5 Types of Budget Models (And How to Choose the Right One)

Creating a budget is the most exciting and thrilling part of running a business!

Ok, maybe not. But it’s necessary if you want to operate efficiently and avoid running out of money. A well-thought-out financial plan is crucial for the long-term success of your business!

One of the first steps to creating a budget is to decide on a budget model. However, it’s not as simple as looking at a list of options and choosing one. It’s important to understand the differences between each model and whether or not it’s the right fit for your business.

In this guide, we’ll break down the five most common budget models and help you pick the best approach for your business.

What is a Budget Model?

A budget model is a framework for how you create and manage your budget.

Most people are familiar with the different approaches to budgeting for personal finances like the envelope method or 50/30/20.

Similarly, there are multiple approaches to creating a budget for your business. The model you choose impacts:

- How long it takes to create your budget

- How much time you spend managing your budget

- The accuracy of your budget

Think of it this way. Let’s say you just raised a $1 million seed round. You need to budget it across multiple departments and expenses over the next 12-24 months. What’s the first thing you need to do?

Your budget model gives you a starting point and repeatable system to decide how to allocate your $1 million, and a way to track whether or not you’re over/under budget at the end of each year.

The budgeting model you choose can vary depending on your industry, the stage of your company, and the types of expenses you have.

For instance, a lot of educational institutions (K-12 and college) use incremental budgets, while some tech startups favor rolling budgets. Don’t worry, we’ll dive into what each of those means next.

For now, just remember that a budget model is simply a framework to give you structure and consistency in your budgeting process.

Types of Budget Models

If you’ve searched for information about budget models before, you’ll notice there isn’t a ton of consistency. Some websites use different terms for the same budget models, and others confuse budget modeling with budget allocation.

We’ve simplified things for you.

Below, we’ve broken down the five most common types of budget models that can be used for any type of business. We’ve also included the pros and cons of each to make it easier to decide which one is best for your business.

1. Zero-Based Budget

Zero-based budgeting is where you start your budget with a clean slate each year. Every department has a starting budget of zero, and management decides how much they need based on their priorities and goals for the year.

Essentially, you build a new budget from scratch every year. Every expense needs to have a justification based on how it’ll help achieve your annual goals.

For instance, if marketing wants to spend $20,000 on software for the year, they need to be able to explain what software they plan to buy and why they need it.

Pros:

- It makes you think carefully about any new expenses.

- Your budget is tied to outcomes.

- Each department needs to be hands-on in the process so it’s more collaborative.

Cons:

- It takes a lot of time to develop since you’re rebuilding the budget each year.

- There’s less flexibility for the budget throughout the year.

2. Static Budget

A static budget is exactly what it sounds like—you set a budget and it stays static throughout the year regardless of external factors or your company’s performance.

Similar to a zero-based budget, static budgets are based on the desired outcome or expected results.

In other words, if you want to reach $X in revenue, you calculate how much you think it’ll cost to get there, and that’s what your budget is based on. Once that number is set, it doesn’t change throughout the year.

For instance, say you set a $20,000 budget for Facebook Ads. Whether those ads result in $10,000 or $40,000 in sales, the budget for the year stays at $20,000 all year long.

Unlike a zero-based budget, a static budget doesn’t have to be built from scratch each year. You can take learnings from the previous year and just make adjustments.

One of the biggest problems with this budget model is that it can force you into a box. You might make the assumption that in order to reach $100,000 in MRR, you need to budget $10,000 for sales commissions and $20,000 for advertising.

But what if it actually takes $25,000 in commissions and $50,000 in advertising? How do you know if the issue is in the way you spent your advertising budget, or that you just didn’t budget enough? It’s difficult to tell with a static budget because there’s little to no flexibility throughout the year so you can’t make adjustments on the fly.

Pros:

- It makes you more conscious about how you spend your budget since you know the amount you can spend won’t change until the next period.

- There’s less maintenance and upkeep. Once the budget is set, it’s set.

Cons:

- You can stunt growth by not adjusting your budget based on your actual performance throughout the year.

- It can be too rigid, particularly for early-stage startups.

- Your ability to reach your goals is heavily dependent on whether or not you budgeted enough at the beginning of the year.

3. Flexible Budget

With flexible budgeting, your budget varies depending on your sales performance throughout the year.

Your fixed expenses like office space, insurance, or utilities will stay the same. But variable expenses directly tied to sales like your cost of goods sold (COGS) and advertising, are based on a percentage of your sales for the year.

Let’s look at an example.

Assume a company is creating a budget based on a projected $5 million in revenue. They budget $1 million for fixed expenses and $1.5 million (or 30% of revenue) for expenses that are directly tied to revenue like COGS.

With a flexible budget, we can forecast how their COGS budget would adjust based on whether they fall below or above their projected revenue target.

| Expenses | $4M Revenue | $5M Revenue | $7M Revenue | $10M Revenue |

| Fixed Expenses | $1M | $1M | $1M | $1M |

| COGS | $1.2M | $1.5M | $2.1M | $3M |

Now, compare these numbers to what the budget would look like with a static budget model.

| Expenses | $4M Revenue | $5M Revenue | $7M Revenue | $10M Revenue |

| Fixed Expenses | $1M | $1M | $1M | $1M |

| COGS | $1.5M | $1.5M | $1.5M | $1.5M |

As you can see, the flexible budget paints a much more realistic picture of how much the company will need to spend to reach each revenue goal. The static budget example is less realistic (and less accurate) since there isn’t a correlation between COGS and revenue.

Pros:

- Gives you a more realistic forecast of the costs associated with growth.

