How to Create Cash Flow Projections: Step-by-Step Guide

Ask any experienced business owner what the most important factor is in staying afloat as an early-stage company, and nine times out of ten you’ll hear two words:

Cash flow.

Think about it. You’ve got operating expenses coming out of your ears, from wages to equipment purchases to tax bills, and if you don’t have enough cash coming in to pay those expenses? Well, you know the rest.

So, what can you do to manage cash flow, short of doubling down on your sales efforts to get that cold hard cash pouring in?

You create (and keep creating) cash flow projections. That’s what.

In this article, we’ll show you exactly why cash flow projections are so crucial and guide you through the process of projecting cash flow for your business.

What Is a Cash Flow Projection?

Let’s start from the top.

Cash flow is the net balance of cash you have coming in and out of your business across a specified timeframe. So, your monthly cash flow is the amount of cash you have moving into and out of your company that month.

That one’s easy to calculate, as you’ve got real-life figures from the last month to use.

A cash flow projection (or cash flow forecast), looks forward to the coming month (or months, or quarter, or whatever time period you want to create a forecast for), and makes an estimate of what cash flow will look like.

While a cash flow projection is an estimate, you’re not exactly plucking numbers out of thin air.

You’re going to use actual figures: your accounts receivable (cash inflows from your customers) and accounts payable (cash outflows—cash you’re going to have to pay during that period for expenses, such as employee salaries).

Okay, so far so good. So, why should you care?

Why Are Cash Flow Projections Important to Understand?

Okay, so there are a few obvious answers here.

You need to know how much cash is coming in so you can:

- Ensure they’ve got enough money in the bank to pay for upcoming expenses

- Deliver on future growth projections

- Make informed business decisions on future monetary investments

Simply put, projecting potential cash shortfalls is the best way to proactively avoid them. Or if you project cash surpluses, you can plan on how to best use it.

But what you’re probably thinking is “Doesn’t my profit and loss statement tell me this information? Why do I need to spend time creating a whole other financial projection?”

The problem with profit and loss statements or income statements (in terms of making estimates of future cash flow) is that they don’t fully represent cash in the bank.

Here’s what we mean:

Regular expenses (things like utility bills, rent, and employee wages) reduce your profitability, and you’ll see these expenses on your profit and loss statement.

But some business spending (like new business assets or other capital expenditures) doesn’t reduce profitability and isn’t included in the P&L statement. You’ll find these typically recorded on the balance sheet.

That means your business can have heavy cash outflows for various startup costs (loading up on inventory, for example) and still look profitable on paper, even though you have negative cash flow.

A similar situation exists on the revenue side of your profit and loss statement.

When your company makes a sale and invoices a customer, this counts as additional revenue in your P&L, even if you don’t have the cash in the bank yet.

Remember: different financial statements capture different aspects of your financial health. It’s by piecing them together that you understand the full story of your business.

So, the short of it is this:

Even a basic cash flow projection is important for businesses to use and understand because, unlike other financial reports and statements, they tell you exactly what your cash levels are, what you’ve got coming in, and what you’ve got going out.

With this you can make accurate, informed decisions and ensure you meet important financial obligations like employee salaries and debt repayments.

How to Create a Cash Flow Projection in 5 Steps

1. Start with Your Opening Cash Balance

This step is nice and easy. Head into your banking app or financial planning platform, and grab your total cash balance across all bank accounts or other cash accounts.

This is the “opening balance” for the period of your cash flow projection. In this example, we’re going to do a monthly cash flow projection, so the opening balance is the closing balance of the previous month.

Pro Tip: Want to skip all of these manual steps? Check out Finmark from BILL!

