Direct Method Cash Flow Statement: How & When to Use It

Business leaders monitor their cash flows to make investment decisions, make sure they’ll meet short-term cash obligations, and assess their overall financial health.

But, finance managers can take some discretion when it comes to calculating their cash flow statements.

There are two methods for building cash flow statements–either the direct or indirect method.

The direct method may not be the most common option among businesses, but it can provide some unique insights that certain organizations find valuable.

Throughout this article, we will dive deeper into direct method cash flow statements, explaining when you’d use this method, what its advantages and disadvantages are, and how to apply it in a real-world scenario.

What is the Direct Method to Create a Cash Flow Statement?

A cash flow statement is made up of three parts:

- Cash flows from operating activities

- Cash flows from investing activities

- Cash flows from financing activities

As we briefly mentioned above, there are two methods businesses can take to build their cash flow statements–the direct or indirect method.

However, these different methods are only applied to the operating activities section of the cash flow statement. In either method, the other two sections–cash flows from investing activities and cash flows from financing activities–are produced in the same way.

The direct method is sometimes called the income statement method. It builds the operating section of the cash flow statement directly using each of the cash inflows and outflows from a business’s operations during a given period.

Put differently, this method is based on all of the transactions that directly impacted the business’s cash balance.

This means a cash inflow from a customer sale is recorded when the actual payment is received, not necessarily when the sale is initially made or “earned” under accrual accounting standards.

On the other hand, a cash outflow, like paying suppliers, is only recorded once the business makes the payment, not when the bill is received or the services are rendered beforehand.

Netting these inflows and outflows will result in the operating cash flow produced or used by the company during a specific period under the direct method.

When is the Direct Method Used?

Since there are two different methods for calculating the operating cash flow for a business, let’s clarify why a company would choose to use the direct method over the indirect method.

The direct cash flow method is based on cash accounting principles, not accrual. Thus, this method is best used by companies that want cash-based accounting reports for decision-making purposes.

Most companies operate with accrual accounting practices, meaning that the direct method is not as commonly utilized.

However, the direct method for building the operating cash flow section may offer more detail and insights into a company’s operations. But, it can be a bit more tedious and time-consuming to produce. Because of this, it’s more common for small businesses with fewer transactions to parse through.

Either way, management teams have a choice of which method to use based on their unique circumstances and needs.

We will further explore these advantages and disadvantages in more detail below. For now, let’s see how building a direct method cash flow statement works in practice.

How to Build a Direct Method Cash Flow Statement

Here is a basic structure for creating a direct method cash flow statement:

