What is Financial Modeling?

Is your business growing, shrinking, or flat?

When should you fundraise, and how much do you need?

At your current pace, how long will your startup last before running out of money?

These are the types of questions financial modeling helps you answer.

While creating a financial model isn’t necessarily the most exciting part of growing a startup, it’s one of the most important pieces to your success.

Unfortunately, a lot of the information online about financial modeling is written for analysts and accountants, which can make the entire process feel overwhelming and complex.

So I created this guide for founders. I’ll break down what financial modeling is, why it’s important, and how to get started.

What is Financial Modeling?

Think of financial modeling as a mathematical blueprint for your business. In dollars and cents, your financial model lays out:

- What your business has done in the past using historical data and reports

- Where your business stands today using KPIs and metrics

- Where your business is headed in the future using financial forecasts

All of this information comes from inputs of your business.

Think about everything involved in the financial side of running your business. You have employees, operating expenses, cost of goods, revenue, and more.

These are all inputs from the same system (your business) that get fed into your financial model.

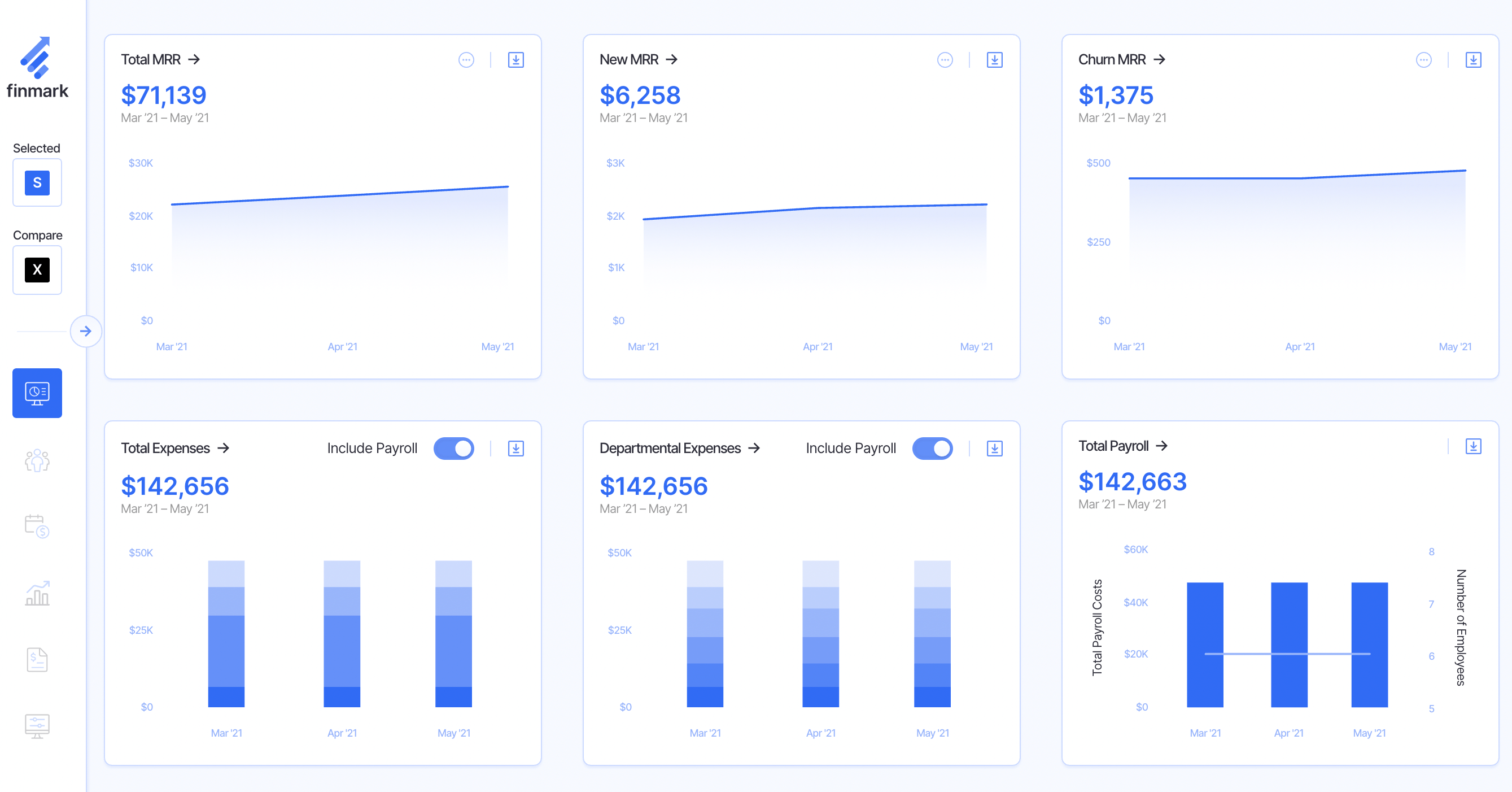

Your financial model takes those inputs, crunches the numbers, and gives you outputs in the form of reports and metrics that tell the financial story of your business.

