Customer Lifetime Value (CLV)

Your customers are your startup’s lifeblood. So it’s important to know how much one customer is worth for your business.

Your LTV is an indicator of not just how long a customer sticks around, but also how invested they are in your product. On top of that, LTV also helps you understand whether or not you’re spending too much (or too little) on customer acquisition.

Let’s explore customer lifetime value (LTV) and why it matters for your startup.

What is Customer Lifetime Value?

Your customer lifetime value (LTV) is how much gross profit one customer generates for your business over time.

This is different from average revenue per account, which calculates how much one customer is worth every month.

Ideally, you should have an average for all your existing customers, but you can also calculate the LTV per product if you have more than one. Knowing which product has a higher LTV will allow you to focus on the most successful products or improve those that aren’t doing as well.

LTV and CAC

LTV tells you a lot of valuable information about your startup. However, its real value stems from comparing it to your customer acquisition cost, or CAC.

CAC represents how much money you have to spend to acquire a single customer. For example, if you need to spend $200 in Facebook ads to generate five leads and turn one of those leads into a customer, that’s a CAC of $200.

CAC takes all of your sales and marketing channels into account and averages it out. If your CAC is higher than your average revenue per account, that’s fine. The revenue generated from this customer in the following months will make up for it. How long it takes to pay back for the acquisition cost is your CAC payback metric.

However, if your CAC is equal to or higher than your LTV, it means you are spending more to acquire a customer than the amount of revenue you’ll generate from them before they churn

So, if your CAC is $200, you should aim for a lifetime value of over $200. But more specifically, you should aim higher — the industry standard for SaaS companies in the growth phase is a ratio of 3:1.

In other words, you ideally want your LTV to be 3 times higher than your CAC to grow efficiently. For the example above, that means you’d shoot for an LTV of at least $600.

Of course, that ratio isn’t set in stone. So if you’re not quite there, no worries. But your goal should always be to have a higher LTV than CAC, otherwise you’ll essentially lose money on every new customer you acquire.

How to Calculate LTV

To calculate your LTV, you’ll need to know your Average Revenue Per Account (ARPA), your Gross Margin, and your Revenue Churn:

LTV Formula

(ARPA* Gross Margin) / Revenue Churn = LTV

Here’s an example:

- You have an ARPA of $340

- Your gross margin is $100

- Your revenue churn is $27

(340 * 100) / 27 = $1259.26

Why LTV is Important

The first reason why LTV is so important is that it helps you measure your customer retention.

The bigger your LTV, the longer each customer stays around for. So if you have a particularly small LTV, you could have a retention problem.

Retention is a key factor in helping your startup grow over time. Just by increasing your customer retention by 5%, you can increase your startup’s profitability by 75%.

Calculating your LTV will also let you know how much your startup should spend on retention compared to acquisition. If you have a healthy LTV and respectable retention rates, then you know you can safely budget more towards acquisition to increase growth.

Since your LTV is already high, newly acquired customers are likely to be worth more and stay around for longer — as long as you treat them the same way you’re treating your other customers.

But customer retention isn’t the only reason LTV matters for your business. Remember that not all customers generate the same amount of revenue.

Some customers will be more valuable than others. And it’s not just a matter of looking at who’s paying for the highest tier for a SaaS product.

For example, someone on the lowest paid tier who keeps their subscription active for several years will most likely have a higher LTV than a customer who tries the highest tier for a few months before canceling.

You can also use your LTV to make forecasts for your finances. Depending on how many customers you currently have and how many you acquire every month, you can forecast your revenue growth.

Overall, LTV gives you a wealth of information and helps you figure out:

- How much you should spend to acquire customers

- How much you should budget towards improving your customer retention

- Whether or not your current offers fit with what your best customers want and need

This important metric gives you insight into your startup’s overall health. A low LTV could indicate that your business isn’t built for sustainable growth.

How to Increase LTV

Luckily, there are several ways to increase your LTV and build towards long-term growth for your startup.

1. Invest in Creating Engaging Content for Your Customers

When your brand creates content designed specifically for your customers’ needs, you can help keep your customers around for longer.

