A Simple Guide to Budget Variance

You’ve been working hard to make sure you’re managing your startup’s finances well.

You put together a budget allocation based on your financial projections, and you’ve built department-specific cost analyses to build budgets for marketing, sales, operations, and so forth.

But now, you’re two quarters deep into the financial period, and your actuals don’t match the budget you worked so hard on six months back.

What gives? Have you adopted an unsuitable budget model? Was your revenue forecast off? Or have your expenses just been a whole lot higher than anticipated?

All of these are potential reasons for what is known as budget variance; a discrepancy between the budget you put together and the actual amount spent.

In this article, we’re going to explore the finer details of budget variance.

We’ll give you an overview of what exactly it is, discuss a couple of different kinds of budget variances (and why they exist), plus show you how to spot a budget variance and what to do about it.

What Is a Budget Variance?

A budget variance is, quite simply, a difference between a budgeted figure and an actual figure.

For example, imagine you’ve budgeted $50,000 for new website updates this year, so $12,500 per quarter.

At the end of quarter two, your website expenses total $30,000, meaning you have a budget variance of $5,000 (that is, your actual costs were $5,000 more than you budgeted for).

Budget variance applies to both revenue and expenses (though it’s more commonly used to refer to expense variances), and is actually more common than you may think.

Some types of expenses are tough to calculate exactly, especially if you’re a relatively new company.

For example, startup costs like equipment and supplies are fairly easy to determine, as are fixed costs such as rent and insurance.

Variable costs (things like utilities and advertising) are by nature less predictable, and so as companies scale it becomes more and more likely that you’ll experience budget variances.

Variances can be described as negative or positive depending on the direction of the discrepancy.

Negative Variance

A negative variance is when you’ve spent more than anticipated.

For example, you budget $20,000 for advertising fees, but your annual total ends up amounting to $24,000.

Positive Variance

A positive variance, on the other hand, is just the opposite: your company spent less than expected.

For example, you budget $3,000 a month for utilities, but your average bills total $2,500.

Budget Variance Examples

Budget variances occur for a variety of reasons, across a number of expenses and departments.

A few common examples include:

- Rent – Your annual rent cost totaled $160,000 against a budget of $130,000, due to a mid-year lease renewal and an associated rent increase.

- Revenue – Your company originally forecasted annual revenue of $2.5m, but due to an unexpected development of a new revenue stream, actual revenue for the year totaled $3.2m.

- Operations – You originally calculated a total operations expense budget of $800,000, but the total operations cost came to $950,000, due to a new government introducing an increased carbon tax scheme.

What Causes Budget Variances?

As we’ve already discussed, budget variances happen for a number of reasons.

Common causes startup founders come across include:

- Inaccurate expectations – This is probably the most common reason. Some expenses are difficult to forecast, especially if you don’t have historical data to call on.

- Accounting errors – Inaccurate measurement of costs is a common reason, especially if you’re managing your financials using outdated tech (ahem, spreadsheets, ahem).

- Economic conditions – External factors such as market demand, increased labor costs, and tax laws can change throughout the year and have a major impact on budget variance.

- Operational changes – Adjustments to internal processes, product development initiatives, and employee hiring are common and can heavily impact both revenue and expenses.

Why Should Founders Be Concerned About Budget Variance?

If budget variances are so common, why should anyone even be so concerned about them?

The main reason founders should be concerned about budget variance is so they can adjust spending and budgetary planning to reflect the actual situation.

To illustrate, imagine you’ve budgeted $1,000 a month for office expenses. In reality, you’re actually spending closer to $2,000.

If you don’t have a procedure in place to identify variances (and rectify them), then at the end of the financial year, you’ll be $12,000 in the hole.

If, however, you have a quarterly budget variance reporting cadence, you’ll determine after the third month that you’ve spent an additional $3,000 on office expenses so far.

Then, you can take appropriate action to rectify the variance (whether it be to seek out alternative supplies, work on boosting revenue to manage the increased expense, or simply adjust your expense budget).

The same goes for positive variances.

If you identify that, in fact, you’re only spending $500 a month on office expenses, then you have an extra $6,000 for the year to play with. You can then choose to redirect this budget into other areas that drive revenue like ads or content marketing.

How to Spot a Budget Variance

Though there are a number of things startup founders can do to avoid budget variances (like using financial modeling software to track and forecast revenue and expenses), budget variances of some form are inevitable.

Estimates change, economic conditions fluctuate, and costs go up (and on occasion, if you’re lucky, down).

So, the first thing you need to know is that in the accounting realm, a difference of 10% or more is usually considered the cut-off point for where a budget variance becomes a problem.

