New MRR

New MRR is one of the more simple financial metrics to understand. Simply put, it is monthly recurring revenue (MRR) that comes from new customers.

Keep reading to learn more about new MRR, including how to calculate it and why it’s important.

What Is New MRR?

New MRR is the amount of MRR gained from new customers.

While Monthly Recurring Revenue (MRR) encapsulates the total amount of predictable revenue your business earns each month from all your customers, new MRR looks more specifically at just the MRR from the new customers acquired during that month.

To learn more about MRR in general, check out our Monthly Recurring Revenue (MRR) article.

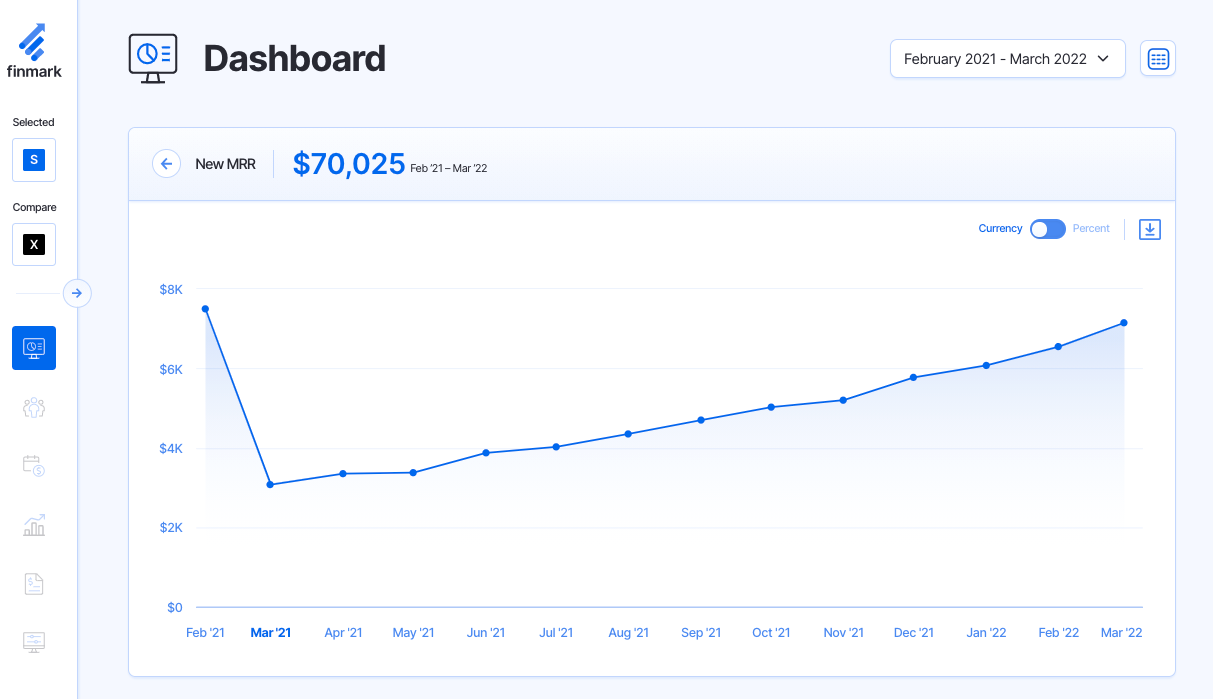

Calculate and forecast new MRR with Finmark!

How to Calculate New MRR

When calculating new MRR, you’ll need to know the total amount of new customers acquired during that specific month and how much monthly recurring revenue each of those customers generated.

New MRR Formula

New customers * MRR per new customer

For example, if you acquired 10 new customers last month and each brought in $1,200 in MRR, then your new MRR for last month would be $12,000.

It’s also important to make sure you’re normalizing any customers that aren’t on a monthly subscription. For example, if you have any customers on annual contracts, then divide the total annual subscription by 12 to get your monthly rate.

Why New MRR is Important

New MRR gives stakeholders a quick peek under the hood. It’s one of the many MRR metrics that provide insights into a company’s cash flow to track performance and predict future growth.

New MRR also helps to understand other elements of your financial model and overall business performance. This includes:

Understand Net New MRR

New MRR helps founders to better understand Net New MRR, another comprehensive MRR metric. Net New MRR tells you how much total new MRR you had during the month from new customers and expansion, minus MRR churn.

Net New MRR is calculated using the following formula:

Net New MRR Formula

New MRR + Expansion MRR – Churned MRR

Set Marketing and Sales Goals

Let’s face it — sales and marketing expectations can fluctuate from day to day in a startup. But setting goals for a certain amount of New MRR can give your marketing and sales teams a solid number to work towards for acquiring new customers.

Insights Into Customer Acquisition Cost (CAC)

Measuring New MRR against your Customer Acquisition Cost (CAC) can also help to understand the performance of marketing campaigns. If you’re spending more to acquire customers than the amount of MRR they’re generating, it could be a sign you’re not spending as efficiently as you could be.

Related Metrics

Dollar New Percentage

Dollar New Percentage is the amount of monthly recurring revenue (MRR) gained from new customers in the current month relative to the amount of total MRR at the end of the last month.

The Fundamentals of New MRR

New MRR is a key indicator of growth and overall financial health and performance. Continuously acquire new customers and you’ll be on your way to success in no time!

Ready to start measuring New MRR for yourself? Start building your financial model in Finmark today.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.