Budget Variance Analysis: A Step-by-Step Guide

Your business’s budget is a guideline for planning expenses and reaching revenue goals. However, while having a budget can help you plan your business activities, it doesn’t necessarily show how the company is performing.

So how can you ensure you’re not drifting too far off course? By performing a budget variance analysis.

Comparing and analyzing variances in your budget vs. actual performance can provide valuable insight into where your money is going and help you make informed spending decisions.

In this blog, we’ll discuss what a budget variance analysis is, why it’s essential, and how to conduct one. We’ll also cover common mistakes made during the process so you can ensure your analyses are accurate.

What is Budget Variance Analysis?

A budget variance analysis compares your company’s actual financial performance against its budgeted or expected performance.

Some common types of variances you may analyze include revenue variances, cost variances, and volume variances.

- Revenue variances occur when actual revenues are different from budgeted revenues.

- Cost variances occur when actual costs are different from budgeted costs.

- Volume variances occur due to differences in production volumes or usage rates.

These analyses help you determine how well the company meets its financial goals, make more informed decisions about further investments, and take corrective action when necessary.

Businesses can conduct variance analysis at different levels, such as departmental or divisional levels. The level of analysis depends on your size and structure.

For example, a small business may only need to analyze overall variances. On the other hand, a large organization may need to analyze variances by division or department.

Favorable vs. Unfavorable Budget Variances

When performing a budget variance analysis, it’s important to note whether the variance is favorable or unfavorable.

A favorable variance occurs when actual performance exceeds budgeted performance in a way that benefits the company.

For example, if your revenue exceeded expectations, you have a favorable revenue variance. You can use this extra revenue to invest in the company, pay off debt, pay dividends to shareholders, or save it for a rainy day.

