What is Strategic Budgeting? (How to Do it Right)

Budgeting is one of the most fundamental yet crucial aspects of running and growing a business.

The thing is, many startups are doing it wrong.

Okay, maybe “wrong” is a strong word, but they for sure could be budgeting a lot more strategically.

This brings us to the point of today’s lesson: strategic budgeting.

In this article, we’re going to discuss what strategic budgeting really means, and how it differs (quite a bit, actually) from simply pulling together a budget based on how much money you have available to spend.

We’ll also give you a comprehensive guide to building your own strategic budget, so you can put what you learn into practice.

What is Strategic Budgeting?

A budget is an estimate of incoming revenue and outgoing expenses for the coming financial period (such as the next month or year).

Strategic budgeting takes this a step further and is a way of creating a budget based on the overarching goals of your company.

It’s about more than just looking at how much money you have to spend, and then splitting it between departments.

With strategic budgeting, it’s much more about considering what you might be able to achieve with that spend, and analyzing different scenarios to build a spending allocation that best positions you for organizational growth.

Your company looks into the long-term when setting goals. To achieve these goals, you may need to implement new processes, purchase new software, or increase your resources. A strategic budget accounts for these long-term growth needs.

For example, if you’re a SaaS business or physical product creator, your business revolves around product development. Strategic budgets ensure product teams can allocate and attain more resources more wisely.

The best strategic budgets are based on three principles. They are:

- Focused on the long term

- Flexible

- Inclusive of contingency plans

Strategic Budgets Are Focused On The Long Term

Standard (read: poor) budgeting is based on the short-term.

It asks, “How much money do we have to spend next month” and bases decisions purely on that answer.

Strategic budgeting is long-term focused.

It asserts that you want your business to survive many years into the future (you do, right?), and asks, “What would be the best use of funds this period, based on the long-term organizational goals we’ve decided on.”

Strategic Budgets Must Be Flexible

Strategic budgets also should be built with flexibility in mind.

Founders and finance leaders know that in business, little goes according to plan. Even the best-laid budgets are subject to unexpected external factors.

The recent pandemic is clear evidence of that: many companies had to very rapidly pivot and adjust their budgets.

Obviously, such things are extremely rare and unforeseeable, but even on a small scale changes can occur that impact your budget’s feasibility (such as changes in local labor laws).

Strategic Budgets Include Contingency Plans

With all of this in mind, it’s a pretty wise idea to build a contingency plan or two when designing your strategic budget.

In the financial world, we call this scenario forecasting.

At a high level, you build out your strategic budget, then create upside and downside plans, which show how your spending might need to adjust if revenue is low, or what you can do with the extra cash if your revenue streams provide more fruitful than expected.

This process is a little outside the scope of today’s lesson, but to learn more, check out our complete guide on the subject: How to Do Scenario Analysis: Step-By-Step Guide.

How To Build A Strategic Budget In 8 Steps

Ready to get strategic with your budgeting?

Follow these eight steps to improve your financial forecast and create a budget that’s congruent with your long-term company objectives.

1. Decide Between A Top-Down or Bottom-Up Budgeting Approach

Top-down is the more widely-used form of budgeting. With top-down budgeting, your senior leadership has the power to design a budget.

They allocate top-line budget amounts for each department and sometimes go a step further and break that budget into specific line item budgets. In other cases, this is the responsibility of the department head, and senior leadership only provides the top-line numbers.

Bottom-up, as you’re probably guessing, starts the other way around.

Each department (led by the department head) figures out the costs involved in achieving growth goals for the next financial period. Senior leadership then signs off (with a bit of negotiation) on those budgets.

The advantage of top-down budgeting is speed. Senior leadership can create high-level budgets and assign more specific spend allocation to department heads.

However, it tends to rely on last year’s figures rather than the requirement for the coming years.

The bottom-up approach is essentially the opposite; it’s a bit slower, but it draws on the experience and expertise of those who are implementing the budget, and is less driven by previous financial periods.

