How to Create a Marketing Budget From Scratch

Things are going well in startup land.

You’ve just received your first round of funding from a venture capitalist, and a portion of that is earmarked for marketing activities.

Now, you can really bring your product to the world, and make an impact on the vertical you occupy.

But there’s a problem:

There are so many marketing strategies, tactics, and angles your company could take. And there’s no way you have the budget to nail everything.

So, how should you allocate your marketing spend, and how do you create a marketing budget that’s going to allow you to achieve your goals without blowing through all your funding?

In this article, we’ll show you exactly how to do that.

5 Expenses To Include In Your Marketing Budget

1. People

When we think of a marketing budget, we jump straight to things like digital ad spend and social media management.

But, none of this works if you don’t have the people on board to run the whole show.

In fact, employee compensation typically makes up as much as 40-80% of a startup’s total revenue.

So, this expense should be the first to include in your marketing budget.

Provide a breakdown of in-house employees by role, as well as freelancers and individual contractors who you might be bringing in to perform certain roles.

If you’re planning on outsourcing any work to an agency, add these expenses here as well.

2. Software

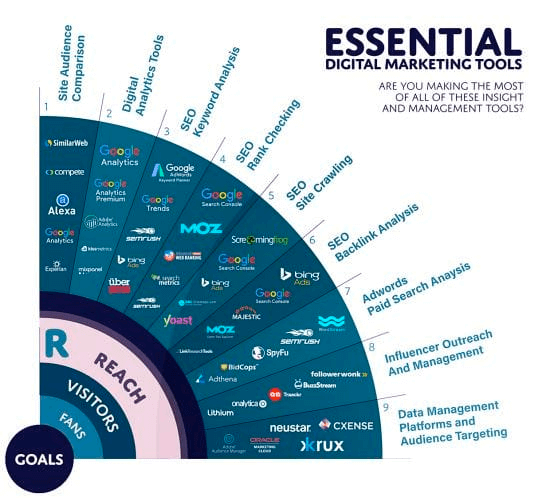

The world of software for marketing (often called MarTech) is pretty vast, with hundreds if not thousands of potential solutions.

Some platforms are fairly low-cost or even free (Google Analytics, for example, has a free version), but if you’re going to get heavy into SEO, content, PPC, or social media advertising, you’ll need to invest in a few SaaS tools to help your team run fast.

In your budget, make sure to detail whether you’ll be opting for monthly or annual billing. Annual billing can often reduce your total cost, but it does of course eat into more of your marketing budget upfront.

3. Equipment

One of the expenses that often gets forgotten and left out of marketing budgets is the equipment your team requires to get the job done.

If you’re planning on hiring new marketers this year, then be sure to include the cost of equipment like laptops, desks, monitors, and company phones.

4. Content Creation

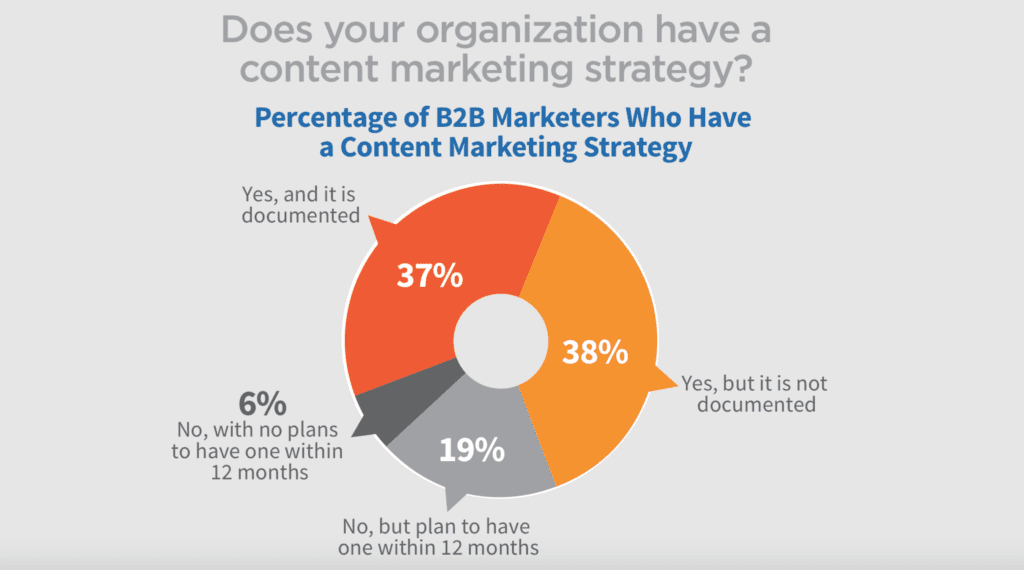

Content marketing is perhaps the most popular form of marketing for B2B startups, with 94% of companies either executing a marketing strategy now (PDF), or planning to within the next year.

