How to Write Investor Emails That Get a Response (Templates Included)

As a founder, how many emails do you get every month?

200? 500? 1,000? Things are getting pretty hard to manage at that point, right?

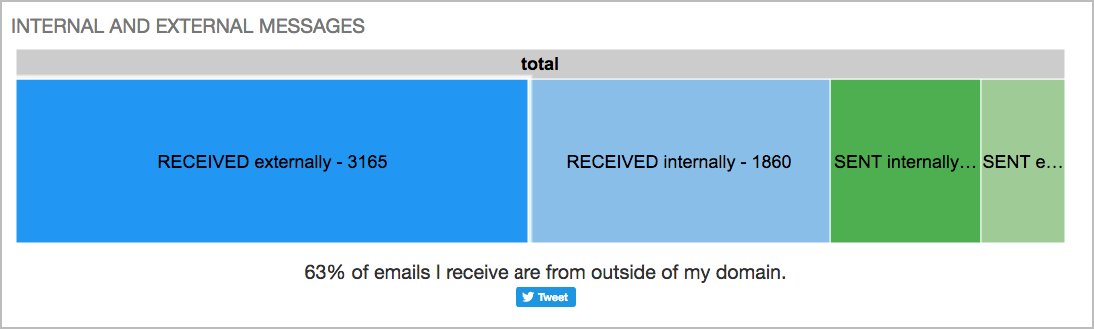

Now consider the average investor, who might receive thousands of emails every single month.

Take White Star Capital’s Christian Hernandez, for example, who received over 5,000 emails in a regular month, over 1000 of which were from unique senders.

That means for every email you send to a potential investor, you’re competing with at least 1,000 others in that same month.

As you can imagine, such investors probably aren’t responding (or even opening) all of these emails.

So how can you expect to get a response from the VCs and angel investors you’re hoping to talk with?

In this article, we’ll provide the perfect five-step framework for writing concise, impactful investor emails that get read and responded to.

We’ll also throw in a simple email template to get you off the ground quickly.

The Perfect Framework For Writing Investor Emails

1. Make It Incredibly Clear What Your Startup Does

The first lesson is this:

Don’t waste any time.

Remember, the person you’re emailing might get hundreds of these same emails this week alone, so they don’t have any time to spare.

After introducing yourself (“Hi, I’m James from Such&Such company”), get straight into what it is your company does.

Don’t fluff this up with fancy startup jargon like “disrupting the market”, just say what it is that you do.

If you’re building a platform that helps users buy, sell, and trade NFTs, say just that, not “We’re helping the next generation of investors build a portfolio of virtual collectibles.”

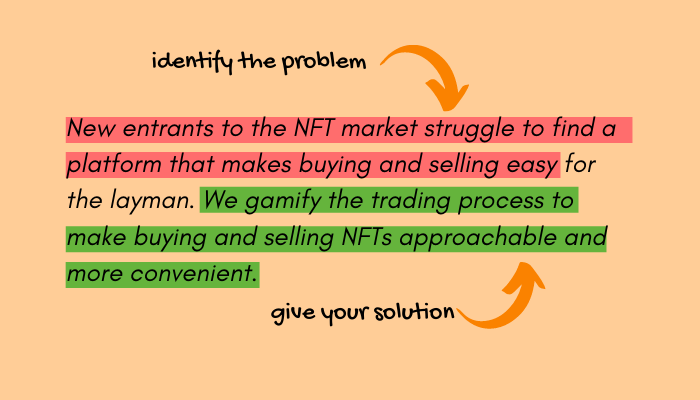

Make it clear, and concise, and then describe the problem that exists in the market, and how you solve it:

2. Sell The Dream

This is the part most startup founders love.

We all have a huge vision for our product and company, and we want to scream it from the rooftops.

Be careful to keep this section of your investor email concise, and ensure it follows the statement of what you do (rather than proceeding it).

