Average Revenue Per User (ARPU)

Your total number of customers is worth its weight in gold, but if you are a subscription-based company charging per user, then average revenue per user (ARPU) is a far more appetizing metric to track.

Why?

We’ll dig into what ARPU is, the difference between ARPU and ARPA, and how to consistently improve your ARPU over time.

Let’s dive in.

What is Average Revenue Per User (ARPU)?

Simply put, ARPU is the average monthly recurring revenue (MRR) per user.

The large majority of subscription-based businesses track ARPU, especially if the company is charging for the product or service by user.

Note: while ARPU is not recognized by GAAP (and therefore there is no standard calculation), many businesses still dig into this metric on a regular basis as it provides deeper insights into potential growth and profitability.

Along this same vein, there is no standard unit of time that you should be measuring ARPU. However, if you are using MRR, then it makes sense to measure ARPU monthly.

The Difference Between ARPU & APRA

While ARPU breaks down revenue per user, the average revenue per account (ARPA) is the average monthly recurring revenue (MRR) per customer.

This is an important distinction — especially if a business is charging by user — as there can be multiple users per account.

For example, Asana, the popular project management and productivity tool, charges per user for use of its tool. A team of Asana users within a company may have a low monthly subscription cost given the bundles and discounts for the overall account, but Asana can still measure both the revenue derived from the total account and for each of the individual users.

Pricing models may be up for debate, but there’s no arguing that you should measure both ARPU and ARPA to have a clear understanding of where your revenue is coming from. This allows startups to stay agile and stay on top of both product strategy and business growth.

How to Calculate ARPU

To calculate ARPU, you simply divide your total MRR by the total number of users.

ARPU Formula

Monthly Recurring Revenue (MRR) / Number of users

For example, if you have an MRR of $7,500 and you have a total of 30 users, then your ARPU is $250.

One key note: if you have a freemium model or offer a free trial for your product or service, then the free accounts (or the month when the user was not yet paying for the product or service) are not typically included within this calculation.

Why ARPU Is Important

If you’ve read our ARPA glossary term, then you likely understand why tracking revenue on a more granular level is important. Not only is it a key indicator of profitability and growth, but it can also be the missing piece to truly understanding your customers.

ARPU helps startups to understand monthly trends, from which products are driving the most revenue to what level of subscription is the most popular or profitable.

Not to mention, ARPU allows you a direct comparison to your competitors. If you have a higher ARPU than the behemoth you frequently compete with , then it’s safe to say you’re heading in the right direction.

Additionally, ARPU provides further color to customer lifetime value (LTV) — the average amount of revenue one customer generates for your business over time. However, it’s important to note that you should always compare and contrast your ARPU (and ARPA) against other customer-based metrics so it isn’t seen in a vacuum (or perceived as a vanity metric).

And just like most SaaS metrics, ARPU is yet another metric that can help in forecasting. If you are tracking ARPU effectively, then you can make solid revenue projections in your financial model.

Finmark’s real-time financial modeling tool helps startups to both create and share financial plans, manage burn rate, and forecast revenue — all without those pesky, templated spreadsheets. Try it out for yourself today.

What Is a Good ARPU?

ARPU can fluctuate tremendously across industries, so there’s not one benchmark that you should be marching towards for ARPU.

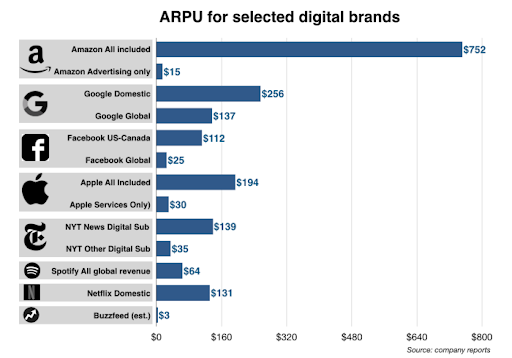

Many consumer-based businesses track by the user (think Netflix, Spotify) along with telecom and mobile companies. These ARPUs are far lower than a SaaS-based subscription service, as seen by this chart from Monday Note.

Your best bet to benchmark ARPU would be to compare yourself against your competitors in your industry — especially if your target market is similar. However, if you are only whale-hunting while your competitors are going for the low-hanging fruit, then your ARPU targets will be vastly different.

How to Improve ARPU

You may be thinking, “Can’t I just find more high-paying customers to increase my ARPU?” Unfortunately, it’s not as simple as that. With ARPU, it’s just as important to focus on your current users as it is to bring in new ones.

In fact, your current users and customers may actually be the secret sauce to optimizing ARPU, from overall retention to add-ons and upsells.

1. Develop a Strong Customer Retention Strategy

Reducing customer churn is a major part of optimizing ARPU. The fewer customers (and users) you have, the lower your ARPU.

If you are consistently focusing on retaining your customers—developing strong customer success strategies, preventing involuntary churn, providing incentives—then you’ll start to see your ARPU improve over time.

2. Utilize Add-Ons & Upgrades

It’s fairly common knowledge that it’s far more expensive to bring in a new customer than to market to a current customer. So start selling to your existing customers!

Make your expansion MRR—the recurring revenue gained from existing customers through upgrades, add-ons, and cross-sells—a core part of your strategy.

3. Consider Long-Term Product Strategy

While many early-stage startups focus primarily on building a product and finding product-market fit, you can’t lose sight of the future.

Consider what new features, services, or complementary products you can build into your future product strategy to help bring in and retain your customers and users.

4. Find the Right Customers

While whale hunting may be fun, it’s risky if the prospect doesn’t come to fruition.

If you are focusing on too many high (or low!) revenue prospects then you may be leaving other opportunities on the table to increase ARPU.

Start Optimizing Your ARPU with Finmark

Ready to start tracking and optimizing ARPU but don’t know where to start?

Finmark’s financial modeling tools can help. We’ll streamline the process so you can focus on what you do best—building your business.

Start building your financial model in Finmark today.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.