Expenses

Spending money may be easy to do, but understanding how to categorize each expense is where things become tricky for some founders.

Luckily, we’ve developed this guide to help you understand expenses, how to best categorize your expenses, and how to cut costs in order to stay in the black over time.

What Are Expenses

Expenses are the costs incurred by a company during typical business activities and operations.

There are several types of expenses, but we typically see the following four categories:

- Sales and Marketing Expenses are the internal and external expenses incurred that are directly and indirectly related to selling and marketing a product or service.

- General and Administrative (G&A) Expenses are a large portion of the total operating expenses for a company, impacting your bottom line without being associated with a specific department or function within your business.

- Research and Development (R&D) Expenses are all costs associated with the research and development of your product or service, along with any intellectual property (IP) generated during the R&D phase, including patents and copyrights.

- Cost of Goods Sold (COGS) is the total cost it takes to produce and sell your product or service.

But these expenses aren’t just lumped together. Depending on the type of expense, it may vary in where it should be included within your company’s profit and loss (P&L) or income statement.

- While some companies include Sales and Marketing Expenses into G&A expenses, we recommend separating out these expenses on an income statement to measure and track key SaaS metrics.

- G&A expenses can be typically found below COGS on an income statement, either grouped together as one line item or broken down further by fees, interest and deducting expenses.

- R&D expenses are included within the overall operating expenses and typically reflected as an individual line item on an income statement.

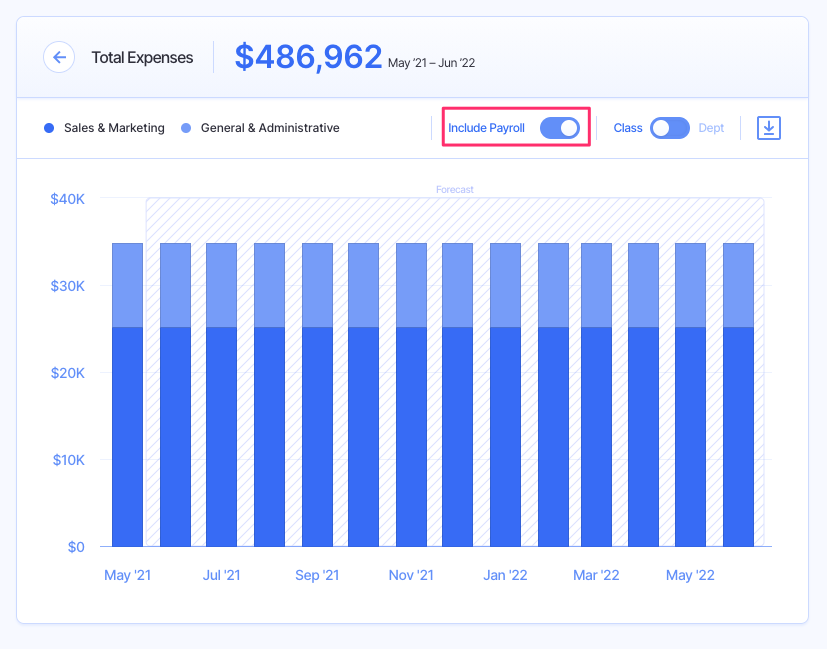

Some companies also include payroll as a separate expense, however, it’s beneficial to review expenses both with and without payroll to get a better understanding of spending outside of your employee base.

In Finmark, you have the option to view your total expenses with or without payroll.

How to Categorize Your Expenses

So you understand the primary expense categories, but what types of expenses should be included in each?

For some expenses, it may be crystal clear which category they fall into.

