9 Popular Revenue Models Explained (And How to Pick the Right One)

Choosing a revenue model is one of the most important decisions you’ll make.

It’ll impact how you set up, operate, and grow your business. However, picking the right revenue model can be tricky because there are so many options and each has its advantages and disadvantages.

In this guide, we’ll go over nine popular revenue models used by some of the most successful and fast-growing companies in the world. In the end, you’ll have all the info you need to choose the right one for your business.

Spoiler alert: You don’t have to choose just one.

What is a Revenue Model?

A revenue model is how a company makes money.

At first glance, that might sound simple. However, when you think about all the different ways a company can make money, it might not be so clear cut.

Are you going to create and sell products?

Will you charge a monthly recurring fee to use your product?

Maybe you’ll act as a middleman between buyers and sellers and charge a fee to make connections.

Those are just a few examples of revenue models, which we’ll explain in more detail later. For now, just remember that your revenue model is simply the framework of how your company will generate revenue.

Revenue Model vs. Revenue Stream vs. Business Model: What’s The Difference?

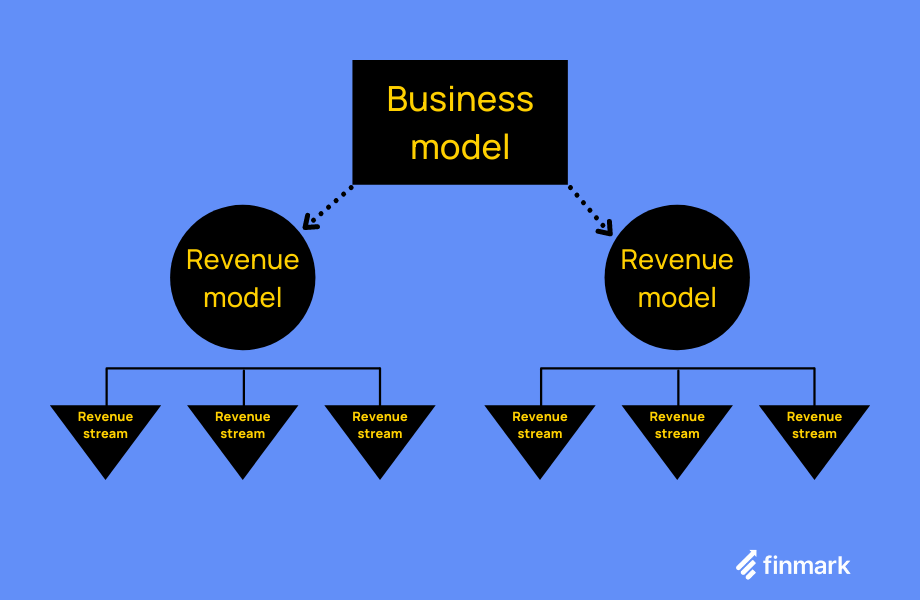

Sometimes people use the terms revenue model, revenue stream, and business model interchangeably. However, they’re not the same.

Unfortunately, a lot of information floating around on the internet about the difference between them is vague and confusing. So, in order to avoid adding to the confusion, here’s a simple way to understand the difference between the three:

- Business Model: What does your business do, who does it serve, and how do you create value for your customers?

- Revenue Model: How does your business make money?

- Revenue Stream: Where does your money come from?

Think of it as a hierarchy. At the top is your business model. Beneath that is your revenue model. At the bottom are your revenue streams.

Just like with revenue streams and business models, there are quite a few different revenue models you can choose from, and you can use more than one.

Let’s take a look at some of the most popular revenue models you can choose from.

6 Types of Revenue Models For Your Startup

Before we jump in the list, here’s something to keep in mind. If you Google “revenue models” you’ll probably notice there’s no universal list of models. Some of the examples we give you will be different from what you’ll see on another site.

However, this list will give you the perfect framework to choose a revenue model for your business.

Let’s dive in.

1. Subscription Revenue Model

How it works: You make money from recurring subscriptions (typically monthly, quarterly, bi-annually, or annually).

Pros:

- Predictable and consistent revenue (monthly recurring revenue!)

- Scalable

- Flexible

Cons:

- You need to invest just as much (if not more) into customer retention as you do for acquisition

- Its popularity has created a lot of competition

Companies that use the subscription revenue model:

The subscription revenue model has become extremely popular over the past decade as more companies realize all the benefits of recurring revenue.

Despite the rise in new companies using this model, it’s been around for a very long time. Think about gym memberships and country clubs. For these places, you pay a recurring fee to get access to their services.

