5 Ways to Boost Revenue When Business is Slow

As a founder, there’s nothing quite as alarming as when sales slow down or unexpectedly decline.

Cash is king in business and once you notice revenue is on a downtrend, you need to identify the issue and take action.

In this guide, we’ll break down how to identify what caused your sales to slow down, give you a framework to turn it around, and show you five ways to create additional revenue during slow periods.

How to Approach Slowing Sales

1. Identify What Caused The Decline

The type of business you’re running will be a major factor in determining the cause of declining sales. Some of the most common reasons why sales slow down in businesses include:

- Seasonality

- A new competitor taking market share

- A downturn in the economy

- Industry changes like new regulations or less demand

- Lower conversion rates

- Fewer leads in the funnel

Consider these different examples for your business. Some are easier to correct than others, but the most crucial step when addressing slowed sales is finding the problem. From there, you can start applying some of the strategies we’ll discuss below to course-correct and increase revenue again.

2. Is it a Problem You Have Control Over?

You know the famous saying, “focus on what you can control”? The same applies to business and slowing sales. For example, if your revenue is dipping because you’re not generating enough leads or your conversion rate is dipping, you have complete control over those problems.

However, if industry changes or a struggling economy are occurring around you, the problem becomes more difficult to fix. In this case, you might have to focus on doing what you can to extend your runway until conditions around you improve, or adjust to meet the new market needs

For example, the restaurant industry was hit hard during the pandemic. It wasn’t something the owners had control over.

As a result, a lot of restaurants permanently or temporarily closed. Some barely scraped by or went into debt to stay open. Then you had a select few that were able to reinvent themselves by optimizing their delivery process, becoming ghost kitchens, and all sorts of other innovative ideas.

Regardless of whether the slowdown in sales is a result of something you did or not, focus on the aspects that you can control.

3. Create a Plan

To get started, you need to create an effective strategy that focuses on increasing your sales. Start by compiling a list of all the options you have available. For example, you could consider internal changes or pivoting the business. We’ll give you more tips in the next section.

Make a list of everything. It’s better to be thorough and include any option, even if it might seem a bit outlandish. You can always cross it out later.

Once you decide which options are feasible, consider the strategies we’ll discuss below and start formulating the plan to increase your sales and revenue again.

4. Implement The Plan

The last and most important step is implementation. Ideas are cheap, and execution pays the bills. Always stay open to new ideas and be ready to adjust on the fly, but stick to your plan and see how things change within your business.

5 Ways to Increase Revenue When Business Slow Down

Here are five actionable tips to increase your revenue when sales slow down.

1. Create New Revenue Streams With Complementary Products

Everything about a complementary product should be centered around the promotion of your primary product or service.

For example, online courses are popular with the SaaS business model and serve two purposes for a startup. First, it acts as a way to give users the skills needed to operate your primary product at the highest level. Second, it allows your business the opportunity to become an authority figure in your industry.

Vyper is a viral giveaway and contests tool that found expansion and growth through the development of premium courses that train their customers to become better marketers.

Other ways you can implement complementary products into your business include:

- Digital products (Ebooks)

- Related services

- Advertising space

Complementary products are one of the best ways to find expansion revenue opportunities to upsell and cross-sell existing and new customers.

2. Optimize Your Acquisition Funnel

If you see sales slow down, one of the first places you should look is at your acquisition funnel. Where do your leads come from? What is your offer?

To best take advantage of your acquisition funnel, you should consider the three stages of the funnel and how you can optimize each stage to improve your conversion rates, get more leads, and increase revenue.

Top Of Funnel

At the top of the funnel, you will be responsible for sending qualified visitors to your website. Otherwise, you get junk traffic that will never make it through your funnel and convert into a customer.

Consider these tips to best optimize the top of your funnel for more high-quality traffic.

