Cash Flow From Operating Activities

If there’s one thing you want to have a firm grasp on when it comes to examining your company’s financials, it’s cash flow.

Cash flow is the lifeblood of a business. Cash flows in and out (hopefully more in), and it’s your job to trace, understand, and analyze where it’s coming from and where it’s going.

To nail this responsibility, you’re going to be spending a lot of time poring over the cash flow statement—the financial report that serves as the starting point for cash flow analysis.

In this article, we’re going to look at the first (and arguably most important) part of the cash flow statement:

Cash flow from operating activities.

We’ll explain what it means, how to calculate it, and most importantly, how to interpret and analyze the information you’ll see in front of you.

Note: If you’re new to cash flow statements, start here: How to Read a Cash Flow Statement

What Is Cash Flow From Operating Activities?

Cash flow from operating activities (a.k.a. CFO, operating cash flow, and net cash from operating activities) is a measure of how much money your company brings in for its typical, ongoing business activities.

That is, if your company is an online shoe retailer, then cash flow from operating activities tells you how much cash you’re generating from selling shoes.

To shed a little more light on the distinction, it’s helpful to understand two other kinds of cash flow, which are the following sections on the cash flow statement:

- Cash flow from investing

- Cash flow from financing

Let’s say you just raised a seed round and got a cash injection of $500k. That’s going to be a positive cash flow, but it’s not exactly from your typical day-to-day operating activities.

So, it’s going to show up in your cash flow from financing section, not under cash flow from operating activities.

Learn more about cash flow from financing in our guide: Cash Flow From Financing Activities

On the other hand, let’s say you have a portion of your company’s capital invested in stocks, and you just earned a healthy dividend.

That’s still revenue, but it’s not cash from your regular activities, so this is listed under cash flow from investing.

Learn more about cash flow from investing in our guide: Cash Flow From Investing Activities

Neither of these activities is part of your normal daily business operations, despite them both being cash-earning activities.

Hence, we divide the cash flow statement up into sections to help us dive further into relevant and salient details and to provide an opportunity for analysis.

What Cash Flow from Operating Activities Tells You About Financial Health

The cash flow from operating activities section is used to understand the cash-generating abilities of your company’s core activities, without figures being stored by one-off or anomaly cash injections such as financing.

Put more simply, you’re answering the question: how much cash are we bringing in from the thing our business actually does?

In practice, you want to compare cash flow from operating activities to your company’s net income.

If CFO is regularly higher than net income, then your quality of earnings is high. The opposite is true if CFO is lower than net income. In this case, there is a question as to why that reported income isn’t turning into cash for the company, which warrants further analysis.

Related: Cash Flow Break-Even Point

How To Calculate Cash Flow From Operating Activities

There are multiple ways to calculate cash flow from operating activities. Each method arrives at the same place but highlight different details along the way. These are known as the direct method and the indirect method.

The direct method is, as you probably guessed, a bit simpler.

It itemizes all of the cash received from customers and paid out to suppliers and subtracts the cash out from the cash in.

It’s the most straightforward and direct because it doesn’t account for any non-cash items.

The indirect method for calculating cash flow from operating activities is a little more complex.

It starts with net income as the base and then makes a number of adjustments (cash and non-cash), such as:

- Deducting increases in inventory

- Adding back depreciation expenses

- Considering increases and decreases in accounts payable

As such, the direct method for calculating cash flow is a bit more accurate and representative of the actual cash flowing in and out of the business.

However, it takes a bit of prep work, as the figures you need aren’t found itemized in the income statement like they are for the indirect method.

What Is Included In The Cash Flow From Operating Activities Section?

The cash flow from operating activities section of the cash flow statement is generally pretty straightforward.

It’s the first part of the cash flow statement and begins with your net income for the period.

Then, you’ll break down any adjustments you’ve made to reconcile net income to net cash from operating activities.

Examples of such deductions include:

- Changes in working capital

- Depreciation and amortization

- Loss on sale of equipment

- Changes to inventory

- Changes in current assets and liabilities

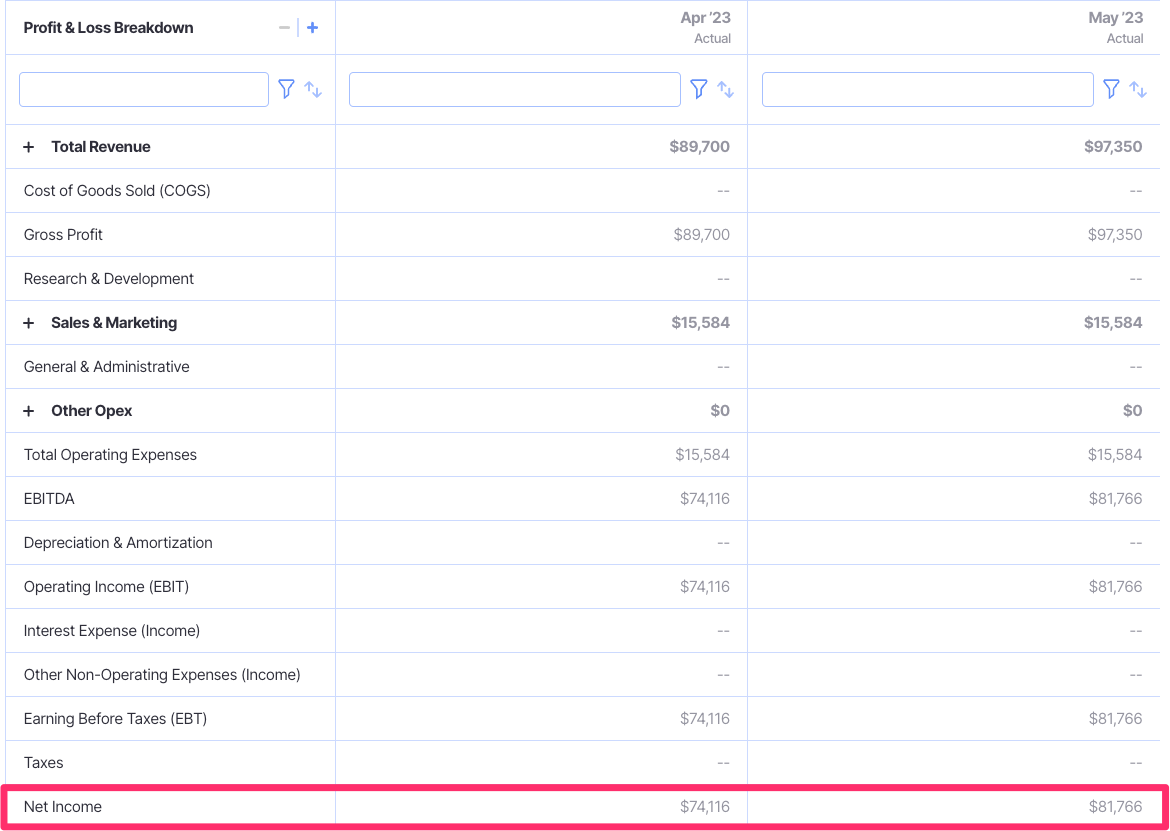

To illustrate further, here’s what a cash flow statement looks like in Finmark from BILL, with the cash flow from operating activities section clearly labeled at the top.

Cash Flow from Operations vs. Net Income: What’s The Difference?

It’s often the case that financial terms get confused and misused, and that’s certainly true of these two financial measures: cash flow from operations and net income.

They are distinct measures, however, and you’ll use one to calculate the other.

Net income comes from the bottom of the income statement and provides the basis for the creation of the cash flow statement. That means you’re going to use net income to calculate cash flow from operations.

Because the income statement uses accrual-based accounting (where revenue is recognized when a product or service is delivered and invoiced, not when the cash is actually received), you need to make some adjustments in order to make the cash flow statement about actual cash.

So, you’ll need to make adjustments to net income by adding back non-cash expenses like depreciation or adjusting for changes in accounts receivable where the cash hasn’t actually been received yet.

Cash Flow vs. EBITDA: What’s The Difference?

These two metrics share a common ground, but they differ based on which ledger accounts are included.

Cash flow considers all revenue expenses entering and exiting the business (cash flowing in and out).

EBITDA is similar, but it doesn’t take into account interest, taxes, depreciation, or amortization (hence the name: Earnings Before Interest, Taxes, Depreciation, and Amortization).

Cash flow is more commonly used by businesses on a day-to-day basis to understand the financial health of their company. EBITDA is more useful for comparing financial performance between companies, as it allows you to compare businesses using different accounting methods.

Learn more about the difference between cash flow and EBITDA in our guide: Cash Flow vs. EBITDA: What’s The Difference?

Keep On Top Of Cash Flow From Operating Activities

At this point, it should be pretty clear that having a firm grasp on cash flow from operating activities is critical for anyone in charge of company finances.

The problem is, calculating this financial metric can be a painfully slow activity if you’re starting from scratch every time.

That’s why the best financial leaders track, manage, and analyze their cash flow statements in a unified finance platform.

Let us introduce you to Finmark, the financial modeling and planning platform for startups and SMBs.

With Finmark, you can integrate your various accounting and finance tools to quickly pull together timely cash flow statements, then spend time on what really matters: analyzing the results.

Dive into Finmark today with a free 30-day trial.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.