Operating Profit

For many startups, operating profit is of utmost importance as it is a key indicator of profitability. If you’re spending more money to operate your business than you’re bringing in, then you need to make a change to increase your operating profit.

We’ve developed this guide to help you better understand operating profit, including how to calculate operating profit, why it’s important, and how to increase your operating profit.

Let’s dive in.

What is Operating Profit?

Operating profit is a company’s earnings after deducting operating expenses and Cost of Goods Sold (COGS). It’s also known as EBIT (earnings before interest and taxes).

It’s important to note that many companies track both operating profit and gross profit.

Gross profit is your retained revenue after incurring the total cost it takes to produce and sell your product or service (COGS). However, one important difference is that gross profit doesn’t account for your operational expenses, while operating profit does.

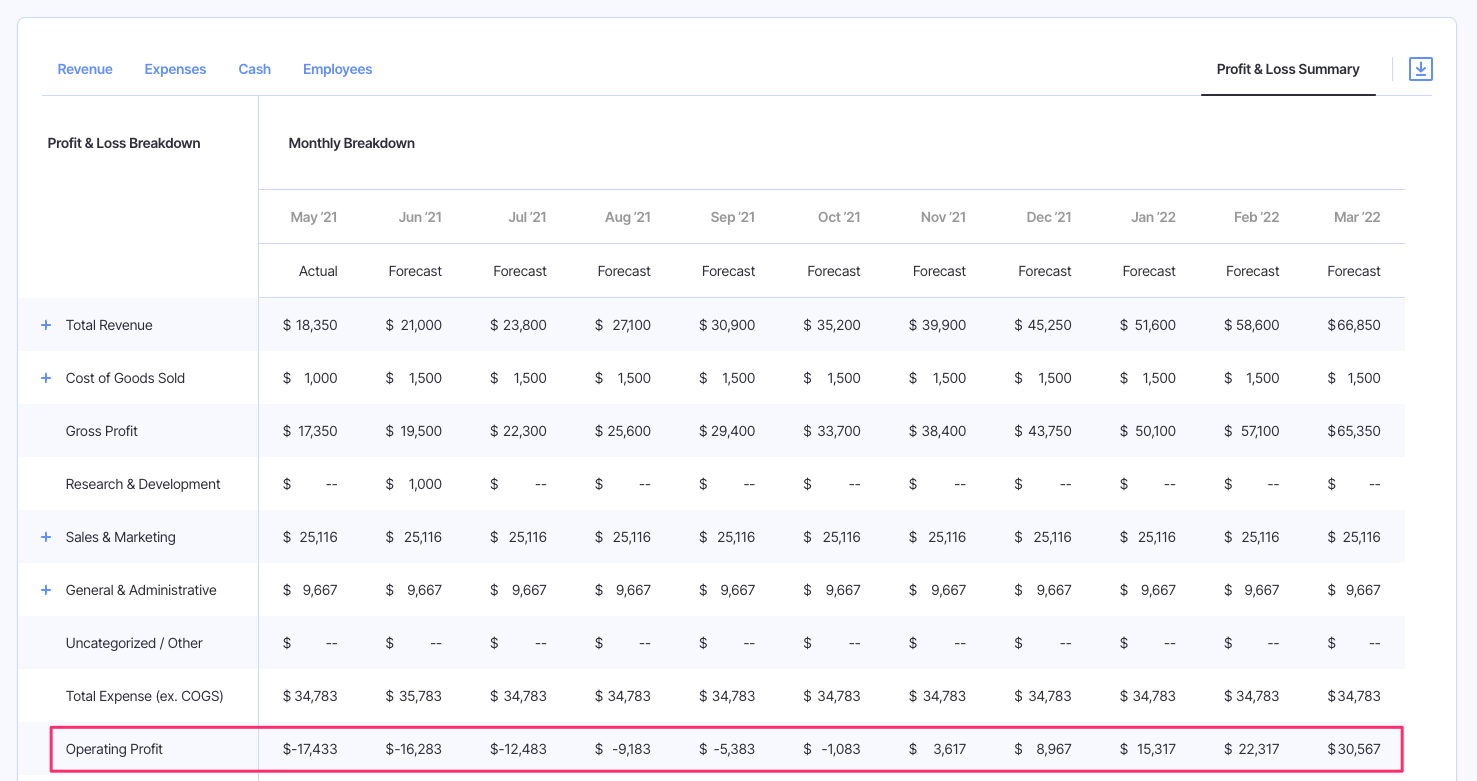

Similar to gross profit, operating profit is typically shown on a company’s income statement. Here’s what it looks like in Finmark’s Profit & Loss report.

Note: Within the below chart, the Total Expense (ex. COGS) line is Operating Expenses.

Start Measuring Your Operating Profit Today!

How to Calculate Operating Profit

A business has two different ways to calculate operating profit, shown below.

Operating Profit Formula: Option #1

Revenue – (COGS + Operating Expenses)

Operating Profit Formula: Option #2

Gross Profit – Operating Expenses

Let’s use the above chart from Finmark as an example.

In May 2021, you finished out the month with $18,350 in revenue. If you were to use the first calculation, then you would add $1,000 (your COGS) and $34,783 (Total Expenses) together, then subtract your revenue from that number to get -$17,433 as an operating profit.

If you prefer to calculate using gross profit (calculation #2 above), then you would subtract your operating expenses ($34,783) from your gross profit ($17,350) to get -$17,433.

Negative profit margins are okay at the start of a business, but if you continuously are in the red with your operating profit, then you will eventually run out of money.

Keep reading to learn why this is the case and how you can change things up to ensure your business starts or stays profitable.

Why Operating Profit is Important

As mentioned above, operating profit is an indicator of profitability.

If your monthly operating expenses are greater than your gross profit, you are losing money every month. And many failed startups know that continually having a cash loss means you may be fighting a losing battle with your business.

