How to Do Cash Flow Analysis: Step-By-Step Guide

The cash flow statement can tell you a lot about the financial health of the business. In fact, 82% of small businesses fail due to cash flow mismanagement, according to a study done by U.S. Bank.

Understanding the inflow and outflow of cash to your business can help you determine if you’ll have enough on hand to meet your short-term liabilities, and how much you’ll have leftover once all obligations are taken care of.

Clearly, running out of cash is a massive risk that many businesses face. So, finance teams can’t overlook the importance of not only creating cash flow statements regularly, but knowing how to analyze these figures and what they can reveal about your business.

Continue reading through this guide as we briefly review why cash flow analysis is so vital to your business’s ongoing success, and provide you with detailed steps on how to execute this process for your organization.

What Is Cash Flow Analysis & What Information Does It Provide?

Before we cover how to do a cash flow analysis, let’s first touch on why this can be so beneficial for finance teams and startup founders alike.

At the basic level, the cash flow of your business shows the net balance of cash after accounting for all inflows and outflows during a certain period of time–like a month, quarter, or year.

So, using historical data, you can use a simple set of calculations to see what your cash flow was during a given period

Net cash flow = Net cash receipts – Net cash payments

However, a full cash flow analysis is a bit more involved and provides you with useful information to help you make informed business decisions for the future.

Cash flow analysis will give you a way to assess the sources and uses of cash in your business, and determine if you have enough money coming in to cover short-term obligations like paying your employees, replenishing your inventory, and any other uses of cash you may have.

In fact, you may find that cash flow analysis is a better indicator of profitability compared to the P&L Statement, as it shows the actual cash that a business has on hand at a given point in time to support its operations and fuel sustainable growth.

Related: How to Create a Cash Flow Projection

How to Do a Cash Flow Analysis: Step-by-Step Guide

Considering the insights you can gain from cash flow analysis, running through this process on a regular basis–like monthly or quarterly–should be the norm for your business.

This will allow you to identify any potential cash squeezes or surpluses in advance so you can make wise business decisions accordingly.

Follow through the steps below when you’re ready to complete a cash flow analysis for your company.

Step 1: Understand the Basics

To begin a cash flow analysis, you’ll need to start with the basic cash flow statement to understand all the possible uses and sources of cash for a business.

As a finance professional, you likely already know the main elements that make up the cash flow statement. But as a quick reminder to ensure we’re all on the same page before diving deeper into the analysis, let’s briefly break down the three core aspects of the cash flow statement:

- Cash from operating activities: the net cash provided/used by the core operating activities of the business, like the sale of goods or services

-

- Sources: cash received from customers

-

- Uses: recurring expenses that support operating activities like salaries, utilities, and supplies

- Cash for investing activities: the net cash provided/used on fixed assets and long-term investments

-

- Sources: sale of an investment security or fixed asset

-

- Uses: purchase of fixed assets or investment securities

- Cash from financial activities: the net cash provided/used by investors, owners, and creditors

-

- Sources: receiving loans/debt or issuing stocks/equity

-

- Uses: debt repayments, stock buybacks, and dividends

Step 2: Identity All Sources of Cash

Once you’re ready to hit the ground running with your cash flow analysis, you’ll first need to identify the cash inflows that your business receives during a given period.

As we briefly discussed above, the sources of cash in a business go beyond the revenue that is generated from the sale of goods and services and reported on the income statement.

For instance, when you’re looking at a P&L Statement, the sale of a fixed asset like a piece of machinery wouldn’t be considered income. But, this sale does provide your business with extra cash that you can use to cover current expenses, which is important to our analysis.

Therefore, cash receivables can also come from:

- Selling property, plant & equipment

- Exiting an investment

- Issuing equity

So, you will consider all the sources of cash in this process, not just the revenue that’s generated from customer sales.

If you’re using accounting or financial software, it can likely calculate the total cash inflow from operating, investing, and financing activities for you automatically–something Finmark, from BILL users enjoy!

Step 3: Identify All Uses of Cash

Similarly, you’ll need to identify all the cash that’s flowing out of your business during the same timeframe in order to build your cash flow statement and perform your analysis.

