Cash Flow vs. Working Capital: What’s The Difference?

The world of finance is full of industry terminology, acronyms, and jargon that, for many business owners, can be tough to get your head around.

Cash flow and working capital are two such examples, and are often mistaken for the same thing or used as synonyms.

While working capital and cash flow have some similarities, they are different measures of financial health and, therefore, should be used together to gain a more holistic picture of how your company is operating.

In this guide, we’ll explore the differences between cash flow and working capital, where to find them on your financial statements, and how to use the two metrics to quantify organizational progress.

What’s The Difference Between Cash Flow vs. Working Capital?

Both cash flow and working capital are measures of the financial health of a company.

Whereas working capital speaks to a company’s ability to repay its short-term debt obligations, cash flow is a periodic measurement of how much money is entering and exiting a business.

What is Cash Flow?

Cash flow is one of those rare terms that is actually pretty self-explanatory. It is simply a measure of cash flowing in and out of your business, typically viewed on a monthly basis.

To calculate cash flow, you take the total amount of revenue that came into your business for the month, and subtract your total expenses for that same period.

The result can be either positive or negative.

That is, if you spent more than you earned for the period, you’ll have negative cash flow.

On the other hand, if you managed to keep expenses under control, and your total expenditure for the month came in under the amount of cash that flowed into your company, then you’ll be cash flow positive.

Cash flow as a metric is typically considered in conjunction with a cash flow ratio. There are three different ratios finance professionals use here:

- Cash ratio: (Cash + cash equivalents) / current liabilities

- Quick ratio: (Cash + cash equivalents + accounts receivable) / current liabilities

- Current ratio: (Cash + cash equivalents + accounts receivable + inventory) / current liabilities

Quick side note: cash equivalents include assets like short-term government bonds, market securities, and certificates of deposit.

All three are measures of how quickly the cash you have on hand (and other current assets like accounts receivable) can be used to pay off your current liabilities.

Where is Cash Flow Found On Financial Statements?

Cash flow is such an important measure of financial success that it has its own report, known as the cash flow statement.

Learn more about cash flow statements and how to use them in practice in our guide: What is a Cash Flow Statement & How Do You Make One?

What Does Cash Flow Tell You About Your Business?

Cash flow tells you important information about your company’s ability to generate and retain cash.

A single cash flow statement tells you about revenue and expenses for the previous month, but what’s really important is to view this data in the context of trends.

For instance, what you’re ideally aiming for is an increase in positive cash flow over time.

That is, you’re cash flow positive every month, and each successive cash flow statement shows that you’re increasing revenue more than you’re increasing expenses.

It’s critical, however, to review cash flow within the context of your business age and stage.

For instance, an early-stage company that is pre-revenue might be in negative cash flow for several months.

While negative cash flow is generally undesirable, it’s common in a company with strong VC backing but without any revenue flowing in from customers (because it’s focused purely on product development).

So, when reviewing your own organization’s cash flow reports, make sure you’re considering changes within context. Learn how in our article: How to Do Cash Flow Analysis: Step-By-Step Guide.

What is Working Capital?

Working capital is a measure of financial liquidity. It is simply the difference between your current assets and your current liabilities.

It’s a good practice to keep your working capital in the positive, that is, where your current assets are higher than your current liabilities.

This means that you would have the ability to repay all of your current liabilities more or less immediately (depending on the liquidity of your current assets).

Working capital can also be viewed in conjunction with another metric called the working capital ratio (current assets / liabilities).

For instance, if your current assets total $20,000, and your current liabilities add up to $10,000, then you have a 2:1 working capital ratio, meaning you could pay your current liabilities twice over and not run out of cash.

Where is Working Capital Found On Financial Statements?

