Scenario Planning and Sharing: Endless Possibilities, Effortless Collaboration

We’ve written previously about why startups should care about financial modeling. A financial model that provides a clear line of sight into key metrics like runway is crucial to survival and scaled growth.

But once that base financial model is in place, it’s important to plan for contingencies.

If 2020 showed us anything, it’s that things don’t always go as planned. We’ve added some new features in Finmark to help you plan for the unexpected.

Be Prepared for Anything with Scenario Planning

What if your initial assumptions are too aggressive? A downside model that is more conservative and reigns in expenses can help extend runway to allow time to course correct.

On the other hand, what if your assumptions aren’t aggressive enough? An upside model enables you to invest more aggressively in areas like hiring to capitalize quickly on favorable circumstances and drive faster customer acquisition.

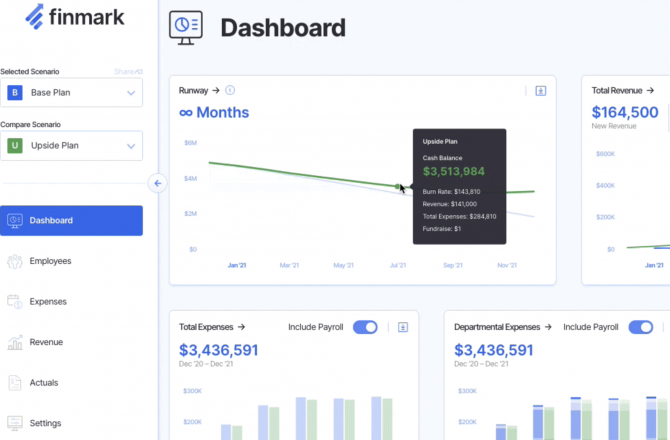

This is why we’re so thrilled to announce Scenario Planning! Finmark now makes it easy for you to create and manage multiple financial plans for your company. You can also visually compare two models directly in your Finmark dashboard.

With these new features, you can create new plans by starting from scratch or by making a copy of an existing plan. Once you have multiple plans in place, you can select which plan you want to view/edit directly from your Finmark Dashboard.

Collaborate with Scenario Sharing

No man is an island, and no founder is either. An effective financial model should be a cornerstone of your strategic decision-making, so you’ll likely need to share it with others inside and outside your organization.

For instance:

- Your investors are asking for a monthly update that includes your financial projections for the next year

- You need input from your co-founder on key assumptions that impact your revenue forecast

- You’ve brought in a consultant to help you manage your expenses and you need an easy way to collaborate with them

Now with Scenario Sharing, you can easily share any of your Finmark financial models with others to facilitate collaboration and scenario analysis.

This feature set allows you to invite new users into Finmark by providing visibility to plans that you have created.

Finmark allows you to manage which plans you want to share, and which plans you want to keep private. When you share a plan, you can also set the level of permissions for each user on a plan by plan basis, including edit and read-only access.

The scenario management capability allows you to see who you have shared each scenario with, share with additional users, edit permissions, and revoke access.

With this new set of powerful tools, you now can plan for multiple scenarios, compare them to one another, and easily share and collaborate with others both inside and outside of your company.

Ready to get started? Sign up today to start building your custom financial model.

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.