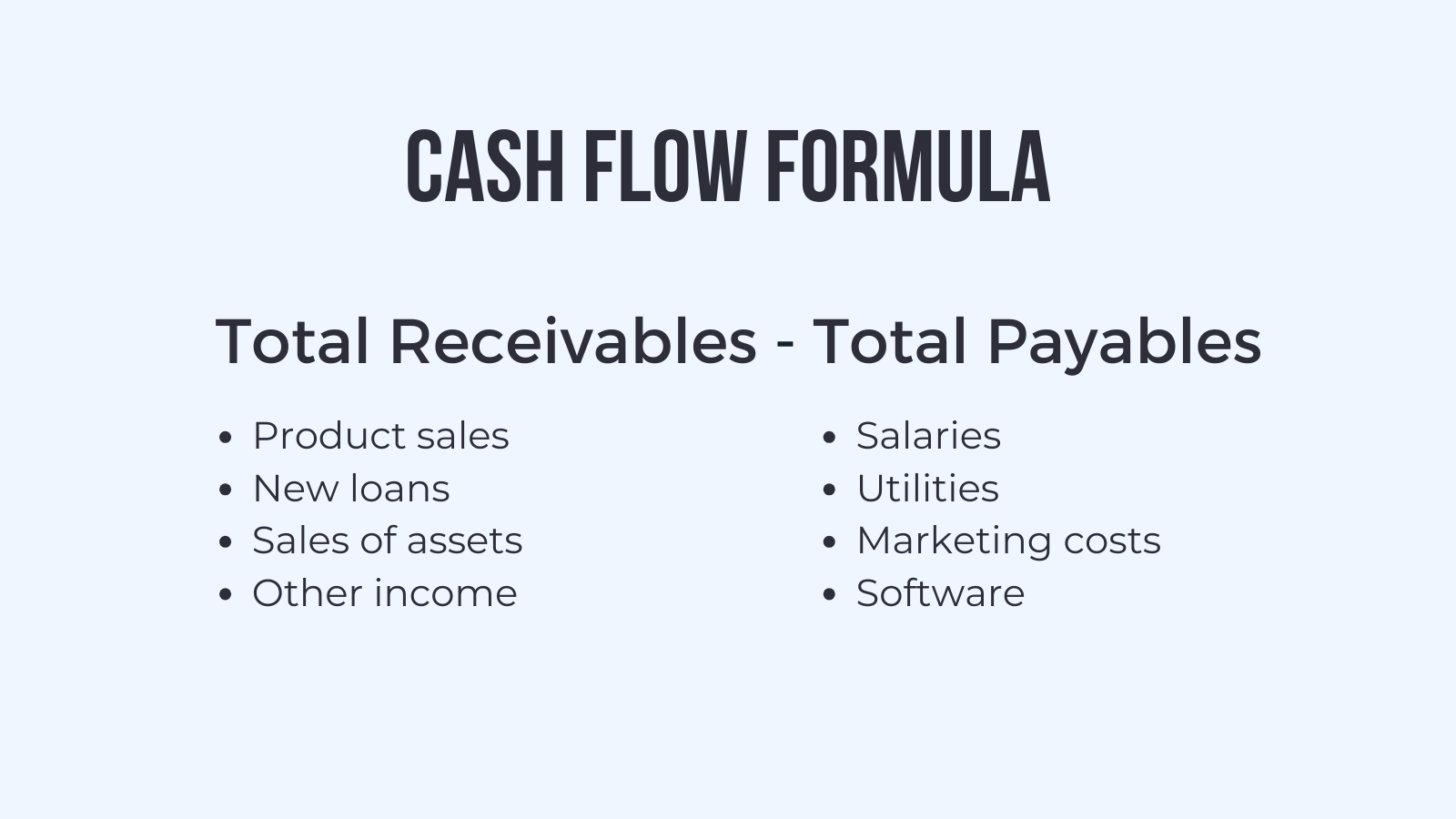

2. Calculate Your Receivables

Now, you’ll need to estimate the amount of money you’re going to receive for the upcoming month—your anticipated positive cash flow. Don’t forget to include other sources of cash beyond sales revenue.

Here’s where to pull this data from:

- Sales of your product and/or services (usually tracked as Accounts Receivable). Be sure to only include balances, or immediate cash sales, that are due within the period you’re creating the cash flow projection for.

- New loans or investments. If you’re currently applying for a loan or raising funding that you expect to receive next month, that’s incoming cash to be included here.

- Sales of assets. If you’re selling any business assets that you expect to receive payment for in the upcoming month, include that amount.

- Other income, such as interest income.

If you use Finmark, we handle all of these calculations for you!

3. Calculate Your Payables

Now, we’re going to do the exact same thing but for your negative cash flow.