- Optimize pages and content for targeted and relevant keywords

- Use paid ads for precise targeting on social platforms like Facebook, LinkedIn, and Instagram

- Create content like blogs, videos, guides, and eBooks that prioritize keyword optimization

By creating high-quality, relevant content, you can make sure that your traffic is already interested and qualified. The types of top of funnel content include:

- Blog posts

- Landing pages

- SEO

- Video marketing

- Paid ads

- Social media

Don’t worry about making the sale at the top of the funnel. The top priority is gauging buyer’s interests and needs to move them along into the next stage of the funnel.

Middle Of Funnel

As you move to the middle of the funnel, engaging with prospects to build trust becomes the top priority. Examples of perfect ways to build trust here include testimonials, product benefits, product reviews, and case studies. But the options are almost endless.

Here are a few content ideas you can use to nurture your leads better while building and monitoring the purchase intent of a prospect.

- Email marketing

- Webinars

- Live events

- Product comparisons

- Free samples

These content examples are used to persuade and educate a prospect. By coming across with the intent to inform, you can truly gauge how interested a prospect is in making a purchase. A/B tests are a reliable way to collect customer feedback and see what content is working best.

Bottom Of Funnel

The bottom of the funnel is where the most money can be made. You were able to attract the right person into your funnel already and qualify their purchasing intent. Now they enter the bottom of the funnel, waiting to be sold on your product or service.

Some of the best ways to execute bottom-of-funnel content include:

- Surveys

- Live demos

- Case studies

- Review and testimonials

By using these channels correctly, you can accelerate the deal cycle and close a prospect faster.

When leads enter this last stage, you want to pull them into new conversion funnels to receive more personalized, targeted experiences optimized for better conversions. It is best to track the most critical metrics, too, to optimize future campaigns further. Here are some helpful KPIs to measure:

- Cost per lead (CPL)

- Customer acquisition cost (CAC)

- CLV (Customer Lifetime Value)

