Budget vs Actuals: How to Find & Analyze Variances

Creating an operating budget for your business is a great financial planning tool. However, you can derive much more value from it when comparing it against your actual performance once the period is complete.

No matter how comprehensive or complete you think your budgeting is, any founder knows that things don’t always go according to plan. So, being able to analyze the variance between your budget and actual performance can tell you a lot about your business.

Throughout this guide, we’ll walk you through how you can assess the variances between your budget vs actuals, and help you determine what it means when the two values don’t line up.

What is the Difference Between Budget vs Actuals?

Your budget includes the financial metrics that your company expects to hit throughout a given period of time–like a year, month, or quarter.

You can think of your budget as the target that your company plans on hitting.

This can include values like your total revenue, expenses, cash flow, cash runway, and any other metrics that you track in your financial model.

In comparison, your actuals are the real metrics that your company has hit throughout the given period. It’s the reality of how your company has performed–not what you’re forecasted or hoping to hit.

Unlike your budget or forecasts, you cannot plan your actuals before they happen. You can only analyze them once you have the data from the completed time period.

To sum it up, your budget represents the figures you expect to hit, and the actuals reflect the performance of your company in reality.

Why Tracking Your Budget and Actuals is Important

When you have a budget, you have a plan and know where your company wants to go. As a result, you can take the necessary steps to attempt to hit those targets.

If you notice that your company is not on track to reach your budgeted values based on current performance, you can dig deeper into your financials to see where you can make tweaks or changes to get back on target.

For instance, if you’re budgeting a cash runway of 24 months by the end of the year, but your cash runway is sitting at 18 months at the end of Q2, you’ll need to strategize how to get these values more aligned before the year is over.

Such strategies can include:

- Lowering your burn rate to extend your cash runway

- Reducing customer churn by improving the customer experience

- Increasing new monthly recurring revenue (MRR) by acquiring more customers each month

- Reducing your customer acquisition cost (CAC)

- Improving your current conversion rate from site visitors to leads, and leads to customers

So when the period is over and it comes time to compare your budget vs actuals, you’ll be able to see what worked operationally, and where you could make improvements going forward.

How Do You Compare Budget vs Actuals?