For example, if you budget $10,000 a month for a certain admin expense, and it comes to $10,600, most financial experts wouldn’t be concerned. If the expense totals say, $11,200 however, then you have a budget variance that needs attention.

Of course, there are no hard and fast rules here, so you can set your variance threshold however you like (as low as 5%, for example, if you’re monitoring the budget extremely tightly).

So, how do you spot budget variances?

Well, you need to set up some kind of system to track your revenue and expenses, and then agree on a regular cadence for assessing actual figures against your budget.

Do yourself a favor here, and avoid the old-school approach (spreadsheets).

They’re a surefire way to create budget variances as a result of inaccurate financial accounting.

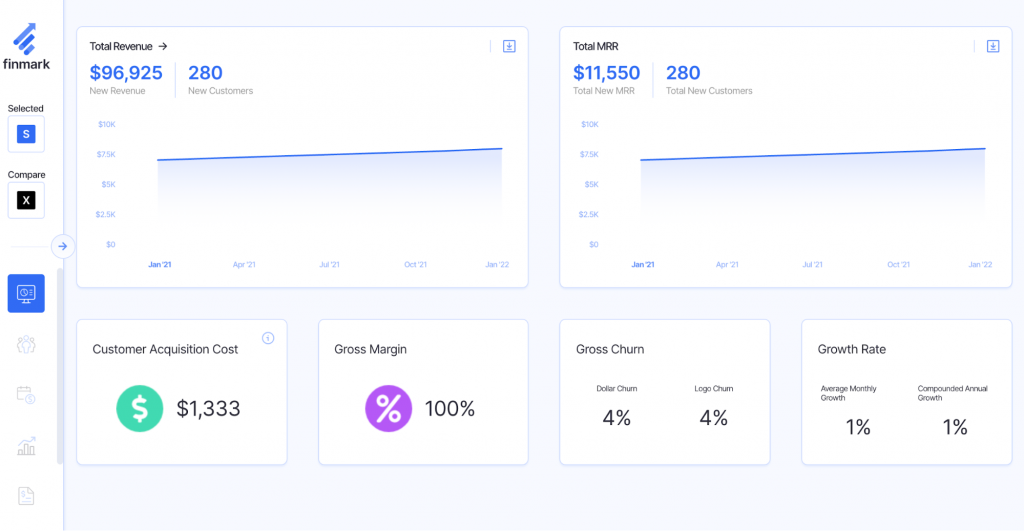

Instead, use a financial reporting platform like Finmark (hey, that’s us!). Dedicated software platforms such as these are much more dynamic, offer advanced reporting and projection capabilities, and allow you to visualize multiple financial scenarios with ease.

So what do you do when you actually do spot a variance?

What to Do When You Identify a Budget Variance

Acting on a budget variance process is a two-step process:

- Determining what led you to the budget variance. Why did it happen? How can you avoid it in the future?

- Deciding on what to do about the variance right now.

The first step (understanding why the variance occurred) often informs the second decision.

For example, if you’ve identified that the reason for the variance is an accounting error, then your action will simply be to rectify the error (and put a procedure in place for avoiding it in the future).

If, however, the variance occurred because an expense increased unexpectedly, then you’ll likely need to reallocate budget from somewhere else.

Your options for tackling budget variances include:

- Increasing or decreasing the budget overall (if the variance is across the board)

- Rerouting budget from one expense to another (if you have a positive variance in one place and a negative variance in another)

- Making strong moves to improve revenue to cater to the increased expense

- Assessing how you can reduce the cost of the expense (looking for new suppliers, for example)

How Often Should You Perform an Analysis of Budget Variance?

Quarterly is probably appropriate for most businesses, though very early-stage startups might wish to bump this up to a monthly analysis.

It’s worth bearing in mind, however, that a period of a single month might not be appropriate to assess how accurate your budget estimations have been.

For example, imagine you’ve budgeted $2,000 a month for an administration expense, and at the end of month one, that expense totaled $2,500.

That’s a 25% negative variance, which is something to be concerned about, but it’s only the first month, and that expense may fluctuate somewhat and average out closer to $2000 a month across the period of a year.

So, if you choose to report on variances regularly, be sure to carefully analyze what might be causing the variance before acting on it.

You don’t just want to know that there is a variance, but why it exists in the first place.

Find & Analyze Budget Variances

Budget variances are a common feature in financial reporting, occurring when actual revenue or expenses are higher or lower than your budgeted figures.

As you’ve seen here, variances can be incredibly problematic for startups, especially those with limited cash flow or without the ability to grow new revenue quickly.

Book a demo with the Finmark team today, and find out how our intuitive financial modeling software can help you monitor variances and reallocate spending appropriately.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.