Based on those outputs, you can understand things like:

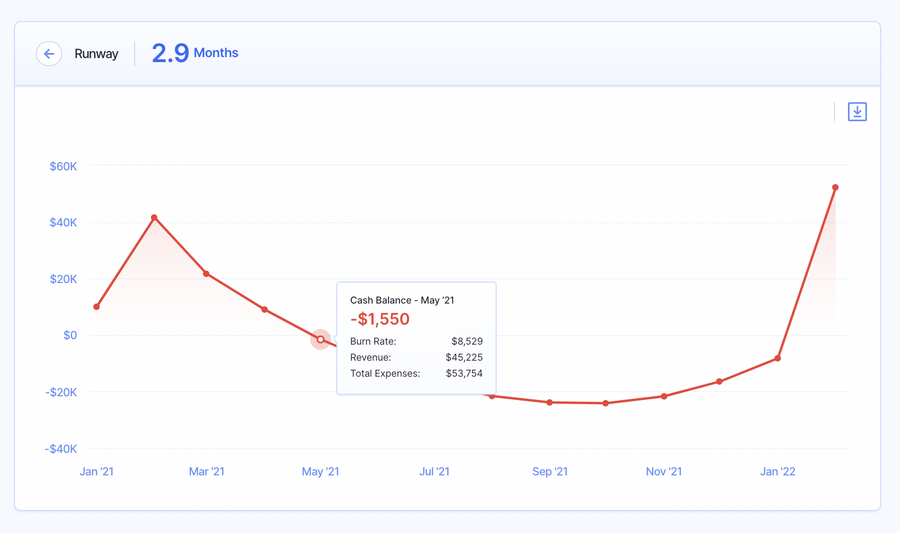

- How long can I operate until I run out of cash?

- Is my business growing efficiently?

- At my current pace, what will my revenue look like in 12 months?

- If I reduce expense X, what impact will that have on my runway?

- When should I fundraise, and how much do I need?

Creating a financial model makes it easier to answer these questions, and more.

Most founders are used to seeing financial models made from spreadsheets that look a little something like this.

Why Founders Need to Build a Financial Model

There’s a lot of value in a financial model for founders. Here are some of the top reasons I recommend founders build and maintain a financial model.

Put Your Ideas on Paper

As I mentioned, your financial model is the blueprint for your business.

Would you drive a car that was randomly put together based on someone’s “gut feelings” and imagination? Probably not.

But if the vehicle was carefully planned out, prototyped, and tested, you’d feel a lot better about taking it for a drive, right?

You should take the same approach with your business.

As tempting as it might be to take your idea for a drive as soon as you have an idea, take a step back and build your blueprint first.

Financial modeling is how you put your ideas on paper. You’re planning out how you’re going to make money, how you’re going to grow, and how much it’ll cost.

With your plan in place, you know how “safe” it is to take your business out on the road.

