Cost of Goods Sold (COGS)

You have to spend money to make money.

That’s what cost of goods sold (COGS) is all about. Whether you’re a manufacturer, online retailer, brick and mortar shop, or even a software company, there are certain expenses involved with producing your goods and services.

In this article, we’re going to break down everything you need to know about COGS.

What is Cost of Goods Sold?

Cost of Goods Sold (COGS) refers to the direct costs associated with producing your product or service.

The expenses that go under the COGS category depend on the type of business you have.

For instance, if you manufacture watches, your COGS would include all the parts that go into creating the watches.

If you’re a watch retailer (meaning you buy watches and resell them) your COGS would include the amount you spend to buy each watch you’re selling.

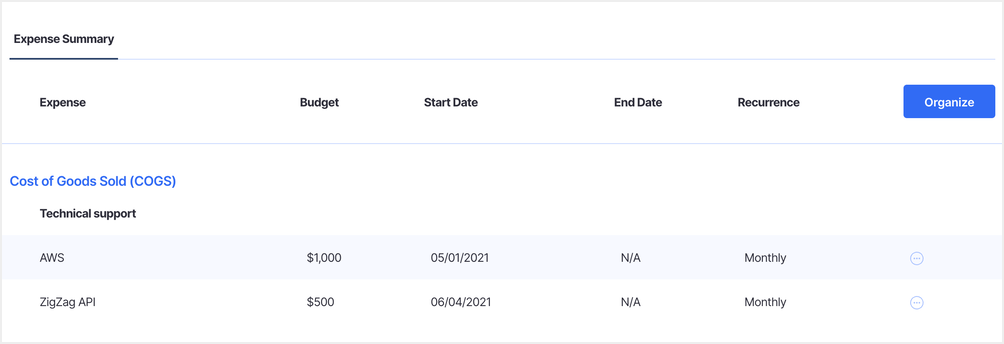

For SaaS companies, COGS might include the hosting expenses for your software or any APIs you pay to use in your product.

Track and forecast your COGS with Finmark!

Typically, COGS will grow with your revenue because theoretically, the more you’re selling the more you’ll need to spend to produce the product/service. Of course, this can vary depending on your business model.

Going back to our watches example, the more watches you sell, the more materials you need to buy in order to produce the supply.

If it costs you $5 to make one watch and you sell 1,000 watches in our first month, the COGS would be $5,000 ($5×1,000). But as word of mouth spreads and you start marketing, more people buy from you. So in your third month, you sell 3,000 watches, making your COGS $15,000 ($5×3,000).

