemer, a year ago, revenue multiples above 10x were the norm for SaaS companies.

As you can see from the chart above, that’s no longer the case.

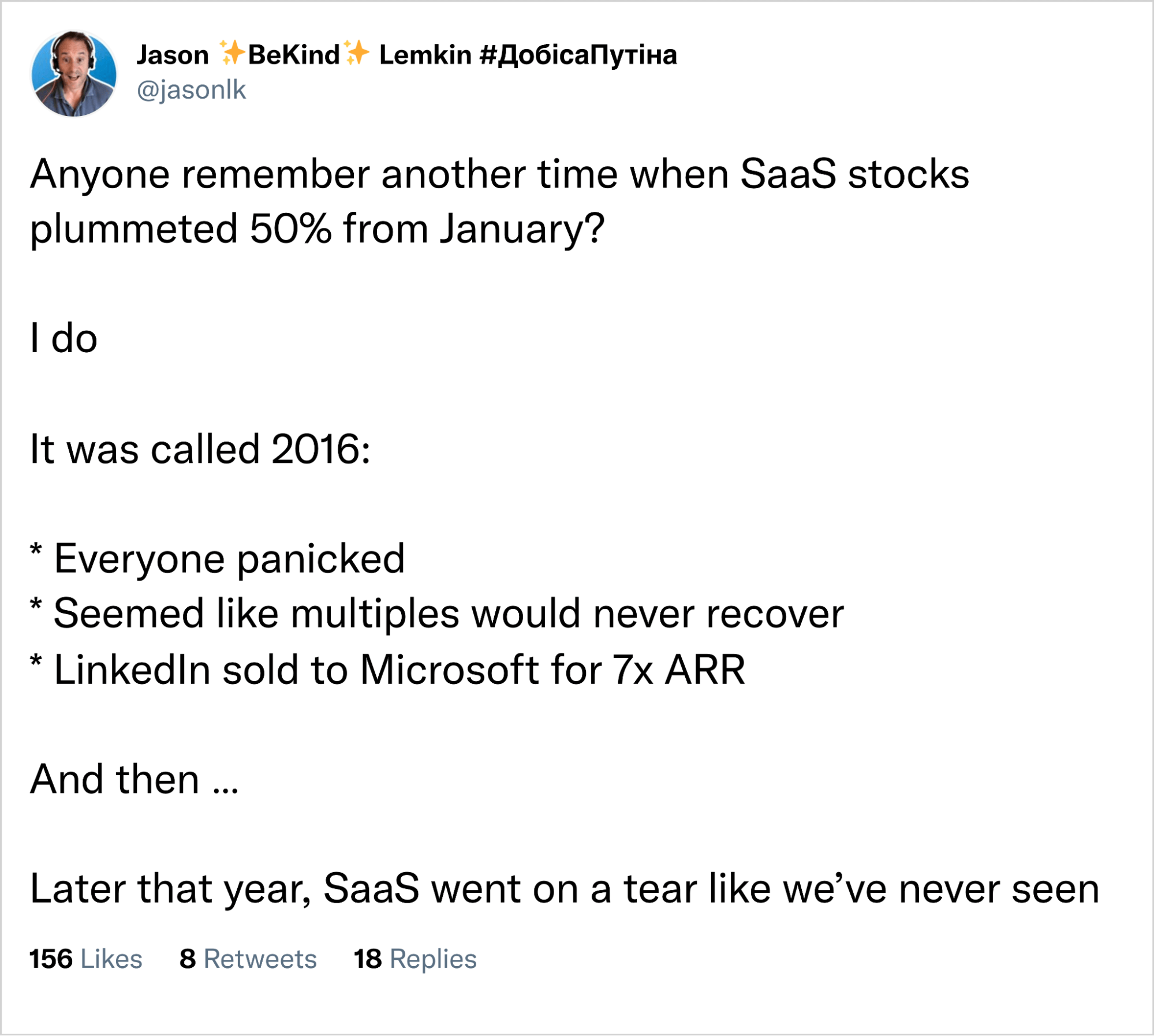

This might seem disheartening at first glance. However, as Jason Lemkin from SaaStr pointed out in a recent article, things may not be as bleak as they seem.