- Conversion rate

- Conversion rate per channel

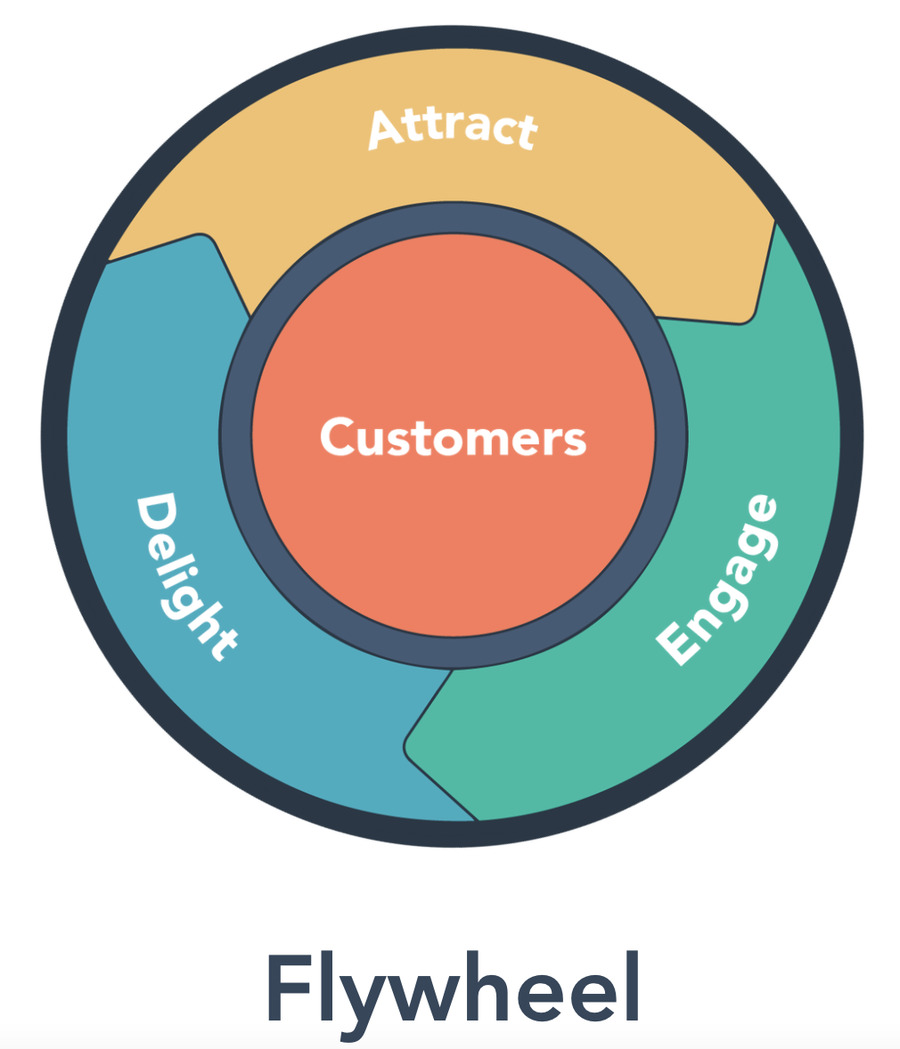

HubSpot is the perfect example of a business that utilizes each stage of its funnel effectively.

First, HubSpot creates enticing content that drives quality traffic to a specific place. It could be a landing page or a blog post that has a specific intent on where the next step of the customer journey will be.

For example, almost every piece of content published on the HubSpot blog contains a call to action in one place. HubSpot refers to this as a content upgrade.

If you are reading a blog about “How To Do Market Research”, HubSpot will include some type of upgrade in the article. If the content was executed properly, you will sign up for or download the content upgrade and move through the middle of the funnel.

HubSpot gives away so many things for free that customers feel obligated to buy a product from them at some point. They offer an entire library of free courses and certifications in the HubSpot Academy.

They also offer freemium pricing on many products like their CRM along with full-time free access tools like a website grade, email signature generator, and blog idea generator. All of these tools require an email and basic information to use to push you into the bottom of the funnel.

At the bottom of the funnel, HubSpot uses a unique approach. Because they place such a heavy emphasis on freemium pricing and free trial offerings, they are focused on nurturing customer relationships rather than closing a deal.

HubSpot refers to this technique as the flywheel model. The goal at the bottom of the funnel is to guide customers through the journey of education and proper software implementation. With such an extensive knowledge base of guides and free content, HubSpot has its customer success procedures on autopilot.

3. Create a Referral Program

Referral programs are a hidden gem in the world of marketing. There is no better way to promote your product than allowing your customers to do the talking for you. This is known as word-of-mouth marketing.

Nielsen states that 92% of consumers trust a recommendation they hear from a friend compared to a traditional media outlet.

By prioritizing the customer experience, you can ensure customers are referring your business to others. The best way to incentivize customers to do so is through a referral program.

When sales are slow, it may seem difficult to rely on your shrinking customer base to bring you more customers. But it always depends on the offer. Start by creating a referral discount coupon that is awarded to both the referee and referrer when they make their next purchase.

If the discount doesn’t work, offer something for free. The focus needs to be on making it worthwhile for the referrer.