If you’re planning on joining them, then you’ll definitely need to account for the expense of content creation, whether you’re creating video, blogging, infographics, webinars, or any other type of content.

Be careful not to double up here with your cost of freelancers in the people section.

If you’re outsourcing to a freelance writer for blog writing, for example, then their expense should go under content creation rather than people.

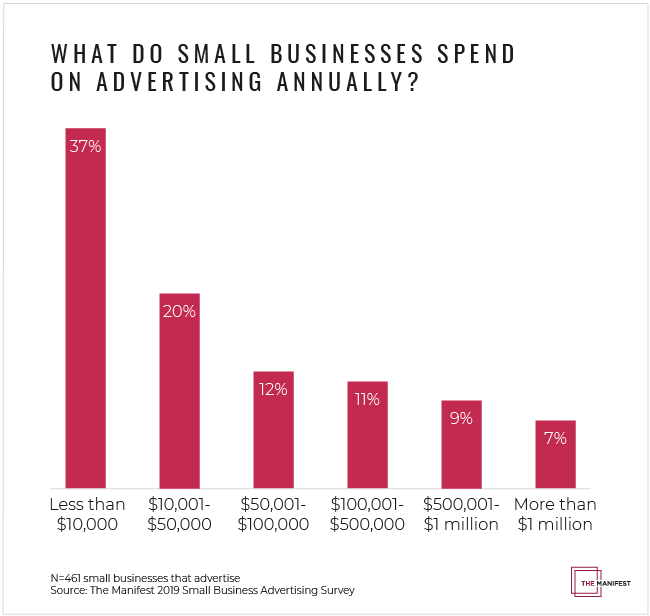

5. Advertising

For many startups, advertising (particularly digital advertising) is a huge chunk of the marketing budget.

This expense should exclude the cost of content creation for the ads you’re running.

For example, let’s say you’re going to create ads like this:

The cost of creative (the design for the ad as well as the copywriting), and of the guide itself, should go under the content creation expense.

The advertising expense should only include the cost of running those ads on Facebook (or whatever platform you’re going to use).

How To Build Out Your Marketing Budget

Before we dive into the steps to take to create a marketing budget, let’s start with a few assumptions:

- You’ve already created your overarching marketing strategy

- You have some marketing goals set already

- You’ve already defined things like target audience, and have an understanding of where to reach them

- You’re building a marketing budget so you know how to allocate funds during the year, and/or to get approval from your boss

On the same page? Cool. Let’s get started

1. Obtain A Financial Planning Tool

I know what you’re thinking:

The financial planning and modeling software platform is telling me the first step is to buy their thing.

Look, we’re not saying that Finmark is your only choice here (thought we’d be lying if we didn’t say we thought it was the best one), but here’s the thing:

Preparing budgets, financial plans, and reports the old-fashioned way (you know, with that not-so-beautiful grid-based application) is just plain painful.

Not only is spreadsheet-land unproductive and time-sucking (and soul-sucking to boot), it just doesn’t give you the same kind of accuracy, data functionality, and visualization capabilities as a fully-fledged startup budgeting software tool.

