How Much Runway Should Your Startup Have?

For most founders, some things come easily.

Understanding market demand, visualizing product roadmaps, developing plans to drive more revenue. These are areas where many founders excel.

What doesn’t come so easily to most is the myriad of financial projections, models, budgets, and calculations involved in building a growth-stage startup.

One question, in particular, is on the minds of most first-time founders:

How much runway should a startup have?

A quick Google search will tell you that the most common answer seems to be between 12 and 18 months, but is this a trustworthy and reliable enough measure to stake your company’s future on?

In this article, we’ll discuss how to calculate cash runway, why startup founders should have a strong understanding of how runway impacts business operations, and, of course, we’ll investigate the data that will help you understand just how much runway you actually require.

What Does Runway Mean?

Let’s start simple.

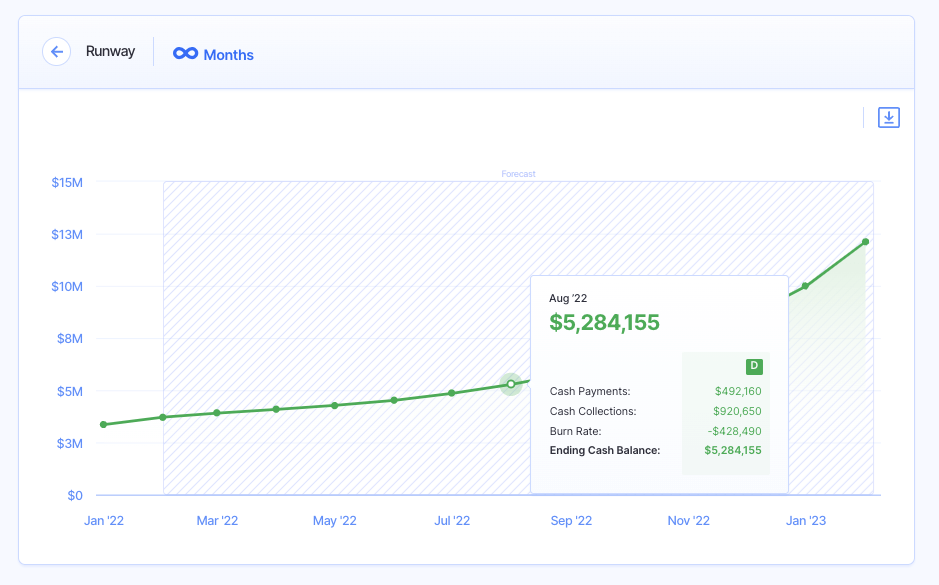

Cash runway is the number of months your company has until it runs out of money.

It’s a very common and important metric particularly for early-stage companies that don’t have well-established revenue streams.

If your only source of cash is the funding you’ve received from an investor, and you’ve yet to generate any revenue (or enough to sustain your ongoing costs), then cash runway becomes a crucial calculation.

So, how exactly do you calculate cash runway?