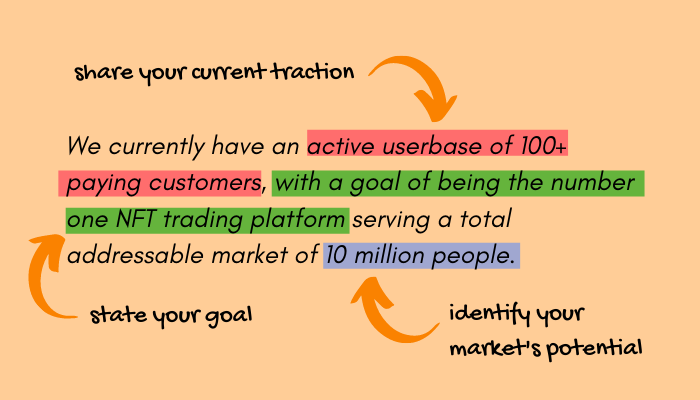

Explain as briefly as possible:

- What your goal is for the company

- Any initial traction you have for the product

- The total addressable market you have identified

For example:

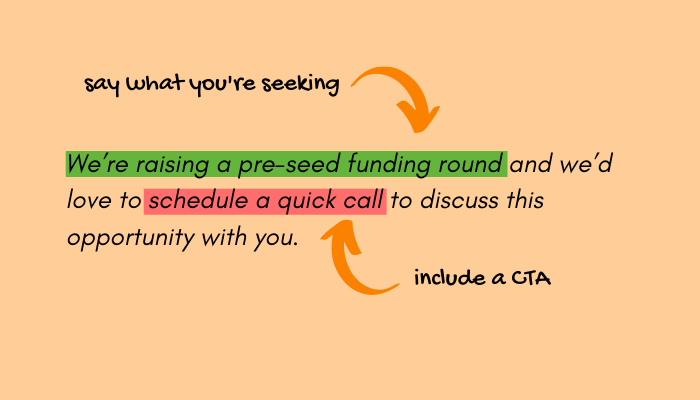

3. Tell The Investor What You’re Looking For

In your third sentence, you should describe to the investor you’re emailing exactly what it is you’re looking for.

Obviously, your end goal is to raise a pre-seed or seed funding round, but your email should be more focused on the next step.

What do you see as the next step here? Do you want to set up a discovery call with the investor? A pitch meeting? Perhaps you’d like to just start a conversation via email, and you have a specific product-related question (“Should we build X or Y next?”)