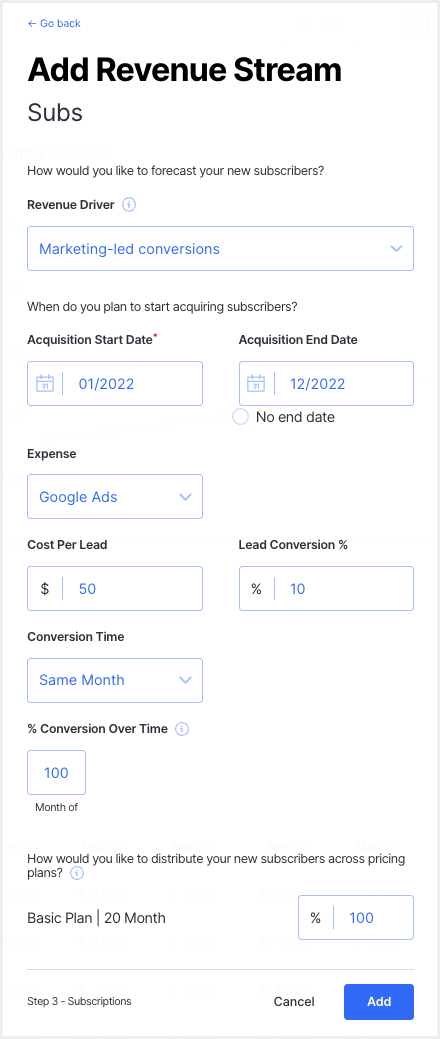

When you’re preparing your marketing budget, not only do you need to think about what your marketing spend will look like over the next 12 months, but also how your spend will impact the company’s growth over the next few years. A financial planning tool is the best way to do that.

On top of that, a financial planning tool allows you to test any assumptions you have about marketing spend. For instance, if your cost per lead is $50 vs. $100, what impact will that have on new revenue generated, and how will that change your runway projections? (hint: you can do that in Finmark)

These are all important questions you need to consider, and it’s very difficult to perform that level of analysis in just a spreadsheet.

So, check out what our platform is all about, and thank us later.

2. Account For All Potential Costs

Your strategy keeps things pretty high-level, but your budget should get right into the nitty-gritty.

For each marketing activity you plan to invest in, be sure to document the expected costs for each aspect.

For example, let’s say you’re going to go all-in on blogging, with a slant toward search engine optimization.

Your budget should include a breakdown of:

- The software tools you’re going to use for keyword research

- The cost of an employee or contractor to perform that research

- The cost of that same person (or someone else) to build out a content calendar, and briefs

- The cost of a software platform to manage your content calendar (if you’re not going the spreadsheet route)

- The cost of your content writers and editors

- The cost of any SEO services, including any software tools you might use for optimization and content analysis

- The cost of an employee or contract to publish and distribute your content

And that’s just for content.

Now go and apply that same methodology across all aspects of your marketing plan.

3. Build In Some Room For Overages

Despite all of your best intentions, you’re not going to get all of the costs 100% correct at the initial budgeting stage.

Looking at the previous example, we’re making a lot of assumptions. We’re assuming that:

- We know what our writers are going to cost

- We know how long it’s going to take to perform keyword research, content planning, editing, optimization, publishing, and distribution duties

- The cost of any software platforms we’re investing will remain constant, and not increase

To make some room for the fact that some expenses are more than a little bit unpredictable, you should build a buffer in your budget to account for overages.

Add 10-20% on top of what you’ve predicted, so you have some room to breathe if certain expenses end up being higher than anticipated.

Review your actual costs against the projected budget on a monthly or quarterly basis, and adjust your overage amount accordingly.

4. Establish A Protocol For Budget Tracking

Speaking of reviewing actual costs, part of the process of creating a marketing budget involves designing a process for tracking expenses against your projections.

This is where the power of a platform like Finmark comes into play, as you’re able to integrate directly with your accounting platform to import and sync actuals automatically.

Decide on a regular interval for budget reassessments. Quarterly may be appropriate for growth-stage companies, where monthly check-ins might be a smarter move for early-stage startups where the budget is particularly tight (and therefore more crucial to allocate wisely).

Look for areas where you’re spending more or less than anticipated, and adjust your projections going forward.

Then, if you’ve got more budget left over (because you ended up spending less than expected), reallocate it appropriately.

How? That’s step five.

5. Look For Opportunities To Double Down On High-ROI Activities

Your marketing budget should work synchronously with your marketing plan, which should be agile and adaptable.

What that means in non-jargon lingo is that you’re constantly reviewing the marketing efforts you’re investing in, and shifting and reallocating spend to those that are proving most impactful.

For example, let’s say you’ve allocated 10% of your budget to PPC ads, and 10% to social ads.

Your social ads are doing okay, but your PPC ads are delivering twice as much revenue.

For growth-focused startups, the ideal move here would be to redistribute some or all of your social spend over to PPC to capitalize on its stronger impact.

How To Allocate Marketing Budget

A challenge for many founders is figuring out how to allocate their marketing spend wisely.

They’ve got a certain amount (let’s say $500,000) to spend for the year. How much should go to content? How much should go on organic social? What about digital advertising? Is it reasonable to split the budget evenly across each discipline?