Calculating Cash Runway

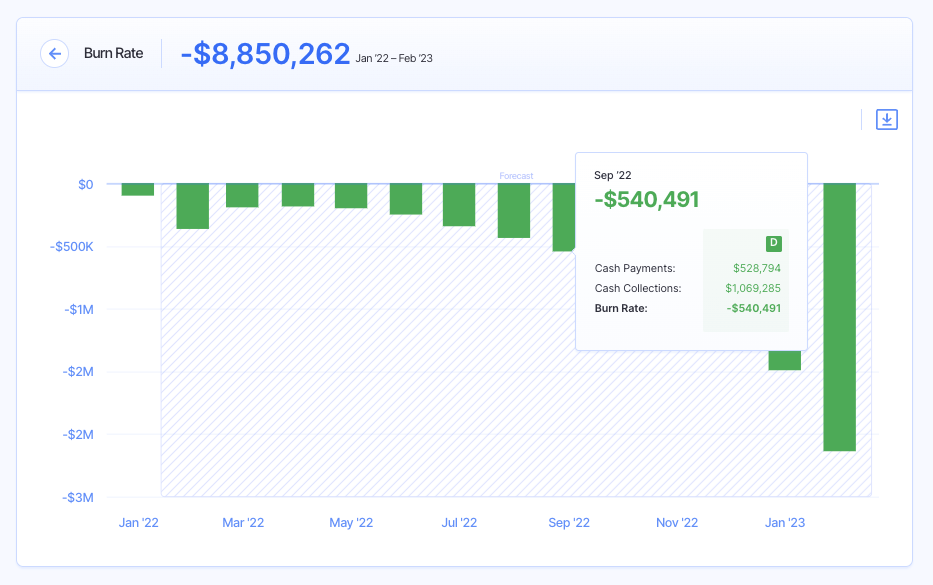

Cash runway is typically calculated using your cash burn rate.

To determine how much runway your company has, you’ll need to know the following figures:

- The amount of cash you currently have on hand

- Your total monthly expenses

- Your current monthly revenue

First, we calculate the cash burn rate, as follows:

Monthly expenses minus monthly revenue.

For example, if your monthly expenses are $15,000, and you have an MRR (monthly recurring revenue) of $5,000, then your cash burn rate is $10,000.

To determine our cash runway, we divide our total cash by our cash burn rate:

Cash runway = Cash on hand / cash burn rate

Let’s illustrate with an example.

Say we have $150,000 in cash on hand. With a burn rate of $10,000, the calculation looks like:

$150,000 / $10,000 = 15

Meaning our cash runway is 15 months.

If you don’t want to do a bunch of math, an easier solution is to use a tool like Finmark to calculate it for you.

With us so far? Cool. So why does all of this matter?

Why Should Founders Be Concerned with Runway Calculations?

Established companies with a strong revenue model tend to be less concerned with runway calculations than their startup counterparts.

That’s because companies with sufficient revenue are turning a profit each month, and they know that they’ve got enough cash coming in each month to cover their expenses.

Startup land is a little different.

Often, early-stage companies aren’t making any revenue yet.

For example, if you’ve just raised a pre-seed funding round, you might be concerned with using that funding to develop a viable product and gain some initial market traction, and not so much with driving revenue.

In this case, you’ll be spending more money each month than you’re making (i.e. you’re burning cash).

This is where understanding your startup runway calculations becomes crucial. If you’re not carefully watching your cash reserves (and how fast they’re depleting), you could quickly run out of cash.

