How to Create a Startup Budget (Template Included)

Did you know that 90% of startups fail?

That’s scary.

But why do they fail?

It’s not because they had a bad idea. It’s also not because they didn’t pick the right market or have enough passion for their product.

The most common reason why startups fail is that they run out of money.

Want to avoid becoming part of that 90%?

Check out our step-by-step guide on how to create and forecast your startup budget.

It will help you:

- Figure out what expenses to include in your startup’s budget (and how to categorize them)

- Forecast your budget for months in advance

- Ensure you’ll be able to generate enough revenue to sustain your company

Most importantly, it’ll help you be better prepared and organized so you don’t unexpectedly run out of money and become another statistic. Let’s get started.

What is a Startup Budget?

A startup budget is an estimate of how much it’ll cost to start and run your business.

On top of that, your budget should also include where the money will come from to continue to operate your startup.

One of the most important things to keep in mind is that budgets aren’t 100% accurate, and that’s ok.

You’re combining historical data and assumptions to predict how much money your startup will need to spend each month. As you make adjustments and go through a few budgeting cycles, you’ll notice that your budget should start to become more accurate over time.

Related: 5 Types of Budget Models (And How to Choose the Right One)

What Should a Startup Budget Include?

Your startup’s budget should include all the necessary expenses to get your business off the ground and keep it operating month-to-month.

We’ll dive into what those expenses are in the next section, but you probably have a good idea of what they include.

It’s important to categorize these expenses by department. Even if you don’t have dedicated departments right now, this will make it much easier as you grow.

For instance, you should separate marketing software from accounting software rather than only grouping them as “software”.

The other part of your startup budget that a lot of founders overlook, is revenue.

When you hear the word “budget”, most people immediately think about expenses or money going out. However, the money that goes out needs to come from somewhere.

If you don’t account for your revenue (current and future), your budget won’t be as accurate as it could be.

Throughout the year, your revenue will hopefully increase. That additional revenue needs to be factored into your budget.

On the flip side, if your revenue doesn’t grow as expected or even trends downward, your budget needs to be prepared for that too.

Don’t worry, we’ll talk about how to prep your budget for the ups and downs of building a startup. But for now, just keep in mind that a startup budget goes beyond just listing your expense.

How to Create a Startup Budget in 6 Steps

Now that we’ve covered the basics, let’s dive into the fun part.

Here’s how to create a startup budget that will prepare you for any scenario.

Step 1: Choose a Tool to Create Your Startup’s Budget

To start, choose a tool to create your budget. A lot of startups prefer to use a combination of spreadsheets and a dedicated SaaS tool.

Spreadsheets are good for getting all your expenses down on “paper” and ideating. However, at some point you’re going to want to move away from spreadsheets and graduate to a dedicated tool that’ll not only help you list your expenses, but forecast your budget and model different scenarios.

Obviously, I’m going to recommend using Finmark. But not just because it’s our product.

With Finmark, you don’t have to deal with a bunch of manual data entry to enter all your expenses or stress over calculations and formulas.

You can connect your accounting software (e.g. Quickbooks and Xero) and we’ll automatically pull in your expense data and sync it on a regular basis.

On top of that, you’ll be able to plan and forecast what your expenses will be months in advance.

Again, you don’t need to use Finmark, but it will save you hours of work and help you avoid making costly mistakes in your startup’s budget.

You can learn more about how Finmark helps with budgeting here.

Now, on to the next step!

Step 2: Make a List of Your One-Time Expenses

Once you have your tool of choice, the next step is to list your expenses. Start with your one-time expenses.