Typical expenses to include in your cash flow projection include:

- Employee wages and salaries

- Rent or lease fees

- Software subscriptions

- Tax payment

- Utility bills

- Insurance

- Seasonal expenses

- Asset purchases

- Marketing and advertising costs

- Loan repayments

- Licence fees

- Franchise fees

Note: There are two types of expenses—fixed and variable expenses. Fixed expenses are easy to project because they’ll likely be the same every reporting period. But variable costs will take some estimating to figure out.

4. Apply the Cash Flow Formula

Now, you simply subtract your total payables from your total receivables—or negative cash flow from positive cash flow.

Cash flow formula: Cash flow = Total receivables – Total payables

Here’s a quick cash flow projection example: let’s say our receivables for next month totals $26,000, and our payables totals $15,000. Our cash flow formula would look like this:

$26,000 – $15,000 = $11,000

Meaning our cash flow for the month is $11,000.

Your cash flow prediction can also be negative if the payables are higher than the receivables. If in the above example, our payables for the month total $32,000, then our cash flow projection would look like this:

$26,000 – $32,000 = ($6000)

5. Add Your Opening Balance to Determine the Closing Balance

If you’d like to determine your closing balance for the cash flow period, simply add your cash flow amount to the opening balance.

So, if our cash flow for the month is $11,000, and we had an opening balance of $4,000, then our closing cash balance will be $15,000.

Calculating the closing balance is important as this becomes your opening balance for the next month, so it’s helpful if you’re creating cash flow projections for several upcoming months in advance (a reasonably common approach).

Tips and Tricks for Creating Cash Flow Projections

Ready to create your first cash flow projection? Before you jump in, let’s discuss a few helpful tips to make sure you create the most reliable and helpful forecasts possible.

Leverage Historical Data for the Most Accurate Projections

Unsurprisingly, the best picture of future cash flow is your historical and current cash flow. Where possible, you should use the data you have on hand to inform your calculations.

For example, let’s say you’ve been in business for over a year, so you have a full 12 months’ worth of data on your utility bills. Use this to inform your estimate of what that expense will look like next month.

If you’re projecting for May, say, then look at what May’s bill was like last year.

Was it higher or lower than April (seasonal variability is important to keep in mind)? Has your bill been trending upward over the last 12 months (perhaps you’ve been continuing to increase production)? If so, work this insight into your expense estimate.

For cash receipts, you want to account for any seasonality in your sales. Again, the answer lies in your historical data. If your sales slow down in summer, assume that trend continues.

Look at past financial statements (including cash flow statements) to get a full picture of what your cash flow over a period of time was and what you can expect it to be.

Use Conservative Estimates

While we want to use hard data where possible, there are going to be expenses that you just have to estimate.

You know how much you’re paying your employees, for example, so that’s pretty hard and fast.

But like in our previous example, where we needed to calculate next month’s utility expense, there’s a bit of estimation involved.

So, when you are estimating revenue and expenses, use conservative figures.

Consider a range for each revenue and expense line, and use the most conservative amount (lowest for future income, highest for expenses) in your projection. This will prevent you from getting into hot water by overcommitting yourself to spending based on an overzealous cash flow projection.

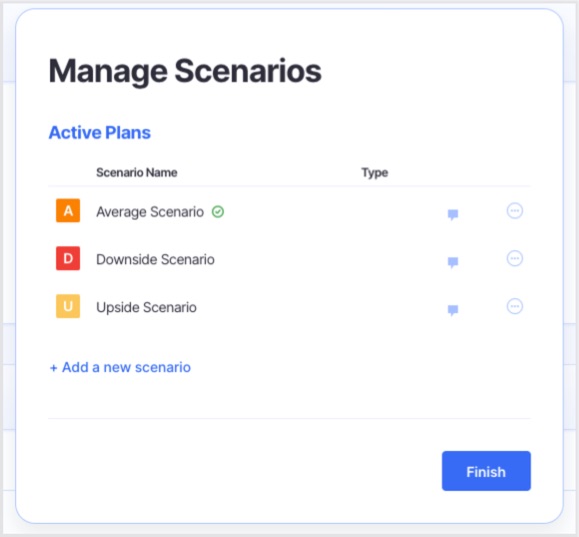

The best solution, however, is to use a scenario planning platform to generate multiple cash flow projections that give you an idea of what cash flow will look like in various situations (for example, comparing your high revenue estimate with your low revenue estimate).