Look for uses of cash like:

- Purchasing inventory

- Rent and utility payments

- Loan repayments

This will likely differ from the expense figure that is recorded on the P&L Statement, as there are other uses of cash by a business that can reduce the amount of cash on hand.

As an example, purchasing a fixed asset isn’t considered an expense on the P&L Statement, though this can drastically reduce the amount of capital that a company has available for use during a given period.

Additionally, liabilities a company incurs during a given time will not be considered in the cash flow statement because it doesn’t actually involve a cash outflow until the transaction is made.

Like with the cash inflows, tallying up your total cash outflows is likely something your accounting software can do.

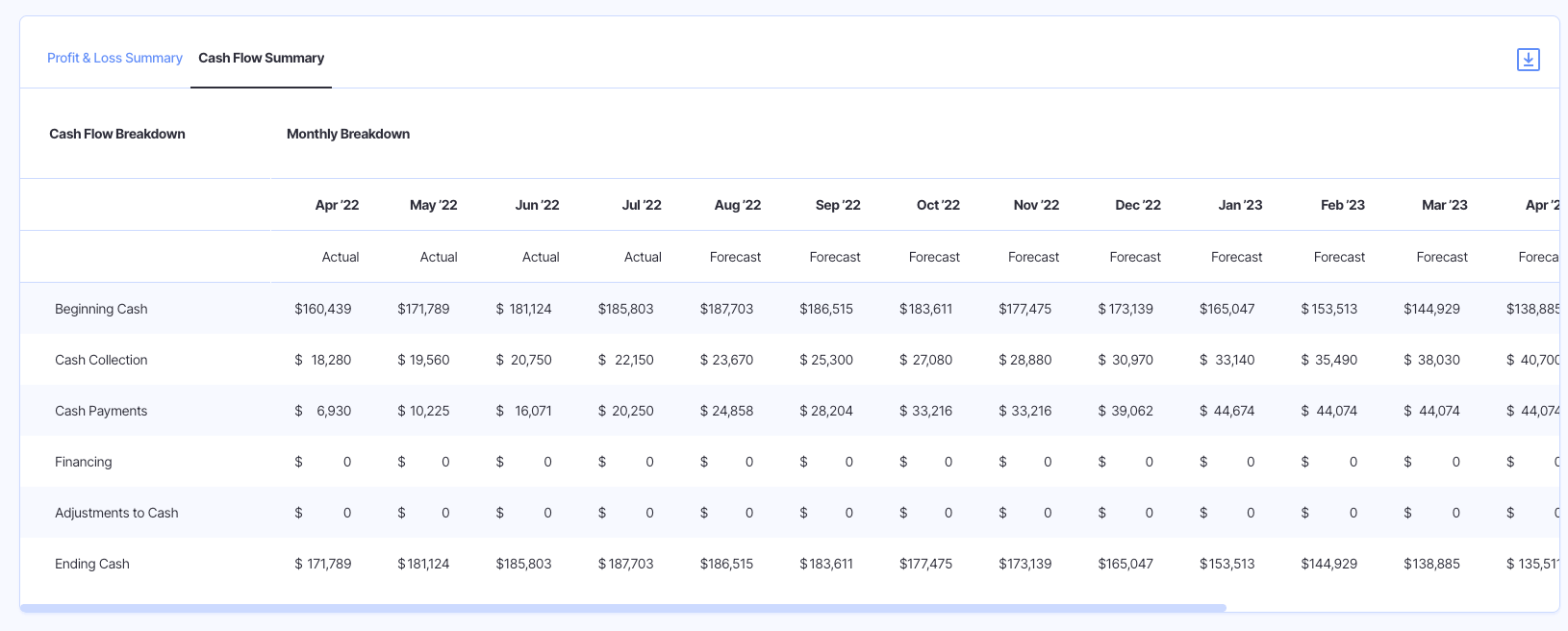

Step 4: Build Your Cash Flow Statement

After you’ve compiled all the possible uses and sources of cash for your business during a given time, you’re ready to build out your cash flow statement and prepare for analysis.

Oftentimes, this is something your accounting software can generate automatically for you, though there are a number of free templates out there that can help you if you’re creating them manually.

This will give you the net cash provided by or used in each of the categories of activities–operating, investing, and financing–by summing up the total cash inflows, then subtracting the total cash outflows for each.

