What is a Cash Flow Statement & How Do You Make One?

For small businesses, the old saying “cash is king” should really be “cash flow is king.”

In an Intuit survey of SMB owners, 61% responded that they struggle with cash flow. A surprising 69% responded that they have been kept up at night with concerns about their cash flow status.

The first step to solving cash flow problems is understanding your cash flow and there is no better starting point than cash flow statements.

But what exactly are they and what’s included? We’ve got all the information you need to start generating cash flow statements today.

What Is a Cash Flow Statement?

A cash flow statement is a financial report that shows how money enters and exits the business.

The two main financial statements (income statement and balance sheet) both show a segment of cash activity. Cash flow statements bridge information from the two to show the complete picture. Together, they are the 3 essential financial reports for businesses.

For example, an early stage business could show a $10,000 loss on its income statement in a month. But if in that month the business also secured a $100,000 investment (which shows up on the balance sheet), the business is cash positive.

Similarly, a business that records a $1,000 profit but makes a $5,000 payment towards a loan (on the balance sheet) is cash negative.

By combining the information on the two statements, you get the full picture of how cash moves through the business. This lets you manage cash flow with exact numbers, not just best guesses or hunches.

How To Calculate Cash Flow

There are two methods of calculating cash flow.

Direct cash flow includes all activity when cash actually changes hands. It’s favored by small businesses or organizations using the cash basis method of accounting because of its simplicity.

The easiest way to calculate cash flow using the direct method is to look at the changes in balances on the balance sheet. An increase in assets and liabilities means cash is coming into the business while decreasing assets and liabilities means cash moving out.

Indirect cash flow is more complicated. You start with the activity on the income statement and make adjustments for non-cash activity that impacts the net income.

For example, depreciation doesn’t represent cash moving out of the business. If it’s included on the income statement, it needs to be adjusted for.

While the indirect method is more complicated and requires more steps, it pays off by being a clearer breakdown. It’s also made much easier if you have a prebuilt cash flow statement that updates in real time.

Which Method Of Cash Flow Is Right For You?

There is no one-size-fits-all methodology when it comes to cash flow.

For businesses that use the cash basis accounting method, the direct cash flow method is typically enough. This is because the business is likely not tracking much non-cash activity to begin with.

As a business grows and its financial reporting becomes more nuanced, the value of the indirect method increases. Simply put, the more information you’re trying to stay on top of, the more you benefit from the indirect method of cash flow reporting.

Still unsure which is right for you? It’s worth creating a cash flow statement using each methodology to gauge how much extra work it takes and whether the value add is worth it.

What Does A Cash Flow Statement Include

A cash flow statement is broken down into three sections. Each section looks at a particular area of the business cash moves in and out from.

Learn more: How to Read a Cash Flow Statement

Cash From Operating Activities

Operating activities is the cash that flows through the business as part of its day-to-day operations. This includes cash earned from sales or spent on expenses.

The starting point for cash from operating activities is the net income reported on your income statement. Then, depending on if you use cash or accrual basis and the direct or indirect method, you adjust so it only includes cash activity.

Possible adjustments to be made when using the indirect method include depreciation, uncollected sales (accounts receivable), and inventory.

Examples:

- Sales revenue

- Rent

- Salaries and wages

- Utilities

- Interest expenses

Cash From Financing Activities

Financing activities include any debt the business tends to or acquires.

When a business takes on debt, cash flows into the business. When it pays down the debt, cash flows out of the business.

Only the principal portion of debt payments are included. The interest expenses are considered an operational expense and included in operating activity.

Debt isn’t restricted just to anything owed to financial institutions. Financing activity includes debt to be paid back to shareholders or dividends owed to investors.

Examples:

- Loans

- Lines of credit

- Mortgages

- Equipment financing

Cash From Investing Activities

Investing activities is when the business purchases or sells long-term assets that change in value. This includes physical assets, stock, and capital expenditures.

A business typically experiences negative cash flow from investing activities when they are investing in their long-term future. For instance, a delivery service buying new vehicles or an online seller investing in a brick and mortar location.

Positive cash flow from investing activities can indicate the business is selling stock or has sold some of its previously purchased assets.

Examples:

- Purchase or sale of property, plant, and equipment (PP&E)