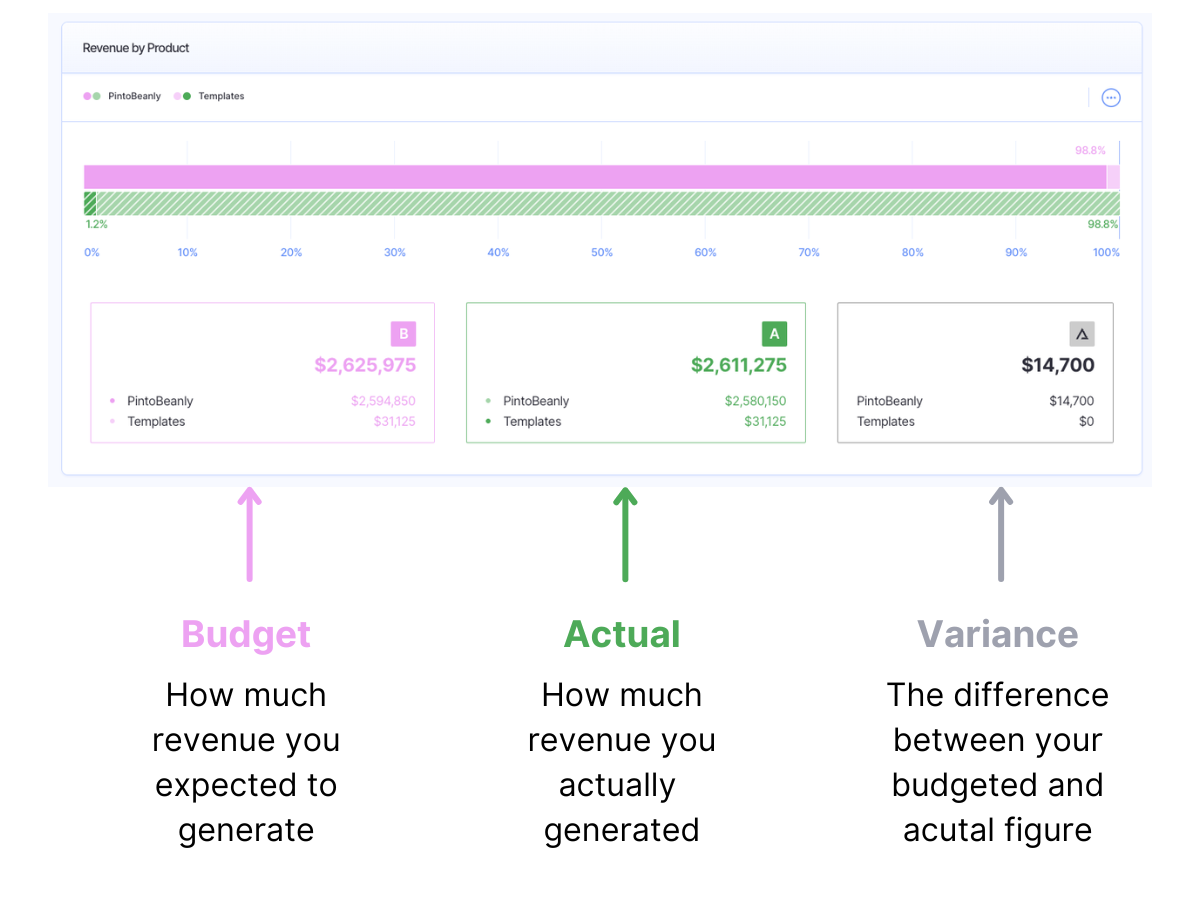

Comparing your budget and actuals is called a budget to actual variance analysis.

Not only does this give you a way to look at how your actual performance compares to your expectations, but it can help you dive deeper to understand the reasons behind the variance.