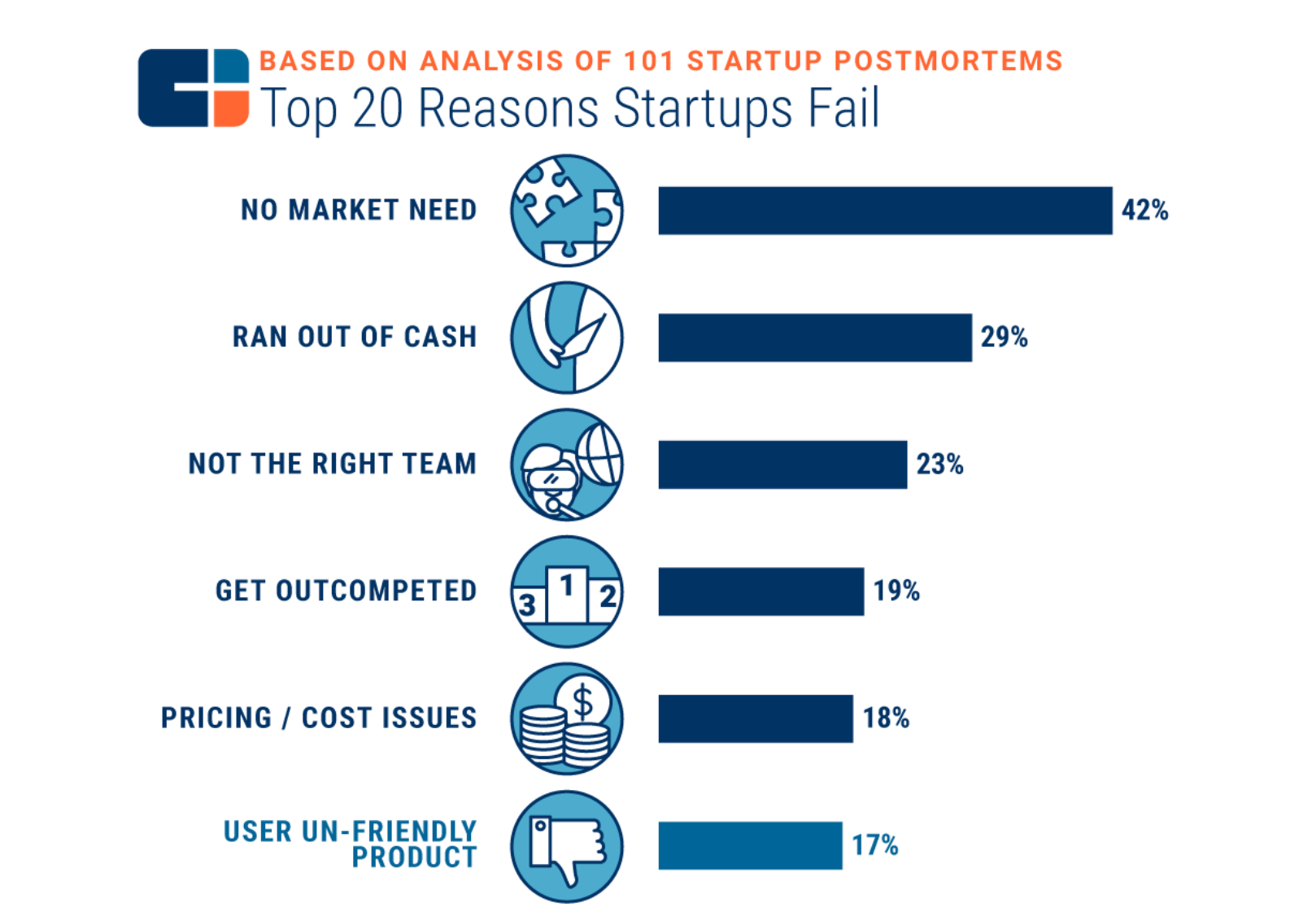

In fact, running out of cash is the second most common cause of startup failure, second only to a failure to build something that the market actually wants.

So cash runway is pretty important. But how much do you actually need?

How Much Runway Startups Need (According to the Data)

Conventional wisdom appears to state that the typical startup needs between 12 and 18 months of runway.

Unfortunately, this conventional wisdom isn’t all that wise, and really isn’t supported by the data we have on what companies actually do once they get funded.