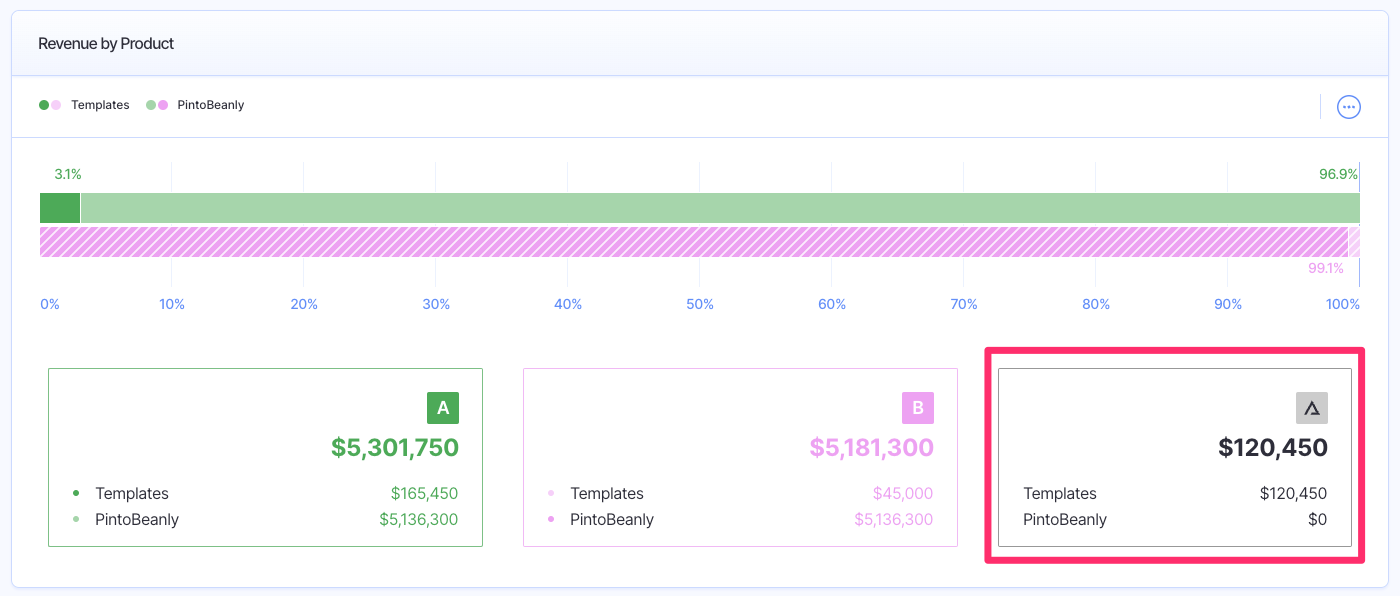

This is a favorable budget variance, where actual revenue (green) is higher than the budgeted figure (pink), giving us a variance of $120,450, as noted in the highlighted box

An unfavorable variance occurs when actual performance falls short of budgeted performance in a way that is detrimental to the company.

For instance, if your variable manufacturing costs are higher than expected without a corresponding increase in revenue, you have an unfavorable cost variance. This additional expense can eat into profits and hinder growth.

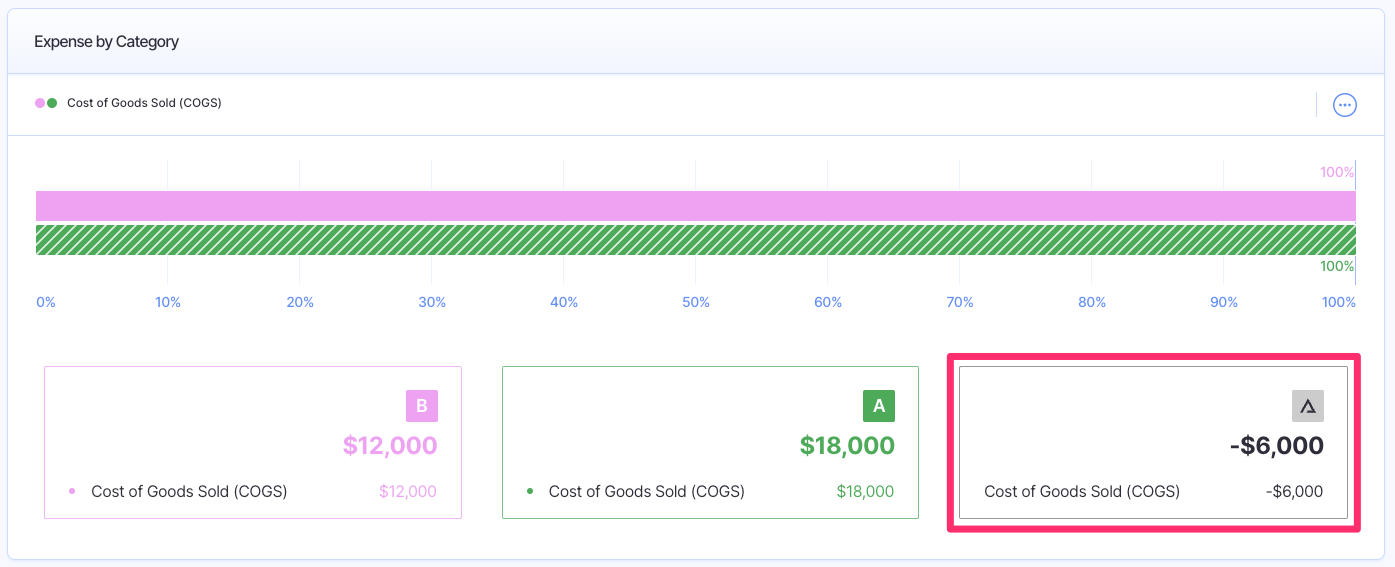

This is an unfavorable budget variance, where actual cost of goods sold (green) is higher than the budgeted figure (pink), giving us a variance of $6,000, as noted in the highlighted box

When analyzing budget variances, it’s crucial to identify both favorable and unfavorable variances and determine the cause behind them.

While favorable variances may seem like a good thing, they could result from an ineffective budgeting process or an error in the underlying data.