Over the years, the ways companies have utilized this model has evolved. Today, there are three popular types of companies that use this model:

- Subscription boxes/e-commerce: Dollar Shave Club, Birchbox, and BarkBox

- Software/SaaS: Asana, Salesforce, and Finmark 😉

- Media: Hulu, Peloton, Tidal

One of the biggest benefits of the subscription model is predictable revenue. Since customers are paying you the same amount each month, it makes forecasting revenue and creating financial projections easier (and more accurate).

On top of that, if you can upsell or cross-sell existing customers, you can grow revenue even if you’re not acquiring a ton of new customers.

2. Transactional Revenue Model

How it works: You make money from selling single or multiple products.

Pros:

- Simple sales process

- Once you find a profitable acquisition channel, you can rinse and repeat it

- You have a wide variety of products to choose from

Cons:

- It can be difficult and expensive to scale

- Testing acquisition channels takes time and money

- Dealing with inventory and returns can be a hassle

Companies that use the transactional revenue model:

As you can see from the three examples above, the transactional revenue model is pretty expansive and includes a few different types of companies.

Casper, for instance, is primarily an e-commerce company that sells their products online. SlideSalad sells digital products online, directly from their website. Target is a traditional brick and mortar retailer–meaning it has a physical storefront.

There are three main approaches to this model:

- You buy the product from one person/company and resell it to another for a higher price

- You manufacture the product and sell it to a retailer, who then sells it to the end consumer

- You manufacture the product and sell it directly to the consumer (DTC)

Additionally, you also have the option to sell in a brick and mortar location or go the online route. More companies are opting to go online with ecommerce because it has lower operating cost and the profit margins are higher.

If you have the itch to sell physical or digital products, this could be a good option to consider.

3. Service-Based Revenue Model

How it works: You make money by selling your time, expertise, and/or labor for a set amount.

Pros:

- Low startup costs

- High profit margins

- Simple to get started

Cons:

- It can be tricky to scale

- It’s very hands-on

- You need to constantly acquire and retain customers to grow revenue

Companies that use the service-based revenue model:

The service-based revenue model is one of the oldest ones on our list. For as long as people have been around, they’ve been exchanging services in some form of another.

One of the biggest benefits of this model is that you can use it to build as big or as small of a business as you want.

For instance, you can be a single consultant that works with a dozen or so clients at a time. Or you can create a large chain that has thousands of clients like Maid Brigade.

If you don’t have a lot of money to get started but have time and a specific expertise/skill, the service-based revenue model can be a great fit.

4. Advertising Revenue Model

How it works: You make money by selling ad space to interested parties.

Pros:

- The more in-demand your audience is, the more revenue you earn

- Businesses are always looking for places to advertise so it’s very evergreen

Cons:

- You need to build a targeted audience first

- Your long term success depends on the quality of your audience. If advertisers don’t see an ROI, they won’t continue to buy ad space).

Companies that use the advertising revenue model:

If you’ve ever seen a company that makes a ton of money but doesn’t actually sell anything to its users, there’s a chance that they’re using an advertising revenue model.

For a long time, a lot of Facebook users didn’t understand what product Facebook was selling. Eventually, they realized that they (the users) were the product Facebook sold. In other words, the users’ attention is what Facebook is selling.

Here’s how the advertising revenue model works:

- Build an audience

- Learn about who your audience is. This can be their demographics, interests, or buying habits.

- Find advertisers who want to reach your audience

- Offer them exposure to your audience for a set price

The first two steps are critical. The more details you know about your audience, the more appealing you’ll be to advertisers.

That’s why social media sites like Facebook, Twitter, and LinkedIn have created such big advertising platforms. They collect hundreds, if not thousands, of data points about their users which they use to allow advertisers to do detailed targeting for ads.

On a smaller scale, let’s look at a site like Morning Brew. They have a large and fairly niche audience, which are people interested in business. Companies that sell B2B products, financial services, and other relevant products are willing to pay a lot of money to get in front of Morning Brew’s audience.

The advertising revenue model is primarily used by media companies. Websites like Forbes, streaming services like Spotify, and a lot of free apps we enjoy make money through ads.

If your plan is to build a business with a massive audience–or a smaller niche audience–then this revenue model might suit your business best.

5. Commission Revenue Model

How it works: You make money by recommending products and services and getting paid a commission from each successful referral.

Pros:

- You don’t have to hold inventory or sell products

- After a while, it can be somewhat passive

Cons:

- Requires an audience

- It requires negotiation to maximize your commission rate

Companies that use the commission revenue model:

With the commission revenue model, you make money from being a broker or an affiliate–a.k.a. “middleman”–that matches buyers with sellers.

Unlike the advertising model, you only make money for successful transactions. It’s usually done through product recommendations or by providing a marketplace.

Mint is an example of a company that uses this revenue model by recommending different financial products to its users. Their users are people interested in personal finance. Banks, credit card companies, and other companies that sell financial services and products allow Mint to recommend their offerings and pay a commission for each successful sale that comes from Mint.