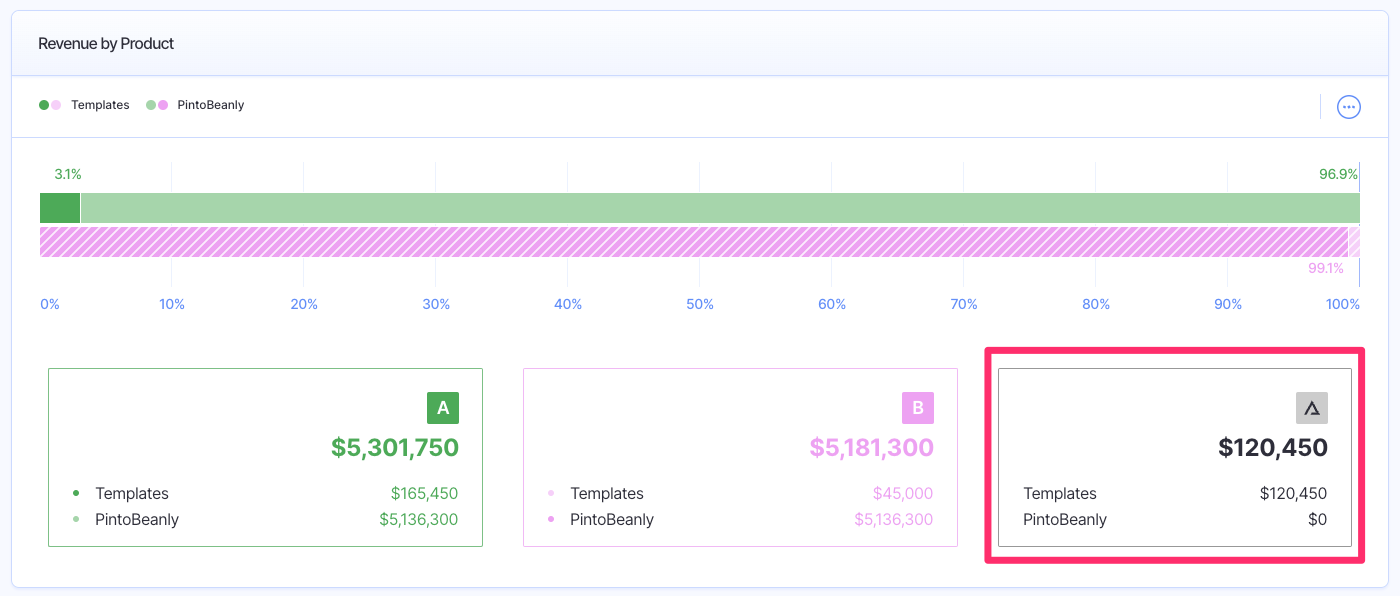

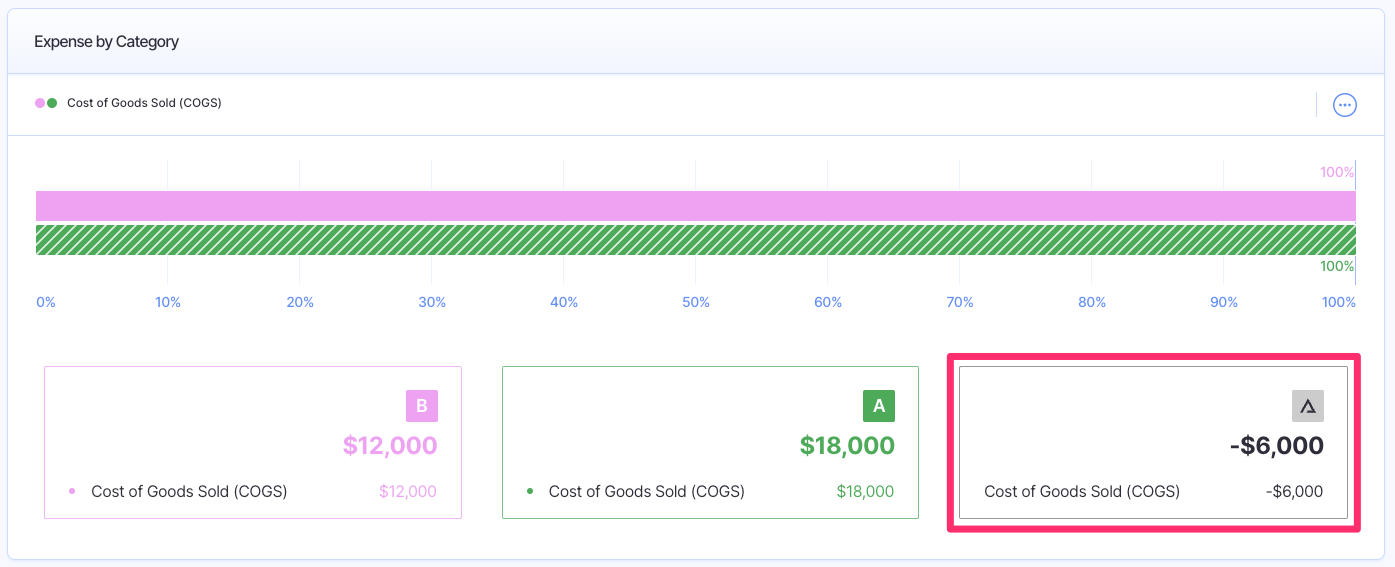

To get started with your variance analysis, you can begin by analyzing one of the two main categories: revenue variances or expense variances.

In other words, you’ll take a look at how your budgeted sales differed from your actual sales performance, and how much your budgeted expenses differed from your actual incurred costs.

Seeing that your total actual revenue or costs differed from the budgeted values is important, though you can really gather important insights for your business by digging into these variances even further.

Here are some of the specific revenue metrics you can compare for further insight:

- Sales price: if the product/service sells at a higher or lower price than projected

- Sales volume: if fewer or more units of the product/service is sold than expected

These are some expense categories you can explore on a more granular level:

- Variable overhead: if costs like utilities and raw materials were greater or less than anticipated

- Fixed overhead: how much predictable costs like salaries or rent payments varied from expectations, though this should be minimal

- Labor rate: if direct labor costs were greater or less than expected, like due to an increase in overtime work

- Administrative overhead: if costs like advertising and sales came in lower or higher than budgeted