Similarly, while unfavorable variances may be concerning, they can also reveal areas where the company needs to make changes.

Why Is Budget Variance Analysis Important to Your Business?

Variance analysis is essential to running a successful business because it helps business owners and leaders understand why there are differences between budgeted and actual performance.

It can help reveal whether your company is making financial decisions that don’t align with its budget, which can lead to corrective action and increased profits.

The purpose of a budget variance analysis isn’t simply to identify variances, but to understand the root cause of those variances.

Ideally, performing a budget to actual variance analysis will provoke questions such as:

- Why did one division, product, or service line perform better than (or worse than) others?

- Why are overhead expenses higher than last year?

- Are variances caused by poor budgeting practices, changing market conditions, new competitors entering the market, unexpected events, etc.?

How to Perform a Budget Variance Analysis

Performing a budget variance analysis can be a complex and lengthy process, but it’s critical to ensure your business’s financial performance is in line with its goals.

Here is a step-by-step guide to help you conduct a thorough budget variance analysis.

Step 1: Gather Data

The first step in performing a budget variance analysis is gathering data.

You will need both the budgeted and actual financial data for the period you are analyzing.

You may find the information you need in financial statements, invoices, receipts, sales reports, production reports, labor cost breakdowns, and other relevant documents.

If you use accounting software, this process is usually much easier, as all of your transactions are recorded and categorized in the software.

Check the reports section for a budget vs. actual report. You may even be able to export it to a spreadsheet for further analysis.

Pro tip: See how to easily compare budget versus actuals in Finmark!

Step 2: Identify Variances

Once you have your financial data, the next step is to identify the variances by comparing the actual figures against the budgeted figures.