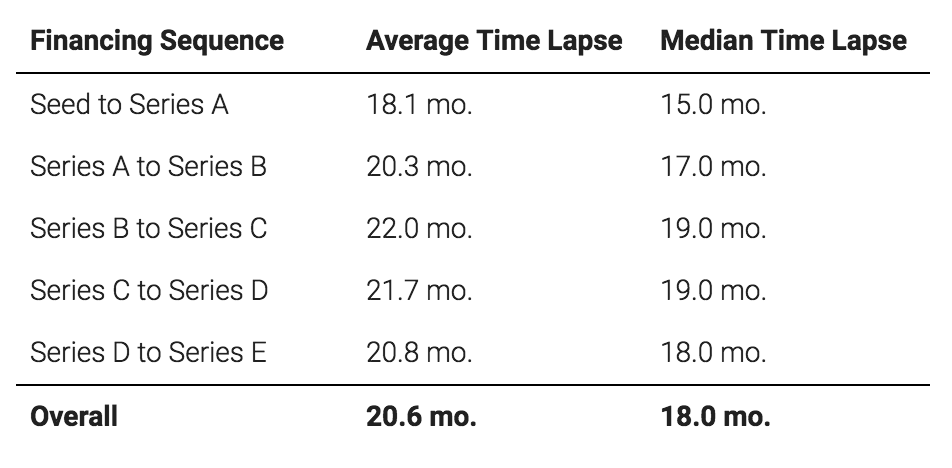

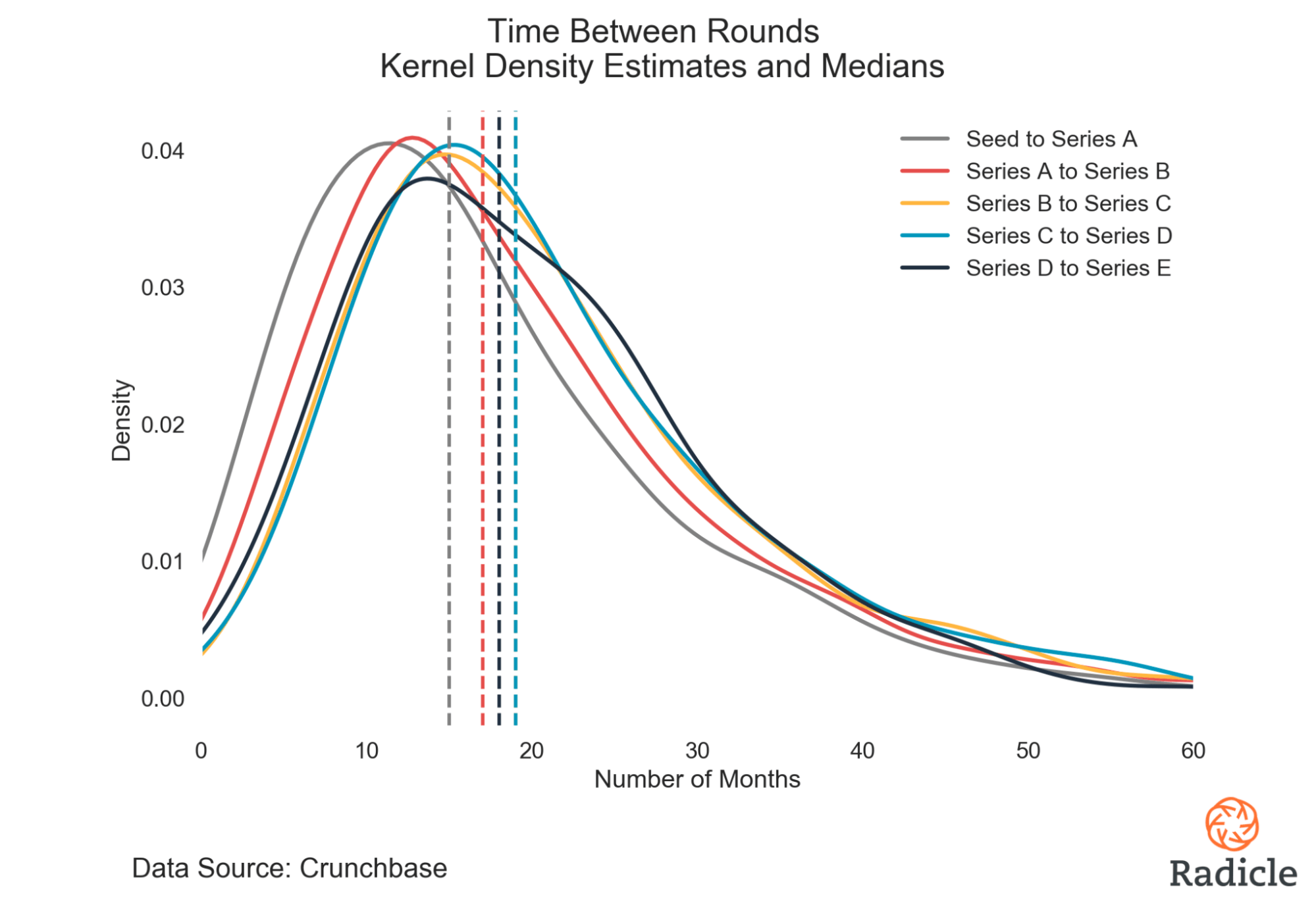

According to an in-depth analysis by data scientist (and Founder & CEO of Invariant Studios) Sebastian Quintero, companies typically spend between 18 and 21 months between funding stages.

The long tail of Quintero’s research results also demonstrates that a significant chunk of startups take as long as 36 months to move from one funding round to another.