Keep Yourself Accountable

Financial models are a good way to keep yourself accountable.

As the old adage goes, you can’t improve what you don’t measure. Tracking your company’s actual performance against the assumptions you made in your model gives you something to build on and measure your progress.

If things don’t go as planned, refer back to your model and see what assumptions you made that were incorrect, and plan accordingly.

I’ll touch on it a little more later, but your model shouldn’t be a static document. It’s meant to change and update with your business.

Avoid Disaster Before It’s Too Late

The number one reason startups fail is because they run out of money.

As a founder, you always need to understand how much money you have and how much you need. Your financial model is like your lookout that tells you when you’re going to run out of money.

That additional 3-6 months means you have more time to course correct and extend your lifeline.

Raise Money More Efficiently

Startups are like step functions. You raise money, you hit a milestone, and then you unlock more money. Your model helps you figure out how much money you need to raise to get to the next milestone.

If you don’t raise enough money, you’re not going to be able to reach your next milestone. At that point, you’ll either run out of money or have to raise a down round.

On the flipside, if you raise too much money, you’ll end up diluting yourself.

For instance, if you raise twice as much money as you need to get to your next milestone, sure you’ll hit your milestone. But you also unnecessarily sold a portion of your company for less value than if you would’ve if you waited until you hit the next milestone and raised again.

Raising money is a great way to grow faster and extend your runway, but you need to do it efficiently.

The Challenges of Financial Modeling

As important as financial modeling is for startups, it’s not exactly something most founders are eager to do.

Not because they’re afraid of what the numbers will show, but because the process of financial modeling can be frustrating, tedious, and overwhelming. As a result, many founders aren’t even sure where to start.

Most Financial Modeling Templates Aren’t Founder-Friendly

For a long time, financial modeling has been done in templated Excel spreadsheets. At first glance, that might make a lot of sense. After all, it’s just basic data entry, right?

Not exactly.

Speaking from experience, financial modeling templates are rarely as “user friendly” or straightforward as you’d think.

Financial models are supposed to be tailored to your business. When you start from a generic template someone else built, you’re shoehorning your business into a spreadsheet that wasn’t made for you.

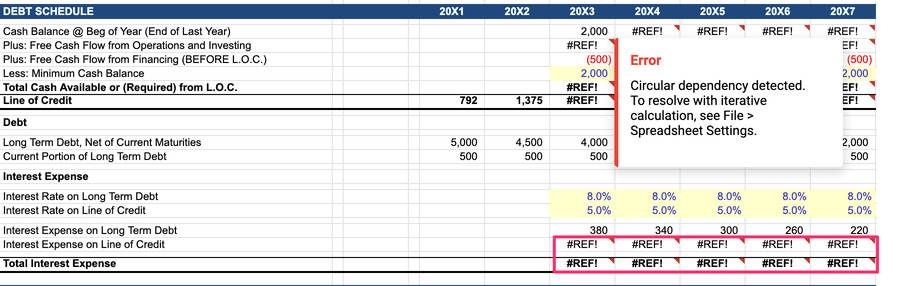

That means you’ll need to customize an Excel template that’s filled with pre-made formulas. You can probably guess where I’m heading with this.

Building Models Can Be Time Consuming & Technical

Another challenge of financial modeling is that for a long time it was something founders felt they needed to outsource to an analyst, fractional CFO, or accountant.

With so many formulas and mathematical equations needed to calculate all the metrics, it can be a time consuming process with tons of room for error.