These are non-recurring expenses like:

- Computers

- Office furniture

- Licenses or fees

- One-off consultations (e.g. consulting with a lawyer)

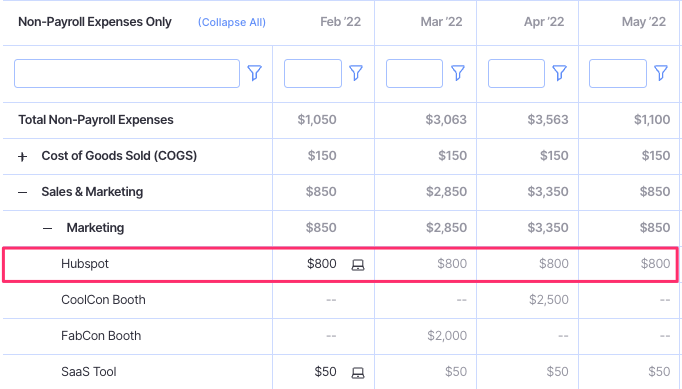

- One-time marketing expenses (e.g. conference booth)

Essentially, anything that you’ll pay for on an ad-hoc basis fits in this category.

Even if it’s something you’ll purchase multiple times throughout the year, as long as it’s not a recurring expense on a set schedule, it’s in this category.

A good example of this would be marketing expenses. If you plan to attend multiple conferences throughout the year, each event will come with its own expense and needs to be included in your budget.

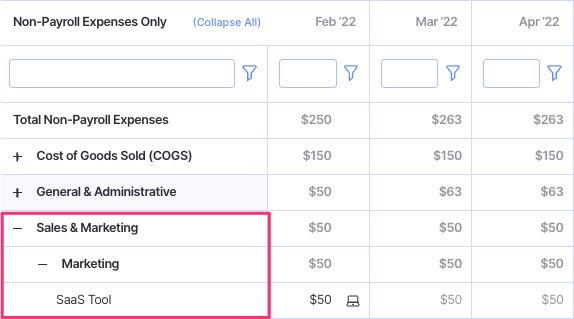

Again, make sure you categorize these expenses by department!

Step 3: Make a List of Your Fixed Costs

Next are your fixed costs. These are the recurring expenses that stay relatively the same month-to-month.

This includes expenses like:

- Rent and utilities

- Payroll and benefits

- Website hosting

- SaaS tools

- Subscriptions

One thing worth noting is that fixed expenses don’t only include things you pay for monthly. You should also include expenses that you pay for quarterly or annually.

For instance, if you have an annual subscription to Hubspot, that’s a fixed expense. Then you’ll spread the cost over 12 months in your budget. So if you pay $9,600 for an annual subscription, you’ll enter that as $800/month over a 12-month period in your startup’s budget.

Since fixed costs are more predictable, they’re easier to forecast. Unless there’s a drastic change to your business, your fixed costs should stay pretty consistent.

Related: How to Build a Budget Forecast From Scratch

Step 4: Make a List of Your Variable Costs

The last type of expense to include in your startup’s budget is variable costs. Just as the name implies, these are expenses that “vary” month-to-month depending on other factors.

Oftentimes, the costs are linked to growth. The more your business grows, the higher your variable costs tend to be, which is one of the biggest differences between variable and fixed costs.

Some examples of variable costs are:

- Cost of Goods Sold (COGS)

- Ad spend

- Certain utilities (e.g. water and electricity)

- Transaction fees

Some software can also go into this category. For instance, some email marketing tools have usage-based pricing. The more your email list grows, the more you pay.

Another common example of this is software that charges per user, like Asana. You may start off paying for 20 users, but if you plan to grow your team to 50+ users, that expense will grow over time.

That needs to be accounted for in your budget.

Forecasting variable expenses for your startup budget can be tricky. It starts by accepting that your budget forecast isn’t going to be 100% accurate. However, the more data you have to justify your assumptions about the future, the better.

Let’s take an expense like Stripe for example. Stripe charges a flat 2.9% plus $0.30 per transaction.

Unless you know exactly how many customers you’re going to acquire over the next 12 months, it’s impossible to accurately forecast this budget.

