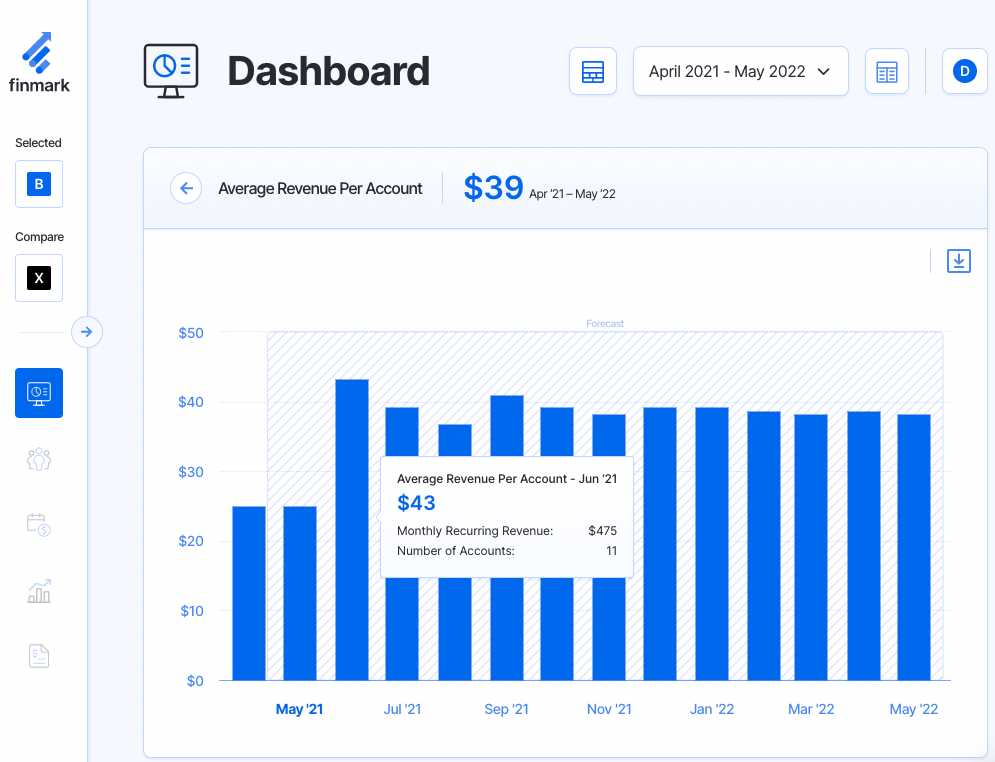

Average Revenue Per Account

In SaaS, there are enough acronyms to make a founders’ head spin.

While the acronyms may be hard to keep track of, the insights derived from these metrics can be the difference between a startup surviving and failing.

In this article, we’ll be taking a look at one of the dark horse startup metrics—Average Revenue Per Account (ARPA).

It may sound like a simple metric on paper, but understanding it can provide immense value. Want to learn more about ARPA? Let’s dive in.

What is Average Revenue Per Account?

The average revenue per account (ARPA) is the average monthly recurring revenue (MRR) per account.

ARPA is a metric typically measured and tracked within subscription and SaaS-based startups. While not recognized by GAAP, many businesses track and measure ARPA on financial statements, as it provides a clear understanding of profitability on a more granular level.

The Difference Between ARPA & APRU

As your company scales, you’ll need to slice and dice data in several ways to capture growth metrics effectively. You have the opportunity to measure ARPA, however can also measure average revenue per user (ARPU).

ARPU is the average MRR per user. This is different from ARPA because some of your customers may have multiple users in their organization. This is especially useful to track if your subscription pricing is per user or seat.

For example, Asana, the popular project management and productivity tool, charges per user for use of its tool. A team of Asana users within a company may have a low monthly subscription cost given the bundles and discounts for the overall account, but Asana can still measure both the revenue derived from the total account and for each of the individual users.

Having this distinction will help Asana, and other SaaS companies measuring both metrics, to have more granular insights into revenue on the individual level.

How to Calculate Average Revenue Per Account (ARPA)

As mentioned above, your ARPA is your MRR per account. To calculate ARPA, you simply divide total MRR by the number of total accounts.

ARPA Formula

Monthly Recurring Revenue (MRR) / Number of total accounts

For example, if you have an MRR of $35,000 and you have a total of 10 customers, then your ARPA is $3,500.

One note: if you have a freemium model or offer a free trial for your product or service, then the free accounts (or the month when the user was not yet paying for the product or service) are not typically included within this calculation.

Why ARPA is Important

Measuring ARPA is important for several reasons. First, it can be a key indicator of profitability and growth.

Second, it can help you decipher and understand your customers. ARPA helps startups to understand monthly customer trends, from which products are driving the most revenue to what level of subscription most customers are capitalizing on.

If your ARPA is consistently increasing over time, then this can also be an indicator that your sales and marketing efforts are paying off.

Your ARPA can also be a quick and easy way to understand performance by comparing your ARPA to competitors or industry averages. This can help to set benchmarks against the players who are taking a similar sales approach. If you’re winning against your competitors, then it’s a great metric to show to investors as well.

Some naysayers say that ARPA is a vanity metric for businesses — if you score one or two major accounts in a small time period, then this may skew your total ARPA.

However, if you measure and track ARPA for both new and existing customers, as well as comparing it against other key SaaS metrics, then it can be an incredibly useful metric to understand current success and plan for future growth.

For example, ARPA can directly affect your customers Lifetime Value (LTV). In short, increasing ARPA can increase LTV.

How to do that? In the next section, we’ll explain exactly how you can increase your ARPA to grow your business.

How to Increase ARPA

In order to increase ARPA, you need to increase the amount of revenue you get from customers per month. Sounds simple right?

In today’s world, there are a vast number of strategies you can take to sell more, but for ARPA, keeping your current customers happy is just as important as finding new ones.

1. Develop Add-On & Upgrade Strategy

Your expansion MRR, the recurring revenue gained from existing customers through upgrades, add-ons, and cross-sells, can be a major part of increasing ARPA. Focusing on the customers that already know (and hopefully love!) your product or service can pay off in dividends.

Providing opportunities to upsell and cross-sell to increase MRR—from encouraging customers to upgrade to a higher price tier, offering complementary products or services, and adding new features for the products customers are using—means your APRA will slowly start to increase over time.

2. Retain Current Customers

Customer churn is directly related to your ARPA. While losing customers is unavoidable, having a clear retention strategy for your current customers can help you to minimize the risk of churn.

This includes providing excellent customer service, preventing involuntary churn, and providing incentives to marquee customers, or even creating communities or events where customers can interact and learn from each other.

3. Target the Right Prospects

Having clear buyer personas within your sales and marketing strategies will help you to further target and sell to the prospects that are most likely going to purchase your product or service.

If you are focusing on too many low-revenue prospects (ones who will come in at a low price point and never upgrade) then you may be leaving other opportunities on the table to increase ARPA overall.

Start Measuring Your ARPA Today

From ARPA to ARPU, it’s clear you need a comprehensive financial modeling tool to measure the key metrics for success, so nothing falls through the cracks.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.