We recommend your cash flow planning involves modeling these three scenarios:

- Base/Average scenario: This is your “business as usual” cash position scenario where you assume revenue and expenses will remain at a steady rate.

- Upside scenario: This is your best case scenario where you assume faster revenue growth and steady (or slightly lower) expenses. Use this to set plans for what you’d do with that extra cash.

- Downside scenario: This is your “worse case” scenario where you assume slower or declining sales figures with steady, slightly increasing, or unforeseen expenses.

Learn more about creating and analyzing scenarios in this article.

You can do this all in Finmark by the way.

Don’t “Set and Forget”

Cash flow projections aren’t a “one and done” kind of operation. The forecasting process requires you to review the information regularly.

As the month (or whatever period you’re projecting for) progresses, you’re going to have more and more accurate data for revenue and expenses, as cash flows in and out of the business.

Use this information to edit and iterate on your cash flow projection, keeping your estimates as accurate as possible throughout the month. By updating your projections on a regular, ongoing basis, you can see where your assumptions were right or wrong.

The goal is to see when things start to stray from your projection. Once your actual cash flows are recorded, you can adjust your strategy. Maybe you have cash surpluses that can be put to work or a cash deficit you need to adapt to avoid.

Use Automation to Build Projections Faster!

Though you can create detailed cash flow projections manually, savvy business owners prefer to use financial planning platforms (you know, like Finmark?) to create and manage these financial reports.

