What is Negative Cash Flow? (The Silent Killer of Small Businesses)

So, you’ve just got off the phone with your accountant, who has just finished your quarterly financial reports.

“Cash flow was negative month on month for the last three months,” they said.

Negative cash flow.

Doesn’t sound good, right? Is this something you should be concerned with, or just a normal part of business operations?

Well, while there are businesses that can run successfully with a negative cash flow (more on that soon), this is, for the majority of companies, a bad sign.

What is Negative Cash Flow?

Negative cash flow simply means that, for the given period, your business spent more than it earned. That is, more cash flowed out of the business then flowed in.

Its counterpart, positive cash flow, is the exact opposite: more money came in than went out.

So, negative cash flow isn’t a good sign, by all accounts, but it doesn’t necessarily mean you’re losing money per se.

Negative cash flow is often the result of incorrectly timed expenses and income.

For example, let’s say you make $10,000 in sales in July and have $5,000 in total expenses to pay. However, that $10,000 doesn’t all make it into your bank account in July; $8,000 is delayed and won’t reach your account until August.

While you technically made a profit for that month, your cash flow was negative, as only $2,000 but $5,000 went out (assuming you’re using cash basis accounting).

So, while that’s not the worst case, it’s still not nothing to worry about, as it can quickly get you into trouble with overdraft fees and other bank charges, and it’s generally not a good look from an investor’s standpoint.

Then, there’s the objectively worse kind, where negative cash flow is persistent across multiple months.

Unless there is an obvious reason for sustained negative cash flow (e.g., you’re growing super fast and making a ton of new sales, but the invoices aren’t due for 90 days), if your cash flow analysis comes up consistently negative, this typically means you’re losing money.

So yeah, a pretty bad sign.

Or is it?

A Note On Pre-Revenue Startups

When looking at negative cash flow, we need to think about it in the context of the business we’re examining.

A long-established business that has suddenly had a huge drop in sales and is seeing cash flow go negative is generally not in a good situation.

But what about an early-stage startup with a recent cash injection from an investor, who is solely focused on building their product.

This kind of company isn’t making any money yet (they are known as a “pre-revenue” company), but they are definitely spending it.

In this case, the business has negative cash flow. While it’s still arguably better to have positive cash flow, it’s not a specific cause for concern here. As long as the company is working effectively toward its goal (reaching the next funding milestone or achieving a minimum viable product that they can put to market), and has enough runway, it may not be as big of an issue.

Consequences of Negative Cash Flow

Let’s get the big hairy one out of the way:

If your business sees negative cash flow consistently and persistently, you’re going to go out of business if things don’t change.

Companies can only sustain going backwards for so long. Unless you have solid backing from an investor, negative cash flow is going to prevent you from being able to pay your bills before long. Even then, a good investor is going to know when it’s time to cut their losses, so negative cash flow can never go on forever.

So that’s your ugly long-term consequence, but there are some shorter-term consequences to cash flow problems as well.

Let’s say you occasionally have a negative month, not due to “losing money” exactly, but because of poorly timed payments from customers.

While this may be okay if you have a decent cash reserve to dip into, for many organizations it can lead to:

- Bank charges like interest or unauthorized overdraft fees

- Late payments to their own suppliers

- Inability to pay staff wages

- Low investor confidence and a lower likelihood to receive future funding

Okay, I know this has been a little doom and gloom so far.

So, let’s turn our attention to what to do about negative cash flow, starting by learning how to identify common causes.

Common Causes of Negative Cash Flow (+ How To Avoid Them)

Ineffective Financial Management

The biggest thing that causes negative cash flow issues for small businesses is poor financial management.

Largely this comes down to scheduling.

The idea here is to get invoices out to customers far enough in advance that they are paid before your expenses go out. A good strategy is to have invoices out on the 1st of the month, due on the 21st, with all of your expenses scheduled from the 25th onwards.

Pro tip: Using AR automation software like BILL can help here.

Late Payments From Customers

Even with the best invoicing process, you’re going to face some late paying customers.

Sometimes that’s because a new member joined their accounts payable team and the invoice got missed, other times it’s just to cash flow issues on their end.

Strategies for overcoming this are:

- Schedule automated alerts to you (and the customer) as soon as invoices are overdue

- Keep an eye on regular late payers and consider not doing business with them

- Create incentives to pay invoices quickly by offering an early payment discount

Incorrect Pricing Strategy

This can quickly put businesses into negative cash flow without even realizing it.

If, for instance, you offer a tiered pricing model with discounts for higher volumes, but fail to account later for an increase in the costs of operation, then a large order could put you into the red.

The best practice here is to revise your pricing strategy and profit levels on a regular basis, quarterly at a minimum.

Unexpected Expenses

Then, of course, there’s just those out of the blue expenses that catch us off guard, like an extraordinarily large utilities bill or a sudden need to invest in online security.

While it’s impossible to predict the unexpected, you can prevent such expenses from turning cash flow negative by ensuring that, generally speaking, your cash flow is sufficiently positive to be able to account for a sudden increase in outgoings.