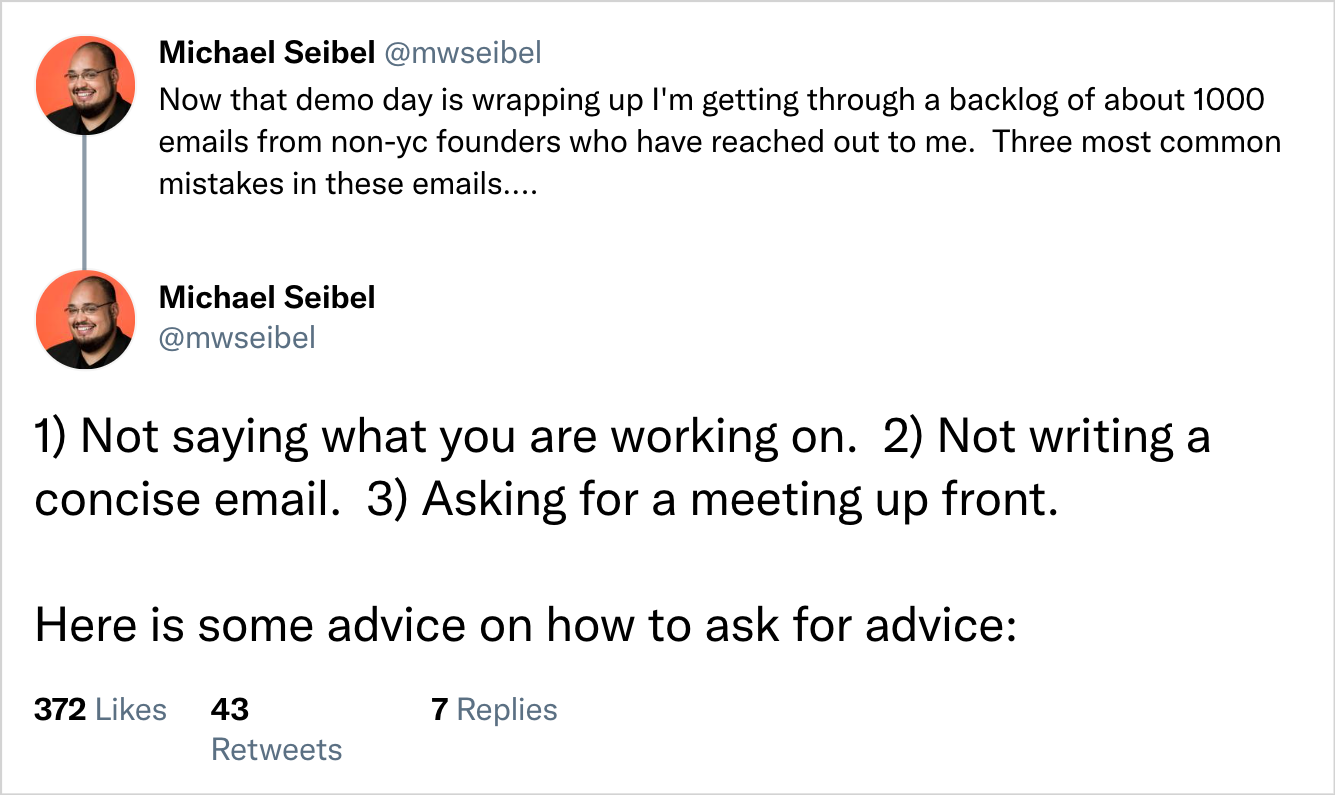

Some investors, like Michael Seibel from YCombinator, prefer this approach.

Starting a conversation in this manner would look something like this:

“We’re working on our MVP and are wondering whether we should prioritize building auction or classified listings?”

Other investors prefer a more direct approach. They know that the end goal is to get on a phone call or meet for coffee, discuss your startup, and kickstart the funding process.

A call-to-action for this type of investor would look like this:

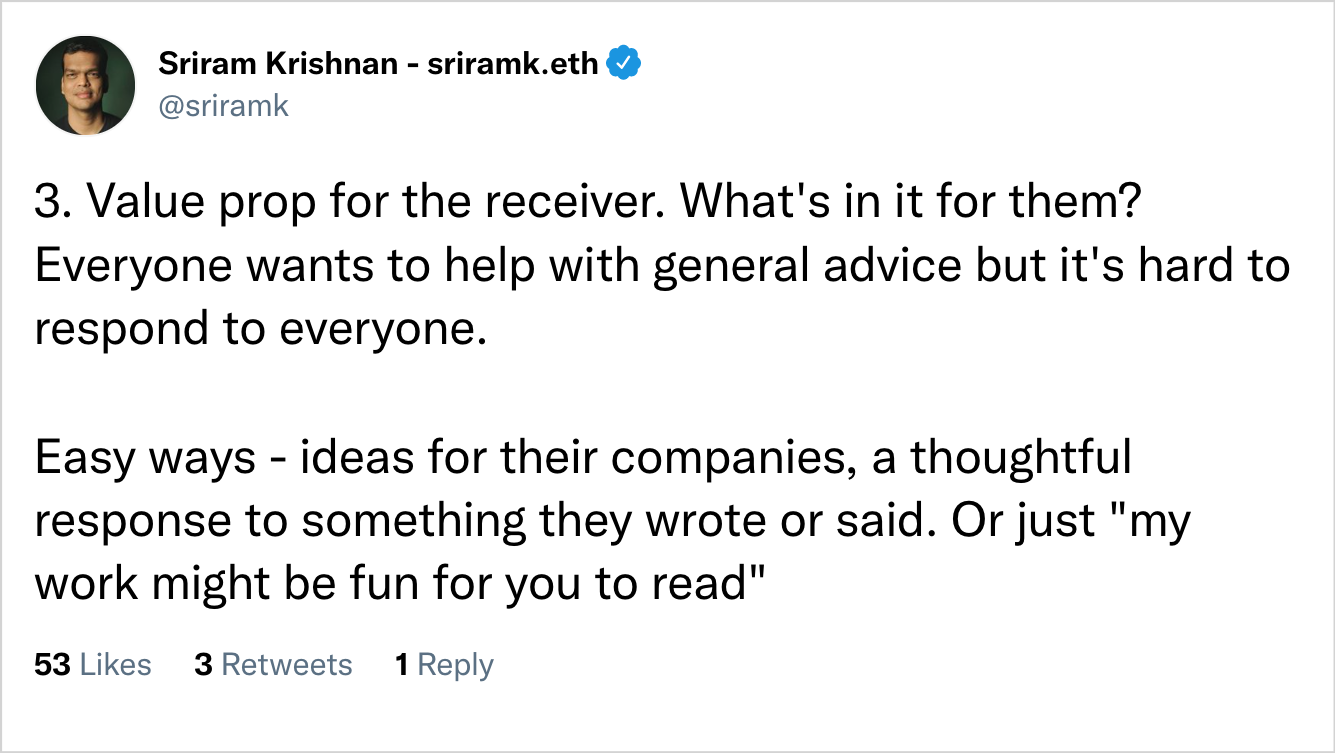

In either case, be sure to be specific in what you’re asking for. Statements like “Would love your thoughts on this idea” are too broad, and are unlikely to receive a response, according to Sriram Krishnan, general partner at investment firm Andreessen Horowitz.

4. Explain Why You’re A Good Fit For The Investor

Investors want to know that you’ve done your research and that you’re emailing them because you believe their firm’s interests and your’s are aligned, not because you’ve emailed every VC in town to try and raise some money.

Before you send your email, do some research on the investor and their firm (if they’re a venture capitalist), and look to identify:

- Recent investments they’ve made

- Any requirements they advertise (such as tech-only or sustainable ventures)

- Typical funding amounts

Then, explain why you believe you and the investor are a good fit to work together:

5. Attach Your Pitch Deck

Lastly, it may be helpful to the investor if you attach your pitch deck to the email.

This allows your investor to find more details about your product, traction, market research, and company vision, but allows you to keep your email short and sweet.

Leave this as a sign-off sentence in your investor email:

“I’ve attached a copy of our pitch deck if you require more details.”

Investor Email Templates & Examples

Writing an email to an investor can be time-consuming, especially if you’ve never done it before and you’re starting from scratch.

Save yourself the hours staring at a blank screen, and get up and running quickly with one of our pre-built investor email templates.

Investor Email Template for Cold Emails

This template is great for cold introductions to investors you´ve never spoken to before.

Hi [investor first name],

My name is [your name] and I’m building [product name], a [product category] that [what your product does].

[Target audience] struggles with [audience pain point], and [product name] helps solve this problem by [how your product solves pain point].

We’re [your goal] and I’d like to [what you want to do next].

We’d love to work with [investment firm name] because [how you fit their investment profile].

I’ve attached a copy of our pitch deck if you require more details.

Thanks in advance for your time,

[your name]

Here’s what this would look like in real life:

Hi Brian,

My name is James and I’m building NFTStation, a trading platform that connects buyers and sellers of non-fungible tokens.

New entrants to the NFT market struggle to find a platform that makes buying and selling easy for the layman. We gamify the trading process to make buying and selling NFTs approachable and more convenient.”

We’re raising a pre-seed funding round and we’d love to schedule a quick call to discuss this opportunity with you.