Jason points out that despite revenue multiples being below three-year lows and long-term averages, SaaS companies are still doing relatively well.

“Customers are buying more than ever. Amazon AWS, Microsoft Azure, and even Google Cloud are on fire, adding insane amounts of revenue this year. The top SaaS and Cloud leaders are even accelerating at $1B in ARR, for goodness sakes!”

Yes, valuations and revenue multiples may be lower than two years ago.

But consider this.

From 2018 to the beginning of 2022, the SaaS industry has been on an unprecedented run.

When you zoom out and take a macro view of where things stand today, it seems like the industry is trending towards 2018/2019 levels, far from the SaaSpocalypse scenario of 2016 (which the industry bounced back from, by the way).

Does this mean that you can go and raise your next round?

Well, it depends…

Considerations For Your Valuation

Just because valuations aren’t at all-time highs anymore doesn’t mean you can’t (or shouldn’t) raise your next round.

However, it does mean that it’ll likely be more difficult, and you probably won’t get the same valuation you would’ve a year ago.

To help you gauge whether or not it makes sense to fundraise now and what kind of valuation you can expect, here are some considerations.

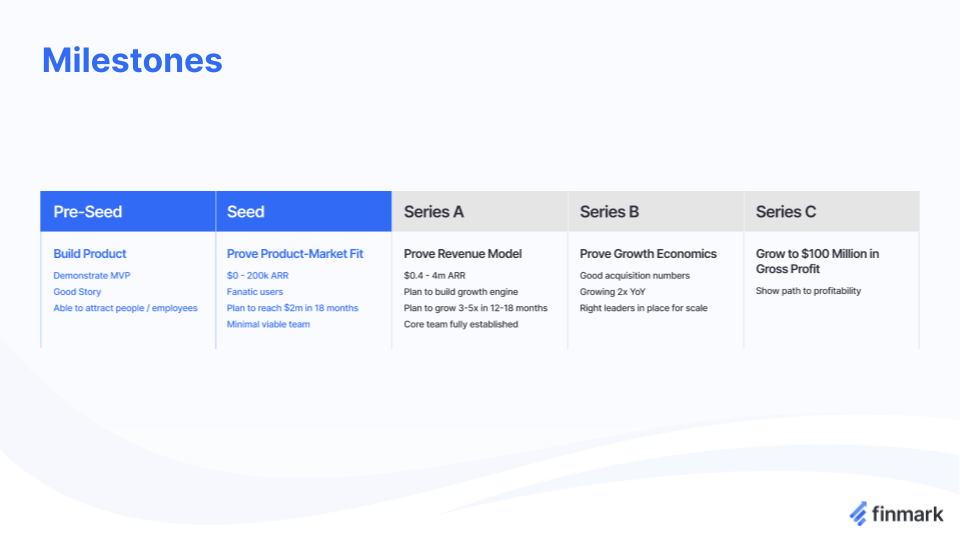

What Milestones Has Your Company Reached?

Investors want to see that you’ve reached certain milestones to feel confident about your progress and potential.

The milestones you should aim for depend on which funding round you’re seeking.

For instance, if you’re raising a seed round, some milestones you should aim for are:

- Product-market fit

- $200K ARR OR Users that are fanatic about what you’re building

- A plan to reach $2M in annualized revenue in 18-24 months

You can see examples of milestones for other rounds in the screenshot below:

If your company has been stagnant since the previous round or isn’t showing signs of reaching the milestones for the next round, it may affect the valuation you receive.

What’s Your Growth Rate?

Another important consideration in your valuation is your growth rate.

How fast are you growing? Is it comparable to startups of a similar size?

A Series C company doing $25M in annual revenue with a 75% growth rate will be valued differently than a Series A company doing $3M in annual revenue with a 150% growth rate.

One of the benefits of our valuation calculator is it considers your revenue growth rate compared to historical averages for companies with similar revenue, which will save you from researching benchmarks and doing manual calculations.

What Revenue Multiple Can You Expect?