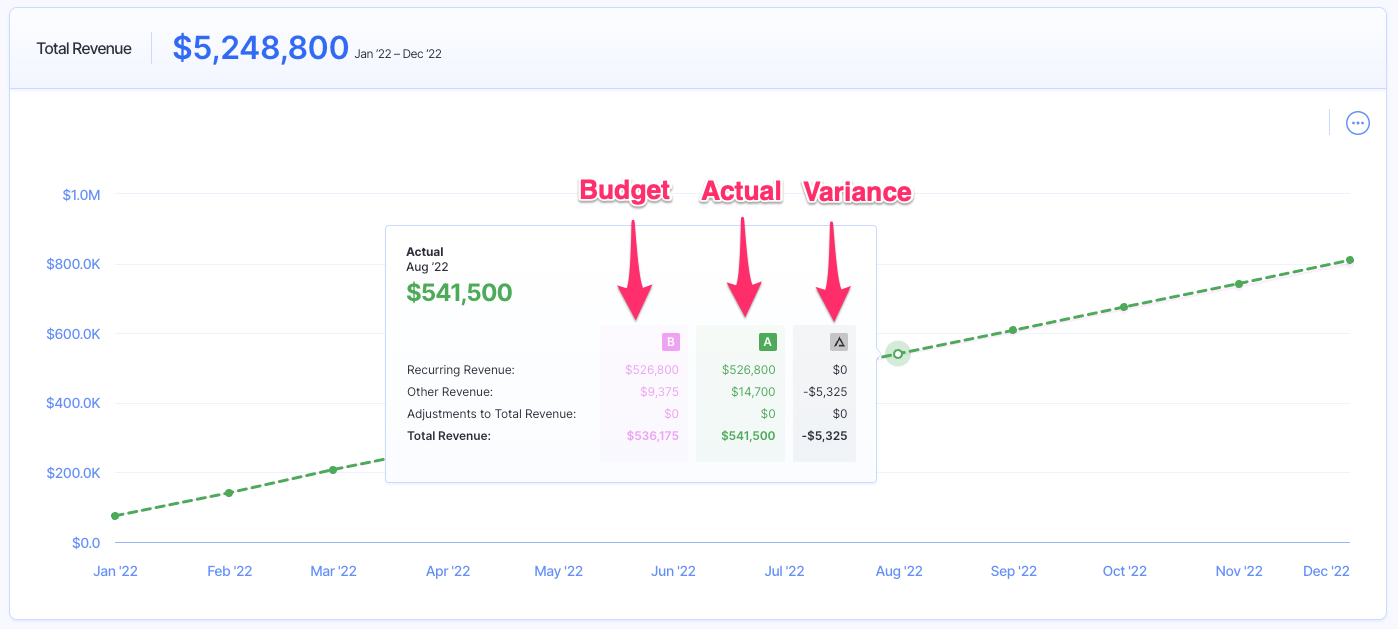

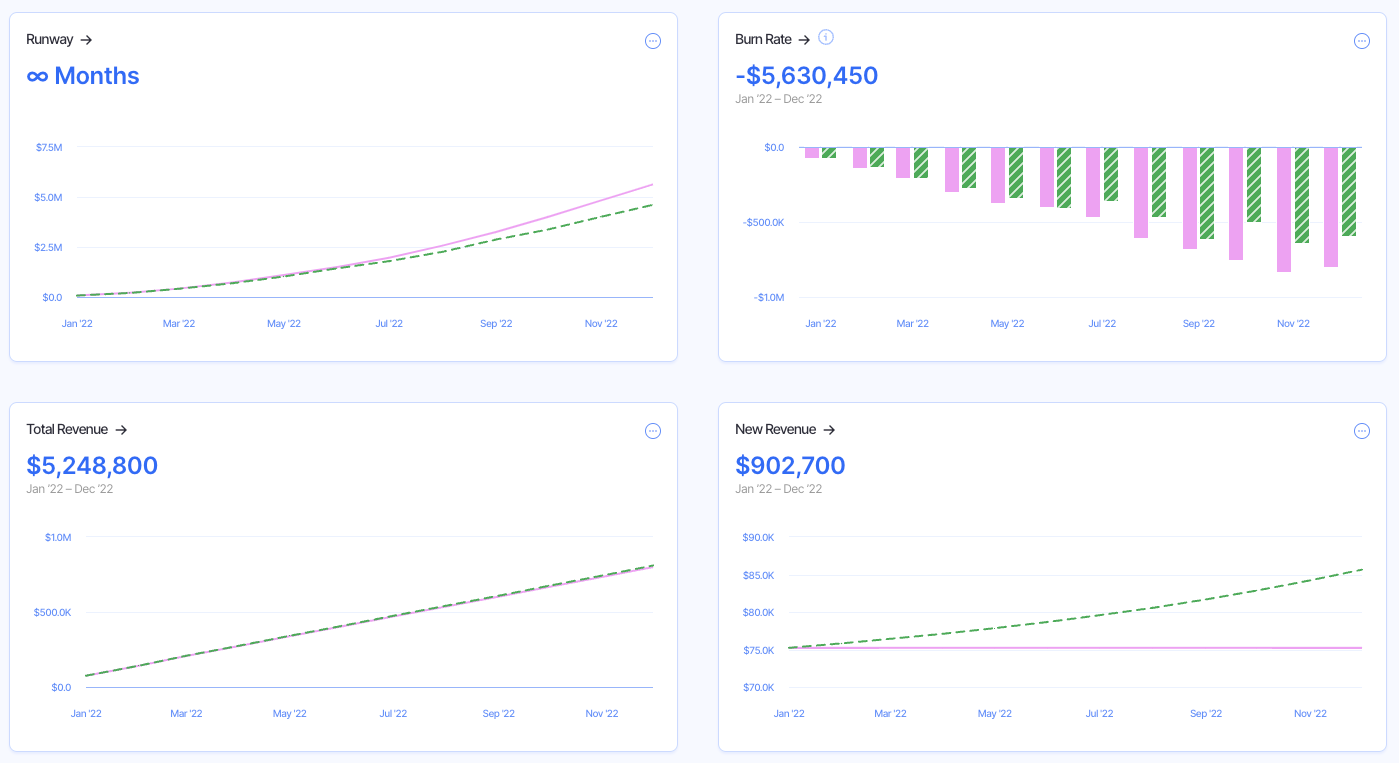

Some accounting and FP&A software allow you to run a budget-to-actual report. For instance, Finmark From BILL allows you to quickly compare budget vs actuals with easy-to-read tables and graphs!