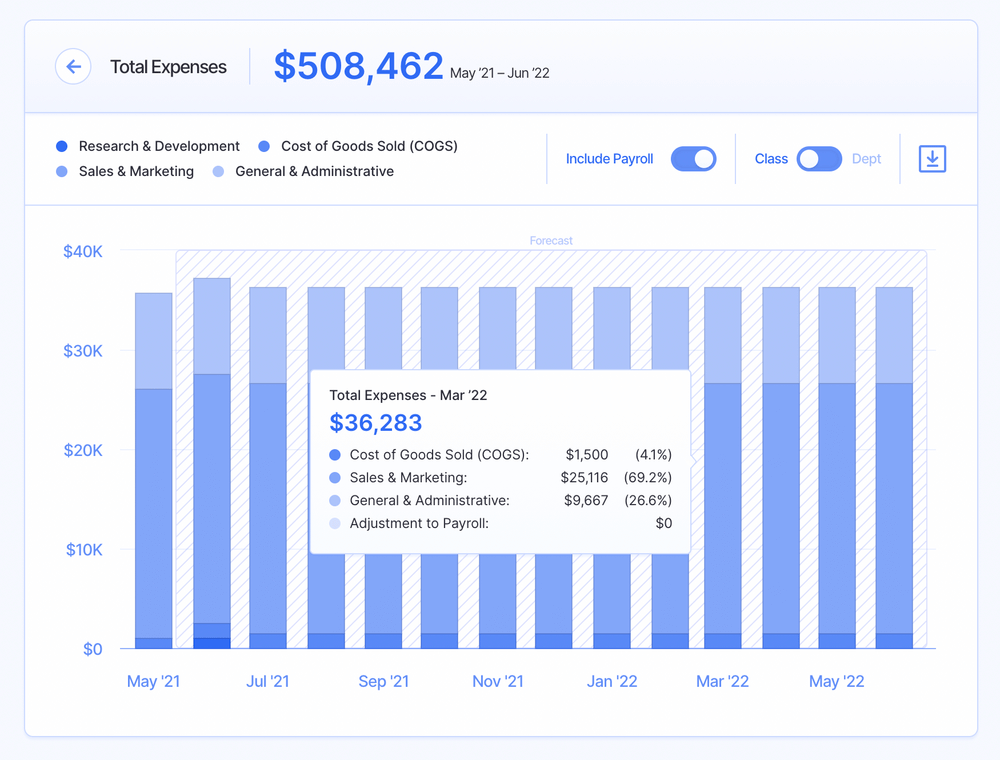

Keep in mind, COGS is different from your other expenses. Operating expenses (OPEX) like sales and marketing, G&A, and R&D are the expenses that go towards running and growing your business. You can spend more or less on them without impacting your production capabilities.

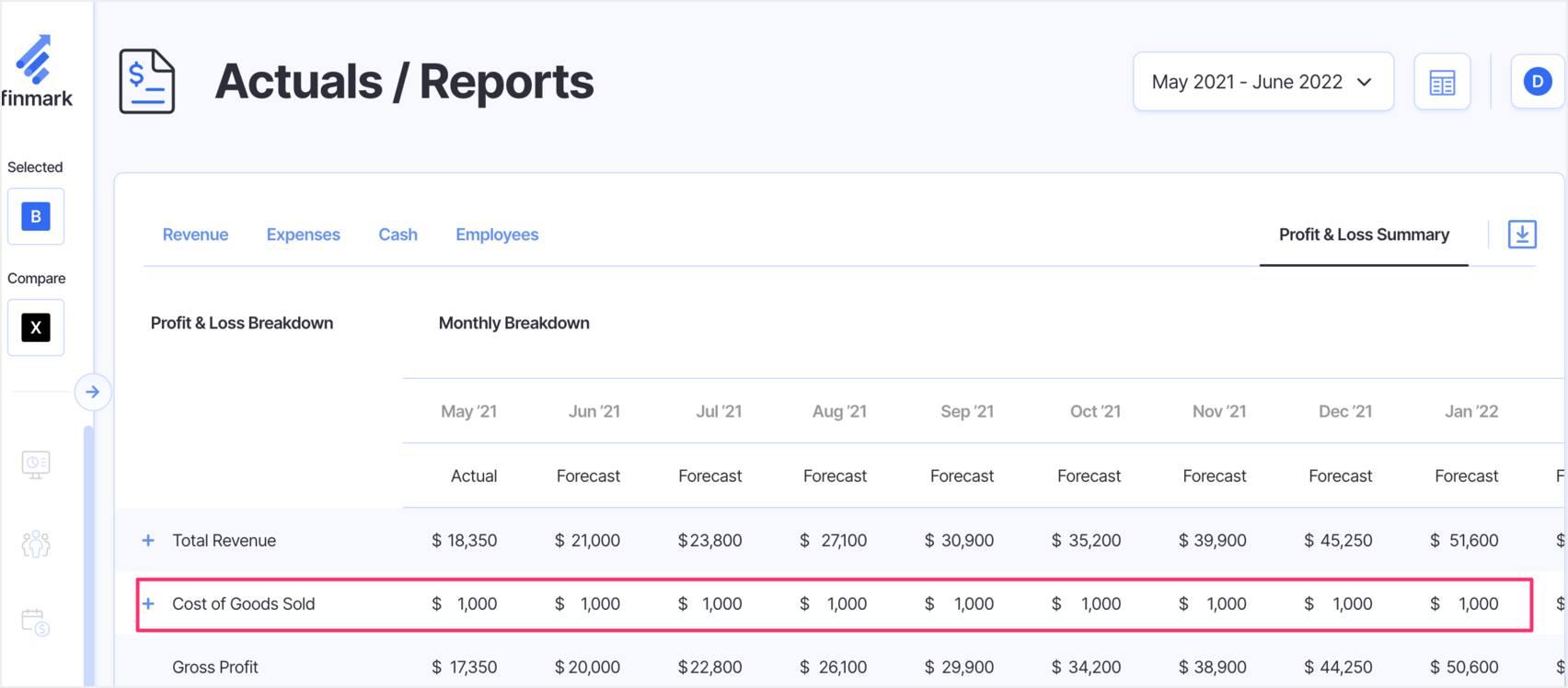

This is why COGS appears at the top of a Profit & Loss statement or income statement, directly under revenue.

