Financial Modeling Templates Are Hurting Your Startup

You’re a founder about to fundraise. To prepare to meet with investors, you know you need to build a financial model to show the amazing growth potential of your startup.

But there’s a problem—you’ve never built a financial model before.

You seemingly have two choices (there’s another option that we’ll talk about later):

- Pay someone to create your model for you (like an outsourced CFO)

- Find a financial model template online and DIY

For a lot of founders, particularly in the early stages, using a template is more appealing and a lot more affordable.

You simply download a template, do some quick data entry, and boom—you have an amazing financial model ready to share with investors and get all the funding you need.

Right?

Well, not exactly.

While financial model templates that you find online may seem like a good option, they can often do more harm than good.

In this guide, we’re going to talk about what financial model templates really are, why founders use them, and how they can negatively impact your business. Most importantly, we’ll give you a much better alternative to any template you’ll find online.

The Ugly Truth About Financial Model Templates

When you see the word “template”, you might assume you’re getting a blank spreadsheet that’s flexible and easy to customize.

However, that’s not always the case.

A lot of the financial modeling templates you find online are:

- Based on models a consultant, accountant, or agency built for another startup

- Models that a startup made for their own business that they’ve made available for download

- Made by people who aren’t financial experts at all. They just know how to put together a nice looking spreadsheet

All of these scenarios have one thing in common—the templates aren’t made for your business.

Since your financial model will determine everything from your hiring plan, budget, growth strategy, and more, it’s crucial that it’s accurate and built specifically for your company.

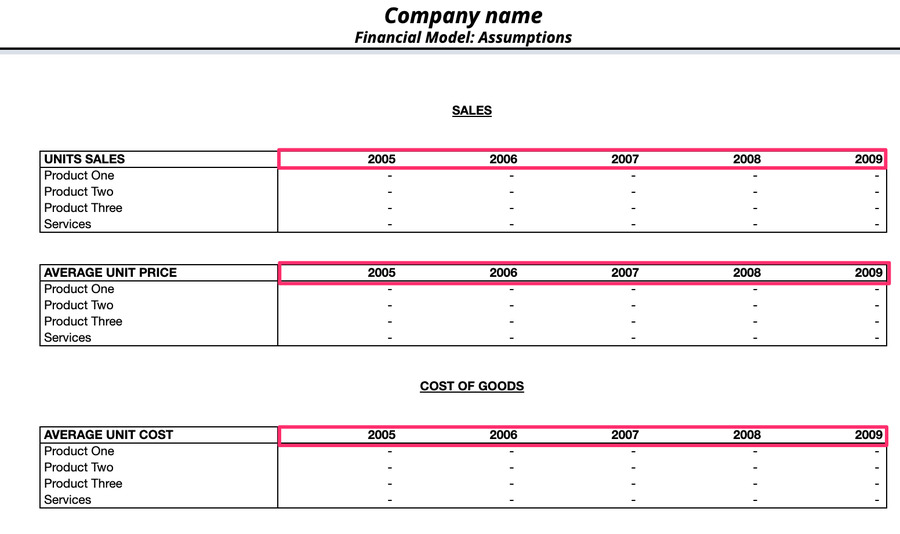

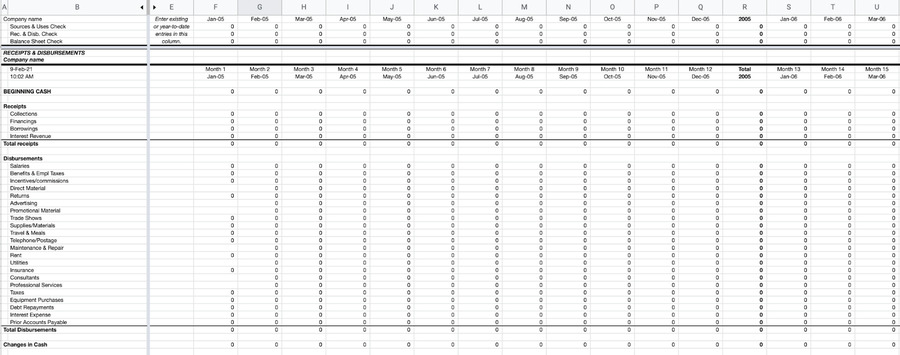

On top of that, several of the financial model templates you can find online are old and out of date, like this one from the early 2000s.

Do you really want to plan the financial future of your company with a potentially outdated template you found online?

Why Founders Use Financial Model Templates

With all the risks that come with templates, you might wonder why founders even use them?

The two most common reasons are:

You don’t have to start from scratch

The mere thought of trying to build a financial model from scratch is agonizing for most founders.

