How to Use Client Advisory Services to Grow Your Accounting Business

Growing revenue is a key concern for pretty much any CPA, especially when you’ve just gone out on your own and are starting to onboard new clients.

For most CPAs, the main way to grow revenue is by attracting more clients.

However, each new client comes with new relationship and contract management issues, and there is an upper limit to the number of clients the typical CPA can entertain.

Add to that the fact that a growing number of low-cost report-generating providers exists, and you start to see that CPA-dom might not be as profitable as you’d initially calculated.

But what if there was a way to not only differentiate your service offering from those low-cost providers and extract more revenue per client (meaning you can earn more with fewer accounts)?

In this article, we’re going to explore the ins and outs of Client Advisory Services (CAS), which, if you hadn’t already guessed, achieves those two goals.

What Are Client Advisory Services (CAS)?

Client Advisory Services are services in addition to the CPA work your clients sign up for.

I mean, it’s kind of in the name: you provide advisory services (so, advice), to your existing clients.

That’s a bit broad, so to define it further, the specific advice you provide as part of your CAS is financial, and related to the CPA services you already provide.

Let’s break that down and illustrate with an example.

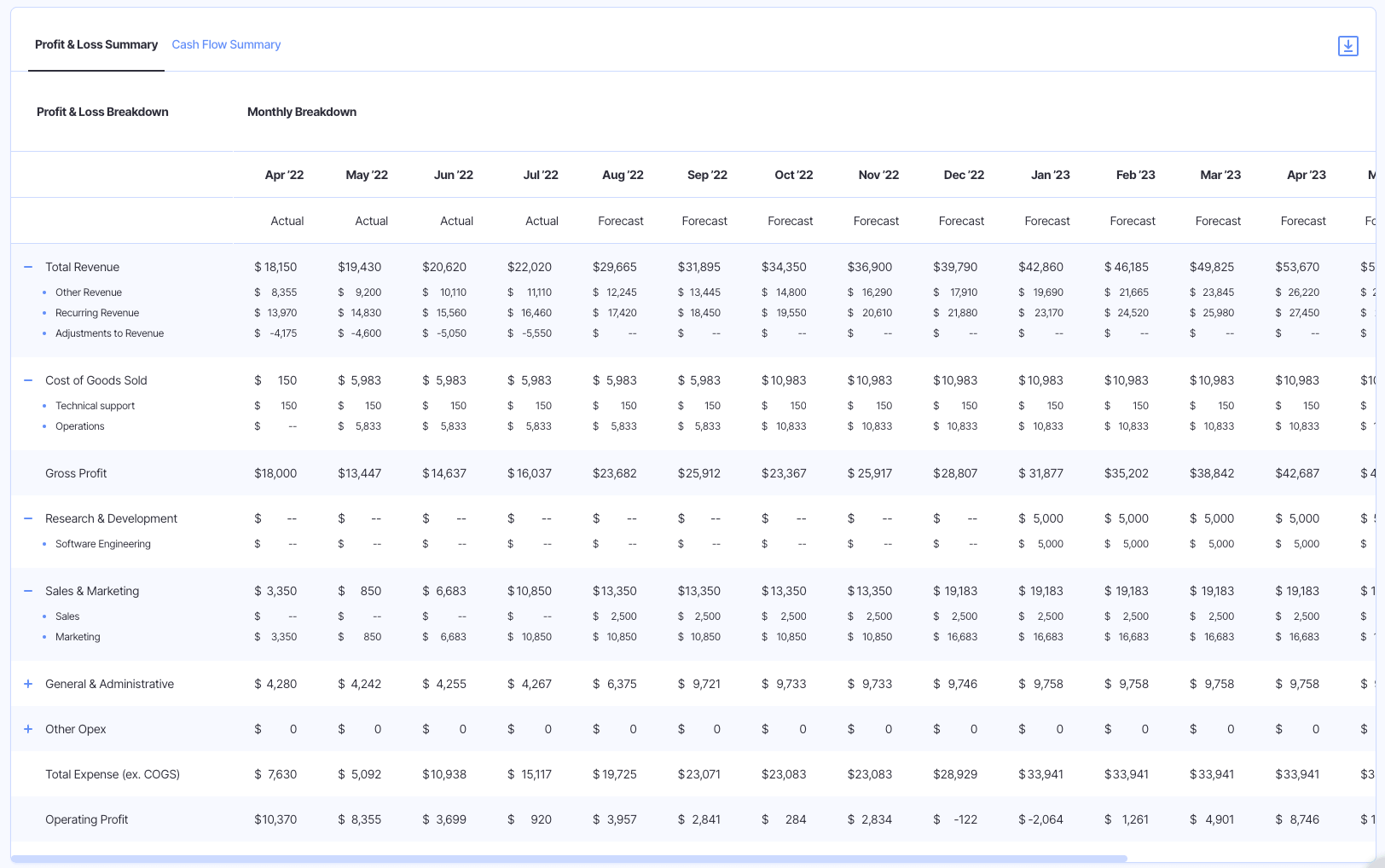

Traditionally, the role of the CPA is to create financial statements (be that a cash flow statement, balance sheet, or profit and loss statement), and then give them to their client (the business owner).