Sum these totals together to get the total change in your cash balance during this time. When added to your starting cash balance for the period, this value will show how much you’ll have left on hand at the end of the period.

In a sense, your cash flow statement may look something like this:

Cash flows from operating activities…………………. $XX

Cash flows from investing activities…………………. XX

Cash flows from financing activities…………………. XX

Net increase (decrease) in cash…………….. XX

Beginning cash balance……………………………… XX

Closing cash balance………………………………….. XX

Step 5: Analysis of Your Cash Flow Statement

Now that you’ve compiled all the relevant financial data and built your cash flow statement, you can analyze it for insights into the financial health of your business.

Each company will have its own purpose for analyzing cash flows given its unique financial situation, goals, and size. However, analysis of some sort can be very helpful in preparing for future quarters, seasonality, economic downturns, and more.

It’s important to point out that what your net cash flow tells you is different than what you can gather from analyzing the operating profit from your income statement.

At the basic level, your business should aim for a positive net cash flow. This means that you ended the period with more cash on hand than you started with, which many see as a good indicator that your business is self-sufficient and able to support sustainable growth.

The following are some of the other ways that you can analyze your cash flow statement to gain business insights.

Investigate Positive Cash Flows

While a positive cash flow is a good indicator of a healthy business on the surface, you should investigate further to understand what the main sources of cash are for a better picture of the business’s financial health.

For instance, if your business is continually selling off assets to support business operations, this likely isn’t sustainable, even if it makes the net cash flow positive for the period. Therefore, bringing in money just for the sake of it to create a positive cash flow isn’t always the goal.

Companies that are more established may find that their cash inflows are largely provided by sales to customers, which is a good indication that the positive cash flow value is a reliable marker that their business is self-sufficient.

Dive Deeper into Negative Cash Flows

Similarly, a period with negative cash flow isn’t always a warning flag, as your business could have recently made a number of large investments in property or equipment that depleted the cash balance momentarily, but will support future growth.

This is especially true for early-stage companies that are making a lot of upfront investments before seeing meaningful sales growth and cash inflows. So, experiencing negative cash flows may be required at certain times, which is something most companies can endure in the short term.

On the other hand, companies may find through their analysis that their cash outflows are indicating a deeper problem that needs to be addressed, like if they’re consistently purchasing more inventory than they can sell or if rent and utility payments are skyrocketing.

Calculate Free Cash Flow (FCF)

Another way to analyze the cash flow of a business is with a free cash flow calculation. The FCF value can be a good measure of profitability because it shows how much cash your business has left after paying for operating and capital expenses.

FCF = Net cash from operating activities – Capital expenditures

This leftover cash can then be spent on other things to grow and add value to the business. So in general, the more FCF that a business generates, the better.

However, similar to what we discussed above, companies that are just getting started may not generate a significant amount of FCF until they’re more established, and the number may even be negative. But, this may not be a sign of a faltering business until it becomes persistent over the long term.

Assess Your Debt Coverage Service Ratio (DCSR)

Calculating your DCSR is a good way to tell if a business that is generally profitable could become illiquid and unable to cover short-term liabilities.

DCSR = Net operating income / Short-term liabilities

Short-term liabilities = a financial obligation that must be paid within the next year

In other words, it will show you how much cash is tied up in outstanding accounts receivables, unsold inventory, etc.

What’s considered a good DSCR will be different for each company given their industry and stage of growth, though the general consensus is that a ratio over 1.25 is ‘strong’ and a ratio below 1.00 is a sign of financial challenge, according to Investopedia.

With this in mind, it’s more acceptable for a newer company to have a lower DCSR than a more mature business.

Start Analyzing Your Cash Flow with Efficiency

Overall, analyzing the cash flow statement helps finance teams manage the inflow and outflow of cash with better accuracy and efficiency. This ensures that the organization will have enough capital to continue operations and grow the business while remaining self-sufficient.

But–there are other aspects of financial reporting and analysis that you can employ to get a complete snapshot of your company’s financial health and future preparedness.

When you have an intuitive financial planning platform like Finmark in your toolkit, your team is better equipped to create and analyze a wide range of financial reports, statements, estimates, and more. Try Finmark for free to see how we can transform your financial planning experience.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.