You’ll need to decide on one of these two budgeting approaches before proceeding.

2. Gain Clarity On Your High-Level Goals

As we’ve already discussed, the thing that differentiates strategic budgeting from the regular approach is a strong focus on your organizational goals.

So, before you dive into the numbers, ask:

What are our main high-level goals for this financial period?

By the way, this should be more of an exercise of recalling and refocusing on those goals, not creating them (that is, you should have already set them).

3. Assign Budgeting Responsibilities

Now, decide who is going to be responsible for what aspects of budget creation.

For example, you might structure task allocation like this:

- Department heads – Responsible for creating department spend budgets

- CFO – Responsible for building the revenue aspect of the budget

- Founder/CEO – Responsible for approving the entire budget

4. Forecast Incoming Revenue

It’s generally a good idea to start by forecasting how much money you’re expecting to generate in the next year (psst, your cash flow projections are a great resource here).

This should include any funding or loans you’ve already received (if you’re still sitting on some cash) or are expecting to receive in the next year.

You can’t spend more than you have, so your total cash reserves set an upper limit for spending.

5. Estimate Costs

This is the other side of budgeting: expenses.

Start by calculating all of your non-negotiable outgoings. We’re talking expenses like:

- Rent and lease fees

- Wages and salaries

- Software subscriptions

- Taxes

- Interest payments

Then, add in what you might call your “growth spending.”

For example, let’s say one of your organizational goals is to grow new sales revenue by 50%, and part of your plan for doing that is to expand your sales team.

The cost of this team (their wages, as well as any costs associated with hiring, onboarding, and training), are part of your “growth spending.”

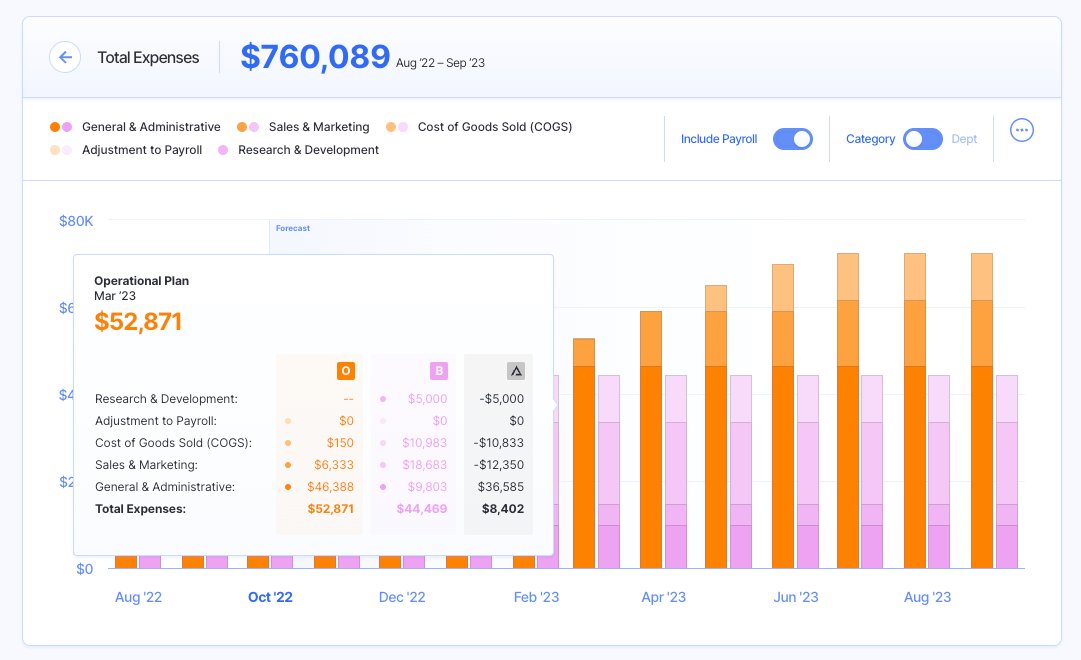

6. Build Multiple Scenarios

The best founders and financial leaders are those who are prepared for several scenarios.