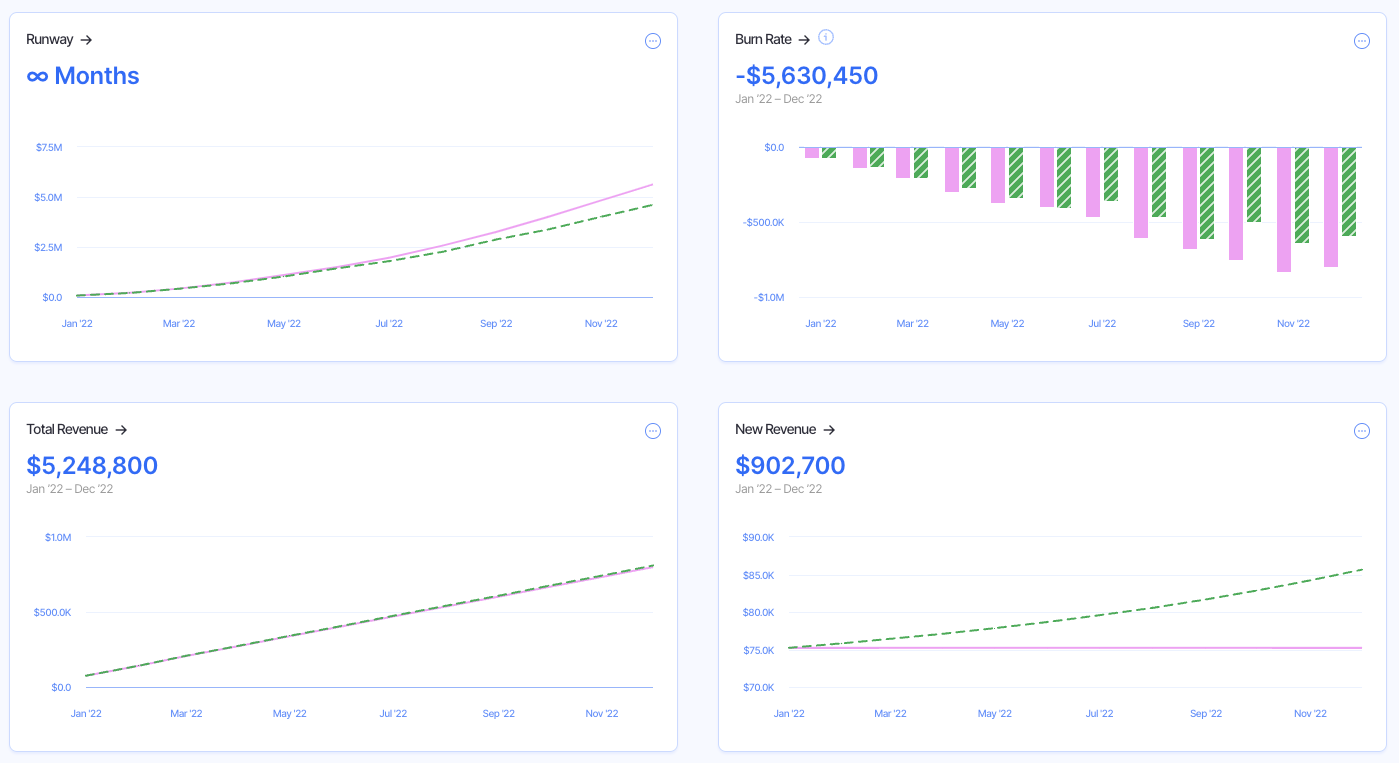

With Finmark from BILL, you can easily perform variance analysis and create data visualizations for the metrics listed above and others. This can help you assess your performance and get to the bottom of any possible variances you discover in revenues and expenses.

Some companies may rely on spreadsheets and pre-made templates to compare budget vs actual performance, though these don’t tend to be scalable, becoming overly complicated and difficult to manage the larger your business grows.

So, the power and functionality of Finmark make it a much more efficient and comprehensive tool for your business to perform budget variance analysis, which you can easily share with your team, investors, or other stakeholders.

What Does Your Budget vs Actual Variance Mean?

Throughout this analysis process, you may discover two different types of variances:

- A favorable variance means your actuals are better than your budget numbers

- A negative variance means your actuals are worse than your budget numbers

It’s important to note that ‘favorable’ doesn’t always mean the actuals were higher than budgeted, and ‘negative’ doesn’t necessarily mean the actuals were lower than expected.

In the case of your CAC, a lower value is actually a more favorable outcome for your business, which means that you had to spend less on marketing and sales efforts to bring in a new customer than you expected.

So, you’d be happy to see that your actual CAC for the quarter was $660 compared to the $1000 that was budgeted.

Keep in mind that there are many reasons why budget variances can occur, including both internal and external forces like changing consumer demand driving sales volume lower, or human error that caused projections to be miscalculated initially.