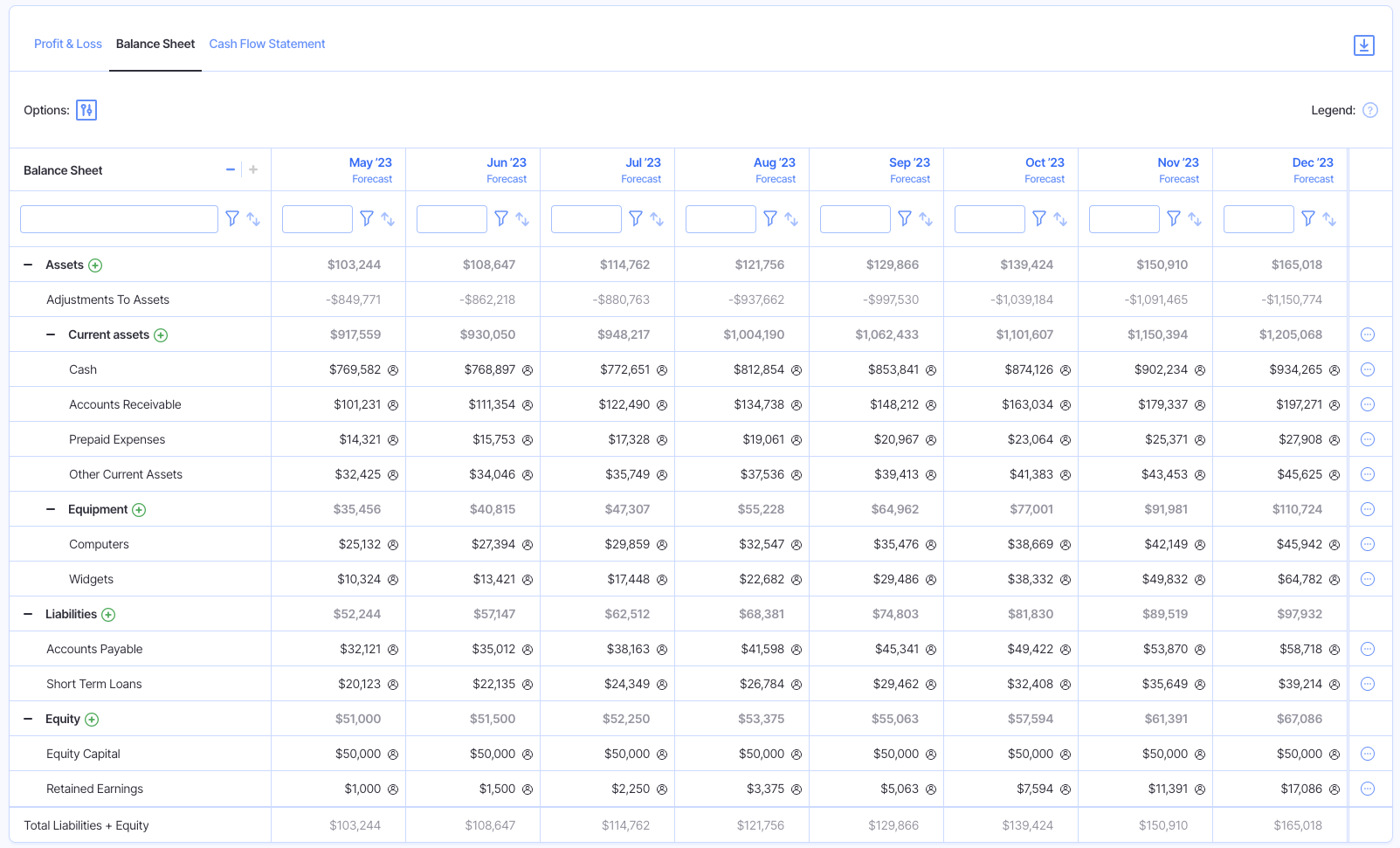

Working capital itself is not typically included on financial statements. However, the information required to calculate it (current assets and current liabilities) is located on the balance sheet.

What Does Working Capital Tell You About Your Business?

Working capital is used to measure the short-term financial health and liquidity of your business.

In particular, it looks at your company’s ability to repay its short-term debt obligations (such as credit card repayments due).

If your current assets don’t exceed your current liabilities (and you have a negative working capital), this signals that you may have trouble repaying your debts in the near future.

In such cases, you may need to look into solutions such as refinancing to convert some of your short-term liabilities into longer-term obligations.

We should note here that while working capital is a valuable metric, it does have its limitations as a measure of liquidity.

The most important of these limitations is the fact that working capital doesn’t consider the specific types of assets or liabilities, nor their underlying due dates.

Say, for example, that you have $2,000 in cash on hand and $22,000 in accounts receivable, totaling $24,000 in current assets.

On the liabilities side, you have just $8,000 in accounts payable. Here, you have positive working capital.

But what if your customers are late in paying, or if their invoices are due after the due dates for your $8,000 in accounts payable?

In this case, while you’re technically fine from a working capital standpoint, you may still struggle to repay your most urgently repayable debts.

Hence, working capital measurements should be monitored in conjunction with the cash flow statement.

Using Cash Flow and Working Capital Together

While cash flow and working capital are two distinct metrics, they certainly aren’t independent of one another.

After all, working capital is intricately concerned with current assets, the most important of which is cash on hand, which clearly has its roots in cash flow.

That means that in practice, you should be monitoring both metrics in conjunction.

As revenue is earned and expenses are paid for, you’re going to see a cycle between cash flow and working capital.

Revenue is earned from customers (which represents a positive cash flow, but no change in current assets as accounts receivable simply converts to cash on hand).

Then, that cash is used to pay down the accounts payable. This creates a negative cash flow and a reduction in both current assets and current liabilities, meaning there is no net change in working capital.

In some transactions, only one metric will change.

Consider, for example, what would happen if your company took out a loan to finance a new capital investment.

This would have an impact on cash flow (as money flows in and out of the business), but not on working capital, as the loan is a long-term liability, and the subsequent purchase is a non-current asset, neither of which are considered in the working capital calculation.

For everyday monitoring of financial health, cash flow is generally the more important metric.

While working capital gives you a sense of your ability to pay down debts, changes in working capital are typically of more interest in the context of end-of-year financial reporting.

As a business owner or finance leader, your time should be spent not on dredging up data to build out financial reports, but on analyzing these statements and pulling out important insights.

With Finmark from BILL, you can quickly calculate your working capital in our integrated balance sheet, or keep an eye on cash flow with a real-time cash flow statement.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.