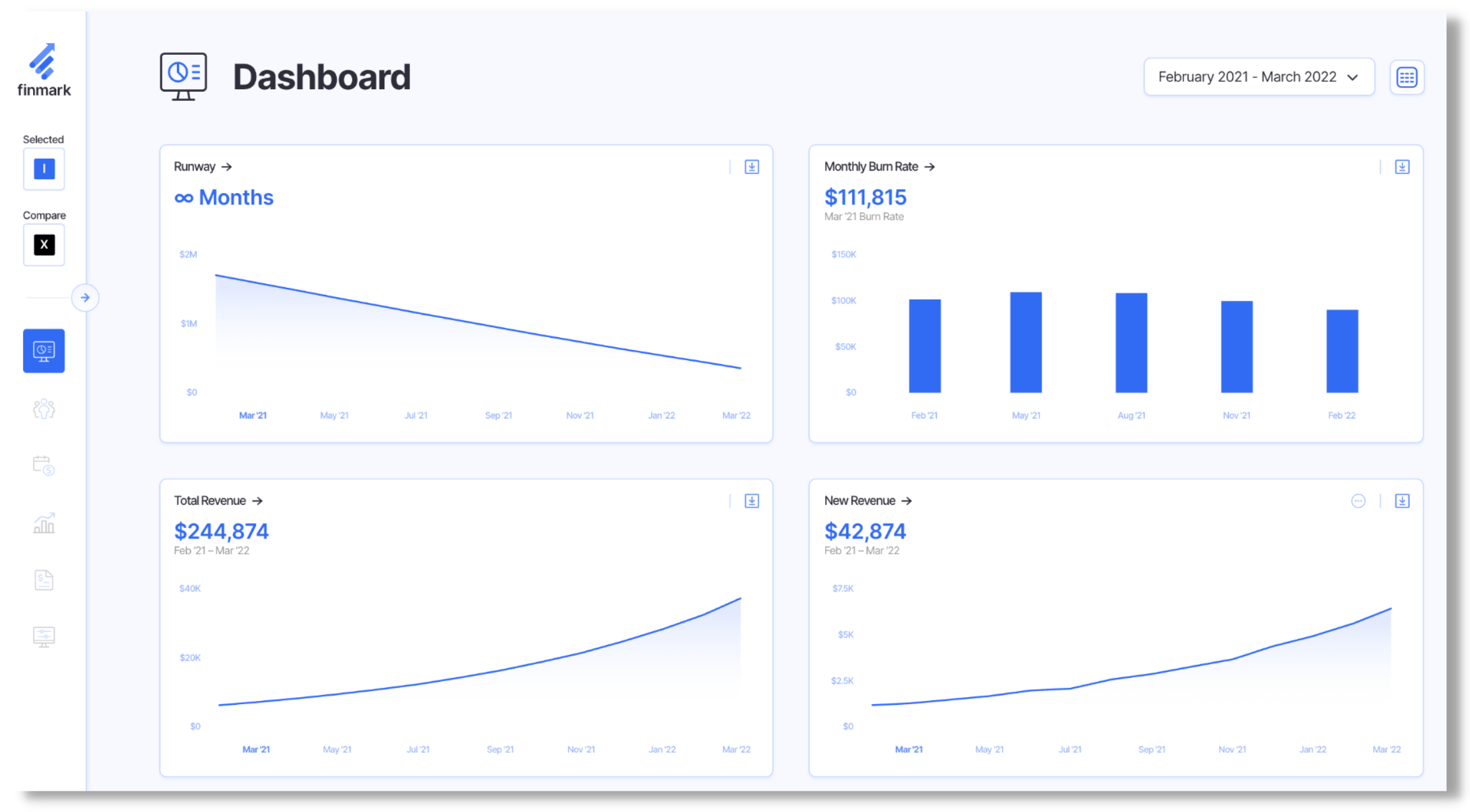

Thankfully, financial modeling has changed a lot in recent years with the help of tools like Finmark. In fact, all these challenges are exactly why we created our financial modeling software in the first place.

Still, regardless of how you build your model, there are certain mistakes you’ll want to watch out for.

Financial Model Mistakes to Avoid

Here are some of the most common mistakes founders make with financial modeling.

1. Trying to Create The “Perfect” Model

There’s a famous quote that’s attributed to the statistician George Box—All models are wrong, but some are useful.

The idea is that no matter how complex or precise you try to make a model, it’ll never be perfect.

As a founder, it’s easy to obsess over every small expense, driver, and other aspects that go into your model. The problem that creates though, is your model becomes overly complex. And the more you complicate things, the more opportunities there are for errors.

