How to Raise Pre-Seed Funding: A Guide for Founders

Founding and growing a company is filled with exciting, daunting, motivating, challenging, and, at times, anxiety-inducing experiences.

One such experience that ticks pretty much all of these boxes is raising capital for your first time.

How much do I need? Where do I even start? How do I get in front of potential investors? And wait, there’s a PRE seed funding round? How does all of this work!?

In this guide for startup founders, we’re going to answer those exact questions.

You’ll come out the end of this guide feeling much more confident about the fundraising process, and knowing exactly where to start in order to raise pre-seed funding.

What Is Pre-Seed Funding?

Pre-seed funding is the earliest stage of funding for a new company, though it’s often not considered an ‘official’ funding round.

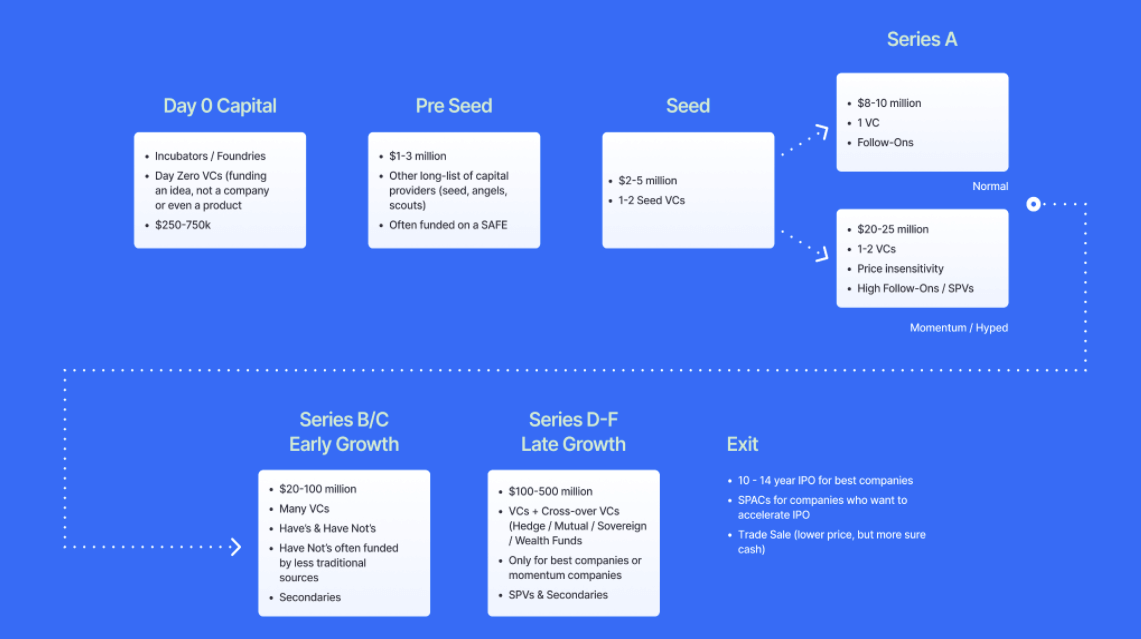

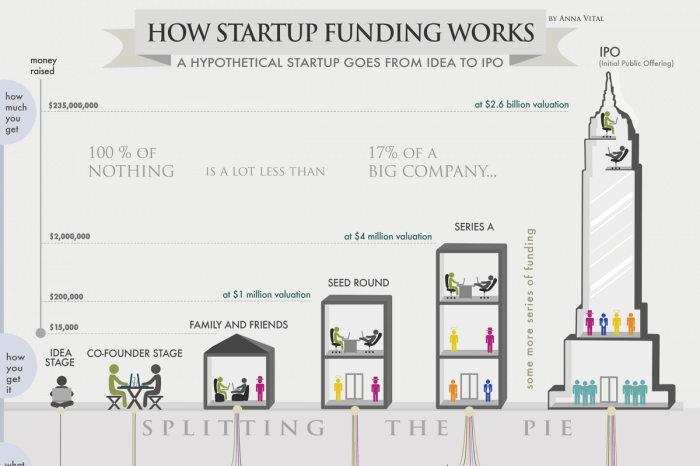

To visualize where pre-seed funding fits into the startup cycle, it’s helpful to understand that startup funding happens in stages; it’s not a one-off affair.

Most of these steps have letters associated:

- Series A

- Series B

- Series C

- Etc

However, before they get there, companies typically go through a seed funding round, and possibly a pre-seed funding round before that.