Operating profit is also important, especially to external stakeholders such as investors, because it removes all irrelevant or extraneous factors from the calculation, providing you with a clear picture of the health of your business.

However, depending on your debt, your operating profit may look like a more positive number than the total cash flow within your business. For example, if you recently made a large purchase that doesn’t affect COGS, then your operating profit may not change, but that will still affect your bottom line.

Related: Cash Flow Break-Even Point

How to Increase Your Operating Profit

You generally have two options to increase operating profit. Neither will come as a surprise, as you need to change up cash flow either in or out of your business to affect your profit margins.

To increase operating profit, you either have to increase revenue or lower your operating expenses and/or COGS. Here are a few examples for each:

Increase Revenue

Sell, sell, sell! Can you consider fresh strategic marketing campaigns to tap into new audiences? Is there an opportunity to add new revenue streams or upsell additional product features? Can you increase your prices to stay competitive?

These, among others, are great opportunities to increase revenue for your business to ultimately increase your operating profit.

Lower Operating Expenses

While operating expenses (also known as OPEX) are crucial to your business—you can’t operate without them!—there are ways to lower these costs to help operating profit.

Your COGS is a major part of your overall operating expenses. Lowering your COGS can include negotiating with suppliers, cutting unnecessary expenses, and finding new suppliers or vendors.

Check out our Cost of Goods Sold glossary term to learn more about lowering these costs.

Lowering operating expenses also means you should be operating more efficiently. Is there an opportunity to embrace technology to automate parts of your business, such as finance or accounting? You can also consider offering incentives to employees (additional vacation days, etc.) to identify ways to operate more efficiently to increase operating profit.

Track Your Operating Profit with Finmark

Profit may come in many forms, but it’s important to track them all. Finmark can help.

With Finmark, you can create and share financial plans, manage burn rate, track profit, and forecast revenue — all without pesky, templated spreadsheets.

Start your 30-day trial and say goodbye to confusing canned financial models and hello to accurate, customized financial models that truly reflect your business.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.