Your model isn’t supposed to forecast where your business will be in five years down to the penny. It’s a tool to help you plan based on historical data, your current situation, and your assumptions for the future.

The perfect example of this is what happened in 2020. Even if you spent months building a model the year before, there’s a strong chance the pandemic made your model wrong, almost instantly.

And that brings me to my next point.

2. Not Updating Your Model

A financial model isn’t a document you create for the year and just let it sit. Basing business decisions on a model that was created six months ago means you’re working with outdated data.

I like to say the half-life for a model is a month.

Every month that goes by, your actuals are different than what you thought they’d be. After six months go by, the data in your model is likely completely wrong if you’re not updating it, which makes it useless.

This goes back to the issues with using spreadsheets to build models. The amount of manual work involved with updating them is more than most founders have time for. So what ends up happening is the model just sits until you have a major event (fundraising, budget planning, an exit or acquisition, etc.).

By that time, going back and updating everything takes even more time. And even worse, you’ve missed out on the benefits of having a model in the first place.

3. Being Unrealistic With Your Forecast

Most founders are optimistic by nature. It takes a certain level of hope and confidence to identify a problem and be willing to create a company that solves it. Plus, nobody goes into business expecting to fail.

While that drive is great for growing a startup, it can backfire when you’re building your model.

For instance, you may have had 10% revenue growth two months in a row. So you assume that trend is going to continue and you build your model based on that assumption. But you have to keep in mind that 10% growth didn’t happen automagically!

That’s why one thing I suggest founders do with their models is to dig into the “why” behind their numbers.

- Why did you have 10% MoM revenue growth for those two months?

- Is it sustainable?

- Could you grow even more?

If your 10% growth came from a Facebook Ads campaign, what would happen if you doubled your ad budget?

That’s one of the biggest advantages of building a financial model. It gives you a chance to step back and analyze why your actuals are what they are, so you can plan for the future.

4. Not Preparing For Different Scenarios

On a similar note, you also want to create multiple scenarios for your model.

I suggest having a base plan, upside, and downside scenario for your model.

Your upside scenario is more optimistic and assumes more exponential growth.

Your downside scenario has less optimistic assumptions about your growth.

Like I mentioned earlier, it’s impossible to predict what’s going to happen two, three, or six months from now with precision. But if you plan for different scenarios, you aren’t completely caught off guard and lost when your plan A doesn’t go as expected.

Want to learn more about how to plan and analyze scenarios? Check out this guide:

5. Not Sharing The Model With Your Team

Unless you’re a solo founder with nobody else involved in your business, you should not be the only person who has access to your financial model.

Unfortunately, that’s what ends up happening too often. You create a model and then keep it locked away where nobody else can see it. But remember, the model isn’t for you, it’s for the business.

At the very least, you should share your model with your leadership team and collaborate on the assumptions it’s built on. Not only will others have insights you might’ve overlooked, but it’s also a good way to keep everyone on the same page.

For instance, let’s say you’re a non-technical founder and one of your co-founders is your CTO. When you’re putting together your model, you might have certain revenue goals you want to hit.

But those revenue goals are made on the assumption that your product will have certain features and capabilities over the next few months.

Your CTO might need to bring on more engineers in order to meet those goals. If they aren’t involved with building and updating the model, the entire model is thrown off because it’s based on inaccurate assumptions.

Trust me, hoarding your financial model isn’t good for you, your team, or your business. If you want an easy way to build and share your model, we’ve made it easy in Finmark.

Ready to Get Started With Financial Modeling?

Creating a financial model doesn’t have to be complicated. But when I built my first startup, it was. That’s why I decided to make Finmark, an easy-to-use financial modeling tool built for founders, by founders.

With Finmark, you can skip the messy and clunky spreadsheets, and create a more accurate financial model faster, without needing to know a bunch of complex formulas.

If you want to take it for a spin and build your model, get a free trial here.

Chief Executive Officer

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.