Cash Flow vs. Earnings: What’s The Difference?

Monitoring and analyzing your financial data can help reveal your business’s strengths and opportunities for improvement.

However, you need to know what metrics to monitor and what they reveal about your business in order to gain these valuable insights.

Two of the most common metrics that help gauge financial performance are cash flow and earnings.

But, if you’re not a seasoned finance expert, you may be unsure about what exactly the difference is between these two figures, and what they can each tell you about your business.

In this article, we will lay out the main differences between cash flow vs earnings so you can see how they work together to paint a comprehensive picture of your company’s financial health.

What Is Cash Flow?

Cash flow is a financial metric that shows the net cash inflows and outflows for your business during a given period of time.

Essentially, your cash flow is a measure of how much cash your business generated and used throughout the month, quarter, or year.

Cash flow is focused on the actual cash that your business collected or paid over the period. It does not take into account any expenses or revenues that were accrued, which are reported on the income statement.

How to Calculate Cash Flow

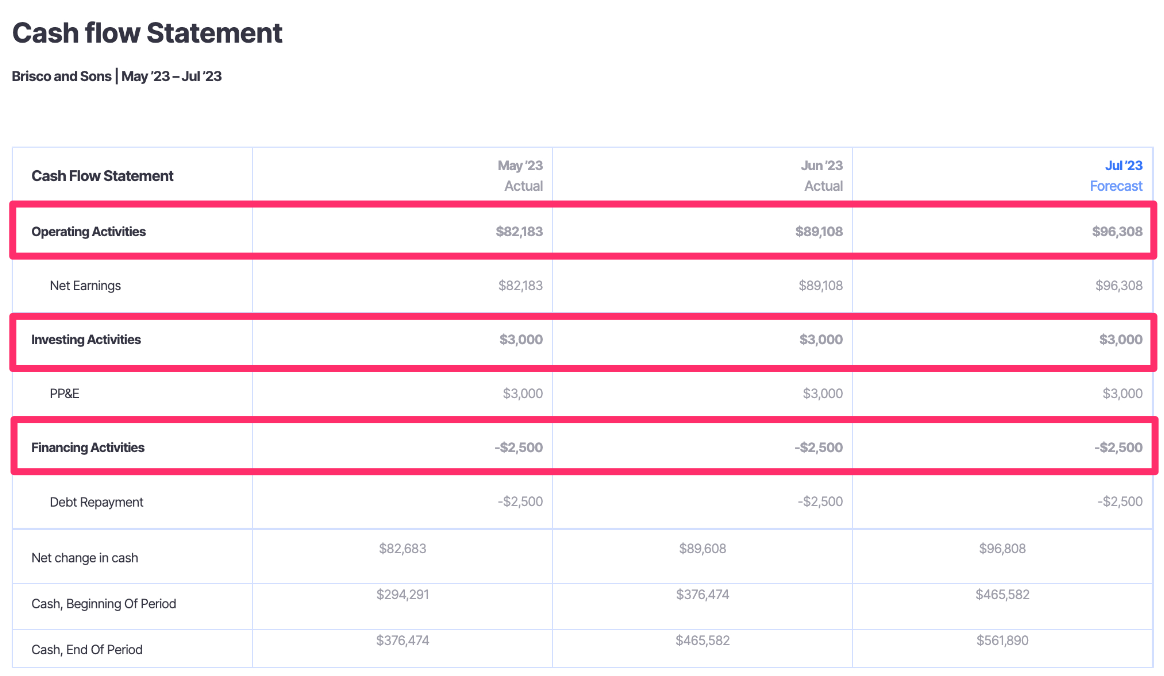

You will find your total net cash flow reported on the cash flow statement, which is further broken down into three sections:

The total of each of these sections will give you your total net cash flow. Here is a simple formula for calculating net cash flow.