How to Analyze Your Budget vs Actual Variance

Once you analyze your budget vs actual performance, you’ll have a better idea of what your variance looks like for each metric.

While it’s normal to have a little bit of variance for each budgeted figure, getting a negative variance that’s significant or consistent is a sign that something needs to change within your business.

We will now go over some of the steps you can take to gain a clearer understanding of any budget vs actual variances you come across in your financials.

1. Find the Source of a Negative Variance

There are a lot of moving parts at play when you’re running a business. So, a negative variance between your budget and actuals can be caused by a number of factors.

Let’s say your actual expenses were higher than what you had budgeted for, causing a negative variance.

Looking at the total expenses will tell you how large this variance is, but you’ll need to dive deeper into each expense category to see what’s actually driving this variance.

Some of the potential culprits could be:

- Your CAC was higher than expected

- Customer service costs were more expensive than what was planned

- Other expenses arose during the period that were higher than initially expected

In a different scenario, you may find that your cash runway ended up significantly shorter than you had expected, meaning you could ask yourself some of the following questions:

- What does your burn rate look like, and why?

- Has customer churn increased while New MRR decreased?

- Have you started spending too much on an unprofitable ad campaign?

Again, seeing an actual vs budget variance at the end of the period is normal, and you’ll likely never see your budget and actuals lining up 100%.

But, when a variance is extreme, you’ll need to dig deeper into the “why” behind it.

2. Analyze What Occurred at the Source

After you’ve discovered some of the reasons that could have caused the budget vs actual variance, you can now seek out the “why”.

For example, if you realized your expense actuals were higher than what was budgeted for the period, and this was driven by higher customer service costs, you’ll need to find the potential source so you can prevent it from occurring again in future periods.

Some potential reasons for higher customer service costs could include:

- A lack of established procedures for customer service reps to work more efficiently

- Not enough resources for customers to troubleshoot issues on their own (blog posts, video guides, etc.)

- Too many customer service reps handling too few customer issues

On the other hand, you may have found that your expense variance was caused by a higher-than-expected CAC. In diving into this further, you could discover a number of reasons that caused this, including:

- Your conversion rate for paid ads was lower during the period, leading to higher ad spend than projected

- Seasonal fluctuations on a new product you’re selling caused sales volumes to be temporarily lower

- High competition in the marketplace is making it more expensive to acquire new customers

Depending on what you pinpoint the issue to be for a given actual vs budget variance, you’ll have different courses of action you can take to get back on track.

3. Make a Game Plan to Fix the Variance

Once you understand where the variance came from and what happened to cause the issue, you’ll have the information you need to create a plan of action.

Considering the previous example of higher customer service costs. Let’s say the problem was due to a lack of educational resources to help customers troubleshoot issues on their own.

There are a number of ways you could work on fixing this issue, like creating more in-depth documentation for your customers to access when they have product-related questions.

With these helpful resources easily available, customers will be less likely to get stuck and rely on your customer service team for help, or worse–end up churning.

Now let’s consider the second example where the higher expenses for the period were driven by a higher CAC. After further investigations, let’s assume this was caused by an ineffective ad campaign that wasn’t targeting the right audience.

By improving the targeting on the ad and maybe even re-assessing the channels your team is using to run those campaigns, you can make your marketing efforts more efficient and help bring down the CAC.

4. Keep Improving Your Forecasting

You may find it difficult to create a budget for your business during the earlier days when you don’t have a ton of data to work from.

But, as your business grows, you’ll have more data to develop your forecasts which can help your budget become more accurate.

The more you’re able to compare your budget vs actuals, you’ll only get better at accurately forecasting your metrics and creating a more realistic budget.

With every new budget you create, keep the past variances in mind so you can make better forecasts every time.

Use Finmark to Stay on Top of Your Budget vs Actuals

Becoming more efficient and profitable won’t just happen for your business by accident. By staying diligent with your planning and keeping track of how your actual figures compare to your budget, you can narrow in what’s working for your business, and discover what areas need improvement.

Finmark makes it easy to compare your budget and actuals right from your dashboard, with helpful chart visualizations and flexible configurations so you can get to the bottom of any budget variance in no time.

Try Finmark today by signing up for a free trial to see the difference for yourself and ditch those complicated spreadsheets.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.