Deciding on arbitrary percentages based on something you’ve read online probably isn’t the best move.

Ideally, (you know, in that ideal world we all live in), you’ll determine the costs of activities you want to do, then create a business case for the required budget.

Assuming, though, that you have a strict limitation to how much you can spend (pretty generally the case with startups), then you’ll need to be a bit more calculated.

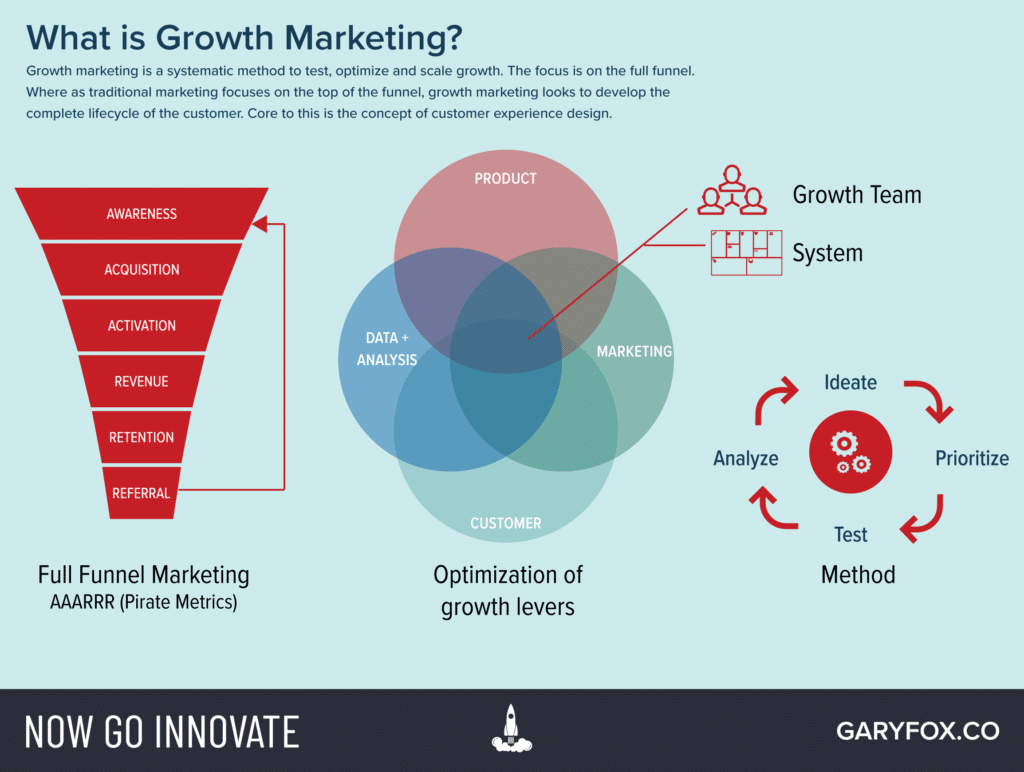

The best thing to do in this case is to take a growth marketing mindset.

Growth marketing is a full-funnel-focused marketing approach that essentially takes the scientific method (create a hypothesis, design an experiment, analyze the results), and applies it to the marketing domain.

Growth marketers use self-generated data to understand what activities and tactics have the biggest impact on their audience, thereby purposefully identifying opportunities to double down and, well, grow.

So, start by setting some percentages based on what you think is going to work. It’s best to focus on just one or two disciplines if you’re just getting started, rather than trying to own every channel possible.

You should also attempt not to go head-to-head with your opposition in super competitive spaces.

For example, if organic content is super competitive in your space, but you see an opportunity to build a presence on LinkedIn, focus there, and dominate.

Let’s say you’re going to open that up to three channels:

- Organic content – 40% of budget

- PPC advertising – 35% of budget

- Social media ads – 25% of budget

Then, you’ll need to design some growth marketing experiments to test hypotheses in each area, with the overarching experiment testing which channel is most effective at achieving whatever goals your organization has set.

Be prepared to be agile, and review and reallocate the marketing budget often (monthly is probably a good interval).

Conclusion

Building a complex marketing budget is a tricky affair.

It involves making some (hopefully educated) assumptions, getting as detailed as possible, and then being agile, constantly reassessing and reallocating as new developments arise and expenses become clearer.

Don’t get stuck in the dreaded spreadsheet-land for all of this, get yourself an ally in financial planning. Book a demo with our team today.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.