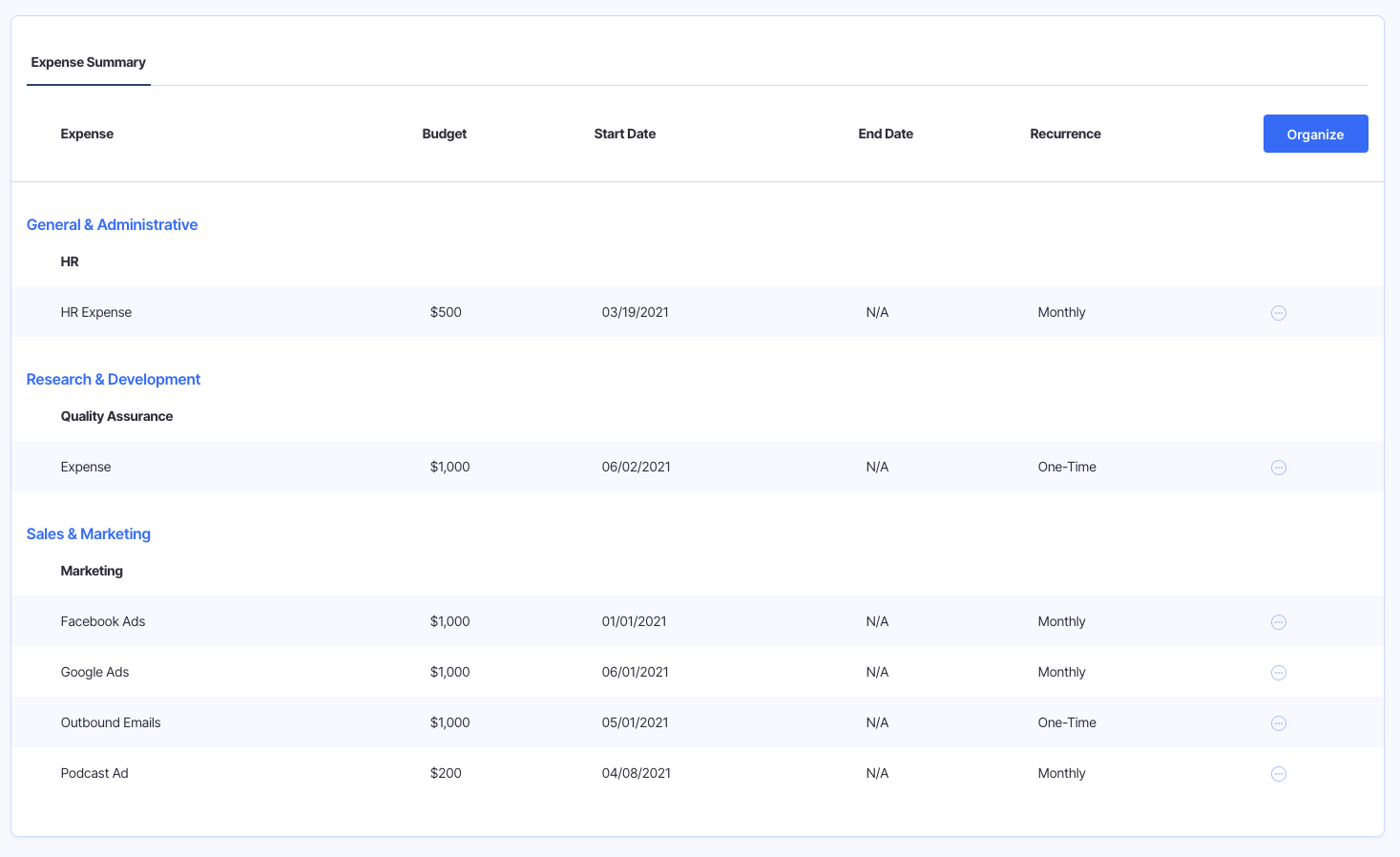

A Facebook ad campaign costing $7,500 will clearly fall within the Sales and Marketing Expense category, but what about the software to help the finance team streamline the back office? (it’d be the G&A expense category).

Here is a handy chart that provides guidance on what should go where when tracking your expenses.

| Expense Class | Expense Departments |

| General and Administration | |

| Administration | |

| Legal | |

| HR | |

| Finance | |

| IT / Helpdesk | |

| Sales and Marketing | |

| Sales | |

| Marketing | |

| Customer Success | |

| Sales Operations | |

| Research and Development | |

| Software Engineering | |

| Quality Assurance | |

| Product Management | |

| Cost of Goods Sold | |

| Operations | |

| Technical Support |

Luckily, our financial modeling software also helps you to discern how you should categorize your expenses. Start your 30-day free trial now.

Why Tracking Your Expenses Is Important

Startups move fast. Moving at the speed of light means that sometimes, things fall through the cracks.

Expenses can’t be one of those things that fall through the cracks.

If you’ve read our content previously, you know that running out of cash is one of the top reasons why startups fail. Not knowing how much you’re spending in a day, month, or even per quarter can be the difference between thriving and being one of the 29% of startups that fail.

Having a real-time understanding of the cash going in and out of your business is of utmost importance, not only so you are prepared come tax season, but also so you always know where things stand as it relates to financial health, business growth, and key KPIs.

Past, current and estimated future expenses are also part of building out sound financial models.

Finally, diligently tracking expenses also means you can likely reimburse out-of-pocket expenses from employees at a quicker rate, keeping your employees happy. Happy employees typically mean more productive, engaged and retained employees — a surprise bonus to tracking expenses!

How to Lower Your Expenses

A quick answer to lowering expenses is to stop spending money. But we know that’s far easier said than done, especially when you’re trying to get your business up and running.

Yes, reducing the amount of money you spend is the key to lowering expenses, but it doesn’t just mean closing your wallet.

Here are a few ways you can lower expenses without cutting off your spending completely:

1. File for an R&D Tax Credit

Building a product can get expensive — fast. However, if you’re based in the United States, you’re in luck.

Depending on the size and age of your business, you may be eligible to claim R&D expenses as an R&D Tax Credit to offset some of the costs incurred during R&D. Talk to your accountant or check out these resources to learn if your expenses qualify for the credit.

2. Track Sales & Marketing Performance

Yup, just about everything within your business needs to be tracked. But tracking means that you have a clear picture of performance, which can lead to optimizations over time.

Understanding the top-performing marketing channels can help to bring down the Cost Per Lead (CPL) and Customer Acquisition Cost (CAC), which may help you to reduce marketing budgets.

Similarly, if direct sales efforts are paying out in dividends while cold calling efforts are stagnant, it may be time to invest more in direct sales efforts and reduce the cold calling spend.

3. Review Your G&A Expenses

Sometimes, G&A expenses serve as a catch-all for expenses that you don’t know where else to put. But this can be a red flag!

Rampant erroneous spending can add up quickly, and knowing where the majority of your G&A spend is going can help you to cut back on unnecessary costs.

For example, is your company spending thousands of dollars on paper and ink each year? Perhaps you consider going paperless to save money (and the environment!).

4. Consider Remote Work

Office space. It’s not just a cult classic film, it’s one of the largest budgetary items a company typically has. Many businesses were forced to move to remote work due to the COVID-19 pandemic, but have now found that employees prefer to work from home.

Reducing or eliminating rent, alongside the associated costs like office furniture, utilities, office supplies and more, can have a significant impact on overall expenses.

<h2″>Track & Forecast Expenses With Finmark

Tracking expenses may be a no-brainer at this point, but don’t waste precious time manually tracking your expenses in Excel.

Our financial modeling software makes it easy to:

- Create, update and share your financial plans

- Manage your burn rate and cash

- Forecast your revenue and expenses

- And more!

With Finmark, you can say goodbye to complicated spreadsheets and say hello to accurate, customized financial models that truly reflect your business.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.