We’d love to work with XYZ Investment Firm because we fit a similar profile to companies you’ve invested in previously (sustainable, future-focused tech startups).

I’ve attached a copy of our pitch deck if you require more details.

Thanks in advance for your time,

James

Investor Email Template for Warm Emails

Use this investor email scenario when you’ve already met the investor previously and they know who you are.

Hi [investor first name],

[Your name] here, we met at [remind the investor how you know each other], where we talked about [your product name], a [product category] that [what your product does].

I’ve been thinking a lot about [a piece of advice or insight you received from the investor], and I have some further ideas on how that might work for [product name].

[briefly outline your idea]

I wonder what your thoughts are on the above? Your feedback would be incredibly helpful.

Thanks in advance for your time,

[your name]

Here’s what this would look like in real life:

Hi Susan,

Chris here, we met at InvestorCon where we talked about 100Proof, an AI-powered fact checking tool that helps content creators avoid misinformation.

I’ve been thinking a lot about your suggestion to integrate a crowd-sourced component, and I have some further ideas on how that might work for 100Proof.

I’m imagining a scenario where users on the consumption side could report information as true or false and provide their sources, and where this process is gamified to maximize buy-in.

I wonder what your thoughts are on the above? Your feedback would be incredibly helpful.

Thanks in advance for your time,

Chris

Investor Email Template for Pre-Seed Stage Companies

This example is a cold email template for companies that are yet to raise any funding and are seeking investors for a pre-seed stage investment.

Hi [investor first name],

My name is [your name] and I’m building [product name], a [product category] that [what your product does].

[Product name] helps solve [audience pain point] that [target audience] faces by [how your product solves pain point].

We are currently a bootstrapped company, and are looking to raise a pre-seed round to [what you plan to do with the funds].

We’d love to work with [investment firm name] because [how you fit their investment profile].

Please see the attached copy of our pitch deck for more details.

Thanks in advance for your time,

[your name]

Here’s what this would look like in real life:

Hi Jonathan,

My name is Samantha and I’m building BetterBottle, the gym water bottle to end all water bottles.

BetterBottle helps keep water cool and fresh even at large capacities, a problem that gym goers regularly complain about, by housing the bottle in a patented insulated layer.

We are currently a bootstrapped company, and are looking to raise a pre-seed round to bring our product to market.

We’d love to work with InvestmentsRUs because I understand you’re actively investing in high-growth consumer products.

Please see the attached copy of our pitch deck for more details.

Thanks in advance for your time,

Samantha

Investor Email Template for Seed Stage Companies

This email template is suitable for companies who have previously raised a pre-seed round, and are looking to take growth to the next level with a seed round.

Hi [investor first name],

[Your name] here, [founder/CEO/other role] of [product name], a [product category] that [how your product solves pain point] for [your target audience] .

Having raised a pre-seed round from [investor] in [month and year of your pre-seed round] and successfully [your growth metrics since the pre-seed round], we’re now looking to maximize on that growth trajectory with a seed round.

We’d love to work with [investment firm name] because [how you fit their investment profile/how they fit your growth goals].

I’ve attached a copy of our pitch deck if you require more details.

Thanks in advance for your time,

[your name]

Here’s what this would look like in real life:

Hi Anthony,

Kevin here, founder and CEO of SmartDiver, a dive planning app that uses AI to help divers find the best dive location based on conditions, proximity, and the cost-effectiveness of travel options.

Having raised a pre-seed round from prominent angel investor Jamie Jameson in September of last year and successfully doubling our user base in the 9 months since, we’re now looking to maximize on that growth trajectory with a seed round.

We’d love to work with TakeMyMoney VCs because of your interest in consumer-facing apps and multiple successes in similar verticals previously.

I’ve attached a copy of our pitch deck if you require more details.

Thanks in advance for your time,

Anthony

Investor Email Template for Series A Companies

Already past the seed stage and looking to raise Series A funding? Use this investor email template to get you started.