You can kind of think of seed and pre-seed rounds as a training ground, kind of like Minor League Baseball while players are developing to hopefully get into the Major League.

Pre-seed funding provides founders with enough money to get off the ground and is typically used to develop an early version of the product which can then be used to raise further funding.

You might be thinking, “isn’t that kind of what seed funding is for?”

Let’s unpack that.

Pre-Seed vs Seed Funding

As with all funding rounds, the definitions overlap slightly.

The main differences between each round come down to things like company valuations and funding amounts, though there are some requirements with regard to traction, product/market fit, etc.

So, what’s the difference between pre-seed and seed funding?

- Seed funding is widely considered the first ‘official’ funding round

- Founders usually receive higher investments from seed funding than from pre-seed

- Seed investors generally require the company to have some form of traction, whereas pre-seed funding can come before any product development takes place

According to Silicon Valley Bank, pre-seed companies tend to raise with a median valuation of $10M, while seed round companies sit at double that with a $20M median valuation.

Seed investments also tend to be larger, with an average of around $1m (vs. half a million for pre-seed funding).

To learn more about the seed funding round, check out our guide: How to Get Seed Funding – A Step by Step Guide for Founders.

What Is Pre-Seed Funding Used For?

Pre-seed funding can be used for a number of purposes. Though the overall goal of pre-seed funding is to help grow the company, where the money actually goes differs based on the company stage, type, and goals.

Here are a few examples of how startups use pre-seed funding:

- To develop an MVP that will allow them to raise a seed round

- To invest in product inventory

- To pay the salaries of new team members

- To invest in equipment

- To gain initial market traction and start attracting customers

It should be noted, however, that pre-seed funding isn’t a must for all startups.