+ Cash Inflows from Operating Activities

– Cash Outflows from Operating Activities

= Net Cash from Operating Activities

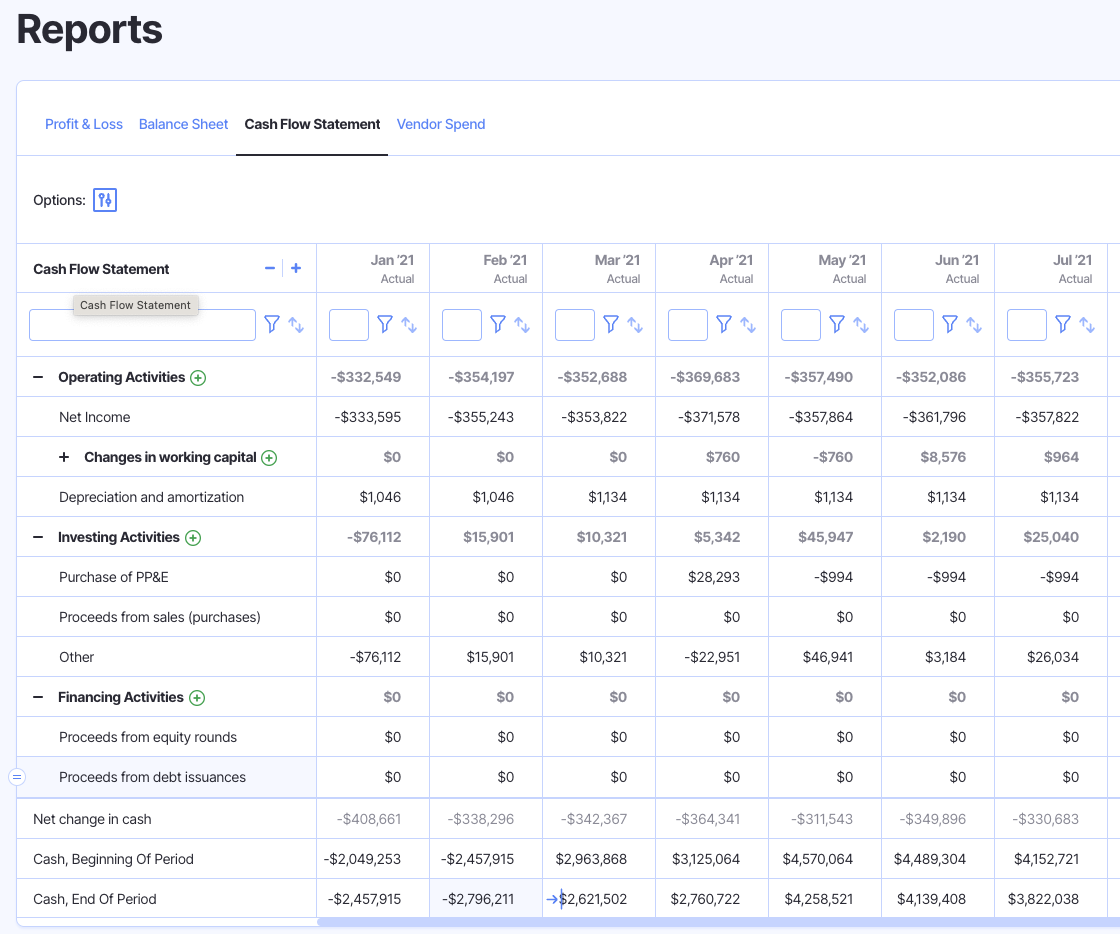

You can use a helpful financial planning tool like Finmark from BILL to easily build a direct method cash flow statement and customize it for your business’s needs

If you’re producing a direct method cash flow statement by hand, you’ll need to go through all of your transactions for the period to determine whether it was a cash inflow or outflow, resulting in your net cash flow for operating activities.

Let’s take a more detailed view of how this looks in practice.

Step 1: Sum Up All Cash Inflows from Operating Activities

First, you will need to identify each of the cash inflows generated from your operations during the period.

This will typically be made up of the actual cash you received from customers for the sale of goods or services–not accrued revenues. This includes any amount that customers pay off on accounts receivable as well.

Sum up each of these transactions to get your total cash inflows generated from operating activities.

Step 2: Sum Up All Cash Outflows from Operating Activities

Once you have summed up all your cash inflows for the period, you will move on to the cash outflows.

Record any transactions related to your operations that detracted from the cash balance. This will include anything you paid to suppliers during the period, the amount of accounts payable that you paid off, and any other operating expenses that resulted in a cash outflow.

In this calculation, also include any cash payments for interest or taxes.

Again, don’t include any expenses that were simply incurred during the period. You should only focus on actual cash transactions.

Step 3: Calculate the Operating Cash Flow

By subtracting your total cash outflows for the period from your total cash inflows, you will be left with your net cash flow from operating activities.

This figure can then be included with the other sections–net cash flow from investing activities and net cash flow from financing activities–to calculate your total net cash flow for the period.

Advantages of the Direct Method Cash Flow

While it’s not as common, there are some advantages to using the direct method to calculate cash flows.

Better Accuracy

The direct method of building a cash flow statement can give businesses a more accurate view of the actual cash that came in and out of their account during a given period.

Since direct method cash flow statements are built directly from the cash-based transactions that occurred during the period, you can get a more accurate calculation of your total cash inflows and outflows for the period.

This is because you did not indirectly back into these values, but calculated them directly using each individual transaction.

Deeper Insights

Some teams like the granularity and transparency that the direct method can provide them with.

By taking into account each individual outflow or inflow, businesses can see exactly what activities are driving cash flows for their organization, and where exactly their cash is being spent.

This level of detail can help them make more informed decisions and discover what specific areas of their operations should be improved for better cash flows.

Disadvantages of the Direct Method Cash Flow

Despite the advantages, there are a few main disadvantages to the direct method of building cash flow statements.

Complex & Time-Consuming Process

The primary factor that deters many organizations from using the direct method is that it is a tedious and complex process.

Each cash inflow and outflow must be individually documented and accounted for, which isn’t always an efficient use of your finance team’s time. It also requires the preparer to consider any expenses that are recorded under an accrual basis but haven’t actually been paid out yet.

There could be serious implications on a business’s financial health and future planning if transactions are missed and the operating cash flow is calculated incorrectly.

Plus, as we already discussed, companies may have to produce an indirect method cash flow statement to meet certain reporting requirements. This only adds more time and work to the finance team if they need to prepare both methods.

Harder to Scale

In some instances, it may be simple to produce a direct method cash flow statement for a smaller organization. But, as a company grows, becomes more complex, and makes more transactions, it can be harder to keep track of all cash inflows and outflows with as much detail.

Thus, the direct cash flow method is not typically something that large corporations utilize.

Wrapping up Our Discussion on Direct Method Cash Flow Statements

The three main financial statements can tell you a lot about your operations, and help you make future planning decisions and projections.

Specifically with direct method cash flow statements, you can get a real-time view of how your cash balance is changing, and the amount of cash that’s actually on hand at a given time.

You can use a powerful tool like Finmark to elevate your decision-making abilities with custom-tailored dashboards, accurate financial statements, and other helpful tools that are relevant to your business.

See why hundreds of businesses rely on Finmark for financial decision-making and start your 30-day free trial today!

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.