- Flexibility is built directly into the budget (hints the name 😉).

- Your budget becomes somewhat automated since your expenses are tied to revenue.

- If you aren’t sure how much revenue you’ll generate, this model can help you account for multiple scenarios.

Cons:

- There isn’t always a 1:1 correlation between revenue and your variable expenses, so the budget won’t always be accurate.

- If your expenses aren’t directly related to revenue, this budget model probably won’t work for you.

- It’s more complex to develop than a static budget.

4. Rolling Budget

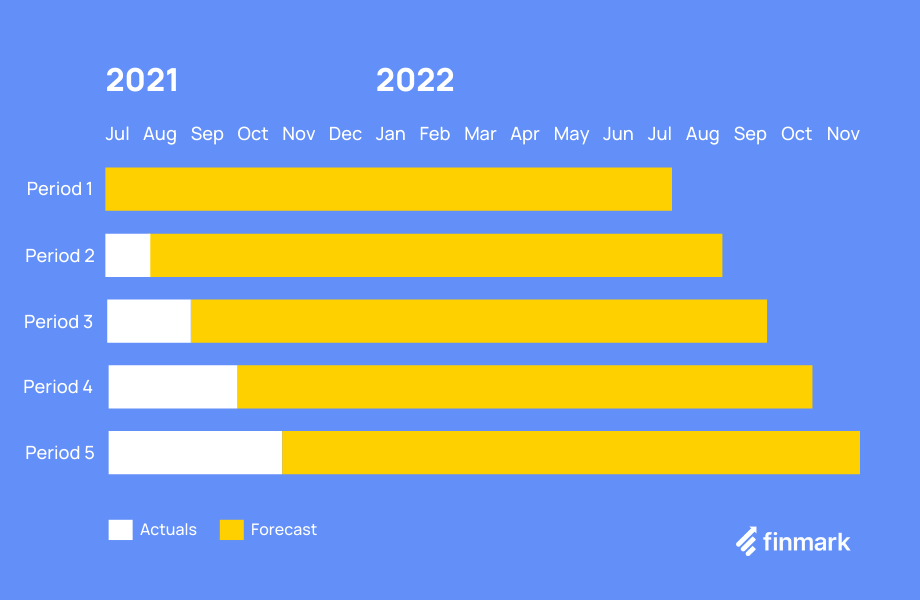

With a rolling budget (also known as a continuous budget) you add a new budget period at the end of the most recent period. As a result, your budget always looks 12 months out (or however long of a horizon you set).

The benefit of a rolling budget is that it takes into account your most recent actuals to forecast your future budget. Here’s a graphic to illustrate how a rolling budget works.

The end result is a budget that’s more accurate since it’s based on recent actuals.

With all of the other budgeting models we’ve covered, the budget is typically set at the end of the year for the following year. The problem with this is that it doesn’t account for everything that changes throughout the year. The way your business looks seven months into the year may be completely different from what you thought it’d be at the end of the previous year.

Pros:

- Your budget is based on recent data rather than just speculation.

- It gives you more flexibility and control over your budget.

- Since you’re regularly reviewing the data, you’ll pay more attention to your numbers and understand why you’re over or under budget.

Cons:

- It requires more attention since you’re updating the budget more frequently. However, if you use a tool like Finmark, this is less of an issue.

5. Incremental Budget

An incremental budget adds or subtracts from the previous year’s actuals. This is arguably the simplest budget model to use because it doesn’t require much maintenance and you’re starting from the previous year’s numbers.

One of the best examples of how an incremental budget works is actually from the TV show The Office. In one episode, one of the accountants (Oscar) realizes they have a surplus at the end of the fiscal year, and they need to spend it so that it doesn’t get deducted from next year’s budget.

In the clip below, Oscar is trying to explain to the manager (Michael Scott) what a surplus is and why they need to spend it by the end of the day.

That clip is also a great example of the downside of incremental budgets. There’s very little incentive for employees to try to cut costs or operate under budget. If a department wants more money for the next year, they can max out their budget each year to justify a bigger budget next year.

This can lead to inefficient spending because the priority becomes using the entire budget rather than optimizing costs.

One thing to keep in mind is that you don’t automatically get additional funds just because you max out your budget. A manager could spend 100% of their department’s budget and next year they could still receive the exact same amount. It’s at the discretion of the founders, finance team, or whoever the final decision-makers are.

If you’re going to use an incremental budget, you need to analyze all the expenses and have a justification for increasing or decreasing the budget each year.

Pros:

- It’s the easiest budget model to implement.

- There’s very little maintenance involved.

- It can work well for companies that have fairly static expenses.

Cons:

- It can lead to inefficient spending.

- You need to trust your managers and ensure that everyone is spending wisely and not just trying to max out the budget.

- Sometimes major external factors like the economy or industry regulations can be overlooked with an incremental budget.

Budget Model Comparison Chart

| Budget Model | Pros | Cons | |

| Zero-Based Budget |

|

|

|

| Static Budget |

|

|

|

| Flexible Budget |

|

|

|

| Rolling Budget |

|

|

|

| Incremental Budget |

|

|

What is The Best Budget Model?

As you can guess, there isn’t a single “best” budget model. Each has its pros and cons.

However, what we can say is that dynamic models like a rolling budget or flexible budget tend to favor early-stage startups since things are constantly changing.

Whichever budget model you decide to go with, you’ll need a tool to build and forecast your budget. If you don’t want to spend hours trying to do it in spreadsheets, give Finmark a try. You can get started with a free 30-day trial.

Happy budgeting!

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.