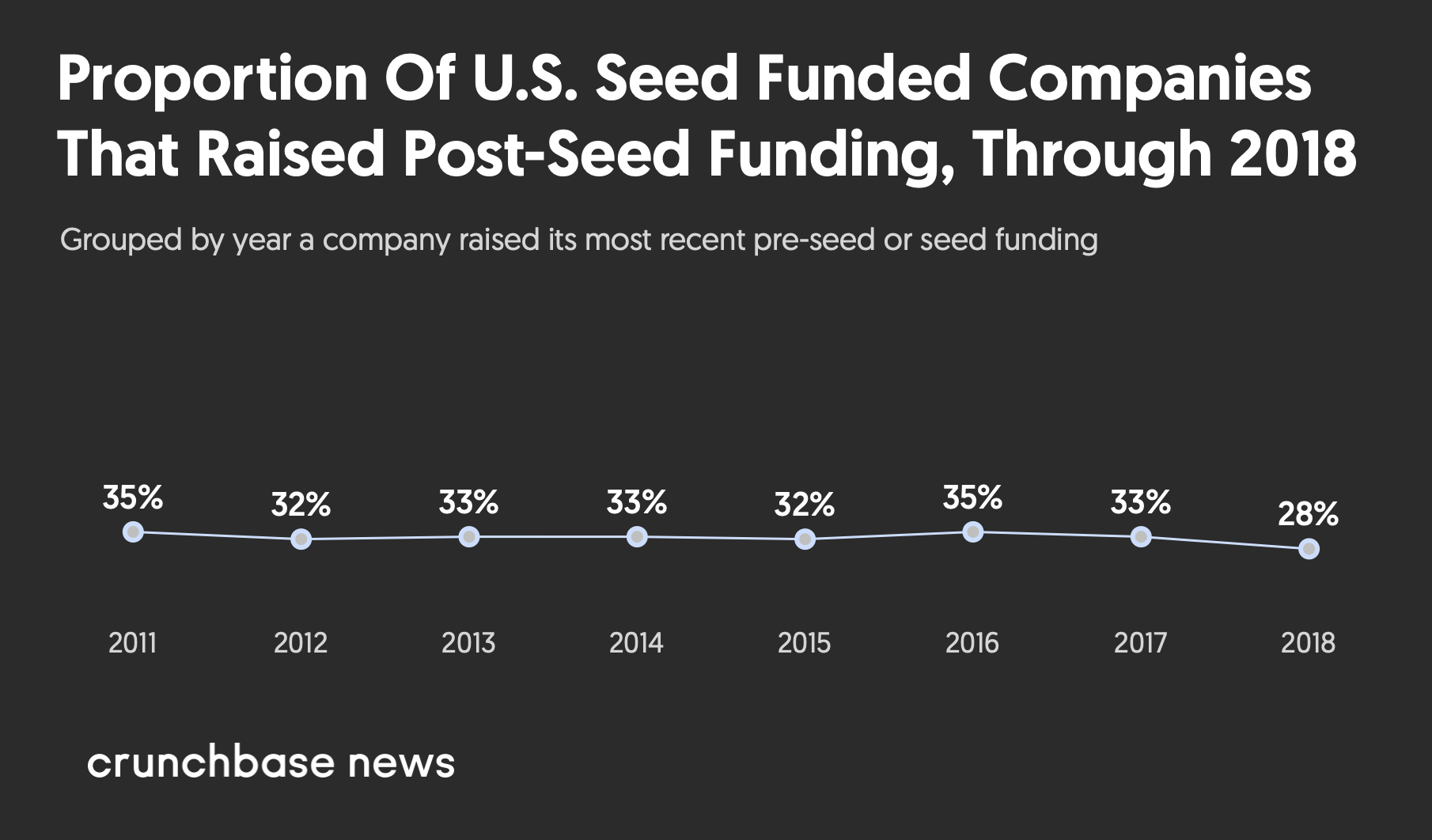

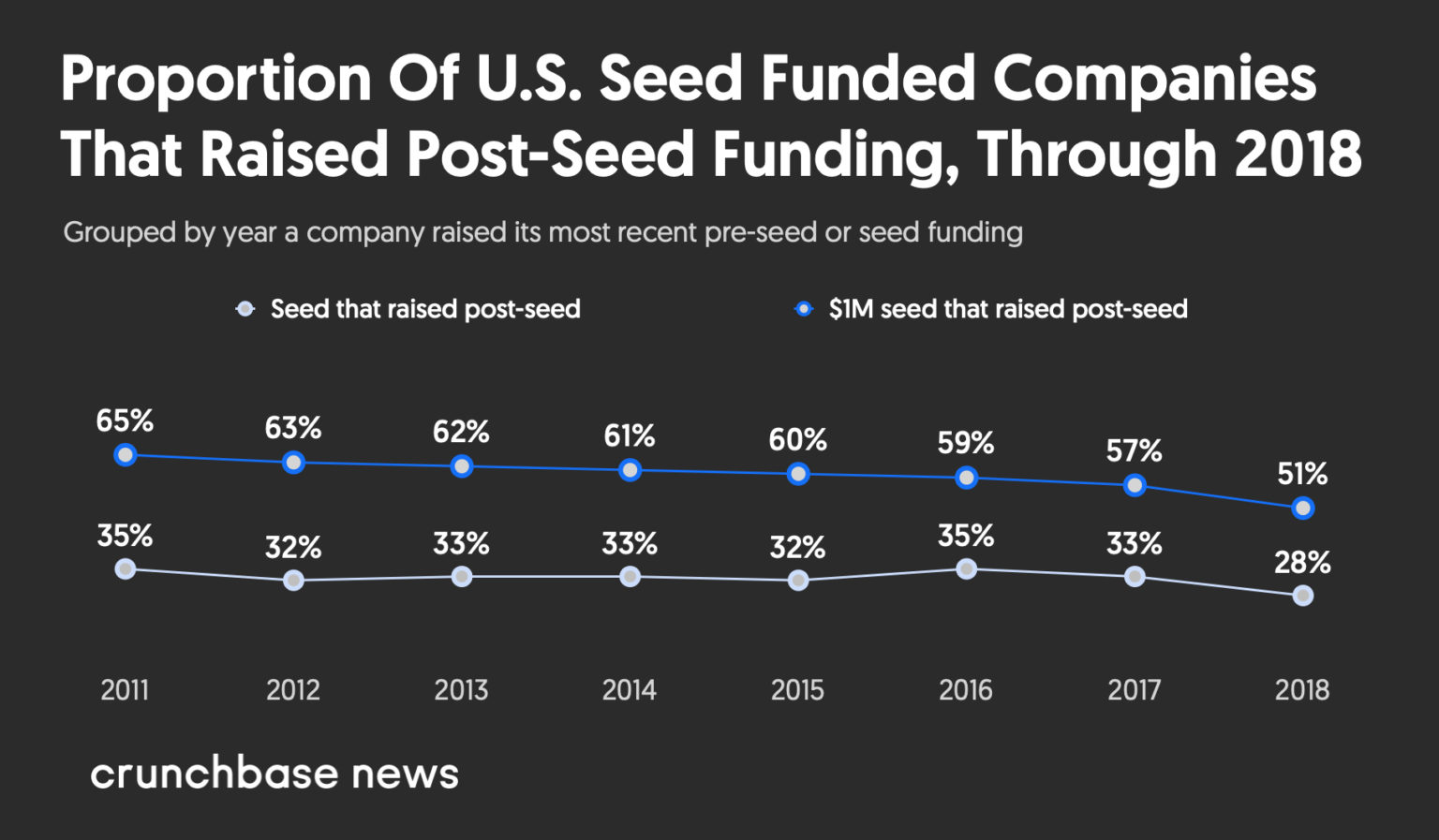

In fact, only around ⅓ of companies that raise a Series A get there by raising a pre-seed round first, according to Crunchbase data.

Read on to find out if pre-seed funding is the right move for your business.

When Should You Seek Pre-Seed Funding?

Before you go seeking investors, it’s important to understand whether your startup is ready.

Investors meet with thousands of founders every month, so you want to be putting your best foot forward.

These are a few indicators that your startup is ready to seek pre-seed funding:

You Can Speak to Product/Market Fit

Startups go through a number of iterations on product during their early stages. Just because you have a good idea that you believe can help solve a problem for your target audience doesn’t mean there is market demand for it.

Sometimes your original MVP doesn’t gain traction, or needs additional features to be a useful tool even as a free platform.

While you probably won’t need to prove product market fit with hard data for a pre-seed round (every investor has different expectations and requirements of course), being able to at least speak to this fit and where you expect it to be will be important here.

You’re About to Make Your First Few Hires

If you’re about to make your first few hires, whether they be executive hires (like a CMO) or additional development manpower, this is a good sign that you’re ready to raise a pre-seed funding round.

You Have an Early Prototype

You might not have a fully developed product or MVP just yet, but that doesn’t mean you can’t raise a pre-seed round.

You will, however, need at least some kind of early prototype. Investors at this stage will want to see some kind of proof of concept, and commitment to actually building the thing.

You Have Garnered Some Early Interest from Potential Customers

This is part of the products market fit conversation, but also speaks to the potential for revenue.

Having some demonstrable interest in your product from members of your target audience will be helpful in convincing investors that your startup is worth funding.

You’ve Developed a Reasonable Revenue Model

You don’t need to actually be making revenue at this stage; many companies spend years in the pre-revenue stage as they work on developing a product that’s market-ready.

However, you’ll want to have a clear idea of how you’re going to monetize your idea once the product is ready, and what revenue figures would look like at different user counts.

Learn more about building out a revenue model in our guide: 9 Popular Revenue Models Explained (And How to Pick the Right One).

How Much Pre-Seed Money Should You Raise?

The answer to the question depends largely on your business needs.