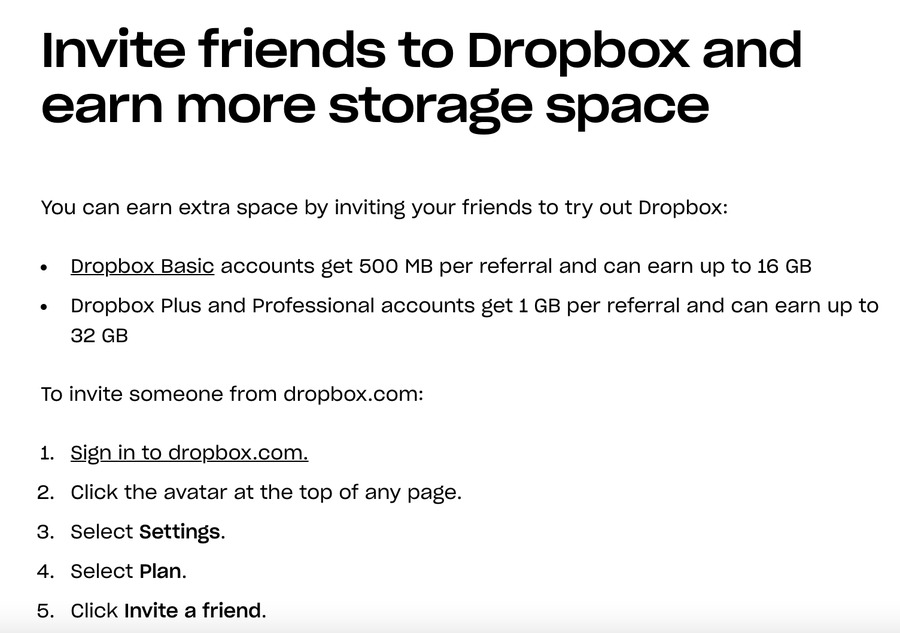

Dropbox is the perfect example of a business that can attribute a significant portion of its early explosive growth to customer referrals. They built a referral program that rewarded current users with additional data storage for free simply by getting some friends to join.

The beauty of the Dropbox referral program was the way they simply expanded their own product offering to entice customers to spread the word about a product they already loved. Every business can find a way to replicate this strategy to fit their current offer that appeals to their customer base while providing enough incentive to send out friend invites.

4. Offer Annual Plan Discounts

When sales are slow, the thought of offering discounts might seem counterintuitive. But hear me out.

Your goal at this point is to acquire customers and generate revenue to avoid running out of money or shortening your runway. Providing a temporary discount to attract new customers in the short term can extend your runway enough to give you time to think about long-term growth.

If you’re a SaaS company, providing a discount for annual plans is a great place to start.

Annual plans give you upfront cash and more breathing room on your runway.

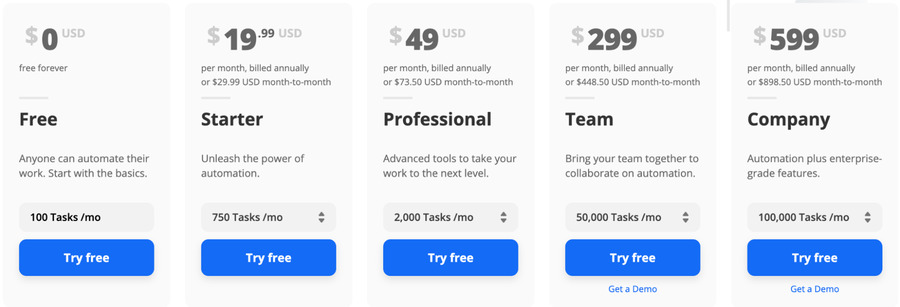

Zapier is the perfect example of how to turn discounted prices into a booming business that now does over $50 million in annual revenue. A significant driver behind their early growth was the availability of annual pricing plans.

While these plans do offer savings upfront, it secures initial capital to ensure a longer runway in the future during a slow sales period. Take a look at how Zapier structures each pricing plan monthly and annually.

5. Reduce Customer Churn

If you’re not getting new customers, you can’t afford to lose existing ones. Customer churn is the ultimate metric to display your customer loyalty and ability to please your current customers.

Here are a couple of tips to reduce customer churn.

First, consider offering customers an incentive to stay. A popular strategy among SaaS companies is to offer an upcoming discount for customers considering canceling their current plans. Baremetrics used this idea to help reduce their churn rate by 68%.

You can also stop churn in advance by optimizing your onboarding process. Sometimes customers churn because they don’t feel like they’re getting enough value from your product. Use your onboarding process to show new customers how to get the most value from your product and why it’s a necessity for them.

QuickBooks is the perfect example of a software giant onboarding clients effectively. They offer articles and videos, along with a nine-step email campaign to show you how to use all of the essential features.

Product education is a powerful way to reduce churn that often gets overlooked. Invest in educating your customers and they’ll be more likely to stick around.

Conclusion

Decreasing sales can seem like an irreversible and discouraging problem to face. But with the right strategies, anybody can turn things around quickly.

Whether you are a bootstrapped startup or an established funded company, you can apply these five tactics to your business to increase revenue when sales slow down.

Finmark can help you track your financials and other key metrics to properly implement these growth strategies and improve the financial health of your business. Sign up for a free 30-day trial today!

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.