If you’re not in the finance field, chances are you don’t have the necessary expertise to build an accurate financial model without some help.

That’s what makes financial modeling templates so appealing. The ability to download an Excel or Google spreadsheet that has all the sections and calculations you need built-in sounds amazing when you don’t even know where to start.

However, most templates aren’t that straightforward.

A lot of them were clearly made for accountants, by accountants. Which means they’re not the most visually appealing things to look at, and you might be unfamiliar with some of the terminology.

So while using a spreadsheet is easier than trying to build a financial model from nothing, it’s not as simple as you might think.

You can get them for free

Look online and you’ll see tons of free financial model templates.

You might assume that most financial models are generally the same, so all you need to do is download a template and fill in your information.

However, the reason these templates are free is because they’re cookie-cutter and aren’t specific to any industry, company size, or even company type.

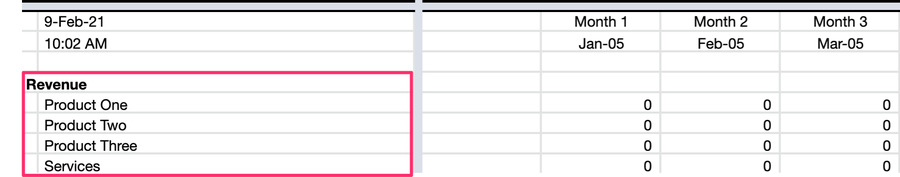

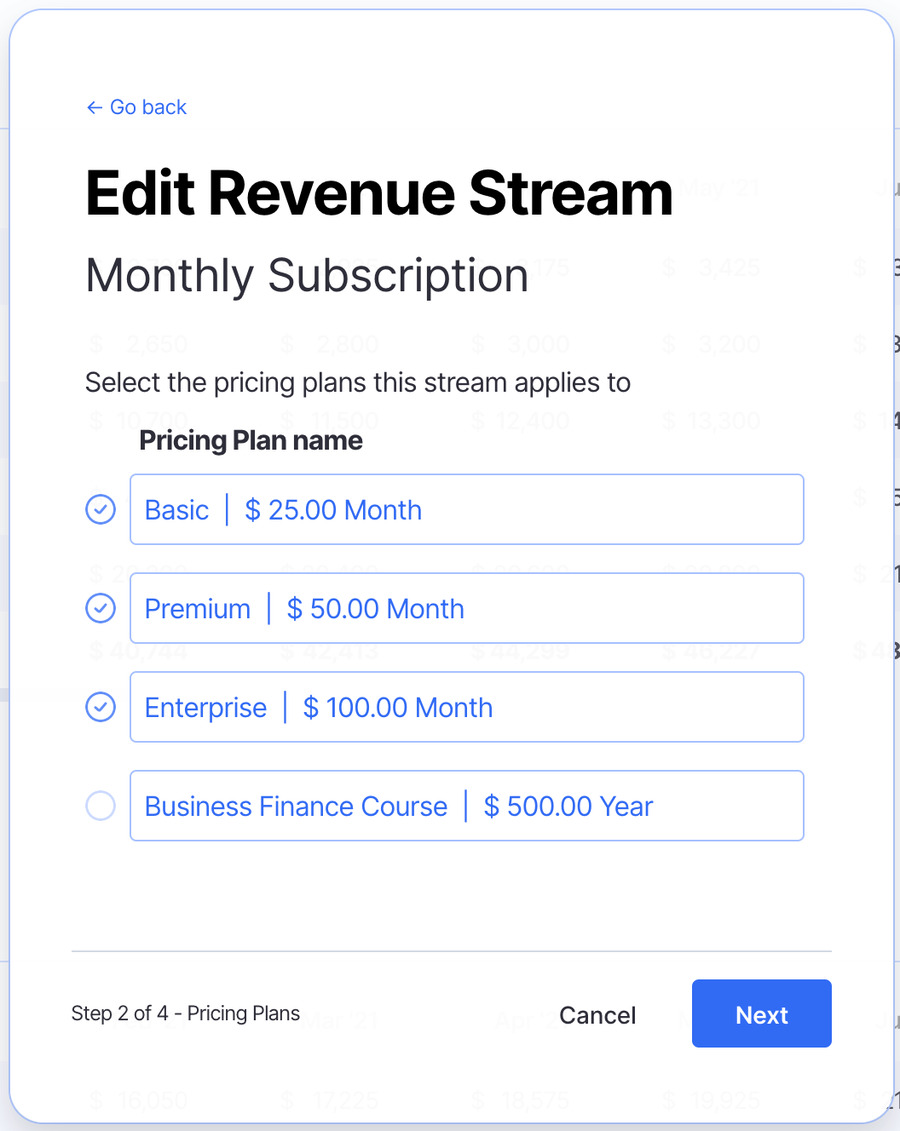

For instance, imagine you’re a SaaS company that has revenue from three different monthly subscription plans, plus one-off services like consulting fees:

How exactly would you add that into this template?