Example of a dashboard in Finmark comparing budget versus actuals across multiple metrics

If you don’t have this option, you can use a spreadsheet. Simply enter all actual amounts in one column, budgeted amounts in another, and subtract the budgeted amount from the actual amount to get the variance.

Step 3: Analyze the Variances

Next, analyze the data to identify significant differences between budgeted and actual figures.

This analysis should go beyond a simple comparison of numbers and look for underlying causes.

For instance, if revenue falls short by a significant amount, it’s crucial to determine whether it was due to a decrease in sales volume, a price decrease, or a combination of both.

Ask questions such as, “Why did this variance occur?” and “What factors contributed to the variance?”

These questions will help you understand why there was a discrepancy between the budgeted and actual amounts.

Some variances may be minor, but others may be significant and require further investigation.

The definition of a “significant variance” varies from company to company. It generally means a variance big enough that the person responsible for the revenue or expense should reasonably be expected to know the reason for the variance.

In a very small business, a $100 variance might be significant. In contrast, in a Fortune 500 company, variances may be tens of thousands of dollars without reaching a level that requires a detailed investigation.

Involve relevant stakeholders, including department heads, finance staff, and operational staff, in the analysis and root cause identification process.

These individuals often have market research, competitor analysis, or operational assessments that can help you understand the external and internal factors contributing to the variance. They may have valuable insights or knowledge of factors that aren’t immediately apparent from the raw data.

Step 4: Take Corrective Action

Based on your analysis, determine whether you need to take corrective actions to improve financial performance.

This may include reducing costs, improving operational efficiency, or shutting down unprofitable product or service lines.

Step 5: Monitor and Review Progress

Finally, monitor and review progress regularly to ensure your corrective actions produce the desired results.

Periodically re-conducting the budget variance analysis can help you track progress and adjust your strategies.

Common Variance Analysis Mistakes

While budget variance analysis can be a valuable tool for managing financial performance, several common mistakes can undermine the accuracy and effectiveness of the analysis.

Here are some of the most common mistakes to avoid.

1. Failing to Account for Changes in Business Conditions

Variance analysis assumes that the budgeting assumptions made at the beginning of the period are still valid at the end of the period.

However, business conditions can change rapidly, and outdated assumptions can quickly lead to inaccurate variances. It’s important to keep track of changes in the market, the competition, and customer demand and adjust budgets accordingly.

2. Overemphasizing Minor Variances

It’s easy to get caught up in minor variances and lose sight of the big picture. While it’s important to identify all variances, not all variances are created equal.

Focusing too much on small variances can waste valuable time and resources that could be better spent on addressing more significant issues.

3. Confusing Correlation With Causation

Just because two events happen simultaneously doesn’t mean one caused the other. Seek out the true root causes of variances—don’t just assume they are related.

4. Ignoring the Impact of Timing

Budget variances can also arise from timing differences between when expenses are incurred and when they are reported.

For example, if a cash-basis company buys supplies in December but doesn’t pay for them until January, it will record the expense in the following period. This can create misleading variances that skew the analysis.

Make Budget Variance Analysis Easy with the Right Tools

Budget variance analysis is essential for businesses of all sizes to monitor financial performance and help achieve financial goals.

Taking the time to identify both favorable and unfavorable variances, uncovering root causes, and taking corrective action can go a long way in helping your business reach its full potential.

Finmark makes it easy to perform a budget vs. actual variance analysis without complicated and error-prone spreadsheets. See it yourself by signing up for a free trial!

Our team of experts will show you how easy it is to perform a budget variance analysis accurately so that you can stay on top of your finances and maximize profits.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.