Why?

For one, great content can help increase customer loyalty. But it can also educate your customers on how to get the most value from your product.

Consider creating a variety of different content types, since different people absorb information better via different channels. Some examples of content you can create include:

- On-demand tutorial videos

- Blog posts and articles

- Webinars

- In-depth documentation

- Podcasts

Remember that the content you create doesn’t have to focus solely on your product. Having a detailed documentation section will help your customers with the technical aspect of your product, but that’s pretty much it.

You can educate your audience on related topics that can help them get more value. For example, Optinmonster’s blog offers tons of tips and tricks for conversion rate optimization, email marketing, eCommerce, and more.

2. Improve Your Onboarding Process

Make sure that your customers are well-equipped to succeed. Your onboarding process is much more than providing documentation — you should carefully guide your customers to help them get what they need from your product.

You can create the best content library in your industry, but too much content can be overwhelming for new customers. They won’t know where to start!

That’s why you should also invest in a better onboarding process.

What emails or resources get sent to your customers, and in what order? Are they given access to a customer success manager? Is it easy for them to find out how to ask a question if they need help?

Time and resources spent on onboarding is never wasted. The more successful your customers can be at the very beginning of their experience with your brand, the better.

3. Collect Feedback From Customers

One of the ways you can improve your onboarding process — and other elements of your customer experience — is to collect feedback from your customers.

You should collect feedback from customers who have been with you for a long time to figure out what you did right and what you can improve.

However, you should also send exit surveys for customers who decide to cancel their subscription.

Ask them the number one reason they decided to leave. You should also leave room for them to write out their thoughts.

4. Create a Stellar Customer Experience

A positive customer experience should expand beyond the onboarding process.

Your customers will stay around longer — and increase their lifetime value — if you provide a great experience for them throughout their entire subscription.

This can be done in a variety of ways, but make sure to consult your feedback data to decide what you focus on first.

Here are some examples:

- Improve the UX in your tool

- Invest in a better customer service team

- Provide several ways to get in touch with customer service (phone, chat, email)

Before you decide to add a new feature, ask yourself if your existing features provide a positive experience for customers. If this is not the case, adding new features may not solve your problem.

5. Improve Your Time-to-Value

Time-to-value is the amount of time it takes for a new customer to get value from your product. You can compare this to return on investment, but this value isn’t necessarily monetary.

The faster your customers realize the value your product has for them, the more likely they are to stay instead of canceling. If they don’t see the value, there’s no point for them to continue paying.

In addition to better onboarding and quality content, consider creating case studies to illustrate different ways in which other users have gotten value.

6. Give Incentives for Annual Billing

Annual billing ensures that a customer’s lifetime value is at least worth one year of subscriptions.

But customers won’t magically choose to go for the annual billing cycle. It’s your job to provide an incentive for them to go this route.