It’s then up to that business owner to figure out what all of that financial information means, and what they should do with it (e.g., identifying an issue with cash flow and a suitable solution).

Clearly, not all business owners are equipped with the financial know-how to achieve this.

Many entrepreneurs come from operational backgrounds.

They’re great at the thing their business does, but are still learning the ins and outs of growing and managing a company, including how to interpret financial information.

What’s more, not all of them want to learn how to interpret financial statements. They’d rather pay an expert to tell them what it all means, and what to do about it.

Enter Client Advisory Services.

For an additional fee, the CPA provides advice based on the financial reports they provide. For instance, they can advise their clients about any opportunities they see to improve cash flow by analyzing the cash flow statement.

The best way to conceptualize CAS is like this:

Traditional CPA services answer, “Here’s what your business did.” CAS goes a step further and answers, “Here’s what these numbers mean, and how to improve them.” Click To TweetWhy Should CPAs Consider Offering Client Advisory Services?

The main reason you should consider offering CAS is that these services are a huge differentiator for your CPA business.

Accounting software and financial reporting tools are making the task of creating financial statements easier and faster than ever. As a result, more and more low-cost providers are available for financial report creation.

If all you’re doing is creating those same reports, then going with a cheaper provider is a no-brainer for business owners. Meaning in the long term, you’ll either:

- Keep losing clients

- Have to continue reducing your fees

Neither are good scenarios.

Providing Client Advisory Services in addition to your regular CPA services helps you differentiate from those low-cost, report-only service providers and keep the bottom line healthy (and growing).

What’s more, being able to give your clients strategic direction and answer questions will help set the top CPAs apart and attract more premium clients.

Providing CAS also means that you’ll generate more revenue per client, allowing you to reach your revenue goals with fewer clients on retainer. This means less relationship management, fewer issues with turnover, and a higher ROI from your marketing budget and client acquisition efforts.

Related: How ProvenCFO is Revolutionizing FP&A With Finmark

4 Steps To Getting Started With CAS

Convinced that your CPA firm needs to start offering Client Advisory Services?

Here’s how to kick things off.

1. Approach This Service Offering With A Different Mindset

Adopting CAS involves much more than simply throwing a line of copy on your website that says, “We can provide advice, too!”

A CPA firm that provides CAS as well needs to adopt an entirely different mindset to operations.

How you communicate with clients shifts. You’re no longer going to be working on a quarterly or even annual basis; you’ll constantly be receiving and answering messages.

As such, you’ll need to adopt software systems you’ve likely never used before (such as customer support and ticket handling software), and train your team in how to use them.

That involves a lot of process and system creation to help you scale (meaning it’s about much more than just crunching those numbers each month).

As you grow, you’ll probably need to add new roles, such as accounts managers and customer support roles. At scale, you might have different employees responsible for:

- Solving customer complaints/issues

- Providing strategic advice

- Creating and sending financial reports

- Sales and customer acquisition

The shift to offering CAS also involves a move to a much more relationship-focused model, moving away from a transactional one (dollars exchange for financial statements).

That means building trust with customers becomes crucial, and that communication should be driven by your firm as much as by customers requesting assistance. That means:

- A comprehensive onboarding process that explains how the engagement will work and outlines communication lines and expectations

- Scheduled relationship management and update meetings

- Proactive advice given every time financial reports are created (rather than waiting for a question to be asked)