But if you look at your historical data and see your customer-base grew 10-15% per month over the past two quarters, you can use those numbers to estimate how much you’ll spend on Stripe fees for the next couple of quarters.

Step 5: Forecast Your Revenue

Remember what we said about the importance of accounting for revenue in your startup budget?

Now’s the time.

Where will the money come from to pay for the expenses you outlined in steps 2-4?

We have an entire guide on how to forecast your revenue, which you can check out here: Revenue Forecasting: 4-Step Guide.

The most important thing to keep in mind here is that you need to account for your best and worst case scenarios for how much revenue you’ll generate throughout the year.

Too many startups make the mistake of building their budget based on overly-optimistic revenue forecasts.

Then, when the business doesn’t generate as much revenue as expected, things go downhill really fast and you become part of that 90% failure statistic. All because you didn’t have a contingency plan.

That’s why we always suggest planning for three scenarios for your revenue forecast:

- Base scenario: This scenario assumes average growth

- Upside scenario: This scenario assumes faster growth

- Downside scenario: This scenario assumes slow or even declining growth

As an example, let’s say your startup has grown its revenue 15% month-over-month for the past six months. The revenue assumptions for your three scenarios might look something like this:

- Base scenario: 15% revenue growth

- Upside scenario: 25% revenue growth

- Downside scenario: 12% revenue growth

Keep in mind though, that all your assumptions about your revenue forecast should be based on data, not just what you “hope” will happen.

In the example above, we’d need a plan for how to achieve a 25% revenue growth rate when we’ve historically achieved 15%.

- Are we going to allocate more of our budget to advertising?

- Did we figure out a way to dramatically increase our conversion rate?

- Do we plan to release a new product line or add-on?

As you can see, it’s more than a guessing game. And in that first bullet point, you can see the relationship between your budget and revenue. The levers you pull in your budget can have a direct impact on your revenue.

But the opposite is also true.

Let’s say your upside scenario becomes reality and your revenue grows faster than you expected. Your budget should change to reflect the new capital you have to work with.

If you made your original budget assuming you’d be generating $100K in monthly recurring revenue (MRR), what happens when you generate $125K MRR instead?

The smart answer is to use the additional revenue to accelerate growth even more. By planning for that increase in your budget, you’ll know exactly what to do if and when it happens.