(Cash Inflows from Operations – Cash Outflows from Operations)

+

(Cash Inflows from Investing – Cash Outflows from Investing)

+

(Cash Inflows from Financing – Cash Outflows from Financing)

=

Cash Flow

You can calculate cash flow manually with the above formula. But, using a tool like Finmark from BILL can help automate the process. Here’s an example cash flow statement in Finmark, with each section highlighted.

What Does Your Cash Flow Reveal?

Analyzing your cash flow will tell you whether your company used or generated more cash during the period. In other words, did you end the period with more or less cash than you started with?

Diving deeper into your cash flow will tell you how effectively you’re using the cash that comes into the business, and where you could optimize for better cash flow.

How much cash flow your business generated (or used) during the period is of interest to internal leaders, investors, creditors, and other stakeholders.

These individuals will use your cash flow value to determine if you’re able to meet short-term obligations with the cash you have on hand, which signifies that your business is self-sustaining and can still generate positive cash flow after taking care of essential spending.

What Are Earnings?

Earnings, or net profit, refer to the company’s net income, or what you made in profit after accounting for all expenses like payroll, cost of goods sold, taxes, and more.

Your earnings are the bottom line metric you will see reported on your income statement, also called the profit and loss statement.

In general, earnings are used as a profitability measure to show the portion of income you got to keep over a certain period of time.

How to Calculate Earnings

You can calculate your earnings using the basic formula that follows.

Revenue – Expenses = Earnings

This can appear to be a simple equation. But, depending on the complexity of your operations and your cost structure, it can quickly evolve into a much more involved calculation.