- Sale of stocks or other securities

- Purchase of patents or trademarks

Cash Flow Statement Example

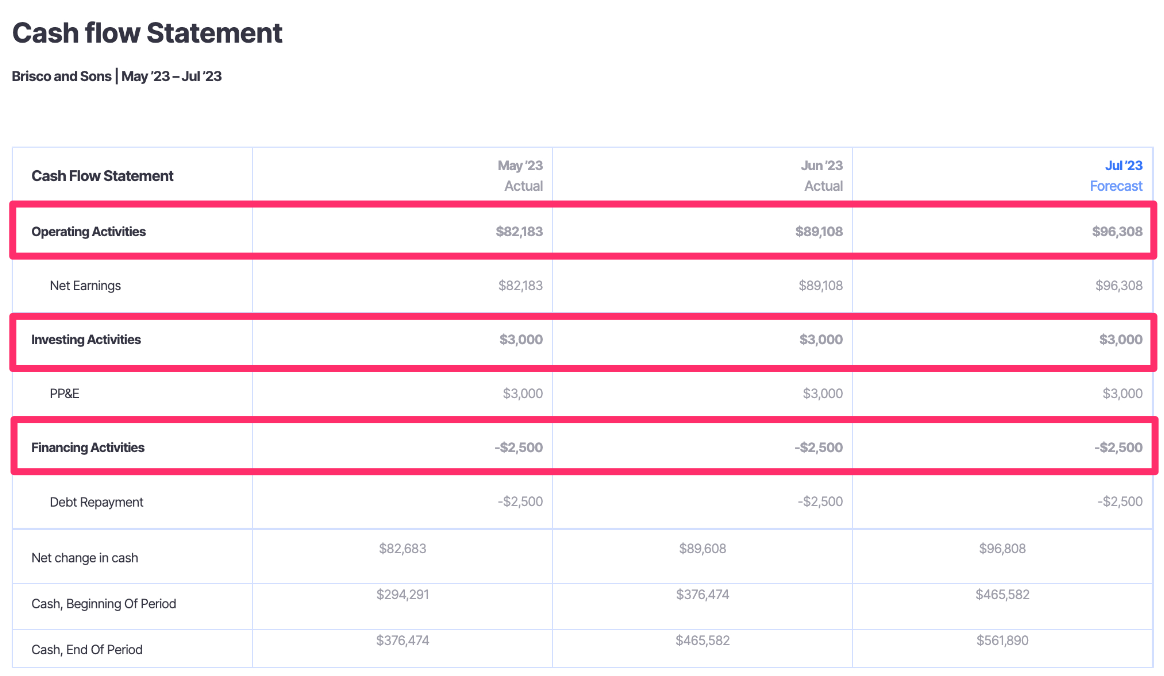

Before you do any cash flow analysis, you need to generate a cash flow statement. Let’s show how with an example.

Mike’s Sound Equipment is generating a cash flow statement for all activity in 2022, their first year in operation. They’ve opted to use the indirect method.

Cash From Operating Activities

The income statement showed a net profit of $100,000. However, $10,000 is unpaid accounts receivable and their accountant helped them calculate $5,000 in depreciation expenses.

The net cash from operating activities is $95,000 ($100,000 – $10,000 + $5,000).

They subtract $10,000 from the net income because it’s uncollected, thus the cash hasn’t entered the business yet. $5,000 gets added back to the amount because, while recorded as an expense that reduces net income, depreciation is not cash activity.

Cash From Financing Activities

Mike’s Sound Equipment secured an SBA loan of $50,000 to cover their initial setup costs. Over the course of the year, they’ve paid down $10,000 of the loan principal.

The net cash from financing activities is $40,000 ($50,000 – $10,000).

Cash From Investing Activity

For the first year, Mike’s Sound Equipment needed to purchase a delivery van to get their products out to local venues. They were able to purchase a van for $30,000. At the end of the year, they decided they needed a bigger van and sold their old one for $25,000.

Mike’s Sound Equipment also kicked off the year with an initial $10,000 investment from one of the owners in exchange for stock.

The net cash from investing activity is $5,000 ($10,000 – $30,000 + $25,000).

The Finalized Cash Flow Statement

Mike’s Sound Equipment’s cash flow statement ends up looking like this:

Mike’s Sound Equipment

Cash Flow Statement

For the Year Ended December 31, 2022

Operating Activities:

Net Income: $100,000

Depreciation Expense: $5,000

Change in Accounts Receivable: ($10,000)

Net Cash From Operating Activities: $95,000

Financing Activities:

SBA Loan: $40,000

Net Cash From Financing Activities: $40,000

Investing Activity:

Stock: $10,000

Change in Property, Plant, and Equipment: ($5,000)

Net Cash From Investing Activity: $5,000

Beginning Cash Balance: $0

End Cash Balance: $140,000

As you can see, the net income number did not accurately reflect how much cash has entered the business.

By incorporating information found on the balance sheet (loans, physical assets, and equity), the business gets a clearer picture of why their cash balance is what it is.

Create Your Cash Flow Statement Today

Monitoring and understanding your cash flow gives you the clearest picture of how money is moving through your business. It gives you the story behind the balance in your bank account.

Generating a cash flow statement takes time and some critical thinking. But if you use a cash flow report that updates with real-time data, you always have the information you need when you need it.

Enter Finmark from BILL. Our platform lets you customize your cash flow statement with sub-headings and choices of what to include so it has the utmost value to you. With integrations to QuickBooks, Xero, Wave, and more, you can plug-in your accounting software to create and update your cash flow statement even faster.

Get started with a free 30-day trial.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.