The relationship between your COGS and revenue plays an important role in your ability to grow, but more on that in the next section.

Why Cost of Goods Sold is Important

The relationship between your COGS and revenue determines your gross margin. Your gross margin is the amount of revenue you retain after subtracting the total cost to produce and sell your product. It’s essentially your gross profit expressed as a percentage.

Gross Margin Formula

(Revenue – Cost of Goods Sold)/Revenue

The less it costs you to produce your product, the higher your gross margins will be, which means you have more money to spend on growth. This is why companies are always looking for ways to produce their products for less.

Let’s look at an example.

Say a company has $50,000 in monthly revenue. But their COGS is $40,000. When you plug that number into the Gross Margin formula, you get

($50,000-$40,000)/$50,000 = 20%

This means that this company has 20% of its monthly revenue to spend on marketing, payroll, R&D, and any other operating expenses.

As you’ll see in the chart below, the less this company spends to produce its products, the higher their gross margins will be (assuming their revenue stays consistent).

| Revenue | COGS | Gross Margin |

| $50,000 | $40,000 | 20% |

| $50,000 | $30,000 | 40% |

| $50,000 | $20,000 | 60% |

| $50,000 | $10,000 | 80% |

How exactly do you lower your COGS without producing fewer products? Let’s take a look.

How to Lower Your Cost of Goods Sold

As we mentioned earlier, your COGS will naturally increase as your business grows. When we talk about lowering COGS though, we mean producing your product for less. So instead of spending $5 to produce one watch, how do we get that number down to $3?

Here are some tips to reduce your COGS.

1. Negotiate With Suppliers

The first place you should look is your current suppliers. Whether you’re a manufacturer, retailer, or even a SaaS company, you’re paying another company for the materials, services, or supplies to produce your product. If you can negotiate better pricing from them, you’ll lower your COGS.

The better your relationship is with your suppliers, the easier it’ll be to do this.

If you just started working with a company, they’ll probably be less likely to give you lower pricing out the gate. But if you become a long-term customer, they’re more likely to want to retain your business.

2. Cut Unnecessary Expenses

If you can’t negotiate with your suppliers for a lower price, you can also consider cutting out expenses that aren’t 100% vital to your product.

Here’s an example.

Let’s say you’re an SEO software company. Your software analyzes content and gives it an SEO score. One of the features in your software is you show your customer’s Domain Authority (DA) and Page Authority (PA). In order to get that data, you use Moz’s API, which costs money.

If you were looking for ways to reduce your COGS, you could consider eliminating that feature, depending on whether or not it’s a strong selling point for your product.

3. Find New Suppliers

You’re not obligated to use one supplier. Shopping around is one of the best ways to reduce your COGS, particularly if your business is growing.

Whether you’re buying raw materials, fully produced products, or paying for hosting, the more you have to buy now and in the future, the more likely companies will be to take you on because you have long-term value.

Just be wary not to only focus on price. You don’t want to skimp on COGS to save a few dollars because it’ll come back to bite you later on.

4. Operate More Efficiently

Efficiency is an often overlooked part of reducing your COGS. Whether it’s lowering your server costs by freeing up old data and files, or implementing new processes in your supply chain, look for inefficiencies that can reduce your cost of goods sold.

Forecast & Optimize Your COGS

Your COGS are always changing with your business. Forecasting what your COGS will look like 12 months from now can give you more clarity on your growth trajectory and help you decide if any changes need to be made before it’s too late.

If you want to forecast COGS or any other metrics, and build a financial forecast for your business, give Finmark a try for free today!

You can also schedule a demo to ask us any questions and to see how Finmark can help you grow.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.