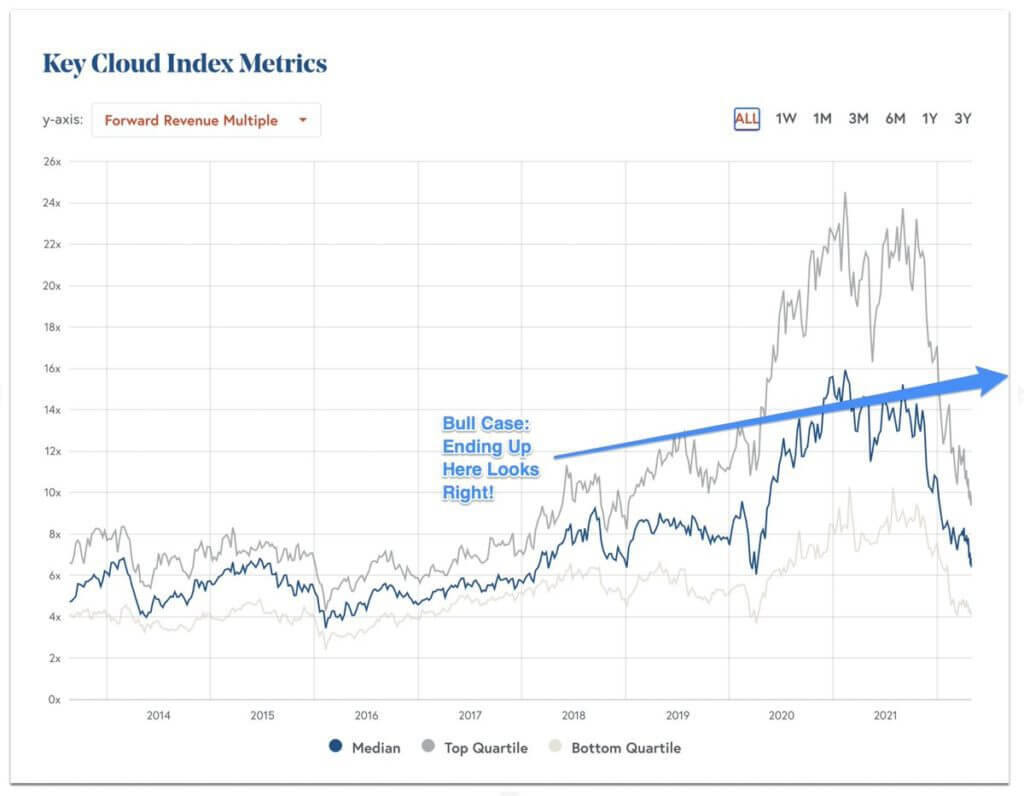

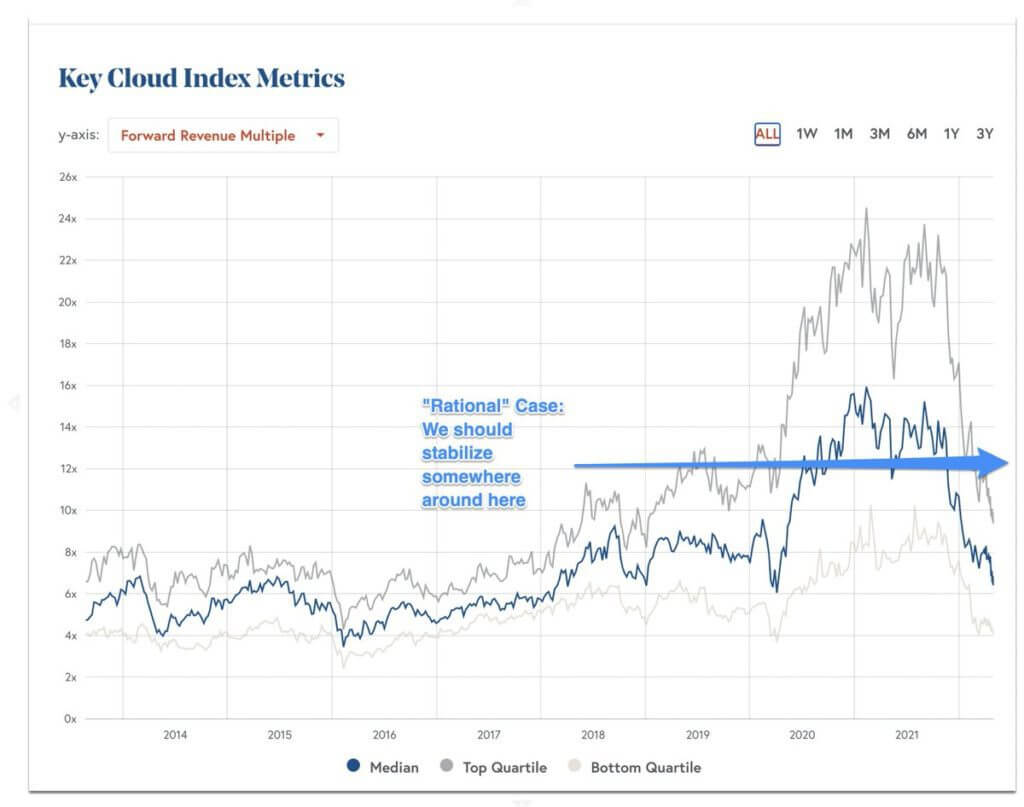

Going back to Jason Lemkin’s article, an essential piece of determining your valuation is your assumptions for what revenue multiples will be going forward.

Jason described three scenarios:

- Bear Case

- Bull Case

- Rational Case

The bear case assumes revenue multiples will fall back to pre-2018 levels.

The bull case assumes that revenue multiples will continue to grow at the same rates they were between 2017-2019, and essentially treats the highs and lows of the Covid years as abnormalities.

The rational case assumes that revenue multiples will level out to pre-Covid levels without the drastic growth pattern of the bull case.

It’s impossible to say which scenario is the most likely. Jason’s view is also based on a longer term horizon than just the next twelve months.

In our methodology, we’re considering what valuations will look like for the next 12 months and therefore accounted for a more modest upper bound and a more drastic lower bound scenario than what Jason had described.

The upper bound scenario assumes revenue multiples will return to pre-covid levels, similar to Jason’s rational case. While the lower bound scenario assumes multiples will hit close to 2016 bottoms, which were lows not seen since 2011.

This gives you enough of a range to plan for a best and worst-case scenario and determine the likelihood of having to raise a down round.

Those are a few of the main considerations for your valuation. Our calculator automates a lot of this for you and considers several other factors. Let’s take a more in-depth look at how the calculator works.

How to Use The Valuation Calculator

We designed this calculator to be simple yet flexible. Here’s a quick overview of how it works.

Instructions

- Download the Calculator

- Navigate to the “Calculator” tab in order to input your company’s data