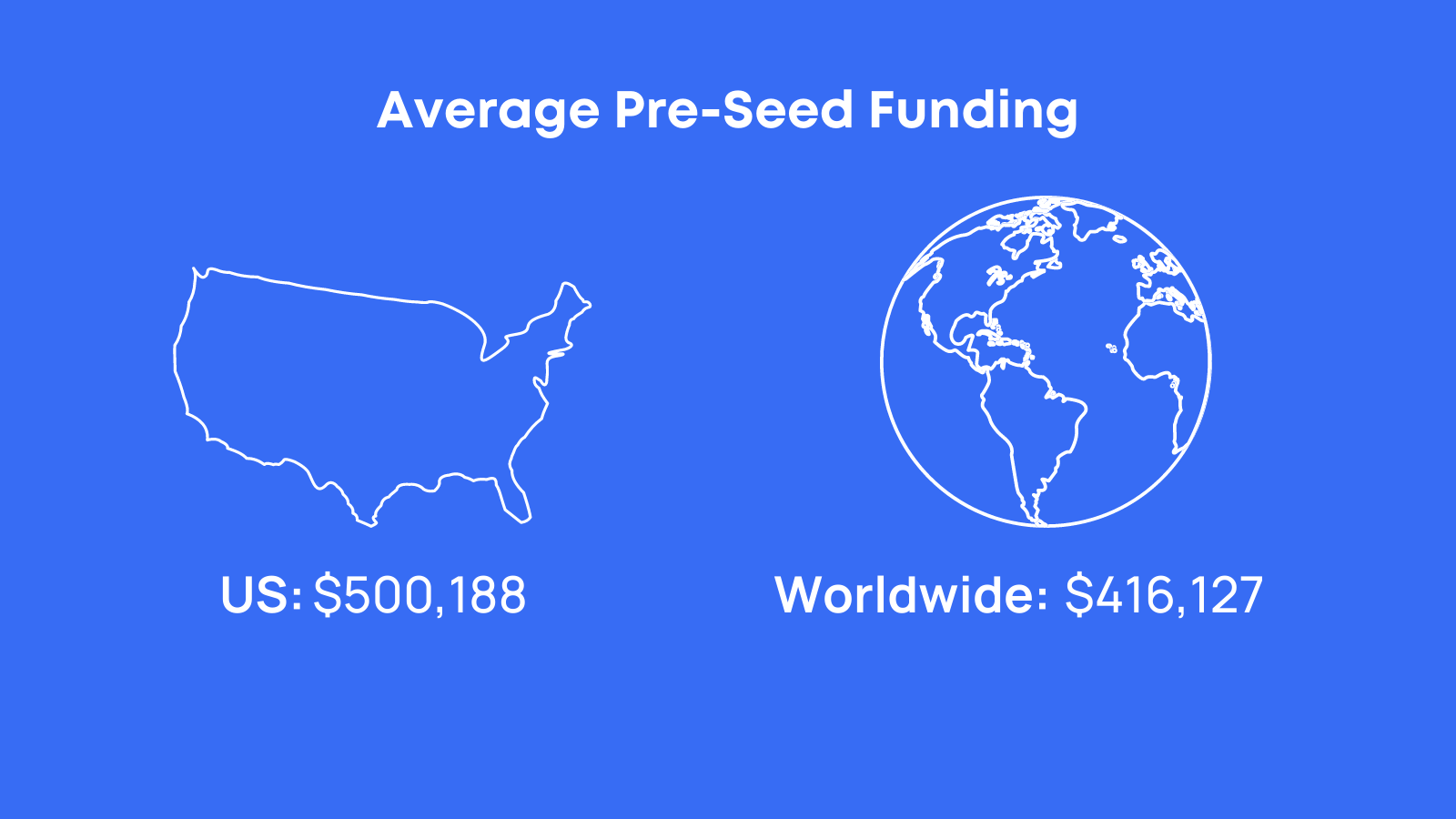

To give you a bit of context, the typical pre-seed investment around the world is between $400-500k.