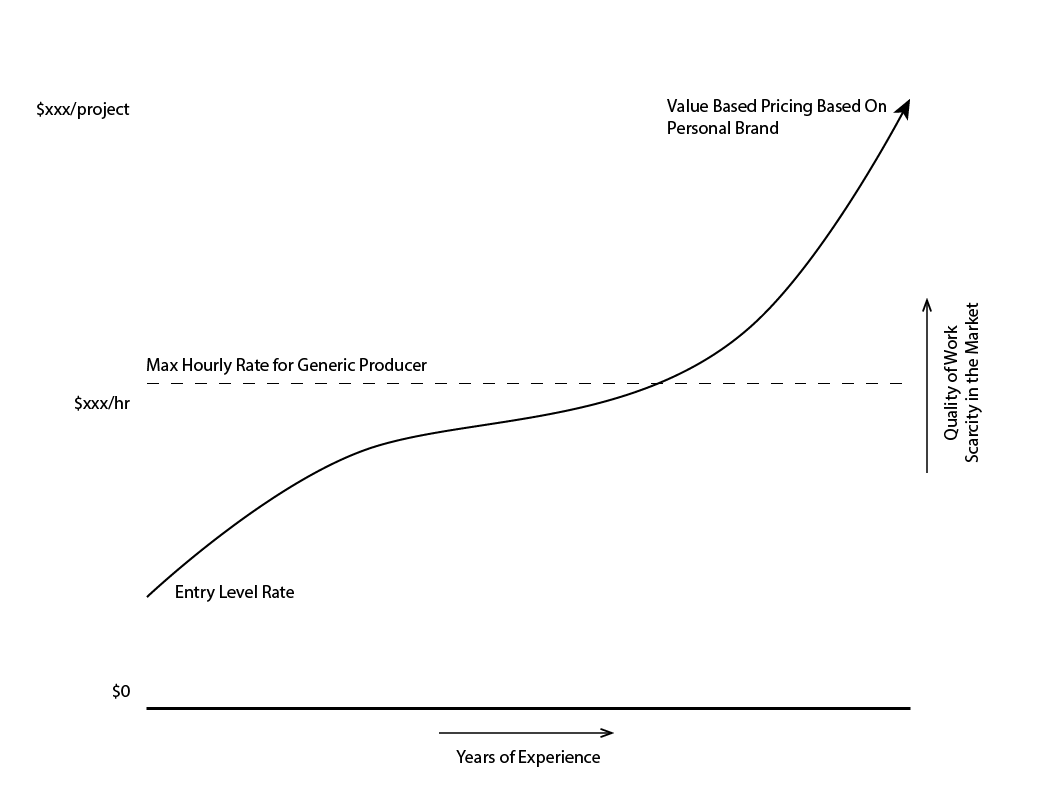

2. Adjust Your Pricing Model

The standard pricing model for CPA services is to charge by the hour. This approach doesn’t work for Client Advisory Services.

You need to shift your pricing to be representative of the value you provide, not the time you spend.

Let’s look at an example.

You’ve recently prepared a client’s quarterly financial statements and provided some actionable advice in relation to them.

They come back with a few questions about how they can lift revenue growth in the next quarter, which take you about 10 minutes to answer.

With the average CPA charging $174 per hour, that advice costs $29 if you stick with the hourly pricing model. This doesn’t remotely represent the value you’ve provided with this advice, which could earn your client tens of thousands of dollars in revenue.

Because it’s difficult to quantify the value of each piece of advice you give, the best idea is to put clients on a monthly retainer, where they pay a set fee each month for access to unlimited advice.

3. Niche Down To Provide Better Insights

The most valuable clients will be looking for specialists, not generalists.

They want to know that you understand their business, industry, and market inside and out, and can provide financial advice within that context rather than in a general one.

If you’re working with a restaurant chain owner, for instance, they’ll want you to be familiar with market trends, food safety legislation, rules around employment and tipping, etc.

To maximize your effectiveness as a CPA providing Client Advisory Services, niche down. Find an industry you’re passionate about, have experience in, or enjoy working in, and advertise your CAS offering as catering to that.

While you develop this niche expertise, you can still provide regular CPA services to existing clients and even offer generalized CAS packages to other industries. But set your long-term goals on specialization to maximize customer value, retention, and revenue growth.

4. Take Advantage of Financial Tools

We already mentioned the need to embrace tools like customer support software as part of your transition to offering Client Advisory Services, but there’s another secret weapon:

Financial reporting and modeling platforms.

These financial tools make it easy to pull out important insights, which you can use to supercharge your financial advice and to collaborate with your clients in real time.

Take Finmark, our very own financial modeling platform for fast-growing companies. With Finmark, you can:

- Build multiple scenarios to show your clients how cash flow would look under given circumstances

- Easily collaborate within the platform with contextual comments and tagging

- Create dashboards for at-a-glance reporting (which you can then use as part of your advisory reports to clients)

- Ensure all client financial data is in one central hub, making it easier to analyze and provide actionable advice on

- Help your clients create budgets, track actuals, and perform variance analyses

Additionally, modern financial tools you can improve client compliance, workflows, and get buy-in.

For example, automated accounts receivable software can help your clients improve cash flow by reducing the average number of days accounts are outstanding.

Become familiar with the tools that are available, so you can recommend them in relevant scenarios and even help clients get set up where required.

Conclusion

Offering Client Advisory Services is a fantastic way to differentiate your CPA firm from the masses of low-cost report-only providers, maximize business growth, and lift your revenue per customer.

Before you dive in, make sure you’re equipped with all the financial tools you need to get the job done right, starting with a financial reporting platform.

Finmark is advanced enough for CPAs to do their work, but simple enough for non-finance people (i.e., your clients) to understand.

Discover how we can help transform your CPA offering today with a free demo.

Contributor

This content is presented “as is,” and is not intended to provide tax, legal or financial advice. Please consult your advisor with any questions.