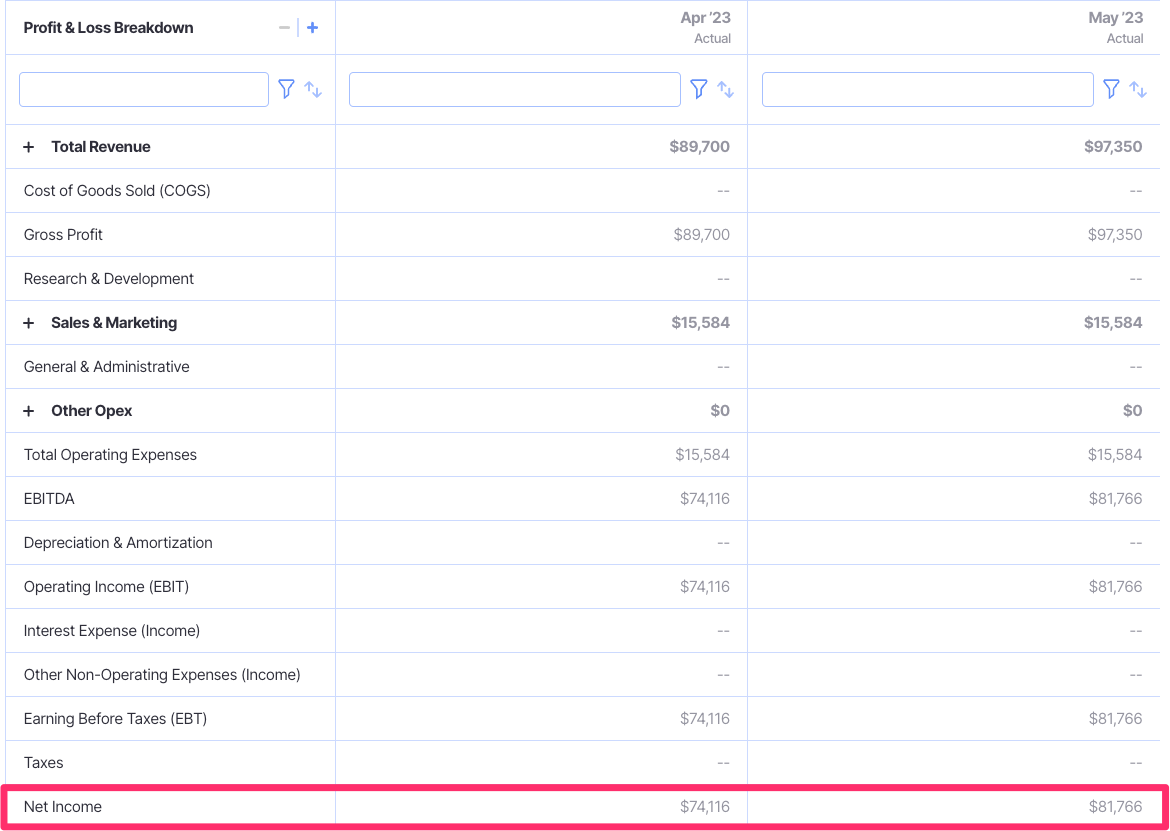

To get an accurate and up-to-date look at your earnings, you can use Finmark to monitor your earnings in real time. Finmark will pull financial data from your accounting, payroll, and other integrated tools, ensuring you get an accurate gauge of your profitability at any given time.

Here’s an example of what an income statement looks like in Finmark.

What Do Your Earnings Reveal?

Again, earnings show the amount of profit the business generated after subtracting all expenses. It is the headline profitability figure that internal and external stakeholders put a lot of focus on.

Investors, creditors, and internal leaders want to see high sales and total revenue figures, but they also want to see how much you’re able to retain as profit as well.

They will commonly monitor the company’s earnings over time, compare them against other competitors in the field and against your projections and forecasts to assess the performance of the company.

In this case, higher earnings are typically seen as an indicator of strong financial performance. Lower or negative earnings signify that your business lost money during the period, which may cause warning signals if this becomes prolonged.

Comparing Cash Flow vs. Earnings

A company’s cash flow and earnings are reported on two separate financial statements. So, while they are similar in some ways, they are meant to provide different insights about your business’s finances and operational performance.

Again, the cash flow that is reported on the cash flow statement is a measure of your business’s total inflows minus the total outflows for a given period.

It is viewed as an objective measure of how much your cash balance changes over a period of time and is a reconciliation of non-cash items that are reported on the income statement.

This is the biggest difference between the two metrics–how they treat non-cash items.

The accrual accounting principles that are used to construct an income statement mean the earnings figure will include non-cash items like:

- Depreciation expense

- Amortization expense

- Reported revenue that you have not yet been paid for

- Deferred taxes

- etc.

By including these items, the earnings figure may inflate or underestimate the actual cash that came in or out of your business during the given period.

Because of these differences, your earnings and cash flow values will almost always differ from one another.

Diving into the items that make these figures different is where you will be able to draw insights from, as we will see below.

Even still, cash flow and earnings are highly correlated. Using the indirect method for building a cash flow statement, earnings are the starting point for calculating the net cash flow from operations.

So, you can anticipate that a higher earnings figure will also signify a higher net cash flow as well, and vice versa.