You can’t, at least not without adding a bunch of customization.

It’s not uncommon for founders to spend days, or even weeks, fidgeting with generic financial model templates to tailor them to their business.

When the only alternative is to pay someone potentially thousands of dollars to build a financial model for you, it’s not hard to understand why founders turn to free spreadsheets.

Luckily, outsourcing your model and using templates aren’t your only two options anymore. (Spoiler alert: Finmark is the solution. But more on that later.)

Why You Shouldn’t Use Financial Model Templates

Now that we’ve covered the reasons why founders use financial model templates, let’s talk about the other side of the coin.

As tempting as it might be to download that free template you just found, consider these pitfalls you’re likely to run into:

1. Templates are not tailored to your business

By definition, a template is not customized. They’re meant for mass-use. However, since a financial model is used to forecast your business, it needs to be customized accordingly.

A $100K MRR SaaS company that sells to enterprise companies shouldn’t be using the same financial model as an e-commerce company that’s just starting out. But that’s what ends up happening with financial modeling templates.

Here’s an analogy. Think about custom-tailored suits vs. off-the-rack suits.

Off-the-rack suits are sized to fit “average” shaped people. But as we all know, everyone is shaped differently. Some people have shorter torsos, longer legs, different arm sizes, etc. So an off-the-rack suit won’t fit everyone’s proportions exactly and generally will need alterations made.

Compare that to a custom-tailored suit that’s made based on your specific measurements. It fits your body perfectly because it was designed for you.

The same concept applies to financial models.

Templates are like off-the-rack suits. They might get the job done in some capacity, but they won’t accurately tell the story of your business and they’re going to need additional work before you can use them.

When you use a financial model customized to your business, you can have confidence that the numbers are accurate, the projections are reliable and it’s reflective of your business.

2. Templates are time-consuming to update

Financial model templates can drain a lot of your time, which is a very limited resource for founders.

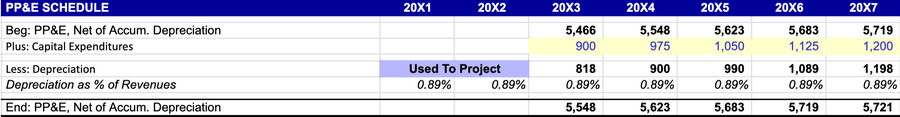

Just think of how long it’d take you to fill out this one section of this template (there are over 600 more rows in this one sheet, and no option to import data from other tools).

Unless building financial models is one of your core competencies, and you’re obsessed with data entry, there are much better ways to use your time.

Rather than spending hours building and maintaining a financial model spreadsheet, you should be focusing your energy on the things that’ll improve your financial projections.

That could mean coming up with product improvements, building a growth strategy, talking to customers, or anything other than updating a bunch of cells in an Excel spreadsheet.

3. Spreadsheets are difficult to share and collaborate on

A financial model isn’t something you build and just look at for yourself. Some of the most common use-cases for financial models are:

- Fundraising

- Forecasting your company’s growth

- Creating a hiring plan

- Planning a budget

- Preparing for an acquisition

- Reporting to your board

All of these involve sharing and collaboration.

Whether you’re sharing your financial model with co-founders to get their input, investors to get fundraising, or consultants that are helping manage your expenses, you need an easy way to show your model to other people.

Have you ever tried to share or collaborate on a huge spreadsheet with 10 different sheets and a formula in nearly every cell?

It’s not pretty.

Even if you add in charts and graphs, the reality is that spreadsheets aren’t the best way to present your financial model because that’s not their purpose.

Spreadsheets force the people you’re sharing and collaborating with to navigate through multiple tabs and read endless rows of text and numbers.

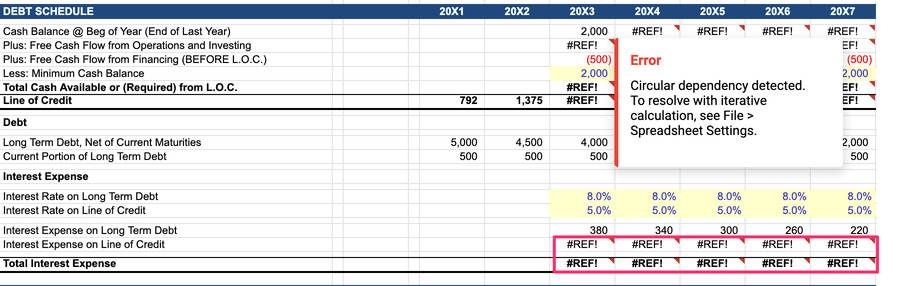

4. Templates are easy to break if you’re not a spreadsheet wiz

It’s happened to us all at some point. You’re trying to adjust a number in a spreadsheet and you end up with an error.

