Integrated Financial Planning: The Future of FP&A

Tell me if this story sounds familiar:

You’re coming up to the end of the financial year, which means it’s about time to start building a strategic plan for next year.

You spend several weeks pulling together all of the data you need, requesting information on salaries from payroll, expenses data from accounting, and sales trajectory information from the sales VP, to name a few.

Then, you sink another couple of weeks into building all of that information into something that resembles a cohesive narrative, before turning your attention to what next year should look like and investing more long days into a financial plan.

When you’re finally done, you roll the information out to the team, and you’re met with crickets.

Marketing doesn’t understand how the lofty revenue goals you’ve set translate into actionable tasks for their team. Operations is worried that they won’t be able to deliver on that level of sales growth, and so on.

The problem?

Your financial planning process exists in a vacuum. Your data is disconnected, you don’t have a repeatable or scalable process, and you’ve waited too long to seek feedback from department heads.

While this is an unproductive approach, to be sure, it’s also one that many financial leaders take, year after year.

The solution?

Integrated financial planning!

It’s a more strategic approach to developing financial plans that looks to eliminate data siloes and prioritizes collaboration between all departments. As a result, you develop plans that are more realistic, and gain buy-in from all stakeholders before the plan is written up.

This article will give you an overview of integrated financial planning, looking at the three legs that support this strategic approach:

- Software

- Collaboration

- Continuous improvement

What Is Integrated Financial Planning?

Integrated financial planning (IFP) is an approach to financial planning and analysis that involves all stakeholders across all departments (marketing, sales, customer service, operations, etc.)

This is in contrast to the traditional financial planning approach, which is finance-centric, and generally doesn’t seek feedback from department heads until after the plan is built (if at all).

At the simplest level, this requires seeking input from department heads during the planning phase. To be even more effective, however, integrated financial planning also applies its “integration” element to a company’s software stack.

For instance, finance needs access to key data from the company CRM and lead management tools (generally the domain of the sales and marketing departments) to understand the revenue pipeline in more detail.

Or, perhaps they need to dive into a breakdown of employee wage expenses, to accurately calculate what resource expenditure will look like as headcount expands.

Without an integrated tech stack, data like this is siloed, meaning finance leaders need to request specific information from department heads.

This not only slows down the financial planning process, but leads to data integrity issues when leaders don’t pull the correct information, or when formatting issues occur.

As such, integrated financial planning must first integrate at the software level, then through organizational and process changes (bringing department heads in at the planning stage).

Also read: What is xP&A? Extended Financial Planning & Analysis

How Does Integrated Financial Planning Work?

Integrated financial planning is an approach, not a process per se.

That is, there is no blueprint or set of steps to follow precisely in order to “achieve” integrated financial planning. Rather, it’s a more strategic mindset that involves three broad changes:

- Integrating your software tech stack to allow finance leaders to access data easily

- Integrating department leaders into the planning process

- Integrating the results of previous financial plans by way of continuous improvements

Below is a brief exploration of how you might approach each change, but bear in mind that how integrated financial planning looks at your specific organization may differ depending on your requirements, structure, and growth stage (and, of course, preferences!).

1. Integration At The Software Level

In order for finance teams to create accurate (and, therefore, effective) financial plans, they need access to up-to-date financial data that is, itself, accurate.

Digging through a bunch of spreadsheets or requesting data exports from department heads is ineffective. You need all of your systems integrated.

First, get your IT team involved.

They’ll likely be more familiar with the ways and processes in which your various software tools can be integrated, and will be able to provide insights into what’s possible and what’s not.

Then, the best practice is to perform an overlapping license analysis. This involves looking at your various platforms across the organization and finding areas where software tools can be consolidated.

For instance, it’s not uncommon for different teams to be working on separate project management or CRM platforms. If you can consolidate these tools, you not only save money on software expenditure, but create a more cohesive data set.

Then, get to work on the integrations.

Try and use native integrations where possible (those built by the actual platforms you’re using).

If these don’t exist (not all platforms play nicely together), use a dedicated SaaS integration like Zapier to create custom connections.

Lastly, make sure all of the relevant data from these platforms is plumbed into your financial modeling platform, and provide access for the finance team to dig deeper into the reporting suite of your various tools, where possible.

Remember: your overarching goal here is to make financial planning easier.

2. Integration At The Department Level

Data access is a powerful first step on the path toward an integrated approach to financial planning.

However, it’s not quite enough if you’re committed to creating financial plans that translate to team performance goals and garner buy-in from department leaders.

To integrate financial planning at the department level, take a two-pronged approach.

First, use a bottom-up model by asking department leaders what they think they’ll need from a finance perspective in the coming period.