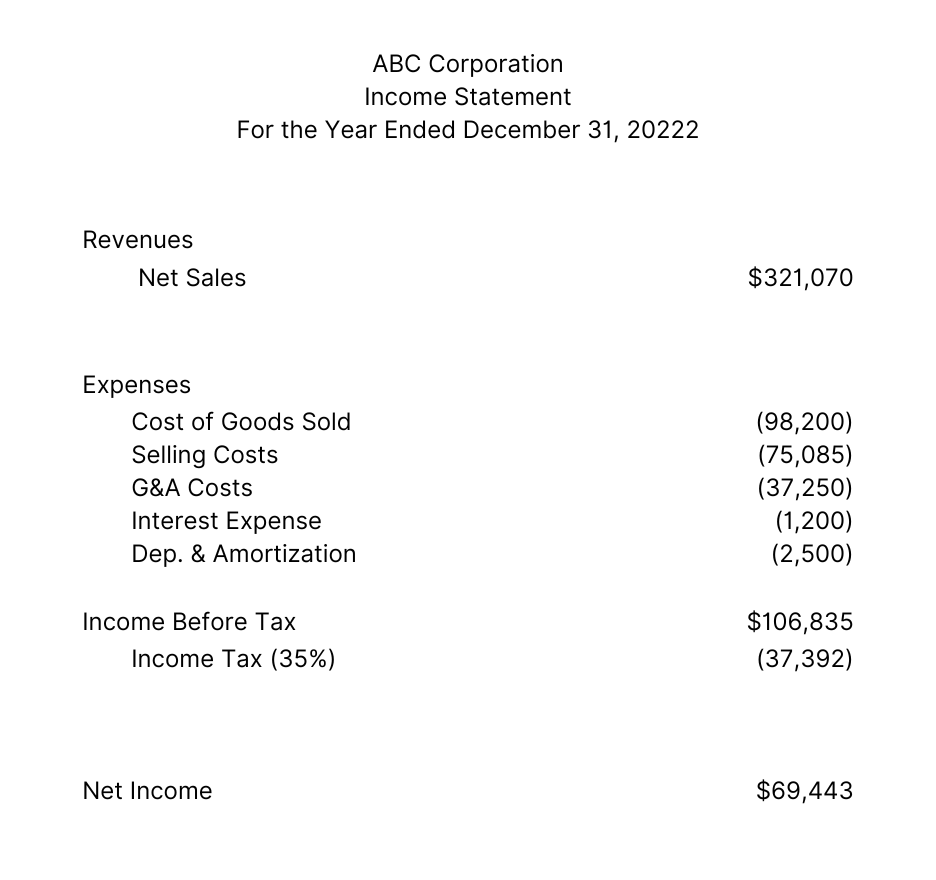

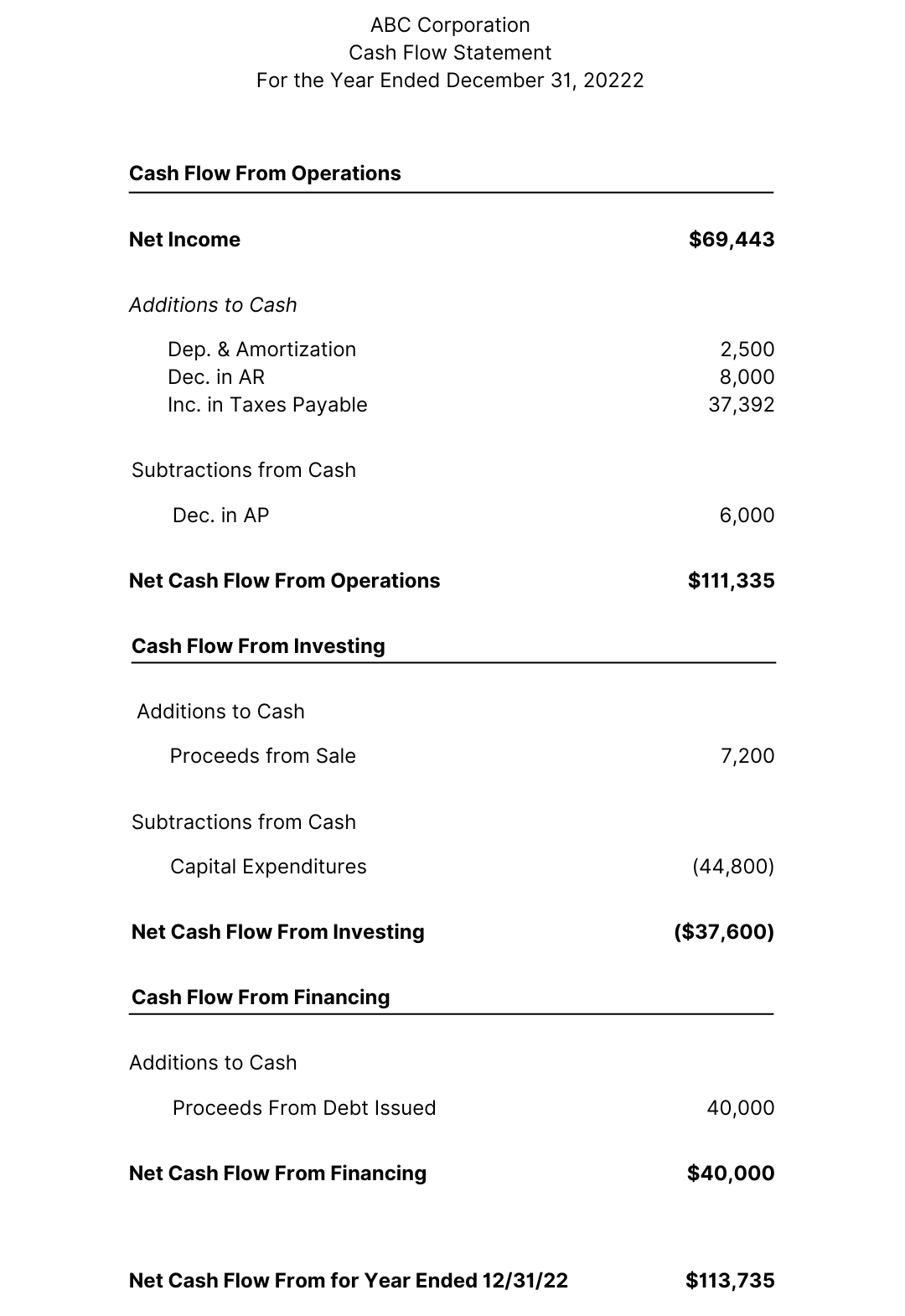

Seeing the Difference Between Cash Flow vs. Earnings: An Example

Here is an example of a company’s income statement and cash flow statement for a given period. From this example, you will be able to see the items that are causing the cash flow and earnings figures to differ.

First, the income statement.

And here is the cash flow statement.

The difference in how each statement treats non-cash items drives the net cash flow for the year to be nearly double the reported earnings.

The income tax gets added back to the cash balance because it has likely only been incurred, not necessarily paid yet.

Plus, the depreciation and amortization expense is added back to cash. It is a non-cash expense that is an important item for accounting purposes but doesn’t involve actual cash leaving the business.

Making these adjustments leaves the cash flow much higher than the earnings figure.

But, this illustration also shows how closely connected the calculations are for these two figures. Using this example, you could clearly see how higher revenue would ultimately lead to higher earnings and cash flow, all things being equal.

Analyzing Cash Flow and Earnings Together for Better Insights

Since these metrics provide two distinct insights, you can gain a better understanding of your business’s financial performance by assessing the two together. In doing so, you make more informed financial planning decisions rather than be misled by either figure.

Using the above example, if you solely referred to the earnings figure to make future decisions for the business, you may expect a cash pinch in the coming months, or scale back on investments to avoid this scenario.

But, looking at your cash flow figure shows you that you may have more cash on hand than you anticipated after looking at the income statement.

So, analyzing both cash flow and earnings will help you make budgets and financial plans that are better suited to your business’s financial situation.

In some instances, you may even see negative earnings but a positive cash flow. Separately, these tell completely different stories, but analyzing the two figures together would provide a much more accurate depiction of the company’s finances.

Using Finmark to Track Cash Flow and Earnings

Assessing your cash flow and earnings side by side will help you better monitor your profitability and operational efficiency.

Rather than relying on just one of these figures alone, analyzing them together will provide a more accurate view of your financial health to assist with forecasting, budgeting, and overall financial planning.

For effective financial management and planning, use an intuitive tool like Finmark. You can view up-to-date figures for both metrics right from your dashboard, and enjoy convenient optimization features and a user-friendly interface to expertly track your finances.

Start your 30-day free trial with Finmark today to access a more accurate and customizable financial model that’s perfectly suited to your company’s needs.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.