Best Practices For Managing Negative Cash Flow

Analyze Cash Flow

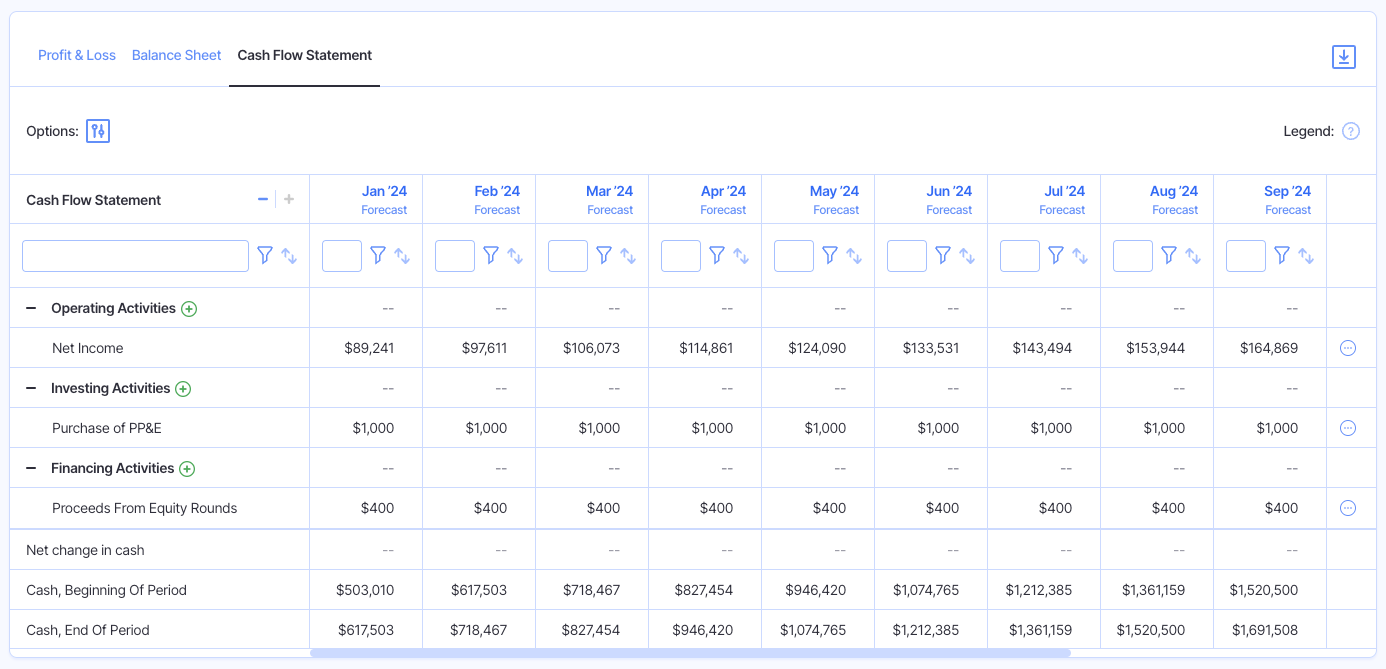

It’s difficult to get a good hold on your cash flow if you don’t have all of your financial details locked and loaded in a single platform.

A financial reporting and analysis tool like Finmark from BILL is your best bet here.

Platforms like Finmark allow you to connect your accounting platform, giving you direct insights into your cash flow.

This will, at a minimum, allow you to see in advance when cash flow is turning negative, and put appropriate solutions into play.

Incentivize On-Time Payments

As we’ve discussed, one of the biggest drivers behind negative cash flow is customers that don’t pay on time.

In an ideal world, every customer would pay you on-time, every time..

But, things happen. Invoices get missed, payments bounce, and new customers sometimes take longer to get set up for smooth payment than expected.

A good strategy for mitigating this is to provide an incentive for on time payments. For instance, you might offer a 5% discount on the invoice total when customers pay before the due date.

Improve Scheduling of Outgoing Payments

Then, there’s the other side of the equation, your outgoing payments.

A good move here is to do what you can to schedule your payables to go out when the account is flush with cash.

For instance, if your clients are expected to pay by the 15th of every month, then it’s a smart idea to talk to your creditors and see if you can arrange to pay them on the 20th.

Forecast Cash Flow Proactively

Cash flow shouldn’t only be looked at retroactively.

The best finance professionals anticipate changes and developments in their company’s cash flow before they happen.

Check out our guide on doing just that: How to Create a Cash Flow Projection: Step-by-Step Guide.

Bring In The Experts

If all of the above doesn’t get you back into the black, it might be time to consider looking for outside help.

Here are a couple of options to consider:

- Look into the possibility of securing a loan or grant to help with short-term cash flow issues

- Engage with an accountant or financial advisor to access expert advice on managing your incoming and outflowing cash

- Seek legal advice on how to receive funds from a customer that’s gone rogue and refused to pay

Minimize Negative Cash Flow With Finmark

Keeping cash flow from turning negative is a fundamental task on any business owner or finance leader’s plate.

But, despite its importance, it shouldn’t consume a significant portion of your time each week.

Instead, save yourself the time (and headache) with a dedicated financial analysis and planning platform like Finmark.

With Finmark, you can track how cash flows in and out of our business, and analyze any potential causes of negative cash flow.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.