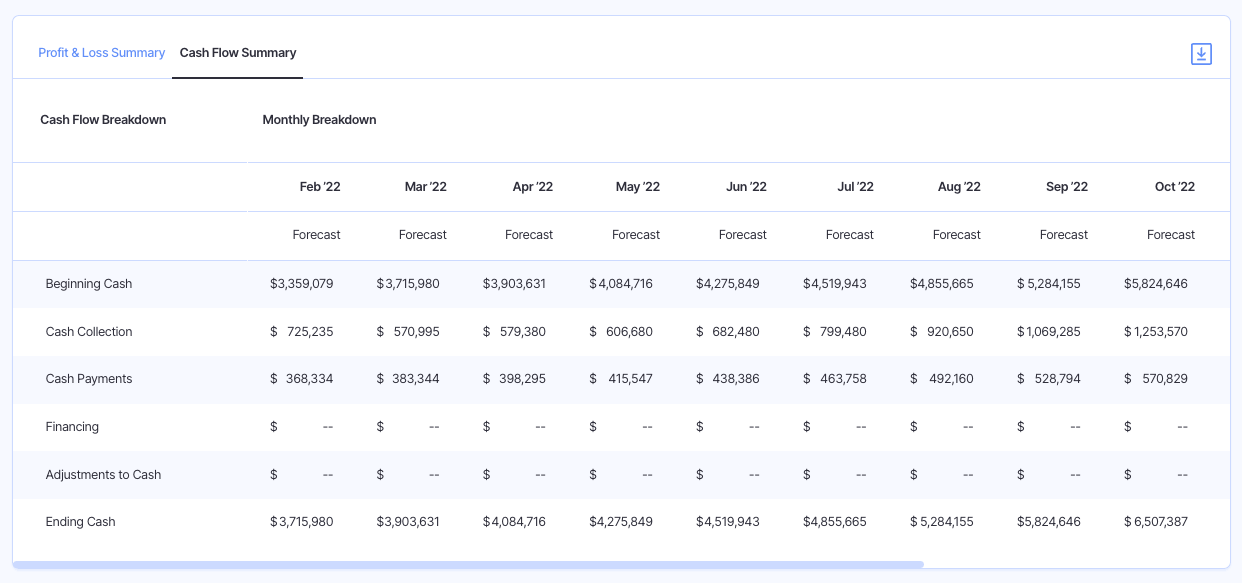

Step 6: Create a Cash Flow Projection

Now that you have your revenue and expenses, the final step is to create a cash flow projection.

A cash flow projection is simply a forecast of how much money will move in and out of your startup each month.

Calculating your cash flow is pretty simple:

- Find your opening balance: How much money does your startup have in the bank at the beginning of the month?

- Calculate your receivables (revenue): How much money is your startup going to receive this month?

- Calculate your payables (expense): How much money is your startup going to pay out this month?

- Use the cash flow formula: Receivables – Payables

- Add your opening balance: Add your opening balance to the number you calculated in step #4 to find your closing balance for the month

Note: If you use a financial planning tool like Finmark, all of this is done for you and made into a chart that looks much better than a spreadsheet. Just sayin…

Cash flow projections are a good way to make sure your business is financially viable.

If your projection shows that your cash flow will be on a decline for a long time with no signs of turning around, you can analyze the numbers to understand why.

This is typically because you’re not generating enough new revenue or your expenses are too high. In either case, you’ll have some important decisions to make.

On top of that, if you plan to fundraise, investors will expect to see your cash flow projections, so budgeting is a great time to put it together.

Related: How to Create a Cash Flow Projection: A Guide for Founders

Free Startup Budget Template

While I highly recommend using Finmark to create your startup budget, I also realize that you may not be at the point where you’re ready for that step (we do have very affordable plans though 😉).

So we created a simple startup budget template that’s particularly helpful for companies that are starting from scratch.

You can download it here: Startup Budget Template

FAQ

There are a lot of questions around startup budgets, so we did a quick search to find some of the most commonly asked questions on the topic. Check out the answers below.

What is a good marketing budget for a startup?