Airbnb and Upwork are examples of the commission revenue model used in a marketplace. For instance, Airbnb sellers–the hosts–list their space for rent to buyers–the guests. In this case, when a guest wants to rent from a host, they pay the nightly rate for the space. Airbnb charges the host a fee when that transaction happens.

The amount you make as a commission is either a flat rate (e.g. $50 for every successful sale you broker) or a percentage (e.g. 10% of each successful transaction). The more successful “matches” you make, the more revenue you earn.

This revenue model is good if you know how to build a buyer-ready audience. In other words, you’re not just building a large audience. You need to build an audience that will buy the products or services you recommend. Otherwise, you won’t generate any revenue.

6. Donation Revenue Model

How it works: You make money from donations.

Pros:

- The free access to your product/service makes it easier to attract people

Cons:

- Asking people to pay you money for something you’re giving them for free is a tough sale

- Your revenue is dependent on people’s generosity, which makes it wildly unpredictable

- It’s very difficult to make a profit

Companies that use the donation revenue model:

Most companies that use the donation or “pay what you want” revenue model have some type of social cause attached to them. Whether it’s providing access to information, medical services, or any other type of social good, these businesses usually exist for a reason beyond making money.

In fact, very few generate a profit. Most of the donations cover their operational expenses. Sometimes that’s not even enough.

However, not all companies that use this revenue model are nonprofits. For instance, the ad blocking plugin Adblock also uses this revenue model. They provide their plugin for free and ask for donations to fund development. They also have a premium version of the plugin that brings in some additional revenue.

An interesting way to use this revenue model is to combine it with another one. For instance, The Salvation Army accepts donations and they also have a retail arm where they resell used items that have been donated.

If you want to run a nonprofit company or build a business as more of a hobby–with the option to earn revenue–then this revenue model might be good for you.

Other Revenue Model Examples

Those are some of the most common revenue models you can use, but it’s not an exhaustive list. Here are a few other revenue models you might consider:

- Interest revenue model: You make money by charging interest to lend money. It’s used by banks and other financial companies. (Ally and Quicken Loans)

- Renting/Leasing revenue model: You make money by renting out the use of your property for a specified period of time. (Holiday Inn and Hertz)

- Licensing revenue model: You make money by granting someone the rights to your intellectual property for a specified period of time and use case. (Disney and Hasbro)

Combining Multiple Revenue Models

A lot of the companies we gave as examples for each revenue model actually use a combination of different models. This strategy allows them to diversify and create a number of revenue streams.

For example, Spotify uses both the advertising and subscription revenue model. Their free service is monetized with ads and their premium service uses a subscription model.

Dollar Shave Club became popular for their monthly razor subscriptions, but they also use the transactional revenue model by selling individual products and kits.

In addition to Upwork’s commission revenue model, they also have a transactional revenue model by providing extra services you can pay for like premium listings.

A lot of media companies that use an advertising revenue model have also sell merchandise, which is a transactional revenue model.

Typically, companies will have one primary revenue model, especially when they launch. After they’ve established that initial model, they branch out. For instance, most SaaS companies start with a subscription model. Over time, they expand to explore other ways of making money like services.

Expanding and diversifying the revenue models allows you to increase your revenue potential, reach more people, and grow faster.

Bringing New Revenue Models to Old Industries

If you’re searching for your next business idea, consider mixing non-traditional revenue models into existing industries. This is the exact strategy a lot of newer startups have used to build their business. Here are a few examples:

The taxi cab industry traditionally used a service revenue model. Then ride sharing companies like Uber and Lyft came along and added the commission revenue model.

Customers use the ridesharing app to get connected to a driver nearby. The app handles the logistics of it all and charges a fee for the ride.

Doctors are another industry that has traditionally used the service revenue model. You go to the doctor and you (or your insurance company) pays the set price depending on what your visit was for.

Today, companies like Jetdoc and Talkspace have introduced the subscription revenue model to the industry. Instead of paying per visit, you pay a monthly fee and have a set number of visits.

Retail is an industry that has been disrupted time and time again. Take clothing for instance. They’ve traditionally used a transactional revenue model where you see a shirt or pants you like and you buy them. The transaction is over.

Fast forward to today and companies like Rent The Runway and Stitch Fix have introduced the subscription and rental revenue model into the industry.

Think about industries or verticals that have relied on a specific revenue model for years or decades. Can you introduce a new framework to make money and add value? A little bit of creativity could be the key to your next startup idea.

What’s Your Revenue Model?

Hopefully, we’ve given you something to think about. Your revenue model is key to making your business successful. If you don’t have an understanding of how you’re going to make money, you don’t have a business.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.