Financial model templates are filled with formulas. VLOOKUPs, IF functions, INDEX functions, the list goes on. A change you make to a cell in one sheet can break a cell in another sheet if you’re not careful.

Even if you’re a spreadsheet pro, since you didn’t make the template you’re bound to run into issues when you’re trying to get it to work with your data.

This goes back to the time cost. You’ll have to spend time learning how to use the template, and also fixing things when they inevitably break.

5. Updating and maintaining spreadsheets is awful

Financial models aren’t meant to be static. Building a startup has plenty of twists and turns, and all those changes need to be built into your model.

Just look back at 2020, when startup companies had to let go of tens of thousands of employees, 69% of brands reduced their ad spend, and many companies saw a drop in revenue.

Now, imagine trying to update your financial model for all these variables in a spreadsheet. It’s a nightmare.

You have to navigate through multiple sheets, change dozens of cells, make new calculations, and nearly re-do the entire spreadsheet.

The mind-numbing process of updating all that is one of the reasons so many companies outsource the work entirely. Either that or leave their model untouched until they absolutely need to update it (which is typically when you’re looking to fundraise).

When used the right way, financial models can be a lot more than just a “report”. You can plan for best and worst-case scenarios, create a hiring plan, adjust your budget, and course-correct when necessary.

The reason most startups don’t get enough value from their models is that they build them in spreadsheets which are a pain to manipulate and aren’t very user friendly.

The Best Alternative to Financial Modeling Templates

If spreadsheets aren’t the best way to build financial models, what should you do?

We built a tool to solve the problems that come with most financial model templates.

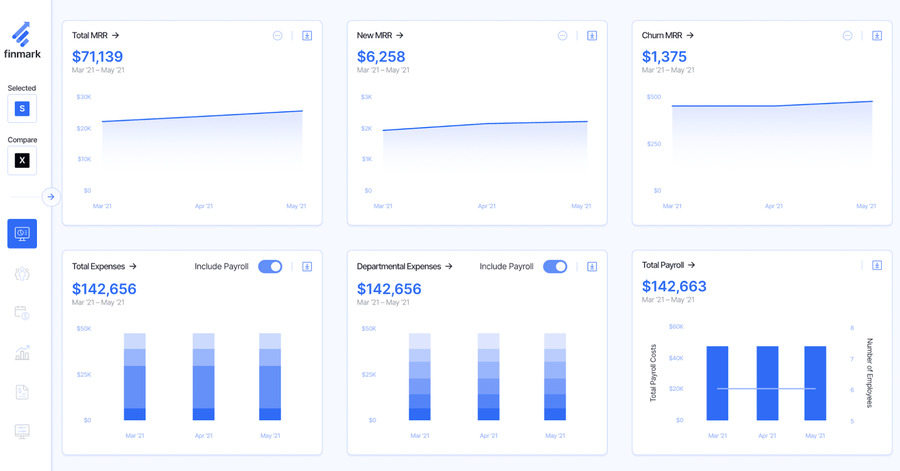

Finmark is a financial modeling tool built for startups. It allows you to create customized financial models as well as track and forecast metrics like MRR, churn, burn rate, runway, and more.

With Finmark, you don’t have to deal with calculations and formulas because our software does the math for you. That means you don’t have to stress over whether or not your data is accurate.

It’s also a lot easier to collaborate on your model and share it with investors, your team, accountants, or whoever.

Instead of sending over an Excel file or link to a huge Google spreadsheet, they’ll see an organized dashboard that’s easy to understand.

Another big difference between Finmark and the financial model templates you’ll find online is we have scenario analysis and planning built-in. You can create multiple financial plans for your startup and compare the models against each other.

For instance, you can create an upside model that projects what happens if your churn is lower, or if you outpace your revenue projections. You can also create a more conservative model to forecast slower growth.

There’s a ton more you can do in Finmark. If you’re interested in checking it out for yourself, click here to learn more.

Ready to Say Goodbye to Financial Model Templates?

I know that using a template for your financial model seems really appealing. After all, templates and spreadsheets can be great for a lot of things… but forecasting the financial future of your business isn’t one of them.

If you’re ready to try a more efficient and easier way to build and manage your financial model, give Finmark a try.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.