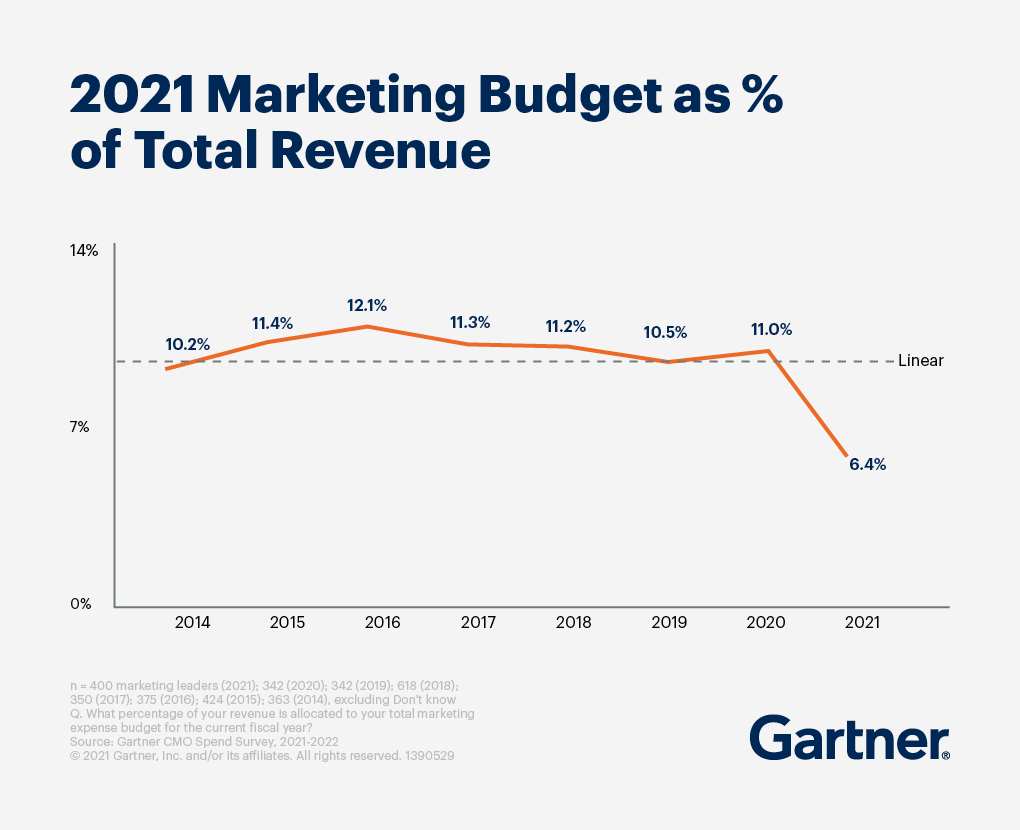

The average startup spends 10%-13% of total revenue on marketing.

However, the amount you spend will depend on the stage of your startup.

If you’re just starting out, it’s best to be as scrappy as possible and explore low-cost or free marketing channels like SEO and social media. More established startups on the other hand have the flexibility to spend more.

How much should I budget for legal expenses in a startup?

Depending on the type of business you have, you can expect to spend anywhere from a few hundred dollars to thousands. It largely depends on what type of services you need, but some common legal expenses for startups include:

- Business formation

- Fundraising

- Terms of use

- Mergers

The good thing about legal expenses is you can get an estimate of how much the services you need will cost beforehand, which you can then add into your startup budget.

How much should startups budget for R&D?

In our Fundraising 101 webinar, our CEO, Rami Essaid, recommended that early stage startups trying to find product-market fit should spend anywhere from 70-80% of their budget on R&D.

In the early days, your goal is to make sure:

- You’re building something that people need

- You’re building the right for their problem

Once you’ve established product-market fit, you can shift your budget towards other departments like marketing and sales. But unless you’ve proven that your product has a need, the other stuff is less important.

Investing in marketing for a bad product is like trying to work out to compensate for a poor diet.

What tool should I use to create a startup budget?

We recommend Finmark. However, if you’re at the very beginning stages and just ideating, you can use a spreadsheet as a base until you’re ready for something more advanced.

What accounting method should I use for a startup budget?

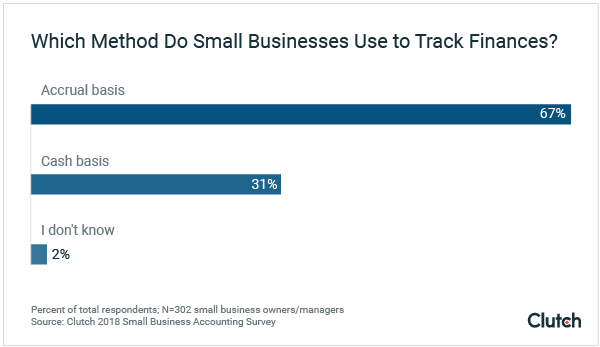

Sixty-seven percent of small businesses use accrual-based accounting to track their finances.

Ready to Create Your Startup Budget?

Creating a startup budget might seem intimidating or daunting at first. However, I hope this guide showed you it’s a lot easier than most people realize, especially with all the tools available to founders.

If you’re interested in using Finmark to create, manage, and forecast your budget, you can sign up for a free trial here.

It’ll save you time and tons of headaches, trust me.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.