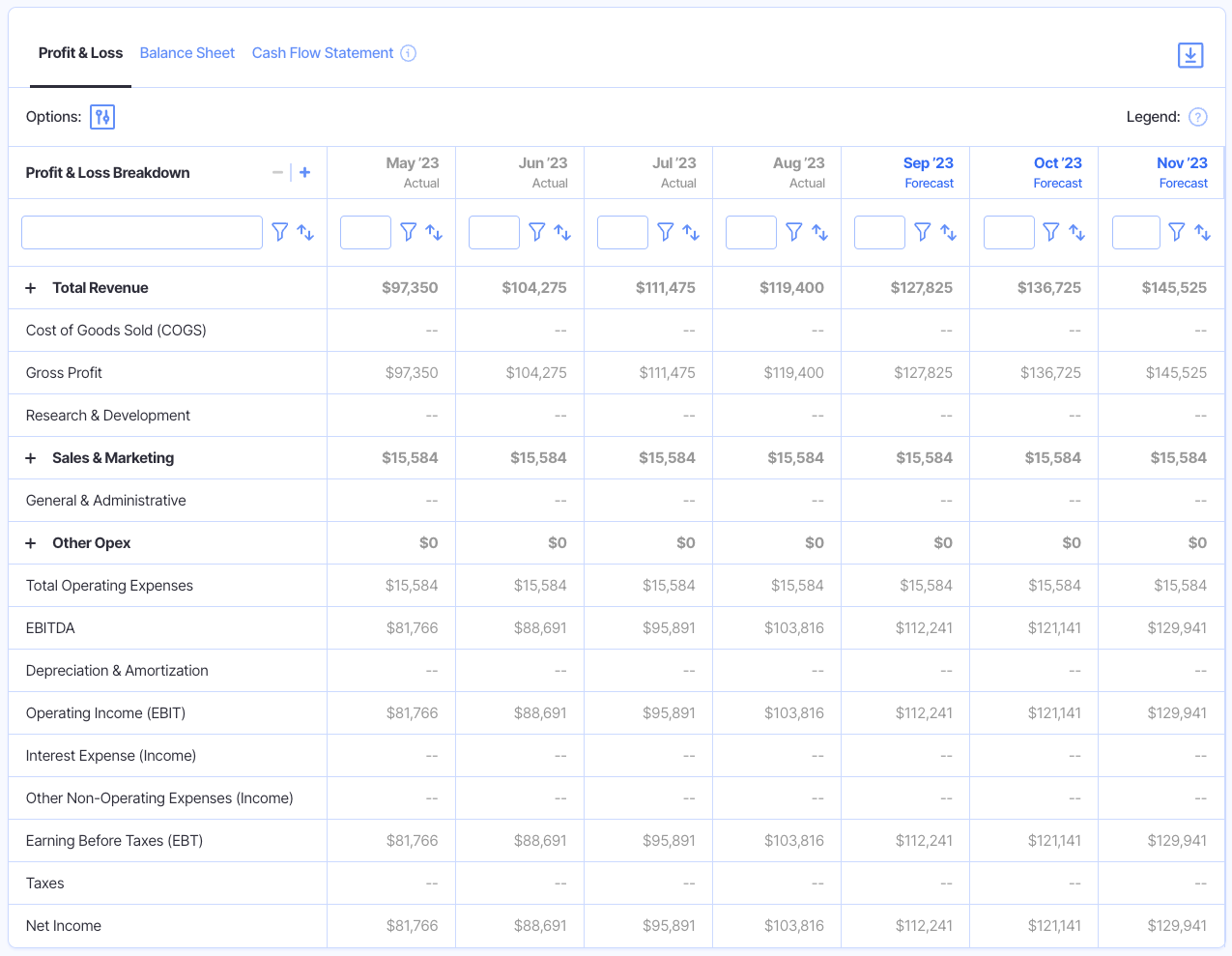

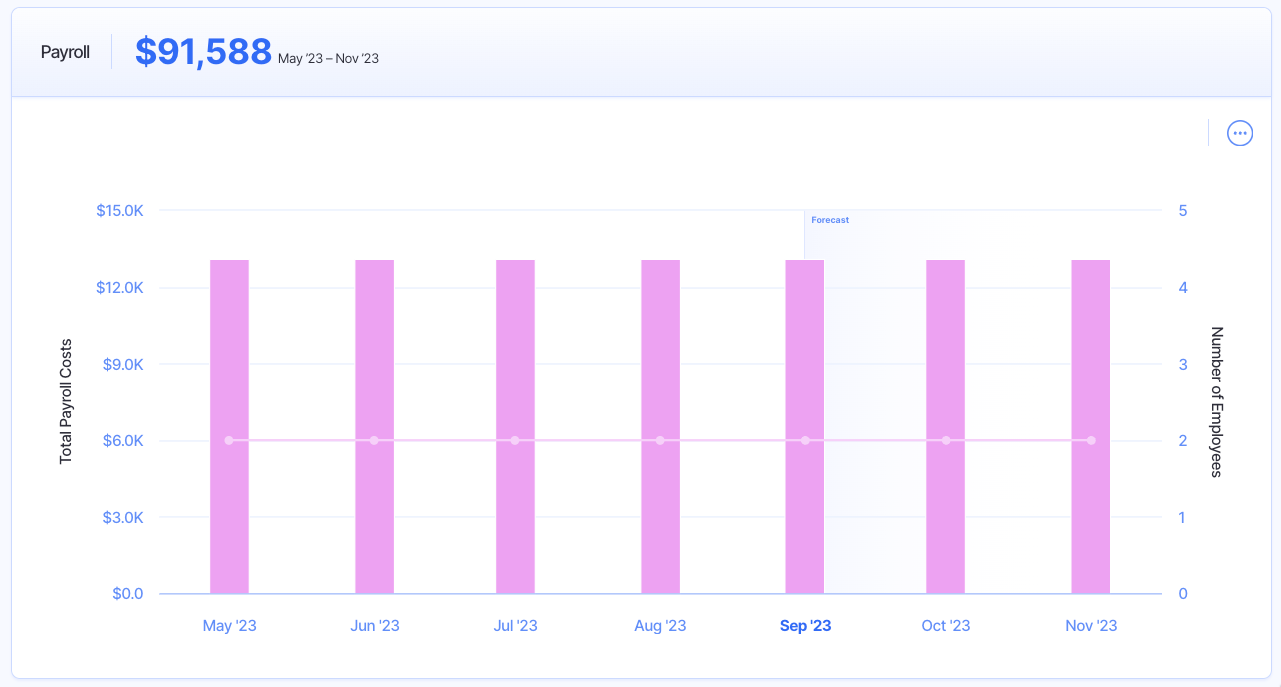

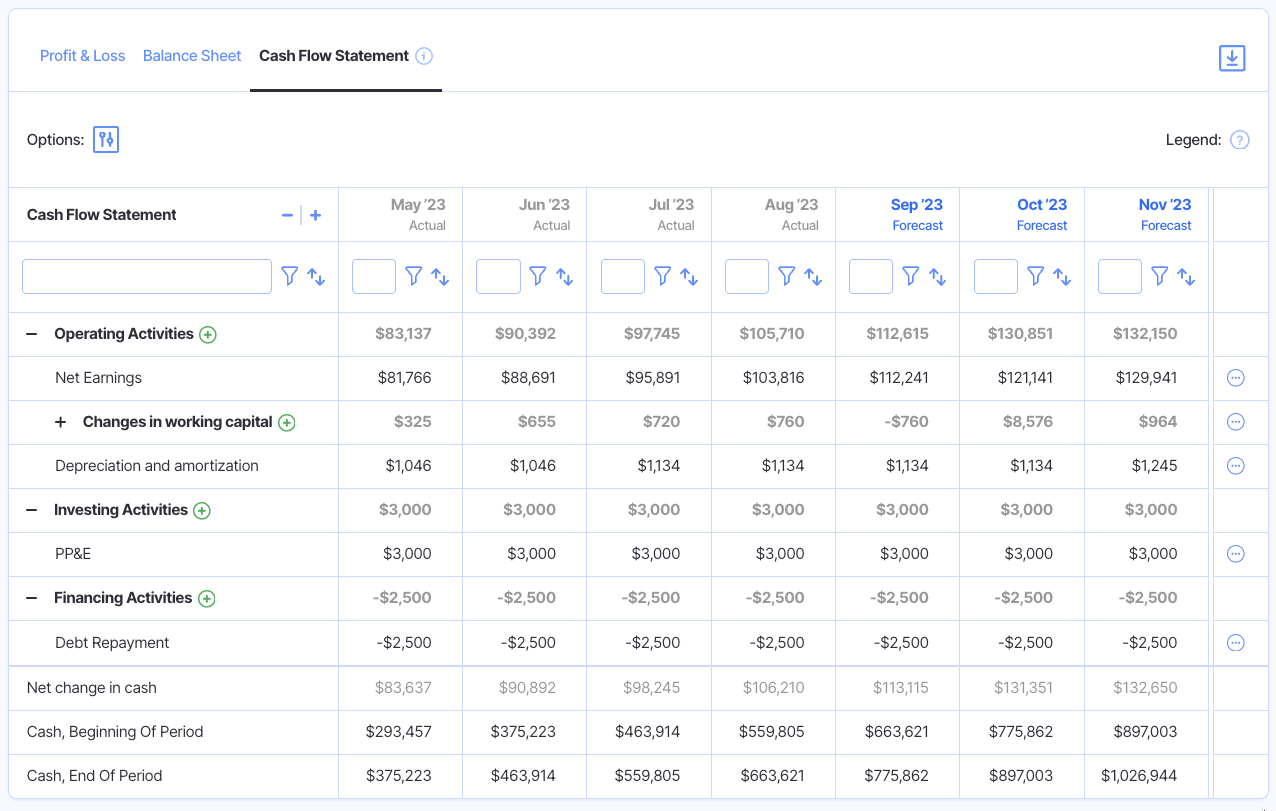

Here’s an example of what our cash flow report looks like, and you don’t have to do a bunch of data entry into a spreadsheet to create it. Finmark automatically pulls in your data and handles all the calculations for you.

Ready for More Accurate Cash Flow Projections?

By this point, you should have a pretty strong understanding of why accurate cash flow forecasts are so important to comprehend (and use). You know how they work, and how to create one for yourself.

But here’s the thing:

Cash flow forecasting is only one piece of the puzzle.

You need to create and analyze a variety of financial reports, statements, estimates, and projections, all of which are made easier when you have an effective and intuitive financial planning platform on your side.

Yeah, that’s us.

Start a free trial of Finmark today, and let us show you how we can transform your financial planning experience.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.