Hi [investor first name],

My name is [your name], I’m the [founder/CEO/other role] of [product name]. We’re a [product category] that [what your product does]. We’ve been helping [your target audience] [solve audience pain point] by [how your product solves pain point].

We’re looking to expand our ability to help [your target audience] by raising a Series A round. We raised a [amount of investment] seed round from [your seed investor], and used this to [growth metric].

We’re looking for investors who [your investment needs], and we’d love to work with [investment firm name] because [how you fit their investment profile].

I’ve attached a copy of our pitch deck if you require more details.

Thanks in advance for your time,

[your name]

Here’s what this would look like in real life:

Hi Christina,

My name is Angie, I’m the founder of RetentionHub. We’re an account-based marketing platform that provides intelligent account insights based on hundreds of micro-interactions. We’ve been helping customer success managers reduce customer churn and maximize revenue retention through our AI-powered recommendations.

We’re looking to expand our ability to help CSMs by raising a Series A round. We raised a $1.2M seed round from SeedPlanters, and used this to enhance our AI engine while tripling our user base.

We’re looking for investors who specialize in B2B revenue platforms, and we’d love to work with ScaleUp Inc as your investment prospectus highlights that you’re specifically interested in funding early-stage startups with strong user traction.

I’ve attached a copy of our pitch deck if you require more details.

Thanks in advance for your time,

Angie

Tips For Improving Your Email Response Rate

Use Your Company Email

One of the mistakes Michael Seibel says reduces his likelihood of replying to a cold email is not using your @company.com email.

Even if you don’t have a live website built yet, you should still own the domain and have a company email set up.

Sending investor emails from this address shows a level of professionalism and demonstrates that you’re serious about the venture.

Emails sent from a personal address may leave investors thinking, “Is this company actually legit?”

Watch Out For Spam Filters

One of the biggest reasons founders don’t receive responses is because their emails get trapped by spam filters.

Spam filters are designed to identify potentially malicious emails and block them from reaching your investor’s inbox, and they mostly do this by filtering for specific words and phrases.

There are a ton of words you should avoid, but the most common that apply to investor emails are:

- Buy

- As seen on

- New you

- Double your

- Earn $

- Cash

- Pre-approved

Personalize Your Email

Studies show that emails with personalized subject lines get opened 26% more often, and receive 83% more responses.

Put simply:

Don’t blast all of your potential investors with the same email.

Make sure to address them by name (just use their first name as it appears more natural and less like a mail merge), and personalize your reason for contacting them based on the VC or angel investor’s typical funding requirements.

Make Your Subject Line Obvious

Don’t try and get too creative with your subject lines, and certainly don’t send emails with headers like:

“A great opportunity for you.”

Look, investors invest in startups. They expect to hear from startup founders who are looking for funding. That’s how the whole thing works. So just be straight up about it:

“Introduction – Tech Startup Seeking Pre-Seed Funding”

Look For A Way To Stand Out

Always keep in the back of your mind the fact that investors get tons of these emails a day, from companies that are probably just as promising as yours.

Part of what’s going to get you a response is being concise, respectful, and upfront with the appropriate information (essentially, following the framework we’ve discussed above).

However, you can boost your chances by finding a quick personal connection with the investor.

For example, if during your research on the VC you’re emailing, you’ve identified that they’re a fan of the Texas Longhorns, see if they’re playing this weekend.

Then, simply sign-off your email with something like:

“Good luck with the Longhorns game this weekend!”

Ready to Make Your Investor Emails Less Cold?

Sending cold emails to potential investors is an important first step in the funding process.

But it’s not all over and done there.

Once you get a response, you’ll need to nurture the conversations, track communications in your investor pipeline, and eventually meet with the investor to pitch your startup and secure a funding commitment.

For more info on pitching investors, check out our guide: How to Pitch Investors: 14 Tips to Get Your Startup Funded.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.