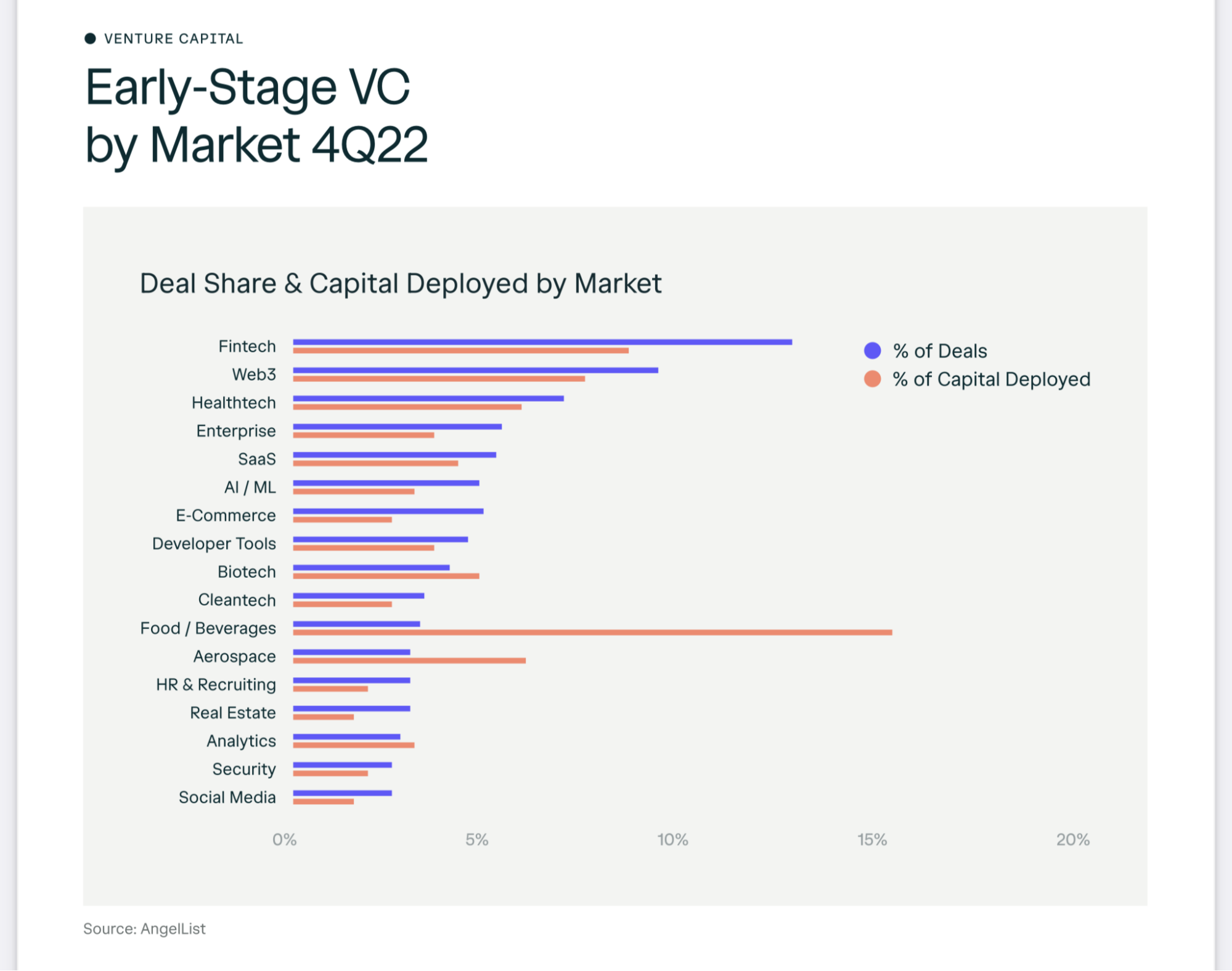

In certain industries, like aerospace or food and beverage, the amount of funding received tends to be significantly higher than average.

As such, this $500k average is representative of the VC market as a whole. If you’re in tech, you should lower your funding expectations accordingly.

The best way to determine how much pre-seed funding you need is to determine either:

- The amount you need to reach profitability

- The amount you need to reach the next funding round

For many tech companies, they’ll be looking at the latter, as a pre-seed funding round is unlikely to see them through to a market launch and profitability.

The best way to calculate this is to look at your monthly cost (for example, the number of developers you need multiplied by their monthly salary), and then multiply this by the number of months it will take you to reach your next milestone.

The goal here is not necessarily to raise as much as possible.

It’s to raise as much as you need.

Remember, there is no such thing as a free lunch here.

According to SeedInvest, most investors take a 10-15% cut of equity at the pre-seed stage. The more funding you raise, the more you’ll be giving up in exchange (in terms of company equity).

This said, an important insight from Crunchbase is that companies that raise more than $1m in a pre-seed or seed round have a better shot of making it to Series A.

So, when determining how much to raise, it may be worth erring toward the bigger end of your expectations to give your startup the best shot at survival.

Where to Get Pre-Seed Funding

Where funding rounds further down the line (like Series B and so on) tend to be more or less restricted to venture capitalist firms, pre-seed funding can come from a variety of sources.

While the terms of your deal will vary, both individually and with respect to the kind of investor you choose to side with, expect to give something up in exchange for the investment.

This isn’t like borrowing $20 for gas from your mom while you were in college. We’re talking tens or even hundreds of thousands of dollars here, and investors aren’t doling money out just for fun.

They’re looking for a return on their investment.

Most commonly, pre-seed money is invested in exchange for equity in your company, meaning the investor will own a percentage of what you build.

Other common terms include:

- Your standard loan with an interest rate

- Convertible debt (like a loan, but it can be converted to equity later)

- SAFE (essentially a promise of future equity)

Here’s a breakdown of the most common sources of pre-seed capital:

Angel Investors

Angel investors are the most common type of investor when it comes to pre-seed funding.

Angels are essentially wealthy individuals (as opposed to an entire firm, which we’ll get to next). These people typically have some experience growing a company, though this experience may not necessarily be extensive.

These kinds of investors tend to be interested in more risky ventures than your standard VC firm, hence you’re more likely to find an angel to provide pre-seed funding.

Angel investors most commonly fund amounts up to $100,000, meaning they might not be the best option if you need a large amount of capital upfront.