This tells us that the median figures are a more reliable figure than the mean figures (as the long-tail outliers skew the mean data).

So what does all this mean?

Well, the median company takes 19 months to go from receiving a Series B funding round to a Series C round, meaning a cash runway of 12 to 18 months isn’t going to cut it.

For a company moving from a Seed Round to Series A (with a median timelapse of 15 months), the upper limit of this estimate (18 months) might work, but certainly not the lower (12 months).

So, here’s the advice:

Based on the data we have for how long companies spend in between funding rounds, a cash runway of 18-22 months appears more appropriate than the “conventional” estimate of 12-18 months.

If you want to play it real safe, prepare yourself with up to 36 months of cash runway available to prepare yourself for those unexpected startup costs that inevitably arise.

Better than using generalized estimates, however, is to calculate how much runway your specific startup needs.

Here’s how:

How Much Runway Does Your Business Need?

So far, we’ve covered how to calculate runway based on your cash reserves and cash burn rate, and we’ve looked at some data that supports the idea that most companies will need between 18 and 22 months worth of runway to survive.

But how do you determine how this applies to your startup?

The amount of cash runway your startup needs depends heavily on your next milestone.

Often, that’s a funding milestone (like getting to a Series A), but depending on your company stage it might also be an exit, IPO, or simply getting to a point where you’re making a profit and can rely on revenue to service all expenses.

For most companies, calculating cash runway is important for understanding how to get through to the next funding milestone, so we’ll use that for the following examples.

Let’s say you’re about to raise a Seed Round from angel investors, and your next funding milestone from there is a Series A funding round.

You need to know how much seed funding to raise so you’ll have a reasonable runway to survive.

To get to a Series A, you need to get your company to a point where:

- You have a proven revenue model

- You’re making between $500k and $4M in annual revenue

- You’ve achieved product-market fit

- You’ve established your core team

Right now you’re feeling pretty happy with your revenue model, and you’ve just hit $240k in ARR (annual recurring revenue). You’ve got a few key hires, but you have a few more employees to bring on board before you feel you have your core team fleshed out.

Your product manager has a solid roadmap for the next 12 months with some strong developments planned which will allow you to serve a bigger market, and you’ve got a plan for growing revenue off the back of this roadmap.

First, determine how long all of this is going to take? Is it a 12 month process? 18 months? 24?

Your product roadmap and revenue development plan should inform this.

Let’s say you’ve calculated it’s going to take 18 months in total to execute your key product changes, make your key hires, and grow revenue to $500k.

Now, let’s go back to our startup runway calculation:

Cash on hand / cash burn rate.

First, we calculate our cash burn rate (monthly spend less monthly revenue).

We know our annual revenue is $240,000, which equates to $20,000 a month. Currently, we’re spending $50,000 a month, which makes our cash burn rate $30,000.

If it’s going to take 18 months to get to a point where a Series A is viable, then we multiply that by our cash burn rate to get $540,000. This is the minimum amount of funding we need to raise during the Seed Round to have a viable runway of 18 months.

Where things get tricky is that our revenue and expenses aren’t likely to stay the same over the 18 month period (for one, we want to grow revenue).

So, we need to make some estimates as to how revenue and expenses will develop during that time to calculate our projected cash burn rate for each month, and then total that.

Conclusion

Cash runway is a crucial startup metric to track, particularly if your company revenue is unstable (or doesn’t exist yet).

It requires an understanding of your cash on hand, monthly expenses, and any revenue you’re currently generating.

From there, you can calculate your cash burn rate (monthly expenses less monthly revenue), and then your cash runway (cash on hand divided by cash burn rate).

But here’s the thing:

Cash runway shouldn’t be a one-and-done calculation.

Startup founders must be tracking cash runway on a regular basis, adjusting revenue and actual expense figures as they develop, so you have an up-to-date understanding of your company’s cash situation at every moment.

To do this accurately (and speedily, with the help of a bit of clever automation), you need a powerful financial modeling tool.

Guess what?

That’s us.

Finmark is a strategic and collaborative financial planning and modeling platform that makes financial forecasting easy.

Book a demo with one of the team today, and find out how we can help you track cash runway for your startup.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.