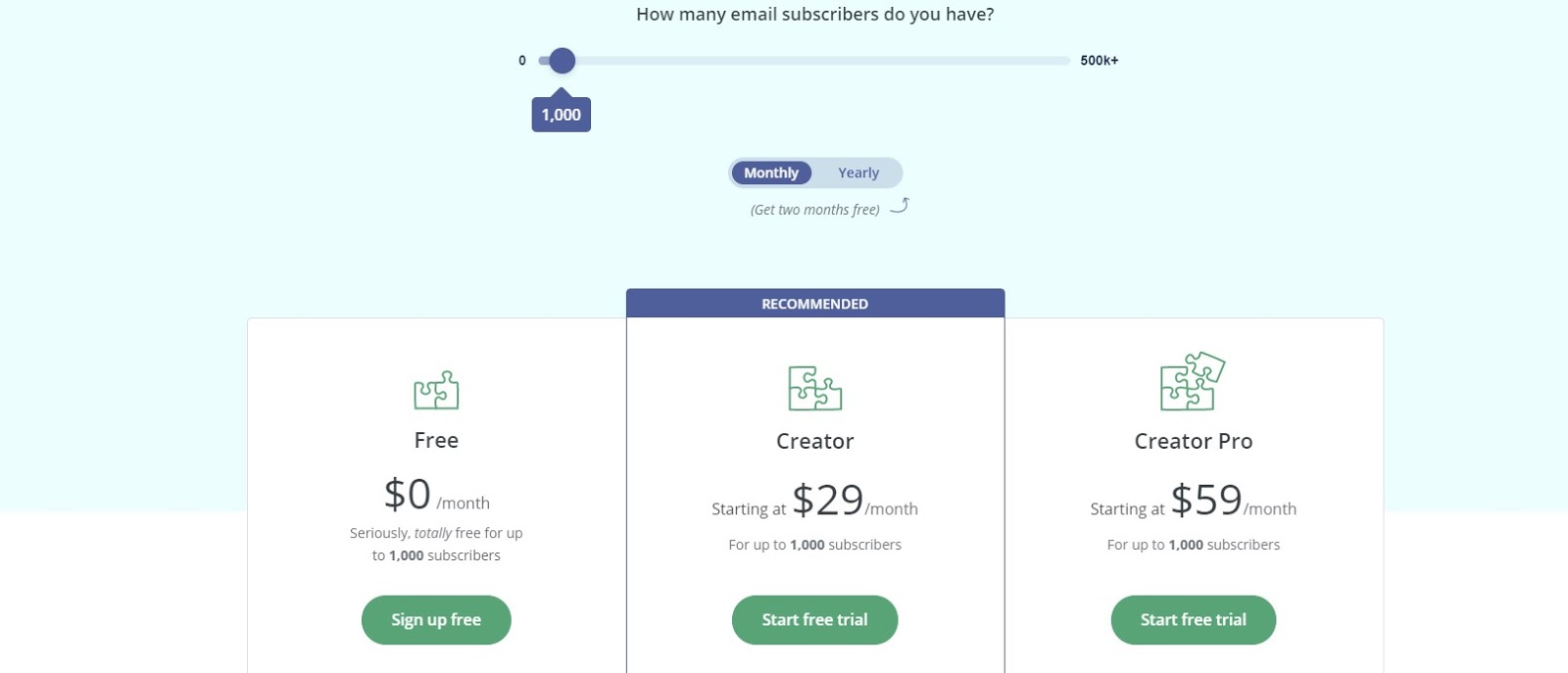

A popular way to do this is to provide savings for the annual subscription. For example, if your monthly subscription costs $49, your annual subscription could cost $499, which is an $89 saving.

Make sure you tell your prospective customers upfront what they can expect to save. That way, they won’t have to do the math.

Convertkit does this by saying annual billing provides two free months:

You can also add a quarterly payment option if this makes sense for your customer base.

7. Upsell and Cross-Sell Existing Customers

Your existing customers already said yes once. So consider investing in a sales team that can upsell and cross-sell to your existing customers.

You’re 60-70% more likely to successfully close a sale with an existing customer compared to 5-20% with a new customer. Your existing customers are also 50% more likely to try new products than new customers, and they’ll spend 31% more.

8. Try Dunning Management

Dunning management refers to a method of managing failed credit card payments. With a billing solution that uses dunning management, you can automate most of the problems that cause credit cards to fail.

Credit cards fail sometimes due to credit card limits, but in other cases, the credit card company decides to block the payment. Whatever the issue may be, consider trying dunning management instead of automatically freezing your customer’s account.

A billing system with dunning management will automatically retry billing the customer. It will also notify the customer via email several times before canceling the account.

This gives the customer a chance to solve the issue with their credit card if they intend to remain a customer.

The Bottom Line for LTV

Your customer lifetime value dictates the sustainability of your business model. When customers are worth more, you don’t have to constantly find new customers just to stay afloat.

This is important to keep in mind when trying to grow your startup. A sudden growth in monthly revenue won’t mean much if each customer has a low LTV. But when your customers are worth more, your growth will sustain itself in the long term.

That’s why it’s crucial to keep track of your LTV. Finmark makes it easy to not just track your LTV, but also put it in perspective with all your other financial metrics and forecast your growth.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.