Look, things don’t always go to plan (I mean, do they ever?)

This can extend from really small things, like only being able to hire four new sales reps when your goal was five, to huge economic, legal, and social changes that are out of your control and entirely unpredictable (ahem, pandemic, ahem).

Obviously, you can’t exactly prepare for the latter, but you can engage in a bit of crafty scenario planning to give you an easy Plan B (and C, and D), should things pan out a little differently than planned.

A good starting point is to create three versions of your budget:

- Baseline plan

- Downside plan

- Upside plan

The baseline plan is your budget if everything goes as expected.

Your downside plan looks at what you should do if revenue is down say, 5, 10, or 20% from budget.

Your upside plan does the opposite: it tells you how to allocate all of that extra cash if things go way better than anticipated (that happens too, you know).

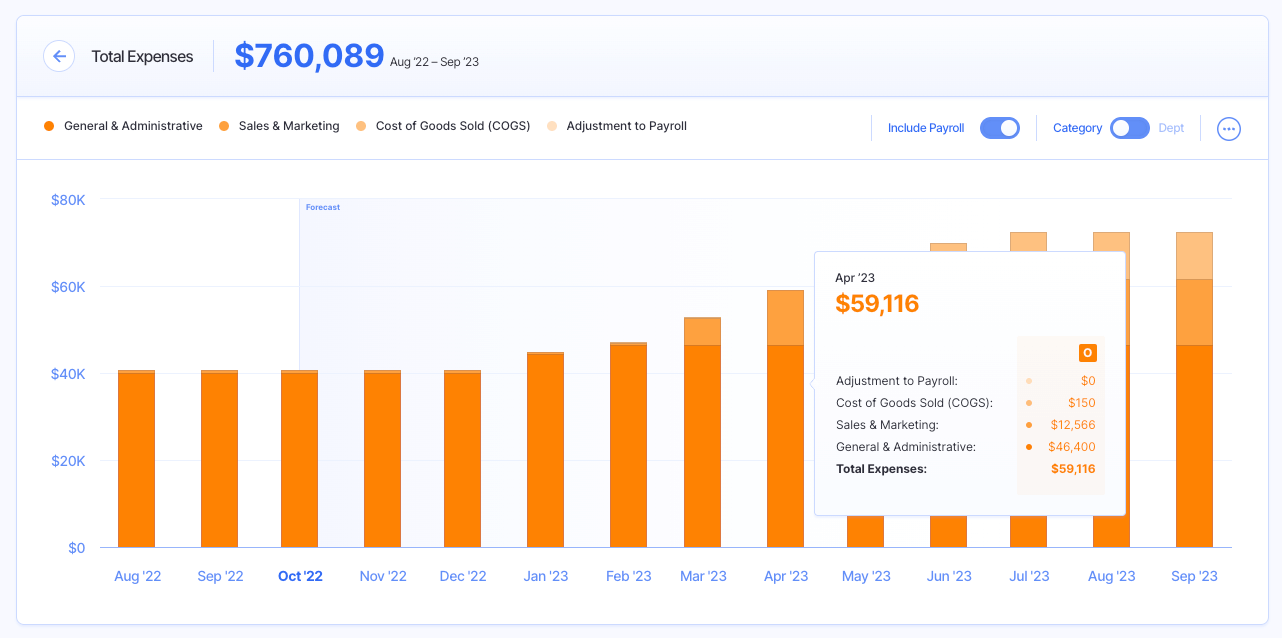

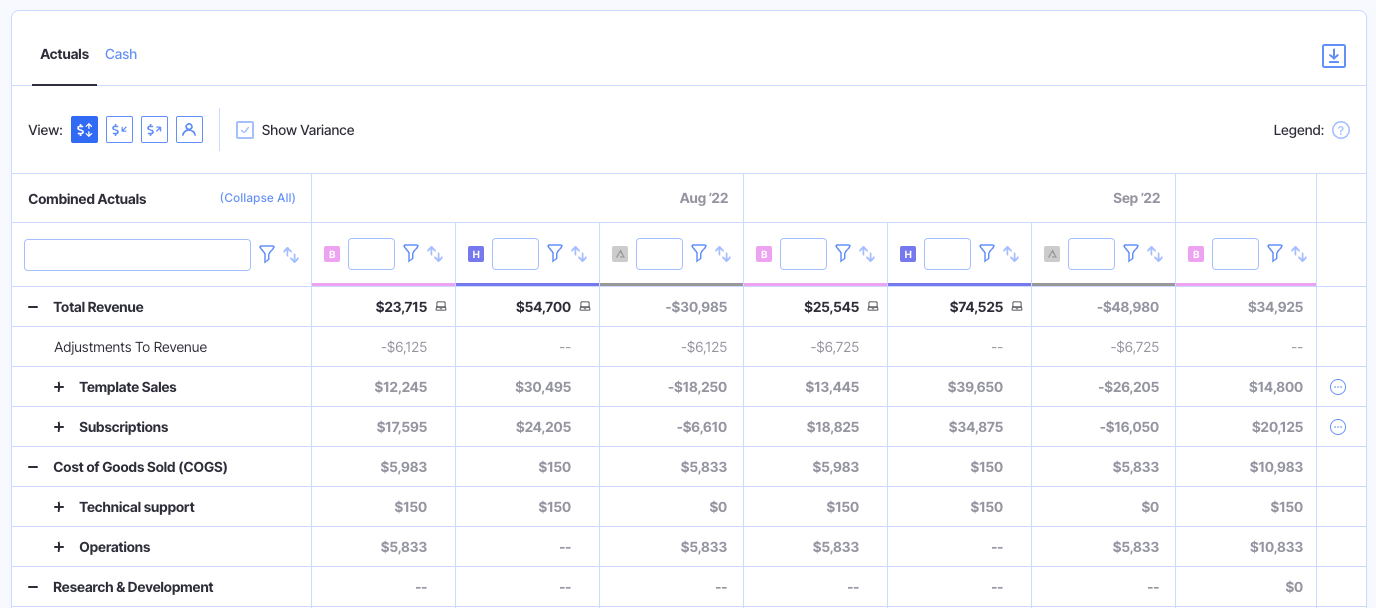

7. Track Actuals Against Budgeted Figures

Strategic budgeting shouldn’t be a set-and-forget affair.

Throughout the month, you should be tracking your actual revenue and expenses against the budget.

This is what tells you if you’re on track (or not), and if you need to activate one of your upside or downside plans.

This step is a process in and of itself. Learn more in our dedicated guide: Budget vs Actuals (How to Compare & Analyze).

8. Design A Plan For Regular Budget Reviews

While you should be tracking actuals constantly, it’s generally a good idea to set aside a specific chunk of time every so often to review your budget, perform a budget variance analysis, and make adjustments where required.

For annual budgets, this process should take place at least quarterly, if not monthly.

More often (so, monthly), is better for newer, more agile businesses, especially if you don’t have a huge history of budgeting (because you’re less likely to be accurate if you don’t have strong historical data to rely on).

Conclusion

You’re probably getting the idea by now that strategic budgeting is about much more than looking in the old bank account and figuring how much you can spend on what this month.

A great strategic budget will help you achieve your financial goals, and provide a way forward even if things don’t go exactly according to plan.

Managing this whole process without a robust financial reporting and forecasting tool is going to be painful, and, to be honest, a bit of a timewaster.

Check out Finmark today, and discover how our intuitive financial platform makes strategic budgeting simple, and helps you with important aspects like scenario analysis and variance reports.

Or jump right in and book a demo with one of our team.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.