- Note: Yellow highlighted cells are manual inputs/assumptions

- Under “Prior Round,” select round type and enter the post-money valuation

- Under “Next Round Assumptions,” fill out the estimated date of your next round, the company’s revenue type (recurring/non-recurring), current ARR or current forward annual revenue estimate, and projected ARR or forward revenue estimate at the time of the next raise

- If you want to adjust the revenue and growth ranges for the line chart, you can change the values in the yellow highlighted cells in the data table headers

- The “Valuation Logic” tab contains our assumptions around multiples based on a number of different sources including Battery, Bessemer, and Pitchbook. These can also be manually adjusted by changing cells with blue text

Can Your Startup Weather The Storm?

This calculator is a great tool to help you prepare for what the future may hold.

However, if you have concerns about how to navigate turbulent times, the impact the economy will have on your ability to fundraise, or anything else, join us for our upcoming webinar: R.I.P. Good Times? Navigating Your Startup Through Uncertainty.

We’ll cover a wide range of topics, including:

- Strategies for weathering the storm

- Impact to valuations

- How to build Base Case, Best Case, and Worst Case plans

- Tips to grow revenue and extend your runway

- How to communicate with investors

- Q&A

We hope to see you there!

P.S. We want to give a special thank you to some people and companies that helped us create this calculator.

Thank you to Jason Lemkin of SaaStr for writing a great article about SaaS multiples, which was a big inspiration behind the idea for the calculator.

Thank you to Battery, Bessemer, and Pitchbook for their detailed data reports which we used in our assumptions for multiples for the calculator.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.