The benefit, however, is that working with an angel investor tends to be a lot faster and more fluid, as they are the sole decision-maker.

Pre-Seed VC Firms

Across all funding rounds, venture capitalist firms are the most common form of investor.

The problem is (at least for early-stage startups), most VCs are only interested in funding more developed companies, and so most often get involved in Series A funding and beyond.

There are, however, some VC firms that invest in fresh startups, and these are the kinds that you may be able to approach for pre-seed funding.

The pros and cons of this approach are essentially the opposite of the angel investor approach:

VCs may be able to provide more capital, but they are typically more stringent with a more drawn-out process.

In some cases, venture capitalists are able to provide some form of coaching and business development assistance as well.

Friends and Family

Friends and family can be a tricky one. You’ve probably heard the saying:

Don’t mix business with pleasure.

However, some very early-stage companies are simply not deemed appropriate by angels and VCs, which can leave founders without much choice.

If you’re going to approach a friend or family member to invest in your startup, it’s a good idea to restrict your options to those who have a degree of investor sophistication, so they can thoroughly understand the risks involved.

From there, approach the conversation as you would with a regular investor; show them a pitch deck, prepare your financial projections, and make sure to put a contract together (you should hire a lawyer for this).

Crowdfunding

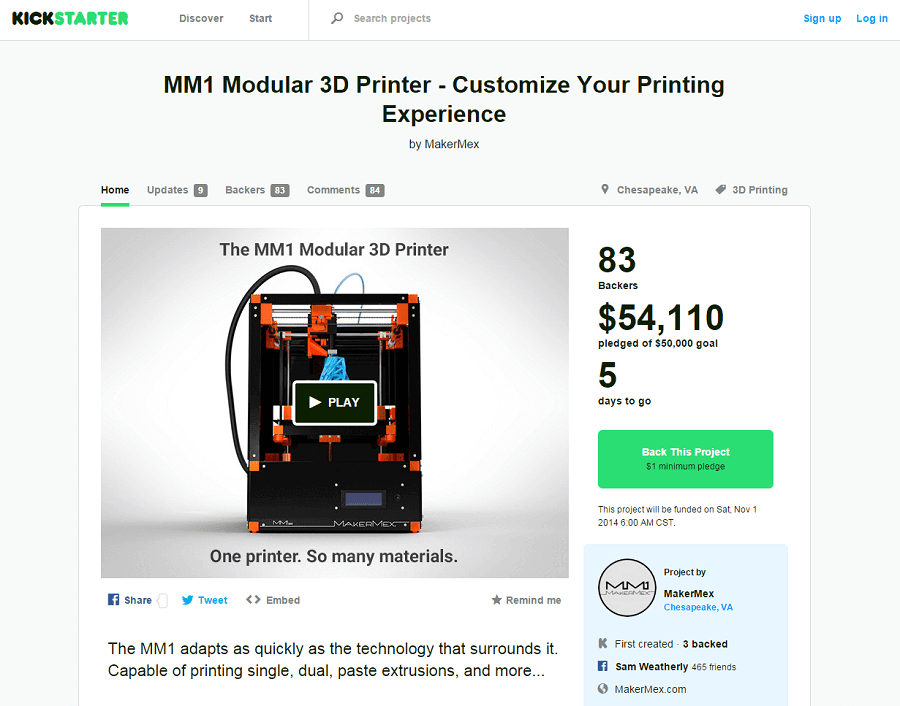

Crowdfunding is an interesting approach to investing that involves obtaining early buy-in from a breadth of future customers.

In this approach, the startup goes to market with a crowdfunding campaign, and says to the world:

“We want to build this thing. We need this much money. If you pledge $X, you’ll be the first to get the product.”

If the founders can garner enough interest, and accumulate enough pledges, they’ll receive the required investment to build the product, and then fulfil their end of the deal.

The crowdfunding investment approach requires a lot of marketing effort (you need to get your campaign in front of a lot of people), but it can also be a great way to not only test the market for your product but to gain some initial traction and brand awareness.

One of the biggest benefits of crowdfunding campaigns is you don’t have to give away equity. Instead, you typically give early access to your product or other perks in exchange for the investment/pledge.

Accelerators and Incubators

Your final option for raising pre-seed funding is to seek an investment from an accelerator or incubator.

These programs are essentially crash courses for early-stage companies.