Look at growth goals, hiring initiatives, new feature releases, and any other strategic undertakings that are likely to mean that a department will be operating at a higher volume than previously.

Then, seek advice from department heads as to what they think this will mean in terms of expenses.

From there, move toward a top-down model, where you create the plan itself and then ask for feedback from each team leader.

Use the recommendations they’ve made, and supplement them with your own market research and hard data.

For example, your head of sales may be able to accurately estimate the headcount required to achieve your revenue goal for next quarter. However, they mistakenly underestimate the total cost of this hiring, because they don’t account for expenses like:

- Commissions

- The purchase of equipment like laptops and phones

- Training and onboarding costs

- Any costs involved with actually hiring

Present your financial plans in a digestible manner (stay away from complex FP&A jargon that only serves to alienate your colleagues), and allow them to digest and respond.

Integrate relevant feedback, then move forward with the plan.

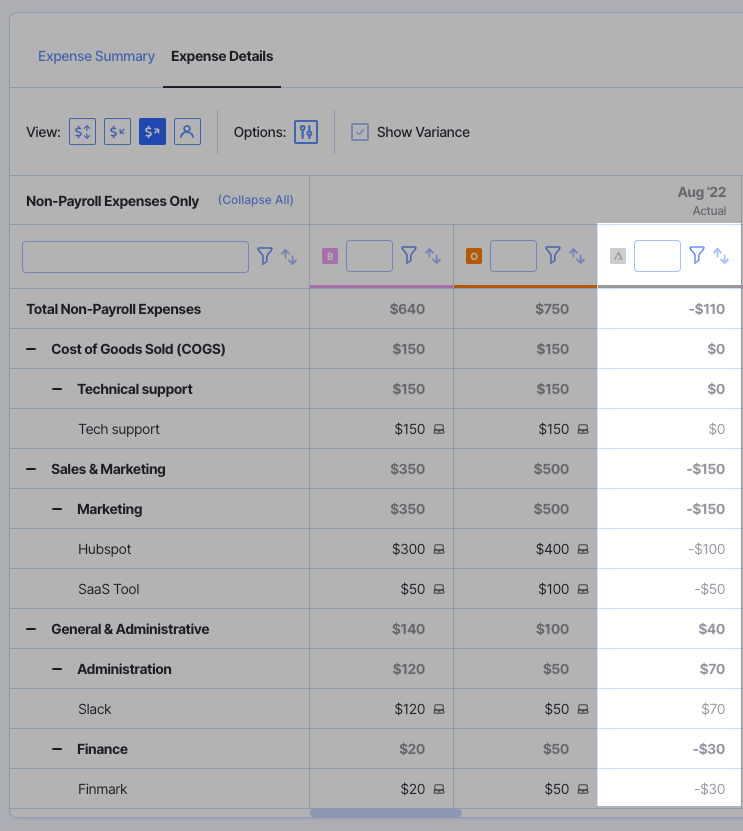

Hint: Finmark, from BILL makes this process very simple thanks to our easy-to-read charts and graphs. Plus, your team can leave comments and notes directly on the platform.

3. Integration At The Strategic Level

This last step of integrated financial planning involves embracing a culture of continuous improvement.

At a high level, this is pretty simple.

At the end of each financial period, review your actuals against your budgets and see how your real-world performance stacked up against your plan.

Ask:

- In what ways did we not meet our goals?

- What external reasons exist for any differences?

- What internal reasons exist for any differences?

- How can we apply this learning to our financial planning process in the future?

This last question is really the crux of the continuous development model.

Let’s say, for example, that you came in at 5% under your revenue target. You did pretty well, and still grew revenue from the previous year, but you didn’t quite meet expectations.

There weren’t any external factors that drove this, and you did everything you had intended to in the plan.

The problem was, however, that it took much longer than you anticipated for your new sales hires to reach a point where they were consistently hitting target, so you lagged behind your new customer goal.

Now, you can apply this learning to the next financial plan, creating a more realistic plan by calculating the actual ramp time required when hiring new salespeople this financial year.

How Integrated is Your Financial Plan?

Integrated financial planning is a powerful approach to creating financial plans.

It helps you create more accurate estimations, design budgets that actually make sense, and gain buy-in from each of your department leaders (you know, the people who actually put the plans you create into action).

To really nail the approach, however, you need a centralized financial platform for managing all of that data, and for translating complex financial information into easy-to-digest reports that make sense to non-finance people.

Finmark is the financial planning tool designed small and medium-sized businesses who want to scale strategically.

Design dashboards to track key financial metrics, easily analyze multiple scenarios, and build budgets and compare actuals in an instant, without having to wade through a ton of spreadsheets and siloed platforms.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.