What you get out of the deal depends largely on the provider, but in most cases, accelerators and incubators offer a lot of coaching, feedback on product development, and open up doors to meet influential people in relevant entrepreneurial communities.

Some of these programs also include some form of pre-seed funding, though many of them simply assist you in raising funding from angels or VCs.

What You Need in Order to Raise Pre-Seed Funding

Before you go out looking for pre-seed funding, put yourself in the investor’s shoes.

What might they expect to see from a company such as yours before making a decision to invest?

Now, this is likely to differ significantly between investor types. Your dad is probably not going to be as meticulous as a venture capitalist would be, for example.

So, if you’re undecided on a specific type of pre-seed investor, the best thing to do is to prepare for the most detailed approach (usually VC firms), so you’ll have everything you need for any situation.

Here’s what most pre-seed VC firms will be looking for in order to assess your request for funding.

- A clear description of the problem that exists

- How your company or product delivers a solution to this problem

- Descriptions of product MVP as well as future development

- Your estimates of the total addressable market

- An analysis of the competitive landscape, and how your product is differentiated

- Your business and revenue model

- Revenue predictions for the next 5 years

- Customer acquisition predictions for the next 5 years

- A description of your team and what they bring to the table (why areyouthe right people to do this?)

- Key milestones in product and company development

- Your plan for future fundraising

- The amount of pre-seed funding you need, and what it will be used for

5 Steps To Raising A Pre-Seed Funding Round

1. Establish Validation

Validation speaks to your understanding of the market, potential market size, and how your product fits within the existing product landscape and solves additional customer needs.

Here are a few questions to ask yourself before looking for investors. They’re questions that investors themselves are likely to ask, so it’s good to be prepared with some answers:

- Can we prove that we have the capability to build this product?

- How can we demonstrate existing demand for the product?

- How big is the market, and is there evidence that it’s size is growing?

- How can we prove that our business is scalable?

2. Set Fundraising Goals

There are two parts to this.

The second is figuring out how much money you need to raise. But before that, you need to get clear on exactly how you plan to use the funding to grow and scale your business.

Refer back to our list of potential uses for pre-seed funding above for more details on the first part.

Then, use this goal to determine how much money you need to raise.

Let’s say your plan is to use the pre-seed funding to build an MVP and take it to market. You anticipate it taking 18 months to complete this.

So, what costs are you going to incur over those 18 months while developing the product?

The totality of these costs represents the amount of funding you need to raise.

3. Find The Right Kind Of Investor

Remember, you’re essentially selling a portion of your company to the investor you choose to work with, and bringing them on as a business partner.

They’ll be your longest-term partner (other than any cofounders you may have), so you want to make sure the relationship is going to be healthy and fruitful.

Look for alignment along axes such as:

- Leadership style

- Long-term market views

- Values and business views

- Desired level of collaboration

4. Prep Your Investor Outreach

Learning how to reach out to investors correctly is crucial. Because this is your pre-seed round, you might not have a lot of pre-existing connections.

As such, you’ll be performing cold email outreach to get in front of potential investors.

This is an art in and of itself. Check out our guide here to learn how: How to Write Investor Emails That Get a Response.

Build out an investor communications sequence using the above guide, then get emailing!

5. Build Your Pre-Seed Pitch

The quintessential tool for communicating your startup’s value and prospects to potential investors is the pitch deck.

The problem is, many investors are growing weary, with DropBox’s DocSend data showing that VC engagement with pitch decks has fallen about 23% YoY.

Here are a few helpful tips for making your pitch cut through:

- Customize your pitch to the needs and desires of each investor

- Discuss long-term objectives and exit plans

- Provide clarity on your revenue strategy

- Talk up your proof traction (VCs are spending more and more time on this section according to DocSend)

Dive deeper into building your investor pitch here and here.

Ready to Raise Your Pre-Seed Round?

Raising pre-seed funding can be a nuanced process, and it’s likely that you’ll meet with several investors and get turned down many times before you achieve success.

That’s just how the game works. Investors need to be scrupulous. Savvy founders use these failures to learn about their shortcomings.

Often, it comes down to their pitch deck, and the quantitative information they provide to demonstrate potential revenue.

One way you can get a step ahead is by providing potential investors with accurate, comprehensive, clear documentation around your financial plan (i.e. how much it’ll cost to grow, what the growth trajectory looks like, etc.).

Finmark makes that process easier by giving you the tools to prepare everything you need to meet with investors. Learn more here!

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.